Will Gold Sustain Its Momentum Above $2,600?

Cooler inflation, a weaker dollar, and geopolitical risks have boosted gold prices. Can the metal overcome key resistance levels to maintain its upward trajectory? | That's TradingNEWS

What’s Driving Gold Prices (XAU/USD) Above $2,600, and Will It Hold?

Gold prices, symbolized as XAU/USD, have recently found themselves at a critical juncture, balancing between economic headwinds and geopolitical tailwinds. With prices hovering around $2,632 per ounce, this precious metal has demonstrated resilience amidst market volatility, supported by dollar weakness, safe-haven flows, and evolving monetary policy signals from the Federal Reserve. However, the question remains: Can gold sustain its position above the $2,600 threshold, or is a deeper correction inevitable? Let’s analyze the factors at play.

The Fed’s Hawkish Tilt and Its Impact on Gold Prices

Gold's recent rally stems largely from the Federal Reserve’s decision to slow its pace of interest rate cuts in 2025, limiting the downward pressure on bond yields and the dollar. The Fed's recent Summary of Economic Projections (SEP) indicated only a half-percent reduction in rates next year, significantly lower than September’s projections. This hawkish stance has capped some of gold’s upward momentum, despite a promising rally above the $2,600 mark. U.S. Treasury yields, particularly on the 10-year benchmark, eased to 4.528%, pulling back from multi-month highs, offering some relief to non-yielding assets like gold.

Meanwhile, the decline in the U.S. dollar index, which dropped 0.59% to 107.79 after reaching a two-year peak, provided a supportive backdrop for gold. Historically, gold and the dollar share an inverse relationship, and the recent dollar weakness has contributed to gold's upward price movement.

Inflation Data and Safe-Haven Demand Fuel Gold’s Strength

Gold's resurgence was also fueled by softer-than-expected U.S. inflation data. The Personal Consumption Expenditures (PCE) price index, the Federal Reserve's preferred inflation gauge, revealed a slower growth rate than anticipated, easing concerns about aggressive monetary tightening. This provided a safe-haven boost for gold, particularly amidst heightened geopolitical risks and looming threats of a U.S. government shutdown.

The ongoing fiscal uncertainty and rising tensions around tariffs under the incoming Trump administration have further amplified safe-haven demand. Congressional gridlock over spending bills and potential shutdowns have historically driven gold higher, as investors seek refuge in the metal's stability during uncertain times.

Technical Levels Define Short-Term Trends for XAU/USD

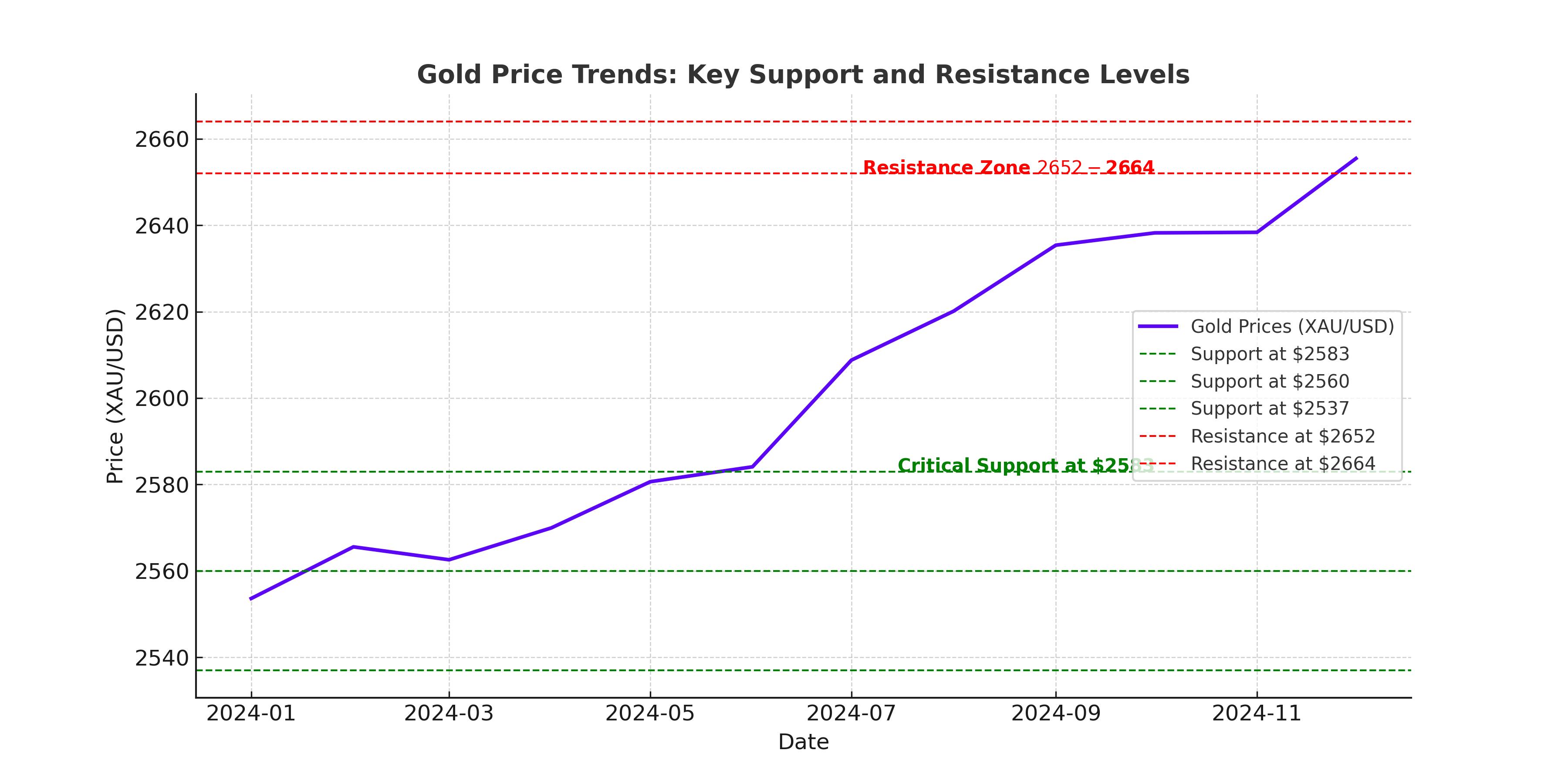

Gold futures showed signs of strength, with February contracts closing above $2,645 per ounce, signaling a potential recovery from last week’s selloff. Key technical indicators suggest that immediate resistance lies at $2,652-$2,655, followed by a more substantial barrier at $2,664. On the downside, support levels at $2,583, $2,560, and $2,537 could serve as critical junctures should bearish sentiment intensify.

The psychological $2,600 mark has emerged as a crucial technical and psychological level. Oscillators on the daily chart are beginning to show positive momentum, hinting at the possibility of a short-term bullish breakout if prices close decisively above the resistance zone.

Geopolitical Uncertainty: A Catalyst for Gold Prices

Geopolitical tensions remain a significant driver of gold’s price dynamics. The BRICS nations’ proposal for a gold-backed digital currency poses a direct challenge to the U.S. dollar's dominance in global trade. This initiative, coupled with escalating tariff threats from the Trump administration, has added a layer of uncertainty to the global economic landscape, further supporting gold's appeal as a hedge.

Additionally, recent discussions on trade restrictions and potential sanctions targeting BRICS economies have underscored gold’s role as a stable store of value. With the BRICS bloc holding 5,700 tonnes of gold, equivalent to 16% of global reserves, their collective push for financial independence could introduce a new era of gold-backed settlements.

Gold’s Role Amid Economic and Mining Developments

The gold mining industry continues to play a pivotal role in meeting global demand. The United States, particularly Nevada, remains a leading gold producer, with key mines like Carlin, Goldstrike, and Cortez driving output. In 2020, Nevada’s Goldstrike and Carlin mines alone produced 1,665 thousand troy ounces of gold, supported by a combined reserve base exceeding 34 million ounces.

Recent advancements in environmentally sustainable mining practices, such as water recycling and land reclamation at Cortez and Turquoise Ridge, reflect the industry's efforts to align with global ESG standards. As demand for gold grows, these strategic mining hubs are well-positioned to capitalize on higher prices.

Market Sentiment and Speculative Positions on Gold Futures

Speculative activity in the futures market has shown an uptick in bullish positions, with money managers increasing net longs on COMEX gold contracts. This aligns with expectations for a potential rally if geopolitical risks intensify or economic conditions weaken further. Hedge funds have also moved to lock in gains as gold prices approached the $2,644 resistance level.

The broader context of global trade imbalances and inflationary pressures continues to support gold’s long-term appeal. With inflationary expectations stabilizing near the Fed's 2% target and central banks worldwide increasing their gold reserves, the metal remains an attractive investment.

Final Thoughts: Is Gold a Buy, Sell, or Hold?

Gold's current position above $2,600 reflects a delicate balance of bullish and bearish forces. While the metal has demonstrated resilience, its ability to sustain this level will depend on upcoming economic data, geopolitical developments, and market sentiment. Investors should monitor key technical levels, particularly the $2,652-$2,664 resistance zone and support near $2,583. For now, gold remains a buy for those seeking long-term stability, though cautious optimism is warranted as global uncertainties persist.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex