oil prices, exacerbating the already volatile market. This concern is underpinned by the fact that crude prices had spiked to a high in 2024 following the air strikes, although they eased somewhat later.

Military Responses and Market Reactions

The US military's interception of an anti-ship cruise missile in the Red Sea, fired from Houthi militant areas in Yemen, underscores the heightened tensions in key shipping routes. These military actions, while aimed at protecting commercial shipping, have inadvertently influenced global oil markets, leading to fluctuations in crude prices.

Economic Perspectives and Future Outlook

World Bank's Analysis of Regional Economies

The World Bank's Global Economic Prospects report provides a nuanced understanding of the economic impact of these conflicts. For the Middle East and North Africa (MNA) region, already grappling with oil production cuts and inflation, growth slowed down significantly last year. The report also highlights that geopolitical uncertainties could lead to surging energy prices with wider implications for global economic activity and inflation.

GCC's Economic Performance and Projections

In the Gulf Cooperation Council (GCC) nations, economic growth is estimated to have decelerated in 2023 due to a decline in oil production. However, there's an expectation of rebounding oil activity supporting growth in these countries in the upcoming years.

Strategic and Humanitarian Concerns in Yemen

Houthi Attacks and International Reactions

The Houthi militant group's attacks on commercial shipping and infrastructure have prompted strong international reactions, including military responses from the US and UK. These actions, while aimed at curbing the Houthis' aggression, also reflect the complex geopolitical dynamics in the region.

Humanitarian Crisis in Yemen

The situation in Yemen remains dire, with significant humanitarian concerns. Access to basic necessities like water and sanitation is critically low, exacerbating the plight of the Yemeni population. International aid efforts, such as those by USAID, have been crucial in providing relief, but the ongoing conflict continues to hinder these efforts.

Market Trends and Predictions

Oil Market Analysis and Predictions

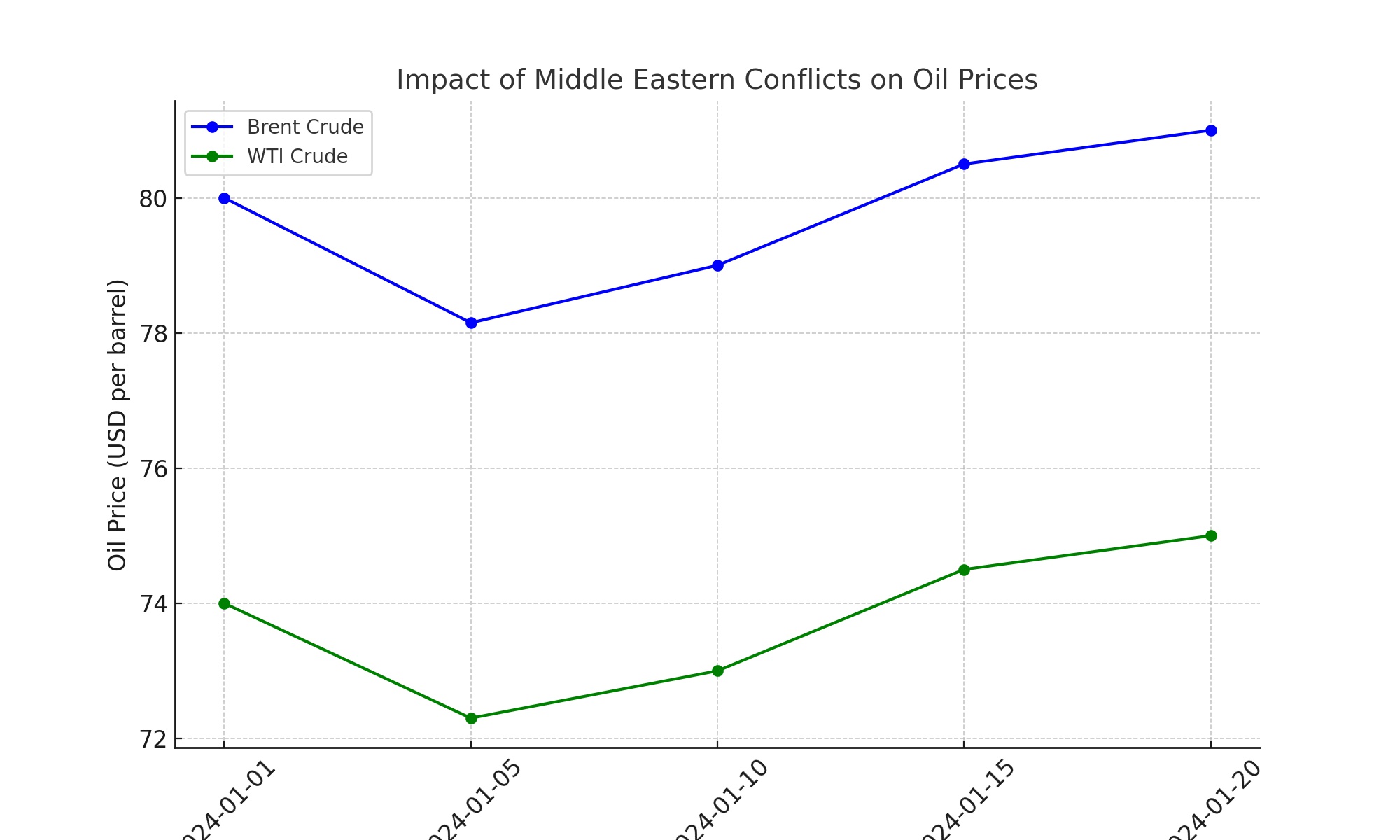

The fluctuating oil prices, influenced by geopolitical tensions and market uncertainties, present a complex scenario for traders and analysts. With Brent crude and WTI crude experiencing volatility within specific price ranges, the market remains unpredictable. Analysts suggest a cautious approach to trading in this environment, with potential for both short-term gains and losses.

Global Economic Forecast in Light of Conflicts

The World Bank's forecasts for global economic growth remain tentative, given the ongoing conflicts and their impact on commodity markets and financial conditions. The possibility of an escalation in the Middle East conflict remains a significant risk factor, potentially disrupting global trade and investment patterns.

Conclusion

In summary, the recent developments in the Middle East have had a multifaceted impact on the global oil market, with implications for prices, supply routes, and economic forecasts. The launch of the Dangote Refinery introduces a new dynamic in the African oil sector, potentially reshaping the region's energy landscape. Meanwhile, the humanitarian crisis in Yemen underscores the need for a balanced approach that considers both strategic interests and the welfare of the affected populations. As the situation continues to evolve, it remains critical to monitor these developments closely, given their far-reaching implications for global markets and geopolitics.