Roku (NASDAQ:ROKU): Analyzing Its Path to $105 Price Target

Strong Streaming Subscriber Growth and Revenue Expansion

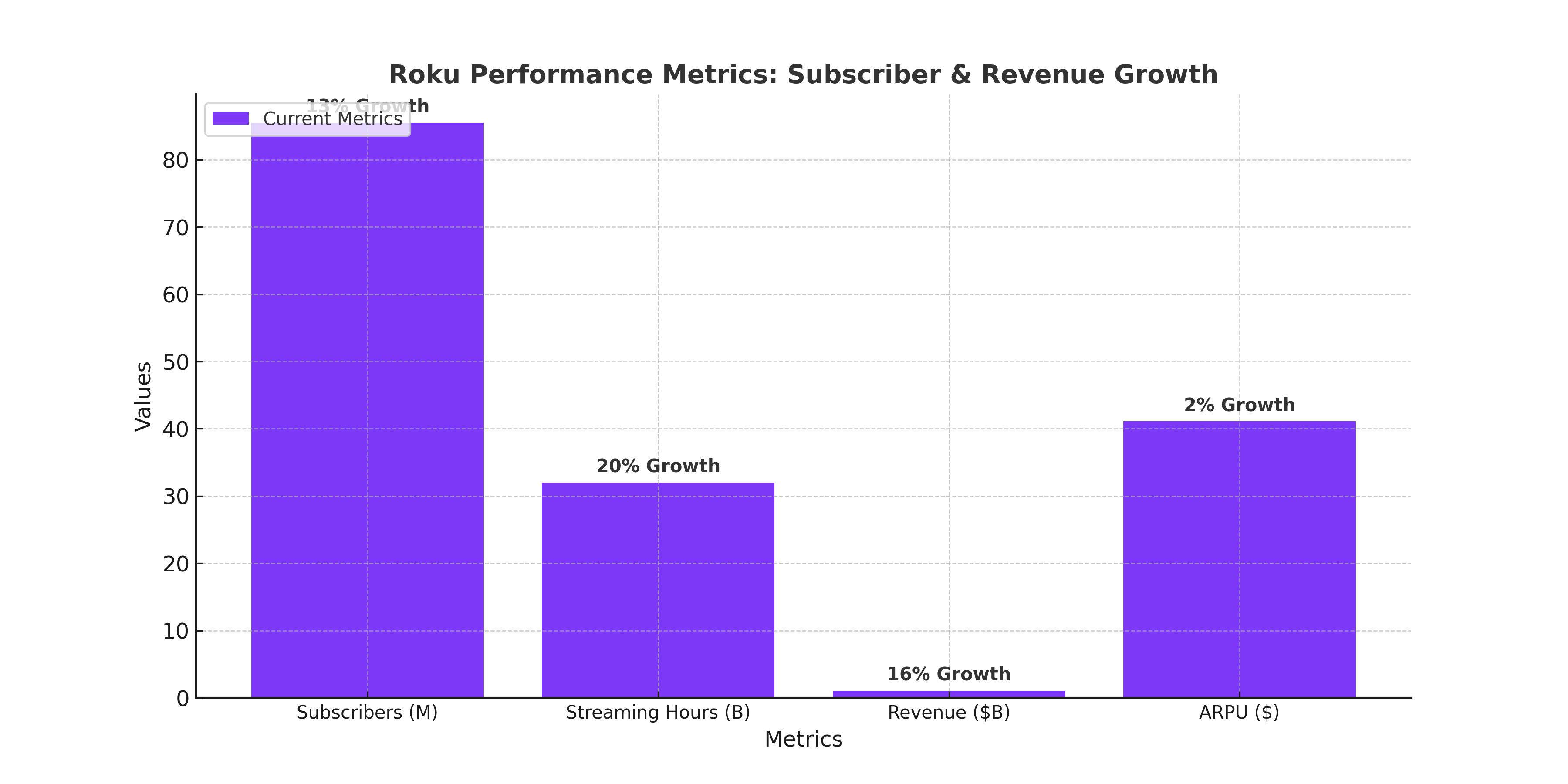

Roku (NASDAQ:ROKU) is solidifying its position as a dominant player in the streaming ecosystem with its robust subscriber growth. As of Q3 2024, the company reported 85.5 million active accounts, marking a 13% year-over-year increase. These subscribers streamed 32 billion hours in the same period, up 20% from the previous year. Roku’s ability to maintain double-digit growth in both subscribers and engagement underpins its long-term revenue potential.

Roku’s revenue reached $1.06 billion in Q3 2024, reflecting a 16% year-over-year increase, driven primarily by platform growth. Despite flatlining ARPU on a year-over-year basis, the average revenue per user climbed slightly to $41.10 in Q3, showcasing sequential recovery. For Q4, Roku has projected $1.14 billion in revenue, up 16% year-over-year, alongside adjusted EBITDA of approximately $30 million. This would bring Roku’s total FY 2024 revenue to over $4 billion, representing a 16.2% growth rate.

Improved Profitability and Path to GAAP Positive Earnings

While Roku remains unprofitable on a GAAP basis, the company has significantly narrowed its losses. In Q3 2024, Roku posted a GAAP net loss of $9 million, down sharply from $330 million a year earlier. Roku’s management has guided for EBITDA profitability in FY 2024, marking a major inflection point in its business trajectory. GAAP profitability is anticipated by FY 2025, further solidifying Roku’s appeal to investors.

This improved profitability stems from strategic cost management and increased efficiency in its advertising operations. The company’s adjusted EBITDA margins have steadily improved, demonstrating that its investments in platform growth are beginning to pay off.

Dominance in the U.S. Streaming Ecosystem

Roku commands a 37% share of the connected TV (CTV) device market, making it the leading platform in this space. The Roku Channel, its flagship free streaming service, has captured 1.9% of the broadcast streaming market as of November 2024, up from 1.0% the prior year. This growth highlights Roku’s ability to expand its market share in a competitive streaming environment dominated by players like Amazon (AMZN) and Netflix (NFLX).

The ongoing trend of cord-cutting and rising adoption of video-on-demand services positions Roku favorably in the streaming ecosystem. The U.S. video streaming market is expected to grow at a compound annual growth rate (CAGR) of 20% over the next decade, creating significant tailwinds for Roku’s growth.

Ad Business Expansion: A Game Changer

Roku’s advertising operations are emerging as a critical revenue driver. Partnerships with major players like The Trade Desk (TTD) and innovations such as the launch of self-service Ads Manager and AI-driven ad tools have enhanced Roku’s CTV advertising capabilities. These tools allow advertisers to create interactive and shoppable ads, providing seamless checkout experiences for consumers through collaborations with companies like Shopify (SHOP) and Instacart (CART).

The political ad cycle in Q4 2024 provided a one-time boost, and management has emphasized the potential for sustained growth in ad revenue. Advertising activities on Roku’s platform outpaced the overall ad market and OTT ad market in the U.S., showcasing its competitive edge in attracting advertisers.

Valuation and Growth Prospects

Roku’s forward price-to-revenue (P/S) ratio stands at 2.1x, well below its three-year average of 2.8x. This indicates a 25% discount to historical valuations, suggesting that Roku remains attractively priced despite its recent rally. By comparison, Netflix trades at a forward P/S ratio of 7.9x, highlighting Roku’s relative affordability.

Roku’s long-term price target of $105 per share implies a 41% upside from current levels. This valuation is supported by robust subscriber growth, improving profitability, and the secular growth of the streaming and advertising markets. Roku’s ability to expand ARPU and monetize its growing user base will be critical to achieving this target.

Risks and Challenges

Roku’s position in the streaming and advertising market is not without vulnerabilities. The company faces a critical challenge in addressing stagnant ARPU (Average Revenue Per User), which stood at $41.10 in Q3 2024, marking no meaningful year-over-year growth. With increasing pressure from competitors like Amazon (NASDAQ:AMZN), Google (NASDAQ:GOOG), and Apple (NASDAQ:AAPL) in the connected TV (CTV) market, Roku must find innovative ways to drive ARPU growth. These tech giants are leveraging their extensive ecosystems and advertising capabilities, which could erode Roku’s 37% market share in CTV devices. Additionally, Roku’s ability to achieve GAAP profitability in FY 2025, a milestone anticipated by investors, remains uncertain. Any failure to meet this expectation could lead to a decline in investor confidence and stock value. Furthermore, Roku’s heavy reliance on the U.S. market, where it generates the majority of its $4 billion annual revenue, limits diversification opportunities compared to its globally diversified peers like Netflix (NASDAQ:NFLX). This overreliance on domestic growth exposes Roku to potential market saturation and macroeconomic risks within the U.S.

Conclusion: A Buy Opportunity for Growth-Oriented Investors

Roku’s strong foothold in the CTV ecosystem, highlighted by its 85.5 million active accounts and 13% year-over-year subscriber growth, coupled with its $1.06 billion in quarterly revenue, underscores its potential as a long-term growth investment. The company’s expanding advertising business, supported by strategic partnerships with firms like The Trade Desk and Shopify, provides a pathway to sustained revenue growth and margin expansion. Despite challenges, Roku’s path to GAAP profitability in FY 2025 could serve as a major catalyst for the stock, aligning with its upward momentum. Trading at a forward price-to-revenue ratio of 2.1x—significantly below Netflix’s 7.9x—Roku presents a relative bargain with a $105 price target that suggests 41% upside from current levels. For growth-oriented investors, Roku’s combination of secular market trends, improved profitability trajectory, and undervaluation positions it as a compelling buy, especially during market pullbacks.