Trump’s Influence on Oil Markets

President Trump’s recent statements at the World Economic Forum in Davos reignited pressure on OPEC+ to lower oil prices, with the claim that reducing oil prices could play a pivotal role in ending the ongoing Ukraine war. Trump's remarks pushed oil traders to offload positions, contributing to the sharp drop in both WTI and Brent prices. However, OPEC+ appears resolute in maintaining its strategy, delaying planned production increases until April 2025. This decision ensures markets are not oversupplied, stabilizing prices in the medium term. The delay also extends the timeline for unwinding production cuts until the end of 2026, a move that underscores OPEC's control over global supply dynamics.

Colombia’s Role in Oil Supply and Sanctions Relief

Oil prices briefly stabilized after the U.S. government withdrew proposed sanctions on Colombia following the country's agreement to accept deported migrants. With Colombia sending approximately 41% of its seaborne crude exports to the U.S., any disruption in this trade could have heightened supply concerns. However, the market remains on edge, with fears that Trump’s unpredictable policy decisions could lead to further disruptions in trade and energy flows.

Geopolitical and Economic Factors Weigh on Oil Prices

Market sentiment also reflects broader concerns over geopolitical tensions and economic data from major economies. Weak manufacturing data from China, the world’s largest oil importer, raised questions about future demand. Citibank analysts highlighted the need for additional policy efforts to stabilize China's economic growth. In Germany, improved business morale failed to significantly offset pessimism about the broader European economic outlook. These factors have collectively added downward pressure on oil markets.

Saudi Arabia’s Strategy and OPEC+ Resilience

Saudi Arabia remains a critical player in shaping global oil prices. The Kingdom is reportedly set to increase its official selling prices (OSPs) for crude exports to Asia, reflecting tightening supplies and rising benchmarks. The flagship Arab Light crude is expected to see a price hike of up to $3 per barrel over the Oman/Dubai average. Such an increase would mark the highest premium since January 2024. This strategy underscores Saudi Arabia's efforts to maintain market share and support its fiscal needs, with its 2025 budget breakeven oil price estimated at $98 per barrel of Brent.

Saudi Arabia’s leadership in OPEC+ remains unwavering despite external pressures. The group’s calculated approach to balancing supply and demand reinforces its commitment to long-term market stability. While Trump’s calls for increased production have garnered attention, OPEC+ has shown no signs of deviating from its planned output strategy.

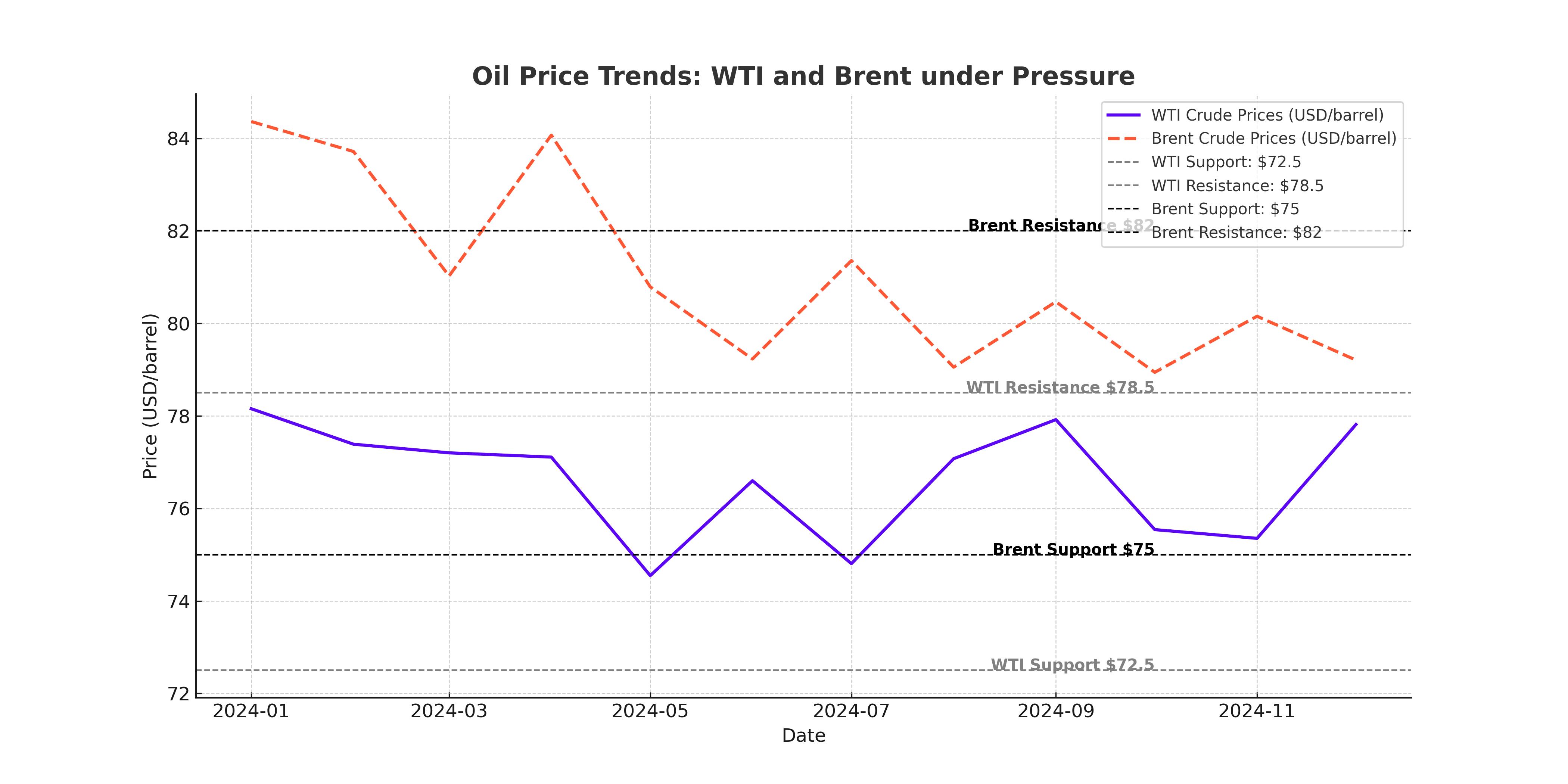

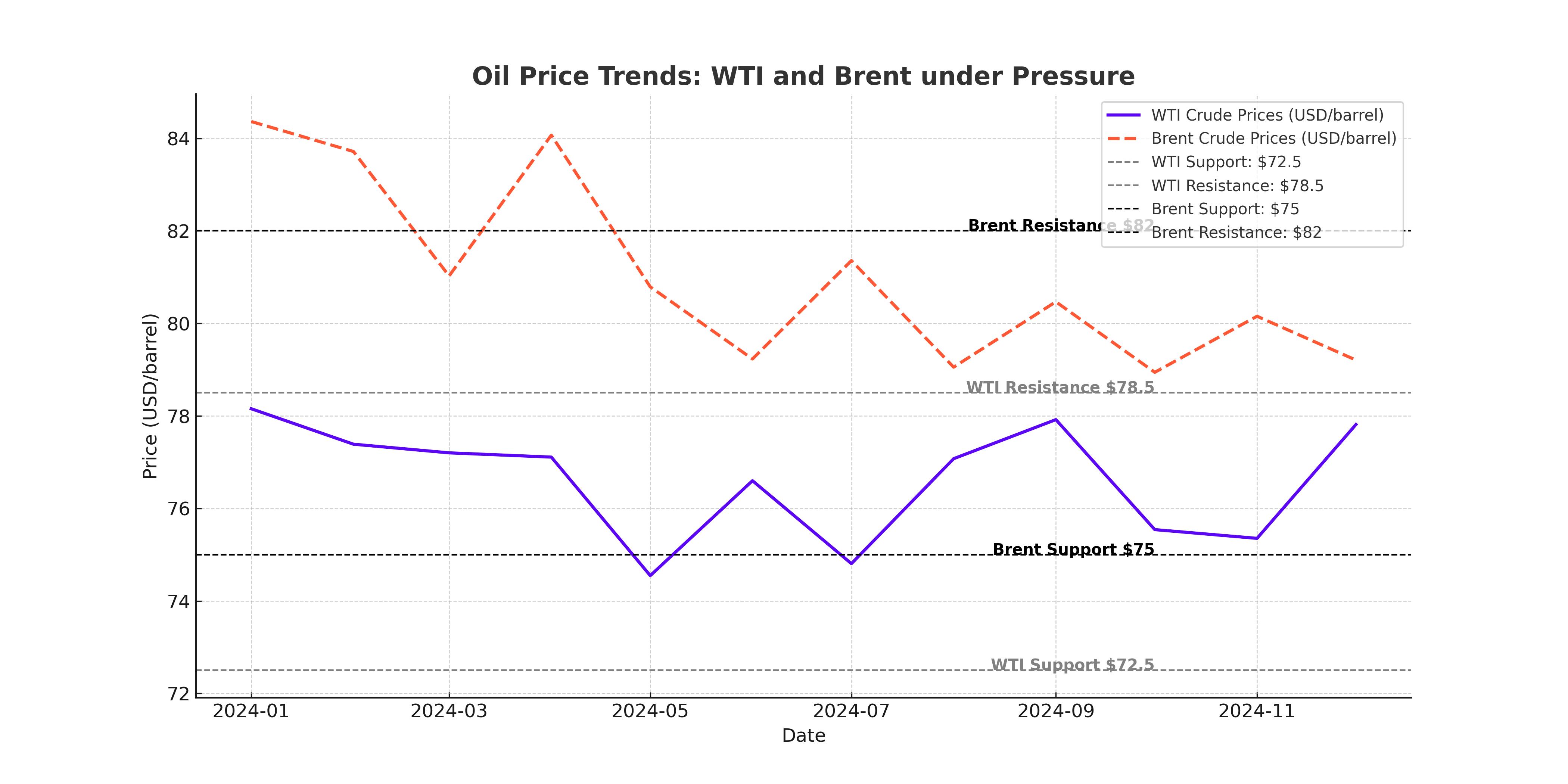

WTI and Brent Technical Outlook

WTI crude is currently hovering near critical technical levels, including the 200-day exponential moving average (EMA). Support at $72.50 per barrel provides a potential floor for prices, with resistance levels around $78.50. Analysts suggest that WTI could see a rebound if global central banks implement further rate cuts, which would support demand. Brent crude mirrors this pattern, trading near its 200-day EMA, with support at $75 and resistance at $82. Despite the current bearish sentiment, both benchmarks remain poised for potential recovery amid tightening supplies and geopolitical uncertainties.

Market Risks and Investor Sentiment

Investor sentiment remains cautious, with markets grappling with Trump’s tariff policies, OPEC+ production strategies, and the broader impact of economic data. The emergence of AI-driven market disruptions, such as China's DeepSeek challenging U.S. technology dominance, adds an additional layer of complexity to energy markets. Safe-haven assets like gold and U.S. Treasury bonds have seen increased demand, highlighting broader risk aversion among investors.

Future Outlook for Oil Prices

Looking ahead, oil markets will likely remain volatile, driven by central bank policies, geopolitical developments, and OPEC+ actions. The Federal Reserve’s upcoming meeting is expected to result in a rate pause, which could support crude prices in the short term by easing recession fears. However, Trump’s persistent calls for lower oil prices and ongoing tensions in Ukraine create significant uncertainty.

That's TradingNEWS

Adobe (NASDAQ:ADBE): Redefining Growth and 52% Potential Upside

Adobe (NASDAQ:ADBE): Redefining Growth and 52% Potential Upside

Is SoundHound AI (NASDAQ:SOUN) the Next Big AI Disruptor?

Is SoundHound AI (NASDAQ:SOUN) the Next Big AI Disruptor?

Can Alphabet (GOOGL) Deliver Over 20% Upside by 2025?

Can Alphabet (GOOGL) Deliver Over 20% Upside by 2025?

Can NVIDIA (NASDAQ:NVDA) Reach $350 Amid Soaring AI Demand?

Can NVIDIA (NASDAQ:NVDA) Reach $350 Amid Soaring AI Demand?

Will Micron Technology (NASDAQ:MU) Regain Momentum and Hit $115?

Will Micron Technology (NASDAQ:MU) Regain Momentum and Hit $115?