Oil Prices Face Heavy Selling Pressure – Is the Rally Over?

Crude oil markets remain volatile as WTI (CL=F) trades below $75 per barrel, erasing all its 2025 gains. Brent (BZ=F) is also feeling the pressure, slipping below $80 per barrel as traders digest a mix of bearish catalysts, including rising U.S. crude stockpiles, weaker global demand, and ongoing U.S.-China trade tensions. After an initial rally fueled by geopolitical uncertainty and OPEC+ production cuts, oil has struggled to hold its ground as economic risks weigh on future consumption expectations.

Surging U.S. Inventories Point to Weak Demand

One of the biggest headwinds for oil prices remains soaring U.S. crude inventories, which are signaling weak refinery demand. Latest reports show U.S. crude stockpiles rose by 4.3 million barrels last week, far exceeding analyst expectations of a 1.5-million-barrel build. This increase, combined with higher gasoline and distillate inventories, is dampening bullish sentiment. Even with OPEC+ maintaining supply cuts, the oversupply situation in the U.S. is making it difficult for WTI (CL=F) to hold higher price levels. If this trend continues, crude prices could see another leg lower toward $70 per barrel.

How the U.S.-China Trade War is Hitting Oil Prices

The Trump administration’s latest tariff measures against China are adding another layer of pressure to global crude markets. China has responded by imposing a 10% tariff on U.S. crude oil, making American exports less competitive. Given that China is a key buyer of U.S. oil, this policy shift could lead to a further decline in demand for American crude. If trade tensions continue escalating, WTI (CL=F) and Brent (BZ=F) may struggle to find bullish momentum, with markets facing prolonged uncertainty over global oil consumption trends.

Iran Sanctions and Venezuelan Exports – Will Supply Disruptions Boost Oil?

Despite bearish factors, the market is still watching developments around U.S. sanctions on Iran and Venezuela, which could impact global oil supply. The Trump administration has tightened sanctions on Iranian oil exports, specifically targeting three major tankers carrying crude to China. This move is in line with efforts to reduce Iranian oil exports, potentially tightening global supply in the coming months. Meanwhile, Venezuela’s oil exports have surged by 15% in January, hitting 867,000 barrels per day, with China being the primary buyer. While Venezuelan production is growing, U.S. sanctions remain a risk factor that could limit future exports.

OPEC+ and the “Drill Baby Drill” Debate in the U.S.

OPEC+ continues to maintain its production cut policy, aiming to support prices. However, the market is skeptical about whether these cuts will be enough to offset rising U.S. production. American oil executives have warned that Permian Basin production growth will slow by 25% this year, but output is still rising by 250,000 barrels per day. This contradicts Trump’s push for higher U.S. oil output, as energy executives remain cautious about capital spending in the current low-price environment. If U.S. producers maintain strong output, WTI (CL=F) may struggle to break above $80 per barrel in the near term.

India Overtakes China as the World’s Fastest-Growing Oil Consumer

While China’s oil demand growth has slowed, India is now driving global oil consumption higher. January data shows India’s oil demand increased by 3.2% year-over-year, with gasoline demand rising 6.7% and diesel up 4.2%. The U.S. Energy Information Agency (EIA) now expects India to account for 25% of global oil demand growth in 2025, surpassing China. If this trend continues, India’s strong demand could provide a floor for oil prices, despite weaker growth in other regions.

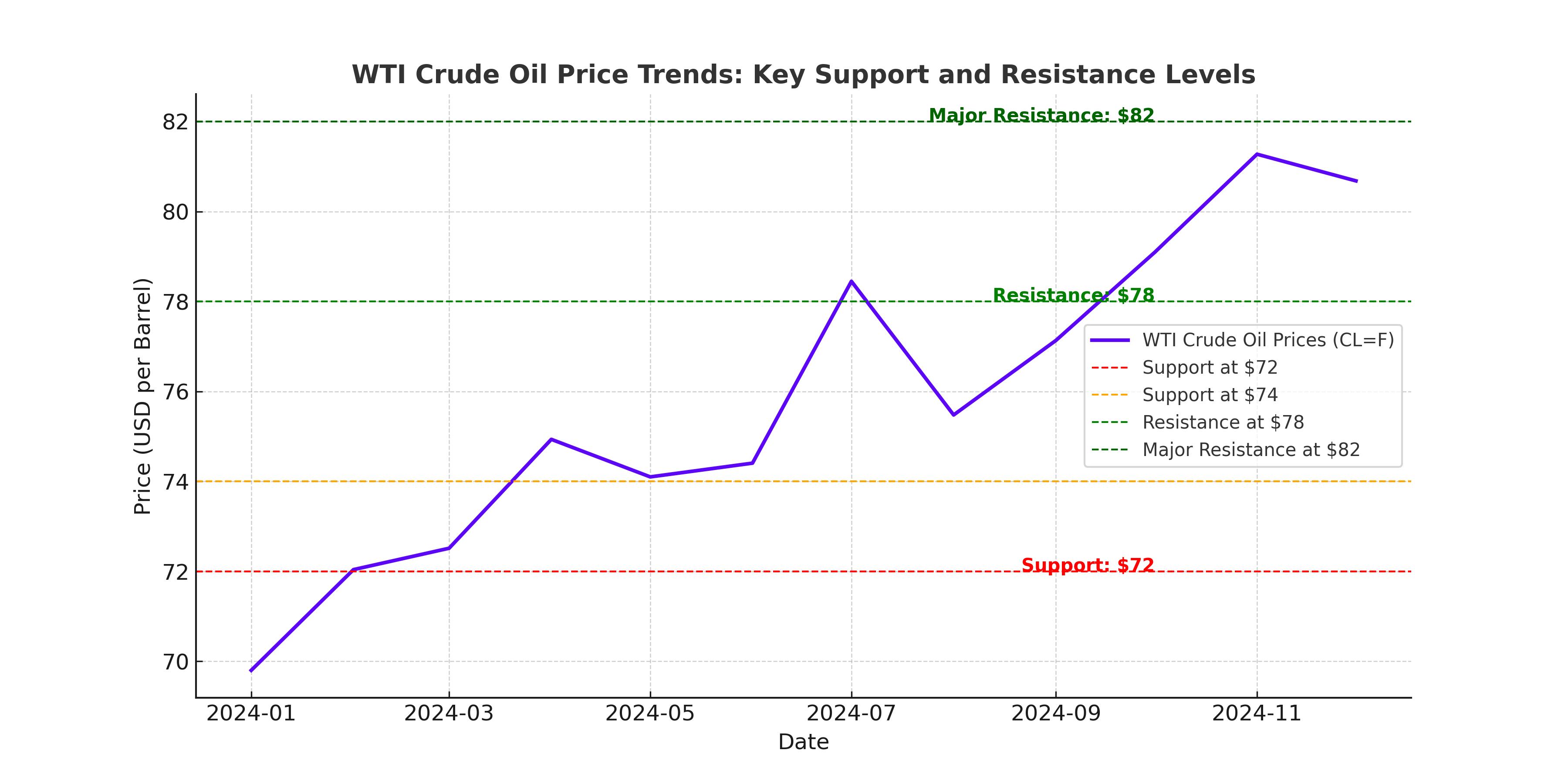

Technical Outlook – Can WTI (CL=F) Hold Above $72?

WTI crude oil is trading near a key support zone at $72-$74 per barrel, a level that previously acted as strong resistance in late 2024. If this support holds, oil prices could attempt a rebound toward $78-$80, with $82 acting as a major resistance level. However, if WTI (CL=F) breaks below $72, it could trigger further selling, potentially testing $70 per barrel. Brent (BZ=F) is also trading near its support zone, with $77 being the key level to watch.

Final Verdict – Where Does Oil Go Next?

Oil markets remain caught between supply concerns and demand risks. While rising inventories, trade wars, and slowing Chinese growth are weighing on prices, factors like geopolitical uncertainty, OPEC+ cuts, and India’s surging demand could provide some upside support. The short-term outlook depends on how the U.S. economy performs and whether oil demand can rebound globally. For now, WTI (CL=F) needs to hold above $72 to maintain any bullish momentum, while Brent (BZ=F) must break above $80 to reverse the recent downtrend. Investors should watch for further developments in Iran sanctions, U.S. production trends, and global refinery demand to gauge where oil prices are headed next.