Meta (NASDAQ:META): Positioned for Transformative Growth Amid TikTok Ban and AI Advancements

TikTok Ban as a Catalyst for Growth

The looming TikTok ban, set to potentially take effect on January 19, 2025, has created significant opportunities for Meta Platforms (NASDAQ:META). The recent ruling by the U.S. appeals court, rejecting TikTok's legal arguments, moves the ban closer to reality. TikTok, which boasts over 170 million U.S. users, is a dominant player among younger demographics, capturing approximately 16.75% of its traffic from the U.S. If this ban materializes, a substantial portion of TikTok’s U.S. users could migrate to Meta’s platforms, particularly Instagram and Facebook, which already cater to over 3.29 billion daily active users globally. A mere 50% migration of TikTok's U.S. audience would translate to a 2.5% increase in Meta's total user base. This influx is expected to bolster Meta's ad impressions and further amplify its already strong revenue base in North America.

Meta’s AI Leadership: The Llama 3.3 Model

Meta’s recent unveiling of its Llama 3.3 AI model underscores its commitment to maintaining leadership in AI-driven social media and advertising solutions. The 70-billion-parameter model not only rivals OpenAI’s GPT-4 Pro in performance but also offers unparalleled cost efficiency, with token generation costs as low as $0.01 per million tokens. By integrating AI advancements like these, Meta enhances user experiences, improves ad targeting, and opens the door to enterprise-level AI applications. These developments could generate entirely new revenue streams while reinforcing Meta's dominance in the digital ecosystem.

Revenue Growth Accelerates Amid Competitive Wins

Meta’s Q3 2024 earnings showcased a robust 19% year-over-year revenue growth to $40.6 billion, fueled by a 7% increase in ad impressions and an 11% rise in average ad prices. The strong quarterly performance was driven by AI-backed ad targeting that delivered measurable improvements in advertiser returns. For FY2024, Meta is projected to achieve 22% revenue growth, reaching an estimated $165 billion. Notably, this growth outpaced peers like Alphabet, demonstrating Meta’s ability to seize market share in the competitive digital advertising space.

Profit Margin Expansion and Buyback Programs

Meta has successfully expanded its profit margins, with Q3 2024 operating margins reaching 38.7%, a 470-basis-point improvement year-over-year. This growth has enabled the company to sustain aggressive capital return strategies, including $36 billion in share buybacks over the past 12 months and an additional $4 billion allocated for dividends. These shareholder-friendly moves are backed by Meta’s $42.1 billion in net cash and marketable securities, underscoring its financial strength.

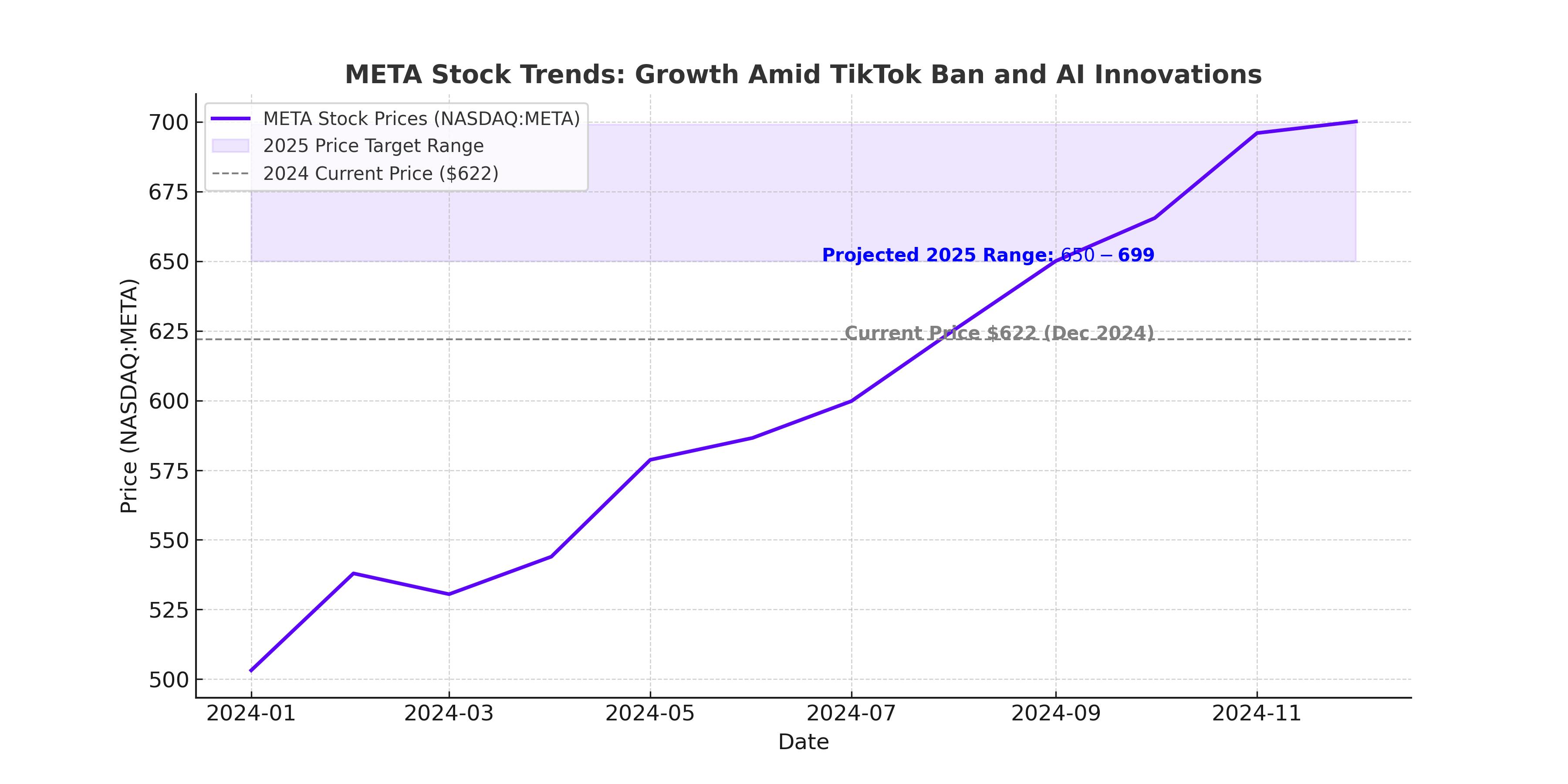

Valuation and Long-Term Potential

Despite its 88% rally over the past year, Meta’s valuation remains attractive compared to its peers. Trading at a forward P/E of 24.5, Meta offers a compelling entry point, particularly when juxtaposed with its fair value estimate of $699 per share, derived from discounted cash flow analysis. This estimate assumes sustained revenue growth driven by the digital advertising market's CAGR of 16.5% and incremental gains from TikTok’s potential ban. Furthermore, Meta’s buyback program and ongoing operational efficiencies are expected to support double-digit EPS growth, projected at 12% in FY2025 and 13.3% in FY2026.

Key Risks to Monitor

Meta’s growth trajectory is not without challenges. Geopolitical tensions could impact Chinese advertisers’ spending, particularly in the U.S. market, where cross-border e-commerce players like Temu have been significant contributors. Additionally, heavy investments in AI and the Metaverse may compress margins in the short term, though they are expected to drive long-term value. Regulatory risks and public sentiment related to data privacy also remain critical concerns for the company.

Conclusion

eta Platforms (NASDAQ:META) is on the brink of a historic growth trajectory, uniquely positioned to reap substantial rewards if the TikTok ban in the U.S. takes effect. With TikTok's 170 million U.S. users potentially displaced, Meta’s platforms, including Instagram and Facebook, stand ready to capture a significant portion of this traffic. The impact on Meta’s metrics could be transformative, adding up to 2.5% to its total daily active users, currently at 3.29 billion globally, while driving higher engagement on Reels, its short-form video format. This shift could fuel a surge in advertising revenue, where Meta already boasts monetization rates that are 4–5 times higher per user minute compared to TikTok.

From a valuation perspective, Meta remains compelling. The stock is currently trading around $622, offering a substantial upside toward its estimated fair value of $699 per share. The company’s robust Q3 results showcased a 19% year-over-year revenue growth, reaching $40.6 billion, while diluted EPS climbed an impressive 37.4% to $6.03. Meta’s ability to leverage AI innovations like the Llama 3.3 model to deliver more efficient ad targeting has already increased ad pricing by 11% year-over-year, a trend likely to accelerate if competition diminishes.

Moreover, Meta’s financial strength is unmatched, with $42.1 billion in net cash and marketable securities, enabling aggressive investments in AI and strategic initiatives. The $36 billion in share buybacks over the trailing 12 months, coupled with operating margins expanding to 38.7%, further underscores its commitment to shareholder value. If TikTok's ban becomes a reality, Meta could capture billions in incremental revenue, reinforcing its dominance in digital advertising and driving even higher profitability.

Meta’s competitive edge is amplified by its scale, innovative AI capabilities, and the potential to absorb displaced TikTok users, not just in the U.S. but globally as regulatory pressures mount against TikTok in Europe and other regions. This scenario positions Meta as the clear beneficiary, with the potential to exceed even the most optimistic earnings projections, pushing EPS growth beyond the consensus estimate of 13.3% for 2026.

With these dynamics, Meta represents a rare convergence of opportunity, innovation, and financial resilience. The potential TikTok ban is not just a growth catalyst but a seismic shift that could redefine Meta’s trajectory. Investors seeking exposure to a dominant player in digital advertising and AI innovation should consider Meta a strong buy, with the stock primed to deliver exceptional returns as it capitalizes on this game-changing moment.