Oil Price Stabilizes Amid Global Supply Tensions and Geopolitical Uncertainty

WTI Crude and Brent Under Pressure from Mixed Market Signals

Oil prices remain volatile, with WTI crude (CL=F) hovering near $73.25 per barrel and Brent (BZ=F) trading at $77.20. Both benchmarks reflect market tensions driven by geopolitical factors and fluctuating demand outlooks. Brent saw a rebound from multi-week lows after Libyan protests disrupted crude loadings at Es Sider and Ras Lanuf, impacting a combined 450,000 barrels per day. While Libya's state-run National Oil Corporation managed to resume operations, the threat of future disruptions continues to underpin Brent's price stability.

China's Demand Wanes Amid Economic Uncertainty

China, the world's largest oil importer, reported weak January manufacturing activity, casting a shadow on crude demand. The unexpected contraction raises doubts about recovery in the Chinese economy, a key driver for global oil markets. Additionally, independent refiners, or "teapots," in China's Shandong province have reduced operations due to rising costs and tariff hikes on sanctioned crude imports. Refining rates for these plants have dropped to 50%-55%, their lowest levels since mid-2024. Meanwhile, state-controlled Sinopec increased refinery run rates by 100,000–150,000 barrels per day to meet Lunar New Year travel demand and prepare for maintenance downtime in spring.

Impact of U.S. Sanctions on Russian Oil Supply

The Biden administration’s aggressive sanctions targeting Russia’s oil trade continue to reverberate across global markets. Restrictions on 183 vessels and multiple energy firms have significantly increased shipping costs for Russian crude destined for Asia. The ESPO blend, favored by Chinese refiners, now trades at a $3–$5 premium to Brent on a delivered ex-ship basis, up from under $2 before the sanctions. India, Russia’s other major buyer, has secured temporary exemptions to allow sanctioned tankers to discharge crude at its ports until February 27, but post-February trade faces challenges due to soaring freight rates.

OPEC+ Balances Production Cuts and Increasing Output Plans

OPEC+ members are maintaining their strategy of holding back 5.86 million barrels per day, approximately 5.7% of global demand, to support prices. However, starting in April, the group plans to cautiously increase output, a decision reaffirmed during recent discussions among key members such as Saudi Arabia, Libya, and Iraq. U.S. President Donald Trump's calls for lower oil prices, coupled with his aggressive tariff plans, add another layer of complexity to OPEC+ decision-making, as members aim to balance market stability with geopolitical pressure.

Libyan Disruptions Offset by Broader Supply Trends

Protests in Libya briefly halted loadings at major ports but were quickly resolved, minimizing long-term market impact. Nevertheless, analysts warn of recurring risks to Libyan production, which remains vulnerable to political and social instability. Meanwhile, Chevron's (NYSE:CVX) $48 billion expansion at Kazakhstan's Tengiz field is expected to boost output by 25%, reaching 960,000 barrels per day by Q2 2025, providing some relief to tight global supply.

U.S. Energy Policies and Tariffs Add to Market Uncertainty

Trump's threats to impose a 25% tariff on Colombian imports and additional tariffs on critical commodities like steel, aluminum, and computer chips have created uncertainty across multiple sectors. Colombia, heavily reliant on the U.S. for oil exports, avoided immediate tariffs by agreeing to U.S. demands regarding deported migrants, but such geopolitical maneuvers contribute to a risk premium in oil prices. Meanwhile, U.S. crude inventories have remained stable, but warmer-than-expected winter weather has reduced demand for heating fuels, tempering price increases.

European and Asian LNG Shifts Affect Oil Market Dynamics

Rising European demand for LNG, spurred by colder weather and declining Russian gas supplies, has diverted shipments away from Asia. European LNG imports for January are on track to reach 11.82 million metric tons, the highest since April 2023. This trend underscores Europe’s reliance on alternative energy sources as Russian pipeline gas remains constrained. Asian spot LNG prices, hovering around $14 per MMBtu, are less competitive, incentivizing sellers to prioritize Europe-bound cargoes.

WTI and Brent Outlook: Key Levels to Watch

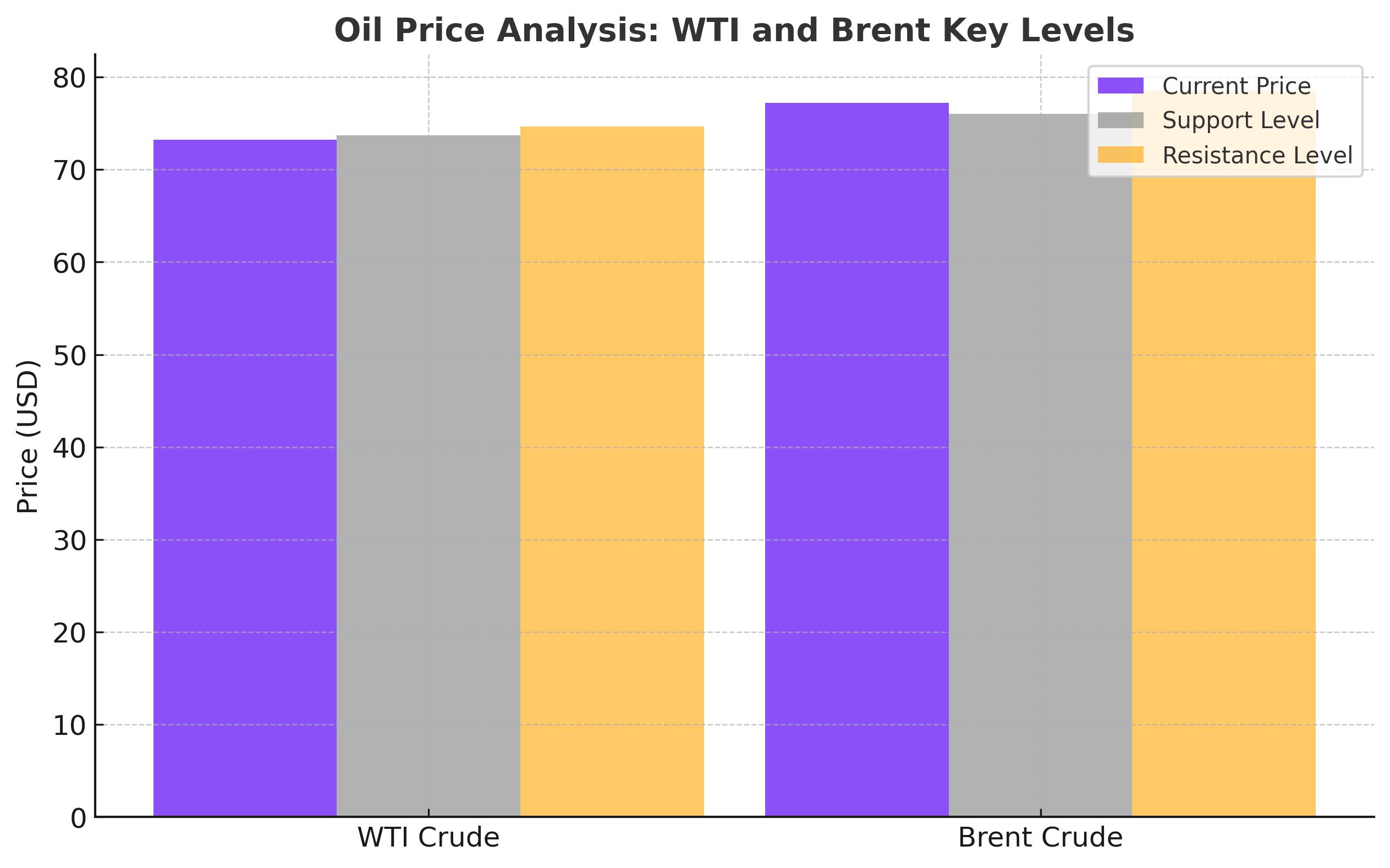

WTI crude faces immediate resistance at $74.67, the 200-day moving average, with further barriers near $75.24 and $76.21. Support lies at $73.70, with additional downside risk toward $72.84 if bearish momentum intensifies. Brent crude, trading near $77, has support at $76 and resistance at $78.50, with potential for upside if Libyan disruptions or Russian supply constraints escalate. Analysts suggest that Brent could retest the $80 threshold if global supply issues worsen or geopolitical tensions rise.

Is Oil a Buy, Sell, or Hold Amid Volatility?

The current market environment suggests caution for traders. While geopolitical risks and supply disruptions support bullish sentiment, weaker Chinese demand and Trump's tariff policies weigh on prices. For WTI, maintaining support above $73 signals a potential short-term buying opportunity, while Brent’s performance near $78 offers a speculative hold as OPEC+ prepares to raise output. Investors should remain vigilant, as the Federal Reserve's upcoming rate decisions and U.S. economic data could influence broader market dynamics.