WTI Drops Below $69 as Geopolitical Tensions and Global Oil Demand Shape Market Dynamics

Brent at $72, China’s Oil Demand Peaks Early, and OPEC+ Strategies Drive Uncertainty for 2025 | That's TradingNEWS

Oil Prices Under Pressure: Supply, Geopolitics, and Demand Dynamics Shape 2025 Outlook

WTI and Brent Crude Movement Amid Geopolitical and Economic Shifts

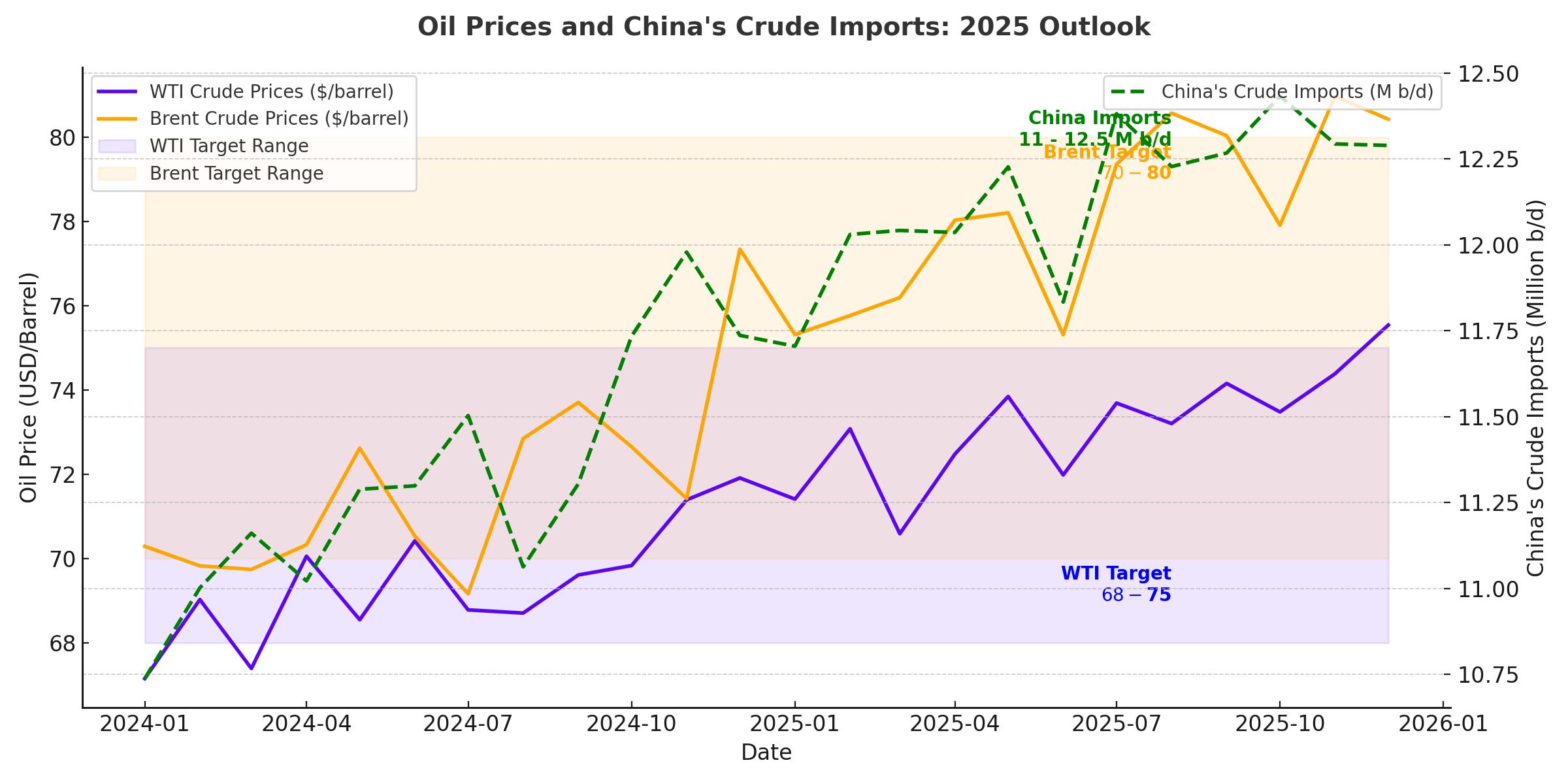

Oil markets remain at a critical juncture, with WTI (CL=F) trading below $68.59 and Brent (BZ=F) hovering under $72 per barrel. Despite volatile geopolitical events, including the overthrow of the Assad regime in Syria and Iran’s accelerated nuclear program, oil prices have exhibited remarkable stability. This resilience underscores the market's nuanced response to regional risks and its focus on global supply-demand fundamentals.

Geopolitical Risks: Middle East Tensions and Global Energy Security

The fall of the Syrian government had limited direct impact on oil prices, with Syrian production contributing only 15,000 barrels per day (b/d) from government-controlled regions. Similarly, Israel's offshore gas production and Iranian exports, which reached 1.7 million b/d in 2024, remain largely unaffected despite heightened geopolitical tensions. Meanwhile, Saudi Arabia's Energy Minister reaffirmed OPEC+'s cautious production strategy, emphasizing flexibility amid weak demand projections for Q1 2025.

The Iran nuclear situation adds another layer of complexity. The IAEA reported Iran's enrichment levels now support potential nuclear weapon development. While this raises regional security concerns, oil market participants remain focused on the absence of direct threats to Gulf production and transportation infrastructure.

China’s Oil Demand: A Slowing Giant in Transition

China, the world’s largest crude importer, is undergoing a significant shift in its energy consumption patterns. The penetration of electric vehicles (EVs) and LNG-fueled trucks has accelerated, with China National Petroleum Corporation (CNPC) projecting peak oil demand by 2025—five years earlier than previous estimates.

In November 2024, China’s crude oil imports rose to 11.81 million b/d, a 14.3% year-over-year increase, as refiners capitalized on price cuts from key suppliers like Saudi Arabia and Iraq. However, annual refinery run rates dropped by 4.6% year-to-date due to maintenance shutdowns and operational inefficiencies among independent refiners. This mixed demand outlook underscores the uncertainty surrounding China's economic trajectory.

Global Supply: OPEC+ Cuts and Shale Producers Adjust Strategies

OPEC+ nations, including Saudi Arabia and Russia, continue to enforce production cuts into 2025 to support prices. Saudi Arabia maintains significant spare capacity, offering a buffer against potential supply disruptions. Meanwhile, U.S. shale producers are recalibrating strategies. Crescent Energy's $905 million acquisition of Ridgemar Energy assets in Texas highlights a shift toward consolidation and long-term value creation in the shale industry.

Deepwater exploration is gaining prominence as a key supply source. Offshore projects in Guyana, Namibia, and South Africa are projected to deliver significant output growth. ExxonMobil’s discoveries in Guyana are expected to contribute 1.3 million b/d by 2037, while new finds in Namibia's Orange Basin could position the country as a top African oil producer.

Economic and Monetary Policy: Dollar Strength and Its Impact on Oil

The strengthening U.S. dollar has tempered oil prices, with institutional investors reducing net short positions to $2 billion—the lowest in seven years. The upcoming Federal Reserve meeting could further influence oil markets, particularly if rate cuts are paused. A robust dollar makes oil more expensive for holders of other currencies, impacting demand from key importing nations.

Additionally, economic instability in regions like the EU, exacerbated by government collapses in France and South Korea, has bolstered the dollar's safe-haven appeal. This dynamic adds complexity to global trade and energy markets, as nations like China push for increased economic cooperation with the Middle East.

New Horizons: Investment in Emerging Markets and Strategic Energy Reserves

Emerging market investments in energy infrastructure are reshaping global supply chains. Argentina's Vaca Muerta shale pipeline and China's Power of Siberia 1 pipeline reaching full capacity underscore the rising role of non-OPEC producers. These projects enhance regional energy security while reducing dependency on traditional Gulf suppliers.

Notably, geopolitical developments are driving interest in national energy reserves. Russia's proposal for a strategic bitcoin reserve contrasts sharply with U.S. efforts to secure critical mineral supplies, such as antimony, underscoring divergent approaches to resource security.

Market Sentiment: Institutional Inflows and Price Outlook

Institutional investors remain optimistic about oil’s long-term value, with deepwater projects yielding double-digit returns on investment. Investments in offshore exploration are expected to exceed $104 billion in 2024, with production projected to grow by 60% by 2030. However, short-term price volatility persists, with bearish risks tied to weak Asian demand and potential U.S.-China trade escalations.

Oil prices are likely to remain range-bound in the near term, with WTI targeting $68-$75 per barrel and Brent stabilizing between $70-$80. Longer-term, sustained demand from emerging markets and strategic investments in energy infrastructure could support a gradual price recovery, contingent on geopolitical stability and coordinated production strategies by major exporters.

This evolving landscape highlights both opportunities and risks for stakeholders, as oil markets navigate a period of transformation shaped by technological advances, shifting demand, and complex geopolitical undercurrents.

That's TradingNEWS

Read More

-

Meta Stock Price Forecast - META at $624: Discounted AI Giant or Value Trap After the $796 Peak?

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Stuck Near $2.00 With 40% Downside Risk as Washington Moves on Crypto

13.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast - WTI Back Above $61, Brent Near $65 as Geopolitics Reprice Oil

13.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today - Dow Jones, S&P 500 and Nasdaq Pull Back as CPI Prints 2.7%; JPM, LHX, INTC in Focus

13.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Reclaims 1.3450 as Fed Political Storm and 2.7% CPI Undermine Dollar

13.01.2026 · TradingNEWS ArchiveForex