What makes NVIDIA (NASDAQ:NVDA) a compelling buy at $144 per share in 2025?

At $144 per share, NVIDIA’s dominance in AI and unmatched innovation signal a strong buy opportunity | That's TradingNEWS

NVIDIA (NASDAQ:NVDA): Charting the Path to AI Dominance and $10 Trillion Valuation

NVIDIA Corporation (NASDAQ:NVDA) continues to redefine the tech landscape, commanding an unassailable lead in AI compute and setting benchmarks in both hardware and software innovation. The company’s remarkable growth trajectory, fueled by hyperscaler investments and cutting-edge GPU technology, positions it as a frontrunner to become the first $10 trillion company.

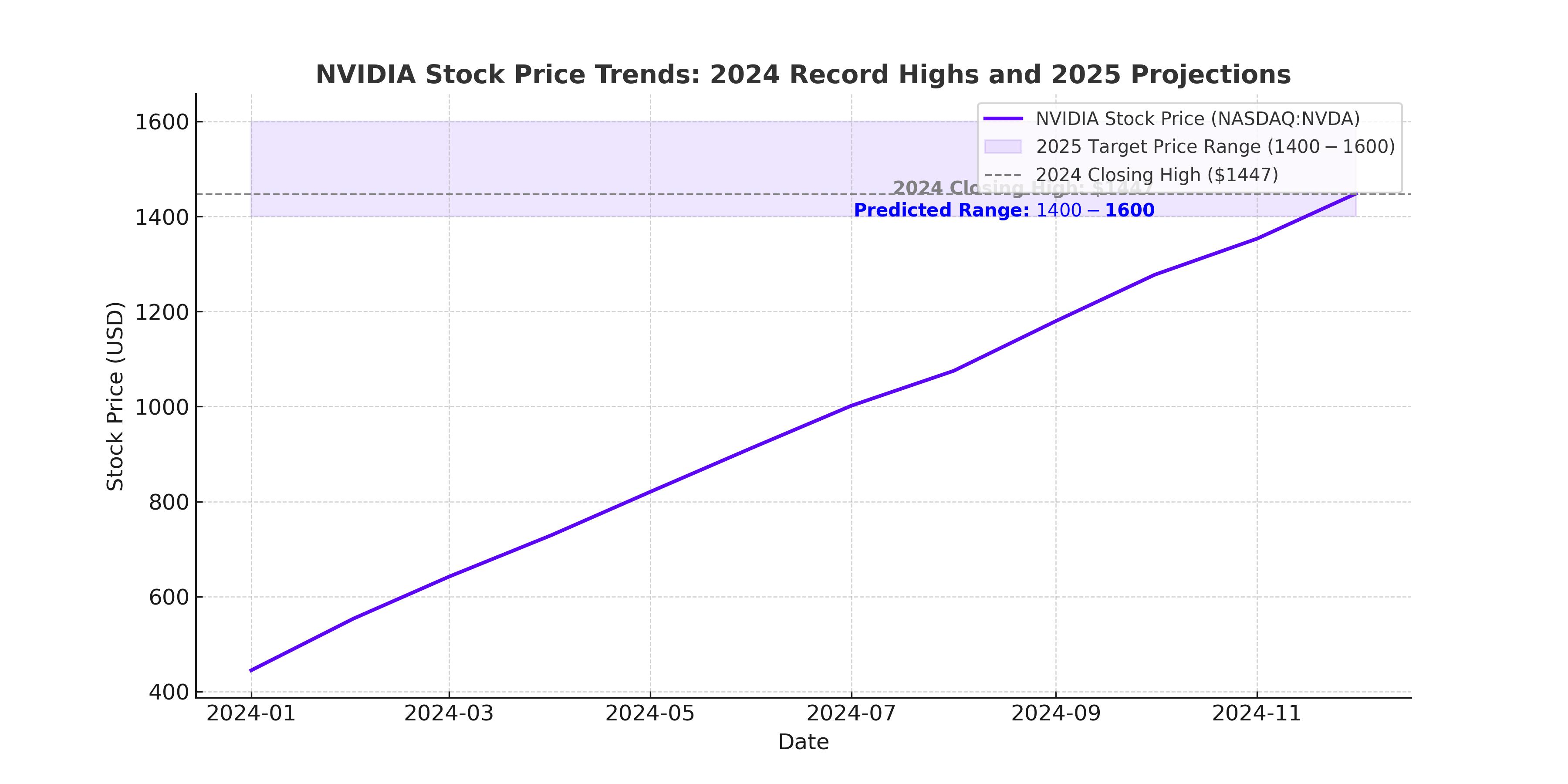

Record-Breaking Growth in 2024 and Beyond

NVIDIA’s 2024 financial results reflect a seismic shift in AI adoption and hyperscaler capital expenditure. Revenues surged 86% year-over-year to $113.3 billion, with operating income doubling to $71 billion. Data center revenue alone soared to $30.8 billion, driven by hyperscalers such as AWS, Microsoft Azure, Meta Platforms, and Google Cloud, who collectively invested approximately $200 billion in data center CAPEX in 2024.

In 2025, hyperscaler spending is forecasted to grow by 50%, reaching $300 billion. This spending spree, driven by generative AI, large language models, and advanced computing applications, is expected to sustain NVIDIA's revenue growth at a similar pace. Analysts project a 50-55% revenue increase for NVIDIA in 2025, pushing its total revenue well past $170 billion.

Blackwell Architecture: Redefining Performance

The introduction of NVIDIA’s Blackwell architecture in 2025 is set to transform the AI landscape. Promising up to 2.5x performance gains in AI training workloads and up to 15x gains in inference tasks, Blackwell GPUs will solidify NVIDIA’s dominance in the high-performance computing market. The architecture's flexibility—supporting configurations from air-cooled to ARM-based systems—ensures broad adoption across industries.

With NVIDIA already commanding 90% of the AI GPU market, the debut of Blackwell is expected to fortify its market share, creating significant barriers for competitors like AMD and Broadcom.

A Moat Built on Hardware and Software Excellence

NVIDIA’s competitive edge extends beyond hardware. Its CUDA software platform, a cornerstone for AI and HPC applications, has built an ecosystem with over 4 million developers. CUDA’s ubiquity and ease of use make it the industry standard, giving NVIDIA a significant lead over competitors. AMD, despite its promising MI300X GPU, lags far behind in software optimization, ecosystem support, and performance benchmarking.

This hardware-software synergy is complemented by NVIDIA’s investments in networking, including the acquisition of Mellanox. Networking revenue reached $3.1 billion in 2024, with InfiniBand and Ethernet technologies playing critical roles in AI factory deployments. NVIDIA’s vertically integrated solutions, such as the forthcoming Blackwell system architecture, exemplify its focus on end-to-end innovation.

Financial Resilience and Growth Prospects

NVIDIA’s financial strength is underscored by its free cash flow (FCF) generation. In fiscal Q3 2025, FCF reached $16.8 billion, representing a 48% margin. This performance reflects NVIDIA’s ability to scale revenues while controlling costs, thanks to operational efficiencies and AI-driven automation.

The gross margin, though expected to dip slightly as Blackwell production ramps up, remains robust at 75%. Analysts predict that NVIDIA could generate over $100 billion in FCF in 2025, driven by sustained AI demand and efficient scaling of its GPU production and networking solutions.

Overcoming Competitive and Macroeconomic Challenges

Competitors such as AMD and Google pose minimal threats to NVIDIA’s dominance. AMD's software limitations and lack of vertical integration hinder its ability to compete effectively. Google’s TPUs, while technically advanced, are restricted to internal use and lack the versatility of NVIDIA’s GPUs.

The primary risks to NVIDIA’s growth are supply chain dependencies, particularly on TSMC for chip manufacturing and SK Hynix for HBM memory. Geopolitical tensions in Taiwan remain a concern, but NVIDIA’s diversification efforts and partnerships with alternative suppliers like Micron mitigate this risk.

Valuation and the $10 Trillion Milestone

With a market capitalization of approximately $3.5 trillion as of January 2025, NVIDIA trades at a forward P/E of 50x based on 2025 earnings estimates. While some may view this as steep, the valuation reflects NVIDIA’s unparalleled growth potential and market leadership. Analyst consensus sees NVIDIA’s revenues doubling by 2026, making the $10 trillion milestone achievable within the next five years.

NVIDIA’s PEG ratio of 1.22 underscores its relative undervaluation compared to sector peers, given its 50%+ projected growth rate. If hyperscaler spending and AI adoption trends continue as expected, NVIDIA could reach a $5 trillion valuation by the end of 2025 and double that in subsequent years.

Insider Transactions and Strategic Moves

NVIDIA (NASDAQ:NVDA) continues to demonstrate strong insider confidence, with key executives making notable increases to their holdings. Recent filings reveal substantial insider purchases at prices between $450 and $475 per share, signaling robust internal belief in the company’s trajectory. These transactions underscore alignment between NVIDIA’s leadership and shareholders, reinforcing trust in its strategic direction.

NVIDIA’s strategic moves further solidify its industry leadership. The company’s acquisitions, such as Mellanox for networking and ARM for advanced chip architecture, have strengthened its vertical integration and expanded its product portfolio. Partnerships with hyperscalers like Microsoft and Amazon continue to drive data center growth, while R&D spending, which exceeded $7 billion in the last fiscal year, cements NVIDIA’s position at the forefront of AI innovation. For the latest insider activity, visit the NVIDIA Insider Transactions Page.

Final Assessment

NVIDIA’s dominant position in AI, bolstered by an 86% revenue surge to $113.3 billion in 2024, makes NASDAQ:NVDA a standout investment in the tech sector. Trading at $144.47 per share as of January 3, 2025, NVIDIA’s valuation reflects market confidence in its trajectory toward becoming the first $10 trillion company. Its hardware-software synergy, including the CUDA platform and Blackwell architecture, ensures sustained leadership in the AI semiconductor market.

With a forward P/E ratio of 50x and free cash flow projected to exceed $100 billion in 2025, NVIDIA presents a compelling case for long-term growth. For investors seeking exposure to the AI revolution, NVIDIA is a strong buy with substantial upside potential. As its market share and technological advancements continue to outpace competitors, NVIDIA is positioned to deliver exceptional returns and redefine industry benchmarks.

Read More

-

GPIX ETF Climbs to $52.54 as 8% Yield Turns S&P 500 Volatility Into Income

02.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI $11.54, XRPR $16.35 And XRP-USD At $1.99 Aim For A $5–$8 Cycle

02.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Tests $3.50–$3.60 Floor Before LNG Wave

02.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds Near 157 as BoJ Caution and Fed Cut Bets Drive the Move

02.01.2026 · TradingNEWS ArchiveForex