Strong Revenue Growth Despite Industry Challenges

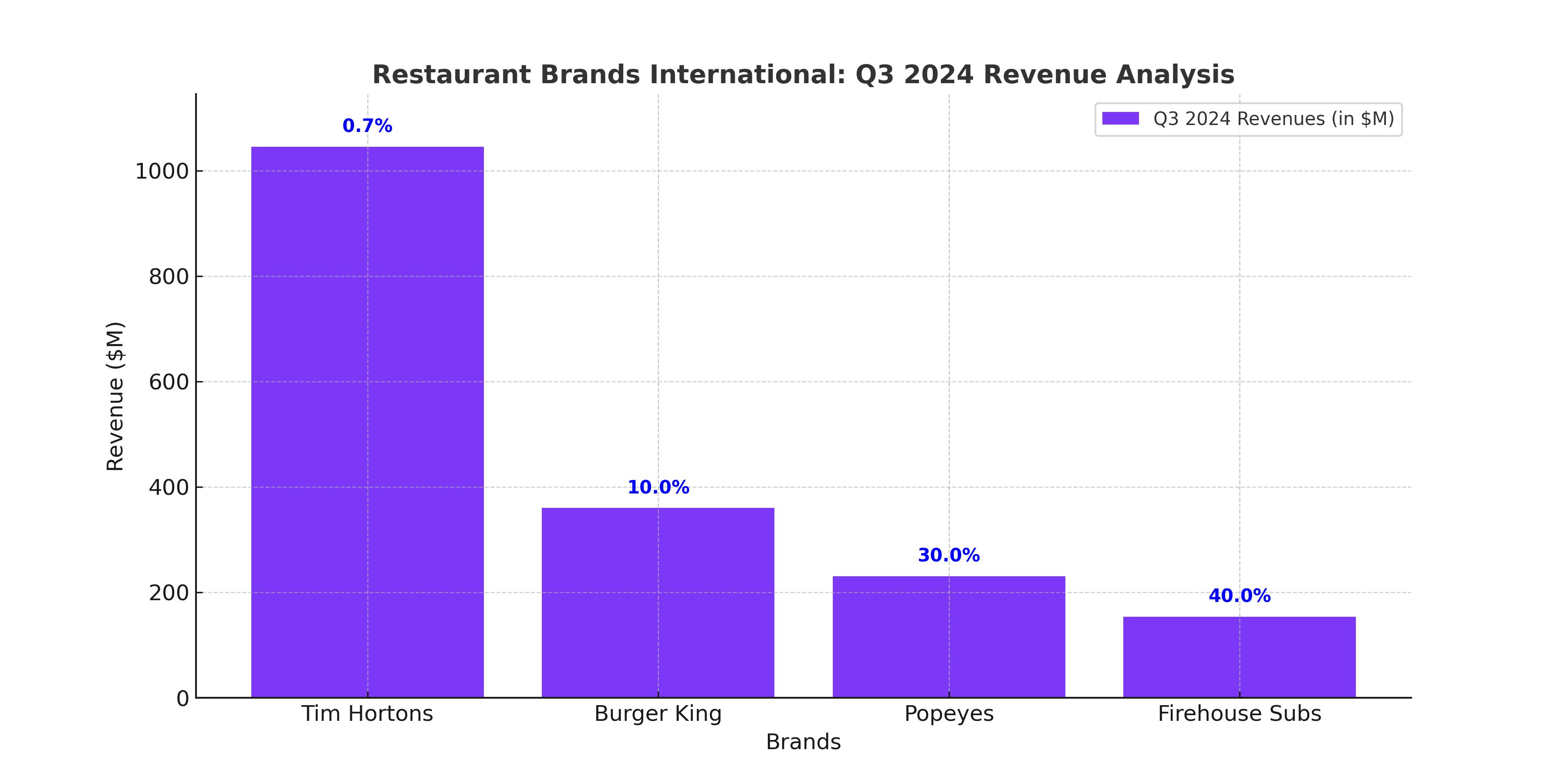

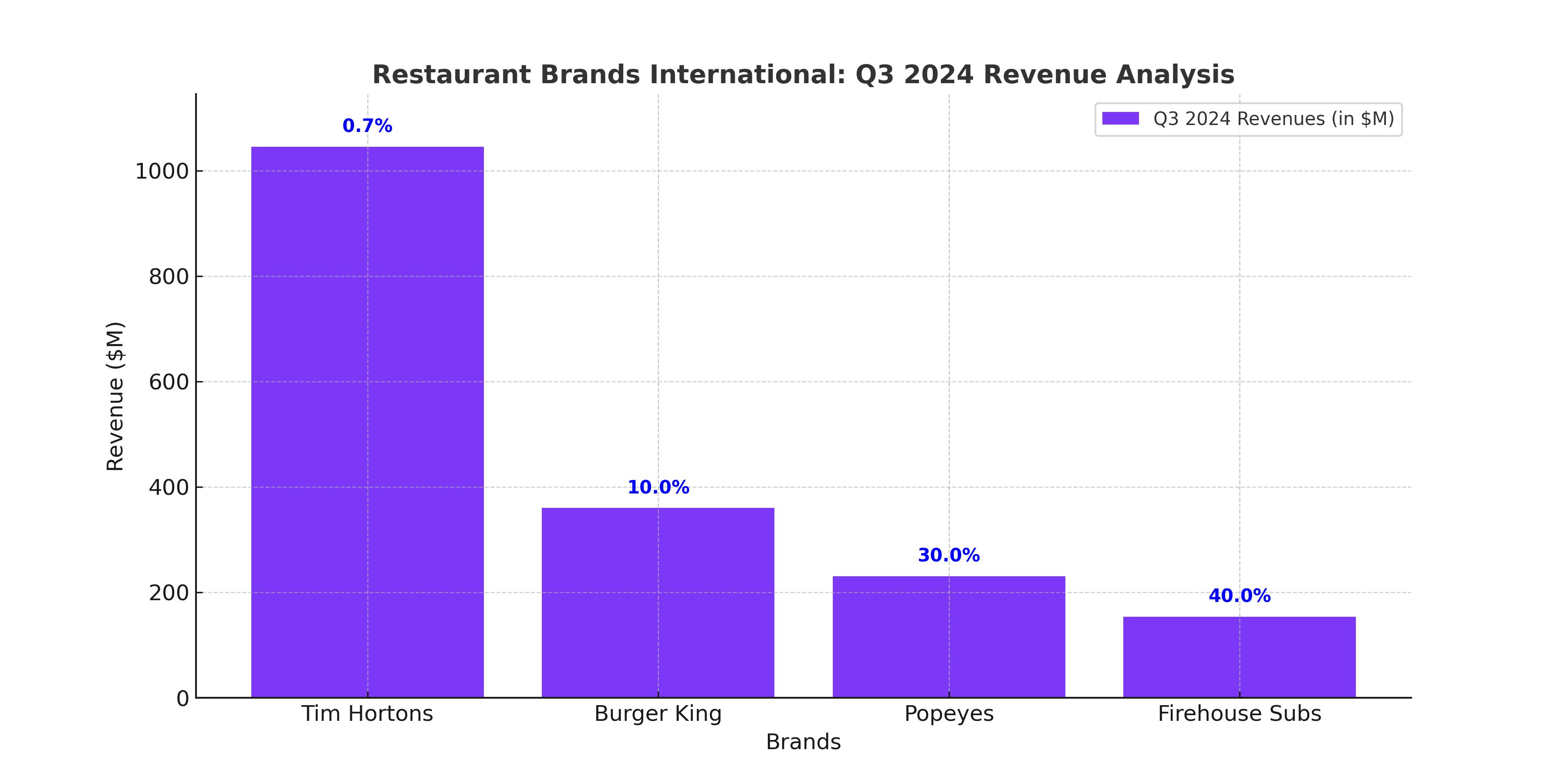

Restaurant Brands International (NYSE:QSR), trading at $60.88, stands out in the quick-service restaurant industry for its solid revenue growth and robust international presence. In Q3 2024, QSR reported total revenues of $2.29 billion, marking a 27% YoY increase and a 10% QoQ rise. Despite industry headwinds, this growth highlights QSR’s resilience and operational efficiency. Burger King contributed $360 million, a 10% YoY increase, while Tim Hortons remained the top performer, accounting for 46% of sales despite a minor -0.8% YoY decrease. Popeye’s and Firehouse Subs saw rapid international expansion, with respective store count increases of 30% and 40%.

Tim Hortons continues to lead, supported by 0.7% organic sales growth driven by favorable forex trends. Its international restaurant count rose by 15% to 1,374 locations, representing 26% of its total units. Burger King also saw a 4.9% increase in international store counts, highlighting QSR’s successful strategy of leveraging international markets to offset domestic pressures.

Franchise Model Bolsters Stability

A cornerstone of QSR’s business model is its franchise-heavy strategy, with 32% of revenues coming from franchising operations. This approach offers a dual advantage: it provides consistent revenue streams while lowering operational risks. However, the company has also balanced its model by increasing company-owned restaurant sales by approximately 700 times YoY, creating a diversified revenue structure.

Franchising reduces operating costs but comes with its own risks, such as dependency on franchisee sales performance, particularly during economic slowdowns. Nevertheless, QSR’s ability to maintain stable topline growth underscores the strength of its operational model, even in a challenging macroeconomic environment.

Liquidity Remains a Strength Despite Debt Concerns

QSR boasts a strong liquidity position, with $1 billion in cash comprising 52% of current assets. True liquid assets, including receivables, represent 83% of current assets, ensuring short-term financial stability. However, the company’s Net Debt/EBITDA ratio of 5.05x signals a heavy reliance on debt for expansion. While 56% of its borrowings will not mature until 2028, the remaining debt portfolio consists of term loans with extended maturities, offering some flexibility.

Free cash flow (FCF) remains robust, with a 22% FCF-to-sales ratio, allowing QSR to reinvest in international expansion and maintain its dividend payouts. The company’s strategic focus on high-growth regions, particularly in East Asia, positions it to capture long-term market opportunities while effectively managing its financial obligations.

Valuation Metrics Signal Undervaluation

QSR’s current P/E ratio of 18.04x is significantly below its five-year average of 23.30x, suggesting the stock is undervalued. Using this metric, the stock’s price target (TP) is calculated at $92.97, implying a 52% upside. Similarly, the P/B ratio of 7.20x, below the five-year average of 7.60x, supports a TP of $76.03, representing a 25% upside.

A DCF model further validates this undervaluation, with a TP of $96.20 indicating a 58% potential increase. This projection is based on conservative assumptions, including a perpetual growth rate of 1.00% and current revenue growth trends.

Technical Analysis Highlights Oversold Conditions

From a technical perspective, QSR appears oversold, with its Relative Strength Index (RSI) at 22 and stochastics signaling potential buying opportunities. The stock is trading below its 50-day and 200-day moving averages, reflecting bearish sentiment in the short term. However, the MACD line and histogram indicate that the selling trend may soon lose momentum, making this an attractive entry point for long-term investors.

Insider Transactions and Shareholder Returns

Insider transactions further affirm confidence in the stock, as detailed on the insider transactions page. Management’s disciplined approach to capital allocation, including buybacks and a 3.5% dividend yield, highlights its commitment to delivering shareholder value.

Competitive Positioning and International Expansion

QSR’s brands, including Tim Hortons, Burger King, Popeyes, and Firehouse Subs, collectively hold a commanding market presence with over 31,500 stores worldwide. Tim Hortons dominates the Canadian market with a 70% share in coffee, while Popeyes ranks as the #2 U.S. chicken quick-service restaurant. Firehouse Subs has been recognized for its food quality and community support, further enhancing QSR’s brand equity.

International growth remains a key driver, with Burger King leading the charge in global markets. The company’s strategic focus on emerging markets, supported by its robust franchise network, ensures a steady pipeline of revenue growth.

Why Restaurant Brands International (NYSE:QSR) Stock Could Be Your Next Big Investment

Restaurant Brands International (NYSE:QSR), the parent company of global giants like Burger King, Tim Hortons, Popeyes, and Firehouse Subs, presents a unique investment opportunity, trading at $60.88 per share as of its last close. With a 52-week range of $56.77 to $73.98, the stock is currently undervalued, offering a potential upside of over 25% based on fair value estimates ranging between $76 and $96. QSR’s strong cash flow, robust international growth strategy, and disciplined financial management make it a standout in the competitive quick-service restaurant sector.

That's TradingNEWS