Tesla (NASDAQ:TSLA) Eyes a New Era: Autonomy, Energy, and Market Growth

From Robotaxis to Cybertruck, Tesla is Shaping Its Future as a Tech-Driven Powerhouse | That's TradingNEWS

Tesla's (NASDAQ:TSLA) Q3 Results: Mixed Financial Performance, Solid Growth Potential

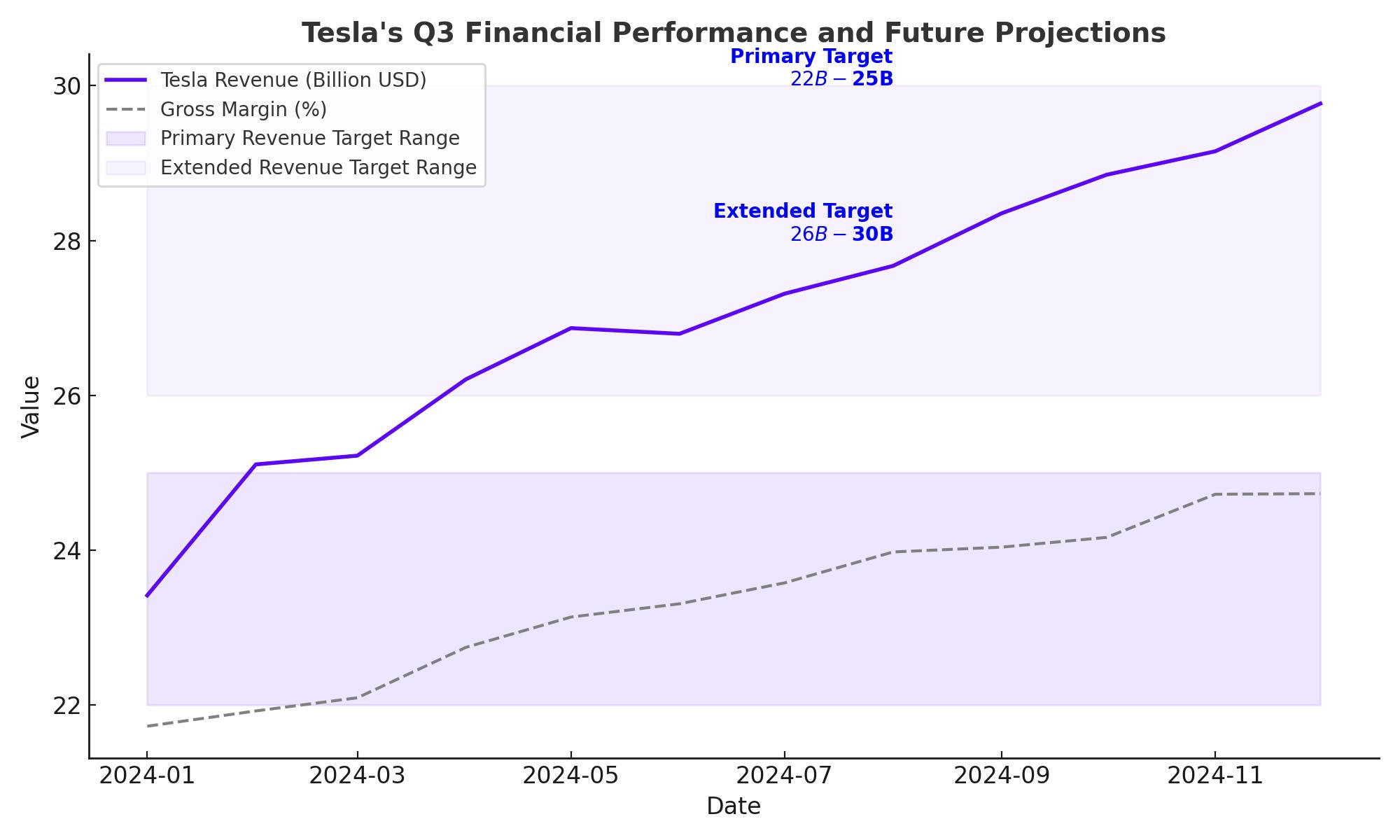

In the third quarter of 2024, Tesla reported a total revenue of $24.3 billion, with automotive revenue showing a year-over-year increase of 6.4%. Despite challenges in maintaining high gross margins due to competitive pricing and increased cost pressures, Tesla’s vehicle deliveries surpassed industry expectations, reflecting robust demand across its model range. However, the anticipated margins face further pressures as Tesla aims to make electric vehicles more affordable with new models priced below $30,000. For investors, Tesla’s near-term focus on price competitiveness poses a potential trade-off with profitability, yet the strategy aims to expand its market share significantly.

Tesla’s gross margin for automotive operations saw a notable increase of 180 basis points, achieving a 21.7% gross margin, driven by operational efficiency gains and energy division strength. The company is strategically leveraging its expanding energy storage business, which contributed over 30% to Tesla’s total gross margin this quarter. However, management has warned that energy margins may fluctuate in upcoming quarters, especially as Tesla adjusts its project mix to balance costs with deployment timelines. Investors eyeing short-term returns may find this margin variability challenging, yet long-term growth in Tesla’s energy division offers substantial upside.

Autonomous Vehicle Prospects: Robotaxis, Cybercab, and Federal Regulations

Tesla’s ambitious autonomous vehicle program remains a cornerstone of its growth strategy, as the company continues to prioritize its robotaxi vision. On the latest earnings call, Elon Musk hinted at the potential of Tesla’s Cybercab—a purpose-built autonomous vehicle optimized for ride-hailing. Priced at around $25,000, the Cybercab aims to disrupt traditional ride-hailing with a fully automated, driverless experience. This strategic pivot could establish Tesla as a major player in the global robotaxi market, which is projected to exceed $100 billion by 2030.

Yet, Tesla’s autonomous vision hinges on regulatory developments that are currently at a nascent stage. Federal regulations under the Department of Transportation and the National Highway Traffic Safety Administration (NHTSA) provide the framework for autonomous vehicle deployment but lack comprehensive guidelines for commercial rollouts. If Tesla’s future-oriented approach aligns with anticipated regulatory easing—potentially influenced by a Republican-dominated Congress and executive branch—the company could accelerate its robotaxi timeline. This regulatory clarity could significantly impact Tesla’s valuation as it transitions from a vehicle manufacturer to a technology-driven mobility provider.

For investors interested in monitoring Tesla’s real-time price movements, refer to the TSLA real-time chart.

Financial Valuation: Tesla’s Growth Trajectory and EBITDA Projections

Tesla’s current valuation reflects investor expectations of high future growth, with a forward price-to-earnings ratio of 80.6x—32% above its historical median. Given its trailing twelve-month EBITDA of $13.24 billion and approximately 3.2 billion shares outstanding, Tesla’s EBITDA per share stands at $4.12, leading to a high multiple of 76x on current earnings. To meet a more sustainable valuation of 30x EV/EBITDA, Tesla would need to achieve approximately $9.5 EBITDA per share, implying a compound annual growth rate of 20.7% over the next five years.

This growth target may appear ambitious, yet Tesla’s expansion into autonomous driving, energy storage, and vehicle manufacturing provides the potential to sustain this trajectory. If robotaxis reach mass deployment, each million autonomous vehicles added to Tesla’s network could contribute a 15% boost to EBITDA. In the most optimistic scenario, these gains could position Tesla to meet its five-year growth targets, effectively supporting its current valuation.

Elon Musk's Government Involvement and Potential Impact on Tesla’s Leadership

Elon Musk’s speculative role in a potential Trump administration’s Department of Government Efficiency raises questions about conflicts of interest. Should Musk assume a governmental position, he may face scrutiny or even divestment requirements. Federal ethics guidelines for government employees mandate divestiture of single-stock holdings to avoid conflicts, suggesting Musk may need to consider his stake in Tesla. Such a move could have implications for Tesla’s stock, as Musk’s influence has been integral to the company’s valuation and innovation trajectory.

For those interested in tracking recent insider transactions and Musk’s activity, check out Tesla’s insider transaction profile.

Robotaxi and Cybercab Vision: Transforming Tesla’s Market Position

Tesla’s autonomous vehicle vision centers on the upcoming Cybercab—a compact, driverless EV optimized for mass adoption. Designed for ride-hailing at scale, the Cybercab is expected to launch at a price point of $25,000, making it more affordable than Tesla’s other models. Tesla estimates that each Cybercab could operate with minimal human intervention, dramatically reducing operational costs for ride-hailing services.

If Tesla can manufacture approximately one million Cybercabs annually by 2030, the company could capture a significant share of the ride-hailing market. With Uber’s (NYSE:UBER) current annual revenue of $41.95 billion, Tesla could feasibly generate over $13 billion in EBITDA from robotaxis alone, assuming comparable gross margins and the elimination of human drivers. Such financial projections underscore Tesla’s potential to redefine urban transportation, positioning the company as a technology-enabled mobility leader rather than solely an automaker.

Expanding Product Line: Cybertruck, Semi, and Government Fleet Opportunities

The upcoming release of the Cybertruck represents Tesla’s entry into the high-margin, high-demand pickup truck segment. As a potential rival to the Ford F-150, the Cybertruck could attract new customers from conservative, rural demographics—segments that have historically favored traditional automakers. With EV market competition intensifying, Tesla’s unconventional design and brand loyalty offer a unique advantage.

Tesla’s Semi truck also holds substantial promise in the commercial logistics sector. If autonomous driving regulations permit driverless operations, the Semi could revolutionize freight transport by reducing labor costs and optimizing delivery efficiency. Tesla’s potential to secure government contracts for freight transportation would further strengthen its foothold in this space, opening a new revenue stream with high growth potential.

Tesla’s product diversification strategy extends beyond vehicles. The company’s megapack and Powerwall storage solutions position it to capture market share in energy resilience and backup systems—a sector that could see increased demand amid rising cyber threats and energy security concerns.

Energy Business and Infrastructure: Building a Sustainable Ecosystem

Tesla’s energy storage division, which includes the Megapack and Powerwall, has emerged as a critical growth area, contributing significantly to Tesla’s overall gross margin. Tesla’s ability to scale production of these energy solutions, particularly for commercial and industrial applications, positions the company as a leader in sustainable infrastructure.

With the U.S. government prioritizing infrastructure development, Tesla stands to benefit from federal initiatives aimed at modernizing the national grid. If Musk’s relationship with policymakers influences Tesla’s role in this process, Tesla could gain exclusive contracts for building charging networks or renewable energy storage systems across the country. Such federal support would accelerate Tesla’s growth trajectory, enhancing its valuation while further integrating renewable energy solutions into the company’s ecosystem.

Financial Risks and Valuation Concerns

While Tesla’s growth potential is impressive, its premium valuation necessitates careful monitoring of financial and operational risks. The company’s forward price-to-earnings ratio reflects high investor expectations that may not materialize if regulatory, production, or market challenges arise. Furthermore, Tesla’s heavy reliance on Elon Musk’s leadership and innovation poses a potential risk; any requirement for Musk to divest his holdings or reduce involvement in Tesla’s day-to-day operations could impact investor confidence.

Tesla’s fluctuating average selling prices (ASPs) and competitive pressures are additional areas of concern. Tesla’s ASP has been trending downwards as the company introduces financing incentives and lower-cost models to maintain market share. While these strategies enhance Tesla’s accessibility, they may compress margins over the long term, especially as new entrants intensify competition in the EV market.

Conclusion: A Moderate Buy with Long-Term Potential

For long-term investors willing to accept Tesla’s inherent volatility and high valuation, NASDAQ:TSLA remains a compelling, albeit speculative, opportunity. Tesla’s ambitions in autonomous vehicles, energy solutions, and innovative product lines, such as the Cybertruck and robotaxis, offer substantial upside potential. However, achieving these goals will require effective navigation of regulatory landscapes, strategic partnerships, and operational efficiencies.

Investors with a high risk tolerance may consider Tesla a moderate buy, given its robust innovation pipeline and the potential regulatory tailwinds under a favorable political environment. For those interested in tracking Tesla’s evolving stock performance, refer to the TSLA real-time chart.

That's TradingNEWS

Read More

-

Broadcom Stock Price Forecast - AVGO 13% Post-Earnings Slide vs. $73B AI Backlog at ~$350

13.01.2026 · TradingNEWS ArchiveStocks

-

Solana Price Forecast - SOL-USD Holds Around $143 as $135–$145 Zone Decides the Next Big Move

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex