Why Broadcom Is a Strong Buy ? AI-Driven Growth,Expansions and Stock Split

Broadcom's Strategic Moves and AI Innovations Propel Its Market Value Beyond Tesla | That's TradingNEWS

Broadcom (NASDAQ:AVGO) Bullish Outlook: AI-Driven Growth, Strategic Expansions, and Stock Split

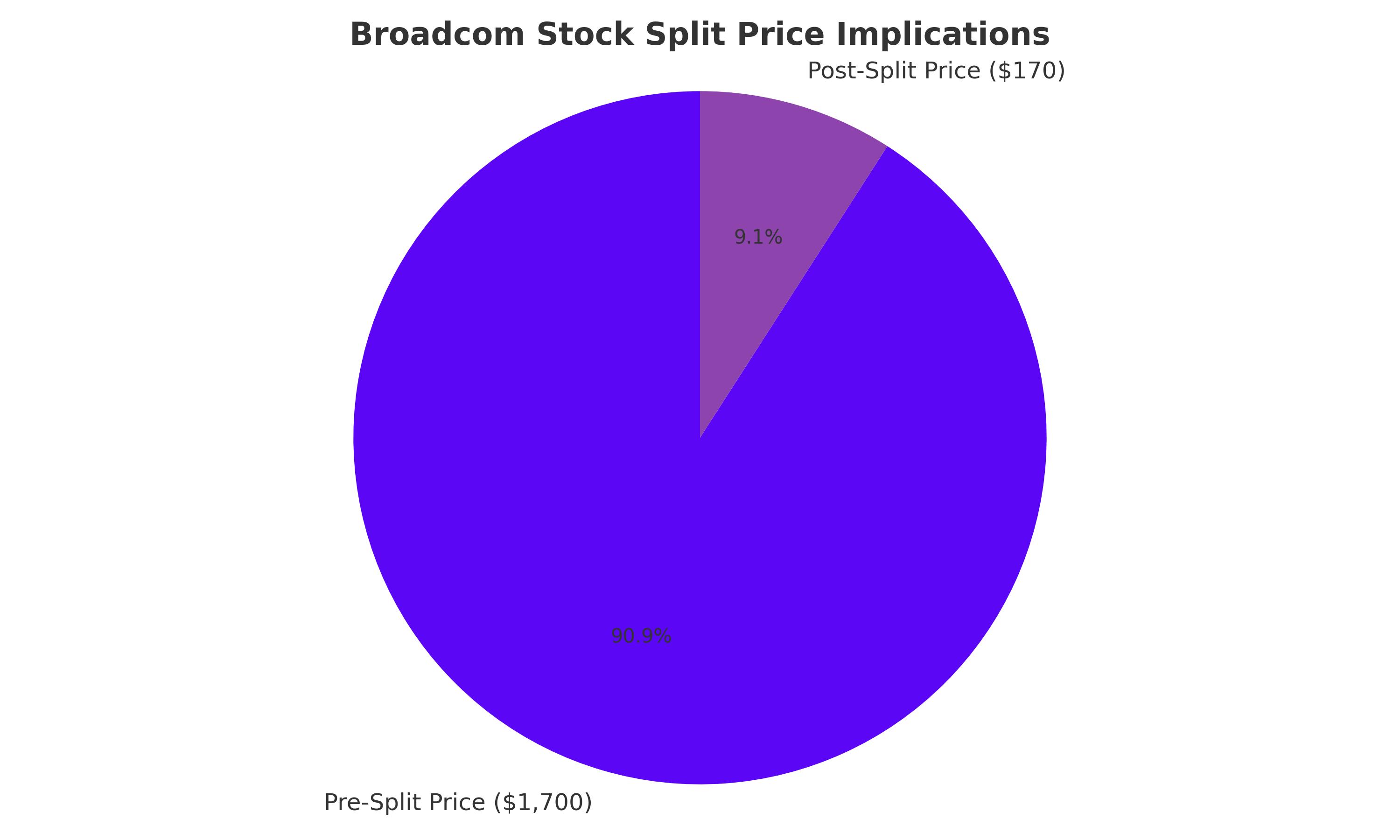

Upcoming Stock Split and Its Implications

Broadcom (NASDAQ:AVGO) has announced a 10-for-1 stock split effective after the market closes on July 12. This split will reduce its trading price from approximately $1,700 to $170, without altering the company’s underlying valuation. The split aims to make options trading more affordable and simplify stock-based compensation, although it doesn’t make the stock more accessible since most brokerages allow fractional share purchases.

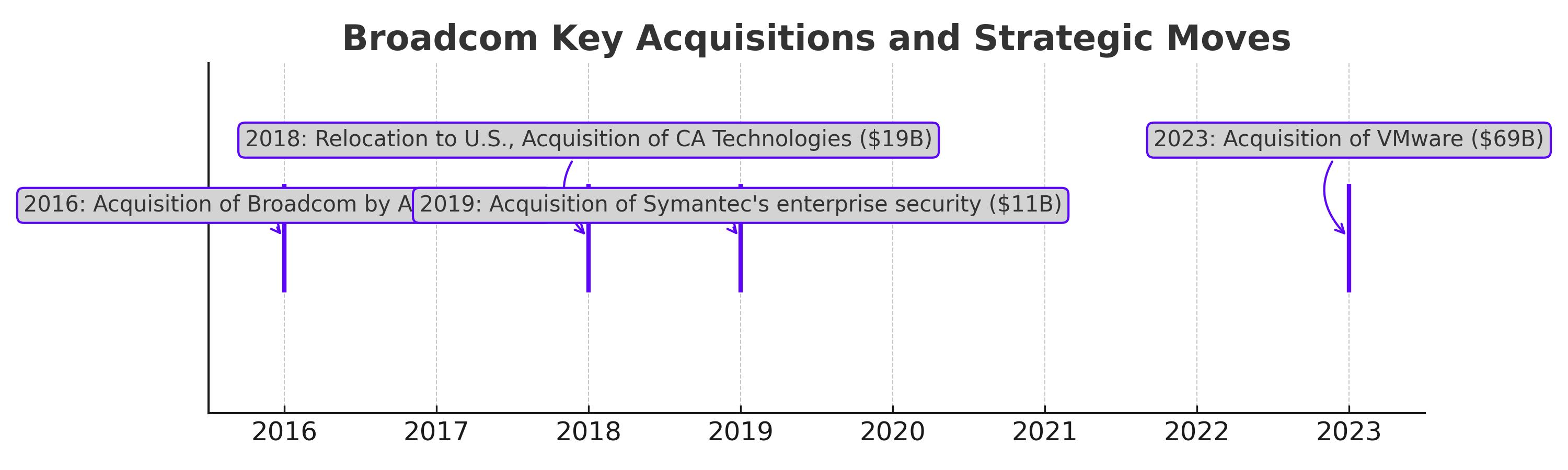

Bold Expansion Strategy

Broadcom’s aggressive expansion strategy over the past eight years has significantly bolstered its market position. In 2016, Singapore's Avago Technologies acquired the original Broadcom for $37 billion, inherited its brand, and relocated its headquarters to the U.S. by 2018. This was followed by strategic acquisitions including CA Technologies for $19 billion in 2018, Symantec's enterprise security division for $11 billion in 2019, and the massive $69 billion acquisition of VMware in late 2023.

These acquisitions have diversified Broadcom's revenue streams, with 58% of its revenue now coming from semiconductors and 42% from software. Over the long term, Broadcom aims to generate about half of its revenue from software, thereby reducing dependence on the cyclical semiconductor sector and its top customer, Apple, which accounted for 20% of sales over the past two fiscal years.

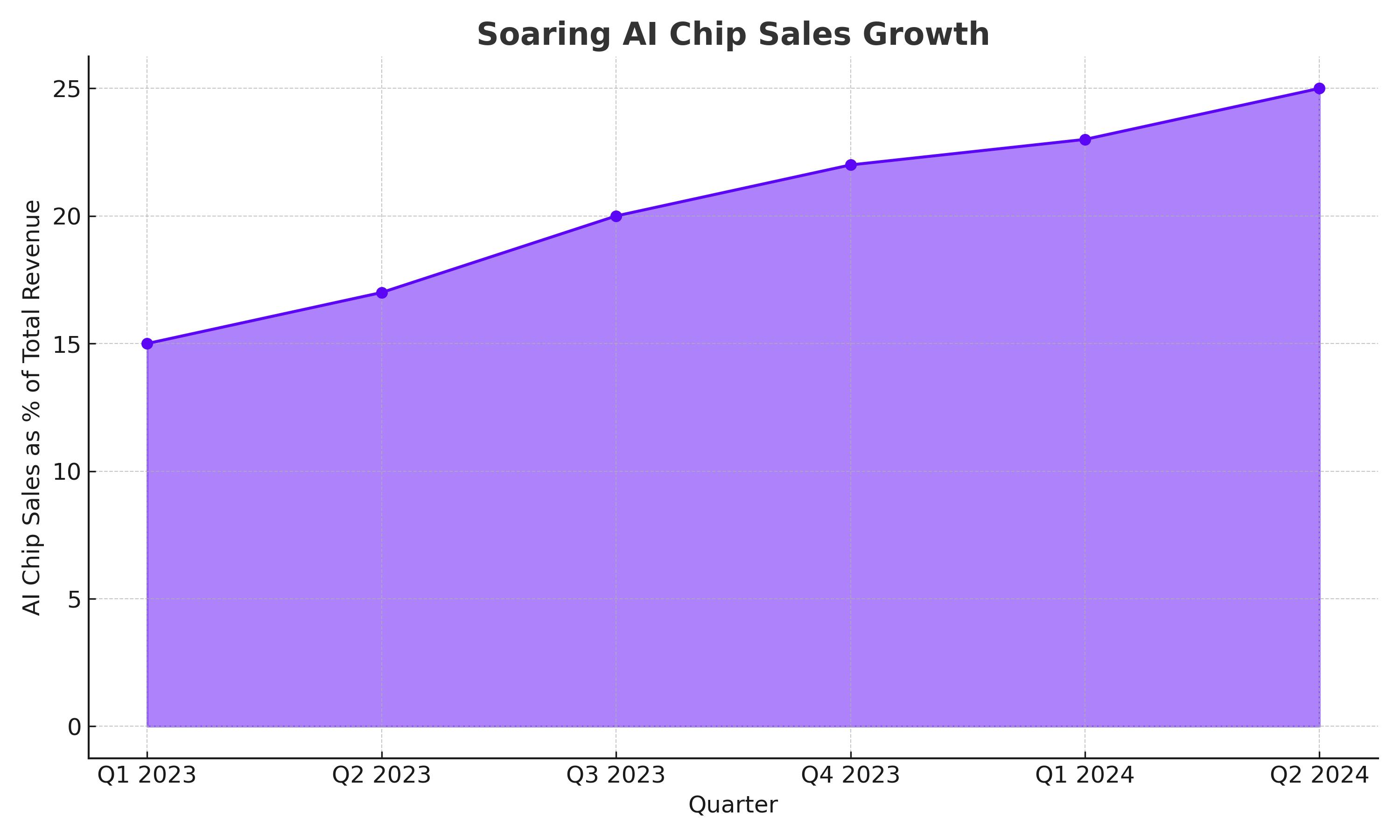

Soaring AI Chip Sales

Broadcom's semiconductor business includes a broad range of wireless, optical, and data storage chips. In Q2 2024, sales of AI-related optical and networking chips surged 280% year-over-year to $3.1 billion, representing 25% of the company’s total revenue. This explosive growth, driven by demand for generative AI applications, offset weaknesses in enterprise and telecom markets amid a challenging macro environment.

Currently, Broadcom's chips power seven of the top eight hyperscale AI clusters, making it a significant player in the AI market and a stable investment option for those looking to benefit from the AI boom without excessive exposure.

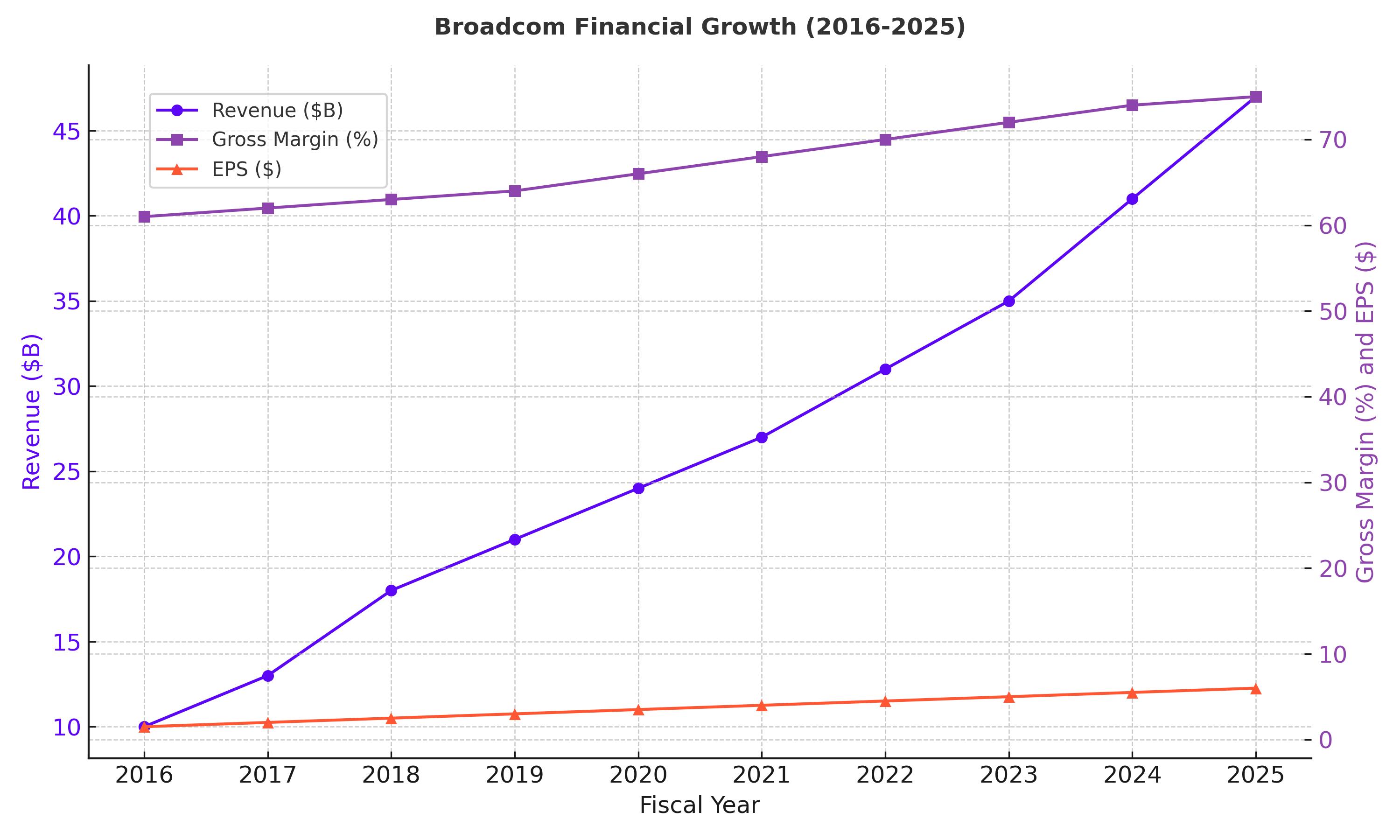

Consistent Financial Growth

From fiscal 2016 to 2023, Broadcom's adjusted revenue grew at a compound annual growth rate (CAGR) of 15%, with its adjusted gross margin increasing from 60.5% to 74.7%. Adjusted EPS also saw a CAGR of 21%. For fiscal 2024, analysts project revenue and adjusted EPS to grow by 44% and 12%, respectively, driven by the first full year of VMware’s revenue. In fiscal 2025, expectations are for revenue to increase by 16% and adjusted EPS by 26%, assuming no further significant acquisitions.

Reasonable Valuation Amid Growth

Broadcom's stock trades at 37 times this year’s earnings and 29 times next year’s earnings, which, while not cheap, are reasonable given its substantial growth and market position. The stock also offers a forward yield of 1.2%. Compared to Nvidia, which trades at 50 times forward earnings, Broadcom offers a more balanced and diversified play on AI, semiconductor, and infrastructure markets.

Market Reaction and Future Guidance

Broadcom's recent earnings report exceeded Street estimates, with Q2 earnings showing a 43% year-over-year revenue increase to $12.49 billion. The company reported a 6% annual growth in semiconductor revenue and a 175% increase in infrastructure software revenue. CEO Hock Tan highlighted record AI product revenue of $3.1 billion during the quarter and accelerated infrastructure software revenue as more enterprises adopted VMware software.

For fiscal 2024, Broadcom forecasts about $51 billion in revenue, surpassing analyst expectations. The company also announced a quarterly cash dividend of $5.25 per share.

Analysts’ Bullish Sentiment

Following the earnings report, multiple analysts raised their price targets for Broadcom. BofA Securities analyst Vivek Arya reiterated a buy rating and increased the price target to $2,000 from $1,680, highlighting Broadcom as a "top 2 AI pick" alongside Nvidia. Barclays analyst Tom O'Malley termed the Q2 report a "mic drop," raising the price target to $2,000 from $1,500. Jefferies analyst Blayne Curtis noted that Broadcom’s AI revenue guidance of over $11 billion for the full fiscal year seems conservative, maintaining a buy rating and raising the price target to $2,050 from $1,550.

Comparison with Tesla (NASDAQ:TSLA)

While Broadcom has surged in value and solidified its market position, it’s worth comparing its trajectory with another major player in the tech space, Tesla (NASDAQ:AVGO). Recently, Broadcom's market value surpassed Tesla’s, reaching around $850 billion compared to Tesla's approximately $500 billion. This shift is due to Broadcom’s strategic acquisitions and its pivotal role in the AI and semiconductor markets.

Conclusion

Broadcom's aggressive expansion strategy, soaring AI chip sales, consistent financial growth, and reasonable valuation underscore its strong market position and growth potential. The upcoming stock split may introduce some short-term volatility, but long-term investors should focus on Broadcom’s core strengths and strategic positioning in the AI and semiconductor markets. Broadcom remains a compelling investment with substantial upside potential. For real-time stock information and detailed analysis, visit Broadcom's real-time chart on TradingNews.

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex