US Dollar Drops Amid Inflation Data - EUR/USD Poised for Gains

Analyzing the Impact of CPI Data, Fed Rate Expectations, and Market Movements on USD and EUR/USD | That's TradingNEWS

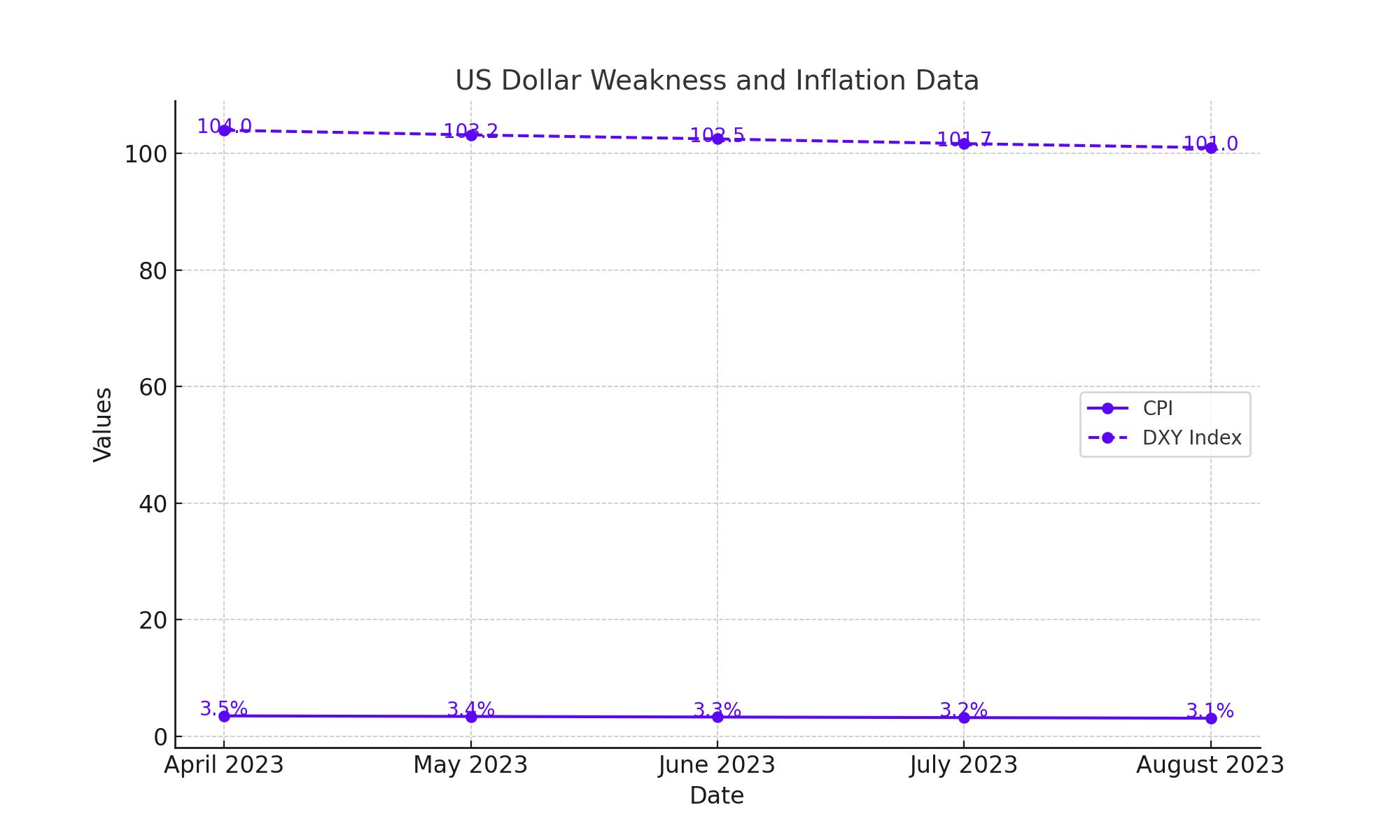

US Dollar Weakness and Inflation Data

The U.S. dollar, as measured by the DXY index, fell nearly 0.8% last week, driven by weaker-than-expected U.S. consumer price index (CPI) data. The headline CPI rose 0.3% in April, below the forecasted 0.4%, reducing the annual rate to 3.4% from 3.5%. This weaker inflation print revived hopes of a resumption in the disinflationary trend that started in late 2023, leading traders to speculate that the Federal Reserve might reduce policy restraint in the fall. This speculation put downward pressure on the dollar, with sellers increasing their bearish positions.

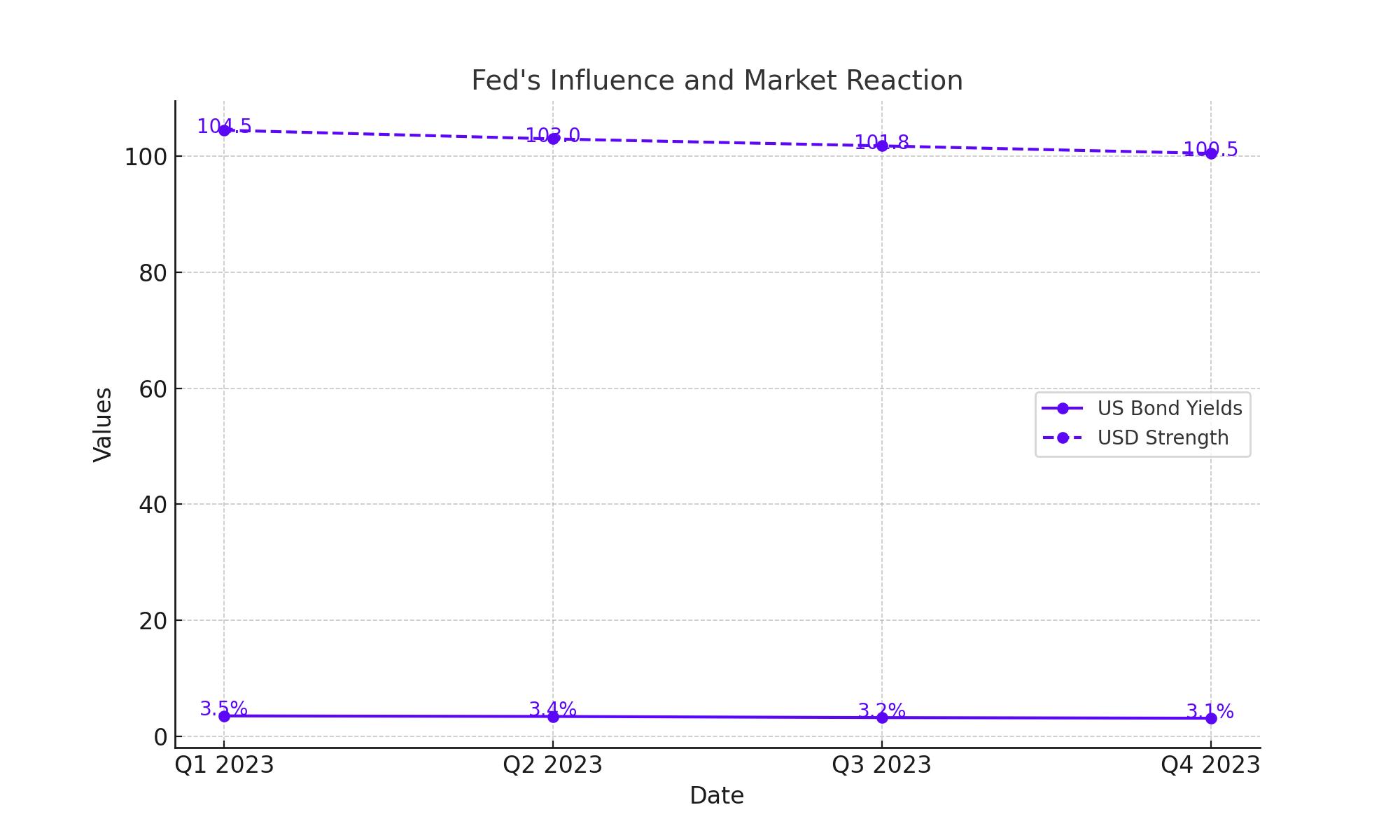

Fed's Influence and Market Reaction

Despite some cautious remarks from Fed officials later in the week, which sparked a modest rebound in the U.S. dollar, the uptick was insufficient to offset the earlier losses. The prospect of Fed easing in the second half of the year, combined with increasing economic fragility, suggests U.S. bond yields may struggle to extend higher, removing a key support for the dollar's strength seen in Q1.

EUR/USD Technical Analysis

EUR/USD remained stable late in the week, holding above the key support level of 1.0865 after Wednesday’s bullish breakout. If the pair maintains this level, it could prevent a resurgence of sellers, potentially leading to a pullback towards 1.0810/1.0800 if breached. On the upside, if buying momentum returns, the pair might face resistance near 1.0980, defined by the March swing high, and further strength could target 1.1020, a dynamic trend line from the 2023 peak.

GBP/USD Forecast and Analysis

GBP/USD surged to a two-month high last week, potentially targeting the 1.2720 resistance level, corresponding to the 61.8% Fibonacci retracement of the 2023 decline. If the rally continues, focus could shift to the 1.2800 mark. However, if sellers regain control, support at 1.2615 to 1.2585 could provide stability, with a breakdown possibly leading to the 200-day simple moving average around 1.2540.

Eurozone Economic Outlook

The Eurozone's finalized June inflation figures, showing an acceleration from 8.1% to 8.6%, will be crucial for the EUR/USD's near-term direction. Market sentiment remains a key driver, and the absence of FOMC member speeches during the blackout period could support the EUR/USD, easing bets on a 100-basis point rate hike later this month.

US Dollar Outlook and Fed Policy

Fresh remarks from Fed officials may influence EUR/USD, with the FOMC planning to "slow the pace of decline in our securities holdings." If the Fed acknowledges a lack of progress toward its 2% inflation target, it could impact the pair. However, if the Fed indicates a readiness to maintain higher interest rates, it could drag on EUR/USD. Conversely, any hints of a regime change could buoy the pair.

Technical Indicators and Price Action

EUR/USD's break above the April high of 1.0885 positions it near the monthly high of 1.0895. A failure to sustain above 1.0860 to 1.0880 might push EUR/USD back towards 1.0770. A breach below the monthly low of 1.0650 could lead to a test of the 1.0610 to 1.0640 region.

That's TradingNEWS

Read More

-

NLR ETF at $145.21: Uranium, Nuclear Power and the AI Baseline Energy Trade

14.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Demand Lifts XRPI, XRPR and Bitwise XRP as XRP-USD Defends $2.10 Support

14.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Slides Toward $3 as Warm Winter Clashes With LNG Demand

14.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Climbs Toward 160 as Japan’s Debt Fears Clash With BoJ Hike Hopes

14.01.2026 · TradingNEWS ArchiveForex