NASDAQ:GPIX: A Comprehensive Analysis of Goldman Sachs' S&P 500 Premium Income ETF

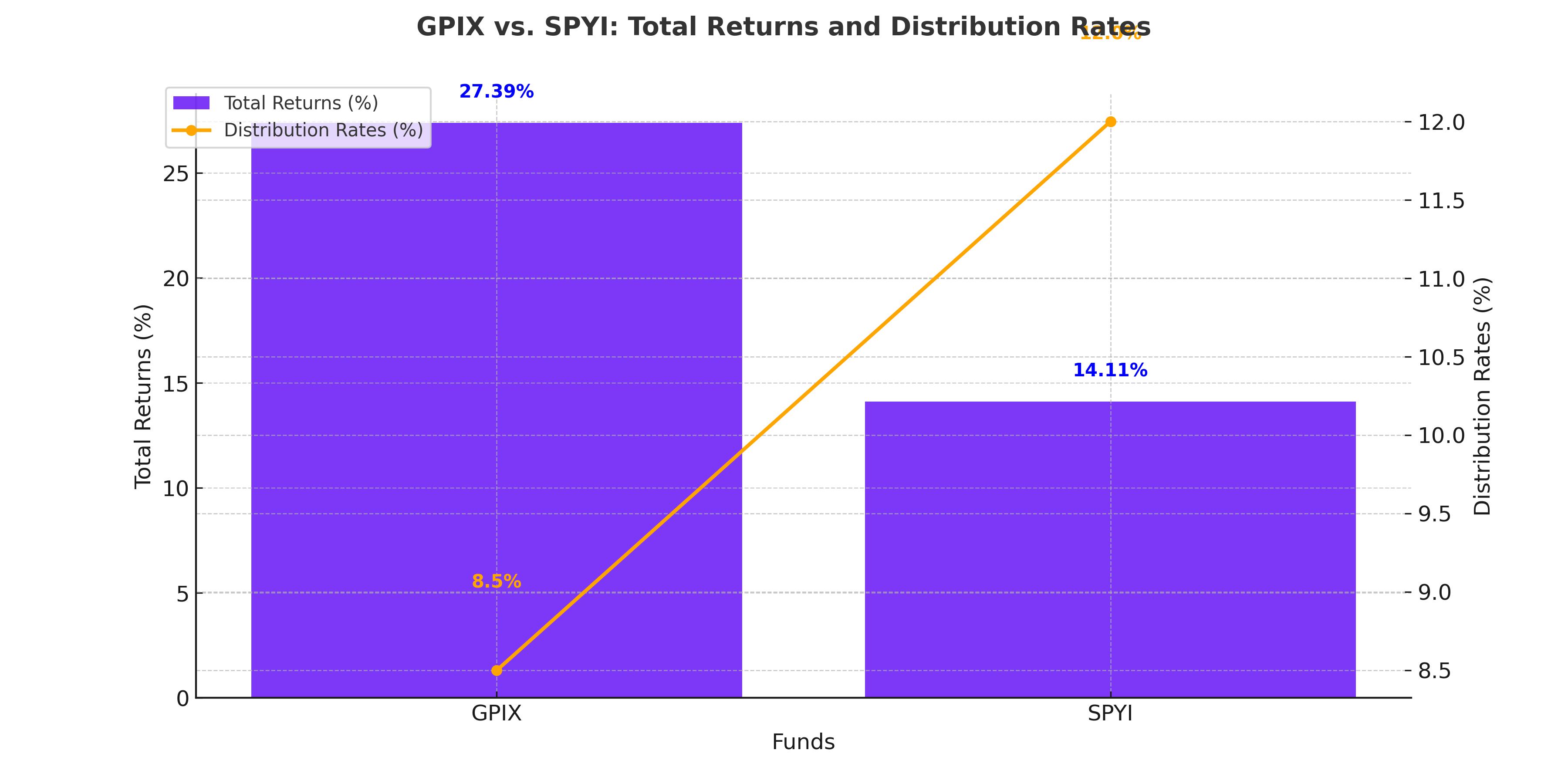

The Goldman Sachs S&P 500 Core Premium Income ETF (NASDAQ:GPIX) is emerging as a notable player in the realm of covered call ETFs, especially for investors seeking a combination of stable income and capital appreciation. With a targeted distribution rate of 8.5%, GPIX strikes a balance between generating income and preserving growth potential, setting it apart from its peers like the NEOS S&P 500 High Income ETF (SPYI). This analysis will delve deeply into GPIX’s strategy, performance, and its potential for investors navigating volatile market conditions.

Understanding GPIX’s Strategy and Differentiators

GPIX employs a sophisticated approach to covered calls by selling call options on the S&P 500 index. Unlike traditional buy-write funds, GPIX adjusts the notional value of its options dynamically, ranging between 25% and 75% of its portfolio. This flexibility allows it to manage risk and capture upside in rising markets effectively. Currently, approximately 36% of GPIX's portfolio is covered by options, leaving the remaining portion open for capital appreciation. This strategic balance is a core reason behind its appeal to long-term investors.

In comparison, SPYI targets a higher 12% distribution rate and covers approximately 76% of its portfolio with options, typically 1-2% out-of-the-money (OTM). While SPYI’s strategy generates higher immediate income, it caps upside potential significantly, making it less attractive during bullish market conditions.

Performance Overview: GPIX vs. SPYI

Since its inception, GPIX has demonstrated superior total returns, outperforming SPYI by nearly 10%. As of the latest data, GPIX boasts a price return of 27.39%, compared to SPYI’s 14.11%. This outperformance is attributable to GPIX’s conservative distribution target, which requires less aggressive option selling. As a result, more of GPIX’s portfolio benefits from the S&P 500’s upward trajectory.

During market upswings, GPIX’s strategy of leaving a larger portion of its portfolio uncapped allows it to outperform funds like SPYI, which prioritize income over growth. However, in down or sideways markets, SPYI’s higher income generation can offset capital losses more effectively, potentially making it the better choice for income-focused investors in bearish scenarios.

How GPIX Captures Upside

The key advantage of GPIX lies in its ability to adapt its options strategy to market conditions. By adjusting the notional value of its covered calls, GPIX ensures that only a portion of its portfolio’s gains is capped. For instance, with the S&P 500 trading at $4,597.58, GPIX’s current 2,475 SPY contracts cover just 36% of its portfolio, leaving the remaining 64% exposed to market growth. This flexibility is critical in bullish markets, where leaving room for capital appreciation can lead to substantial outperformance.

Tax Efficiency and Distribution Stability

GPIX’s distributions are primarily classified as return-of-capital (ROC), a tax-efficient feature that appeals to income-focused investors. ROC reduces the cost basis of shares rather than being immediately taxable, allowing investors to defer taxes until the shares are sold. This characteristic enhances GPIX’s appeal to long-term holders seeking predictable income with minimized tax implications.

SPYI also utilizes ROC, but its higher distribution target may lead to greater fluctuations in NAV over time, especially in prolonged market downturns. Investors must weigh the trade-off between higher immediate income and potential long-term erosion of capital.

Market Outlook: GPIX in a Volatile S&P 500

The choice between GPIX and SPYI hinges on market conditions and investor objectives. For 2025, if the S&P 500 continues its upward trend, GPIX’s strategy will likely lead to superior total returns due to its ability to capture more of the market’s upside. Conversely, in a flat or declining market, SPYI’s higher income generation may provide a buffer against losses.

For investors prioritizing portfolio growth, GPIX’s conservative approach to option overlays and its ability to balance income with appreciation make it an attractive choice. Meanwhile, those focused exclusively on generating the highest possible income may find SPYI’s strategy more appealing, despite the potential for lower long-term total returns.

Final Assessment

GPIX is a compelling option for investors seeking a balanced approach to income and growth within the S&P 500 framework. Its ability to adapt its options strategy dynamically ensures resilience across market cycles, making it a strong candidate for buy-and-hold investors. For those seeking to maximize income at the potential expense of growth, SPYI remains a viable alternative.

Ultimately, GPIX offers a well-rounded investment vehicle for navigating the complexities of today’s markets, particularly for those looking to achieve steady income without sacrificing growth potential. Its strategic flexibility, coupled with robust performance, positions it as a leading choice among S&P 500 covered call funds.