Oil Prices in Flux Amid Market Shifts and Global Dynamics

Weak Chinese Data Sparks Demand Concerns for WTI and Brent

West Texas Intermediate (WTI) crude oil, trading at $69.70 per barrel as of early Wednesday, reflects a bearish sentiment stemming from weaker-than-expected Chinese economic data. Brent crude, priced at $73.56, has shown resilience but is equally weighed down by global uncertainties. China’s retail sales and industrial production reports underscored a subdued consumer spending environment, heightening fears about demand from the world’s largest oil importer. November's crude processing fell to 58.51 million tonnes, the lowest since June, amplifying concerns of weak industrial activity. Year-to-date implied fuel demand dropped 3.3% to an average of 14 million barrels per day (bpd), a troubling figure for global demand forecasts.

US Inventory Data Provides Mixed Signals for Crude Market

The American Petroleum Institute's report offered a glimpse of optimism with a 4.7-million-barrel decline in U.S. crude inventories for the week ending December 13, surpassing market expectations of a 1.85-million-barrel draw. Gasoline inventories, however, rose by 2.45 million barrels, signaling a potential softening in downstream consumption. At the key Cushing, Oklahoma storage hub, crude stocks increased by 800,000 barrels, reversing last week's drawdown of 1.517 million barrels. These mixed inventory signals keep the market cautious ahead of the Energy Information Administration’s forthcoming data.

Fed Interest Rate Decisions Add to Price Volatility

The Federal Reserve’s impending policy announcement is pivotal, with markets anticipating a 25 basis-point interest rate cut. A dovish forward guidance could weaken the U.S. dollar, potentially supporting USD-denominated commodities like oil. Conversely, a hawkish stance might dampen demand, exerting additional downward pressure on oil prices.

OPEC+ and Non-OPEC Supply Dynamics Influence 2025 Forecasts

OPEC+ recently delayed easing its 2.2 million bpd production cuts to April 2025, extending their gradual unwinding until September 2026. Despite this, analysts project a surplus for 2025, with estimates from the International Energy Agency (IEA) predicting a glut of 950,000 bpd, potentially increasing to 1.4 million bpd if production cuts are rolled back. Meanwhile, non-OPEC output from nations like the United States, Brazil, and Guyana is poised to outpace demand growth, which the IEA forecasts at a modest 1.1 million bpd for 2025.

Geopolitical Risks and Regulatory Impacts on Supply Chains

Iran’s oil exports, now estimated at over 1 million bpd, remain resilient despite sanctions, driven largely by sales to China. The Revolutionary Guard Corps has tightened its control over logistics, reportedly managing 50% of Iran’s exports. Concurrently, new sanctions from the European Union and the United Kingdom target Russia’s shadow fleet, further complicating global oil flows. In the UK, the Energy Profits Levy continues to deter North Sea investments, prompting operators like Apache and Ineos to pivot towards the Gulf of Mexico.

Wild Cards: Trade Tensions and Economic Policies Under the Trump Administration

Incoming U.S. policies, including proposed tariff hikes on China, pose significant downside risks to oil demand and economic growth. However, Chinese monetary policy easing and infrastructure investments could counteract some of these effects. Analysts remain divided on the net impact, with Saxo Bank highlighting the delicate balance between fiscal stimulus and geopolitical strife.

Bearish Outlook for 2025, but Potential Recovery Drivers Exist

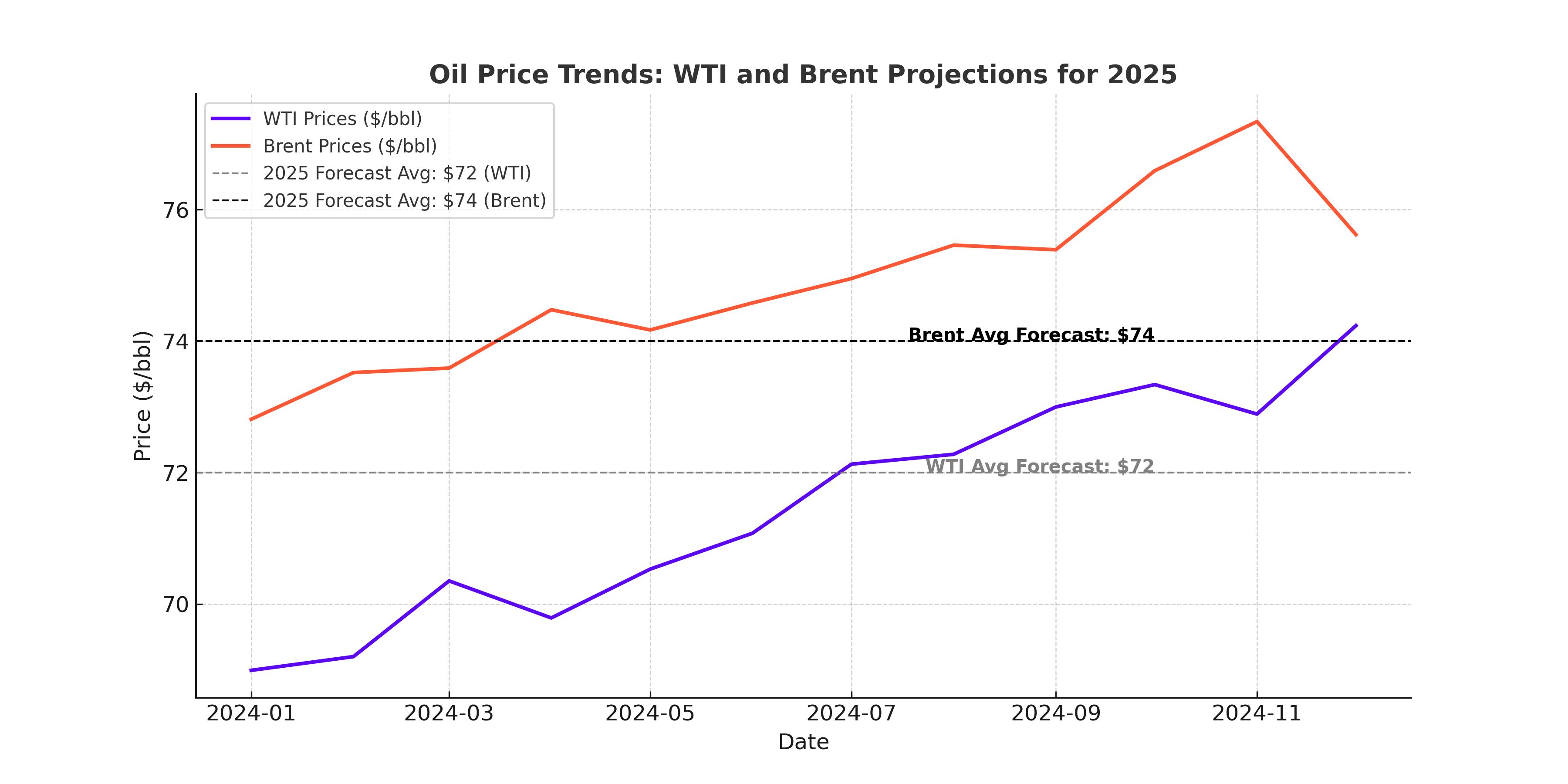

Major investment banks maintain cautious price targets for 2025, forecasting Brent crude to average $74 per barrel. While risks are skewed to the downside, factors such as tighter U.S. sanctions on Iran, heightened Middle East tensions, and a softer dollar could offer price support. The EIA anticipates Brent prices to dip slightly from $74 in Q1 2025 to $72 by Q4 2025, with WTI expected to follow a similar trajectory.

This intricate web of market dynamics, geopolitical shifts, and macroeconomic trends underscores the volatility in oil prices. With WTI hovering below $70 and Brent near $73, the interplay of supply-demand fundamentals and external shocks will likely shape the crude market's trajectory into 2025.