Amazon (NASDAQ:AMZN) Redefines Growth: Q3 2024 Breaks Records

AWS Dominates, Prime Video Expands, and Ad Revenue Soars—Amazon Powers Into 2024's Final Quarter | That's TradingNEWS

Amazon.com Inc. (NASDAQ:AMZN): A Deep Dive into Q3 2024 Performance, Growth Potential, and Strategic Positioning

Amazon.com Inc. (NASDAQ:AMZN) has once again proven why it holds a commanding position across multiple industries, as demonstrated by its stellar Q3 2024 earnings report. With revenues reaching $158.9 billion, a strong 11% year-over-year increase, the company has shown that its growth engine is far from slowing. Despite external headwinds, such as inflationary pressures and heightened competition, Amazon's diversified revenue streams, operational efficiencies, and heavy investments in artificial intelligence and cloud computing position it as a market leader. Let’s break down the numbers and understand the key drivers that continue to propel NASDAQ:AMZN forward.

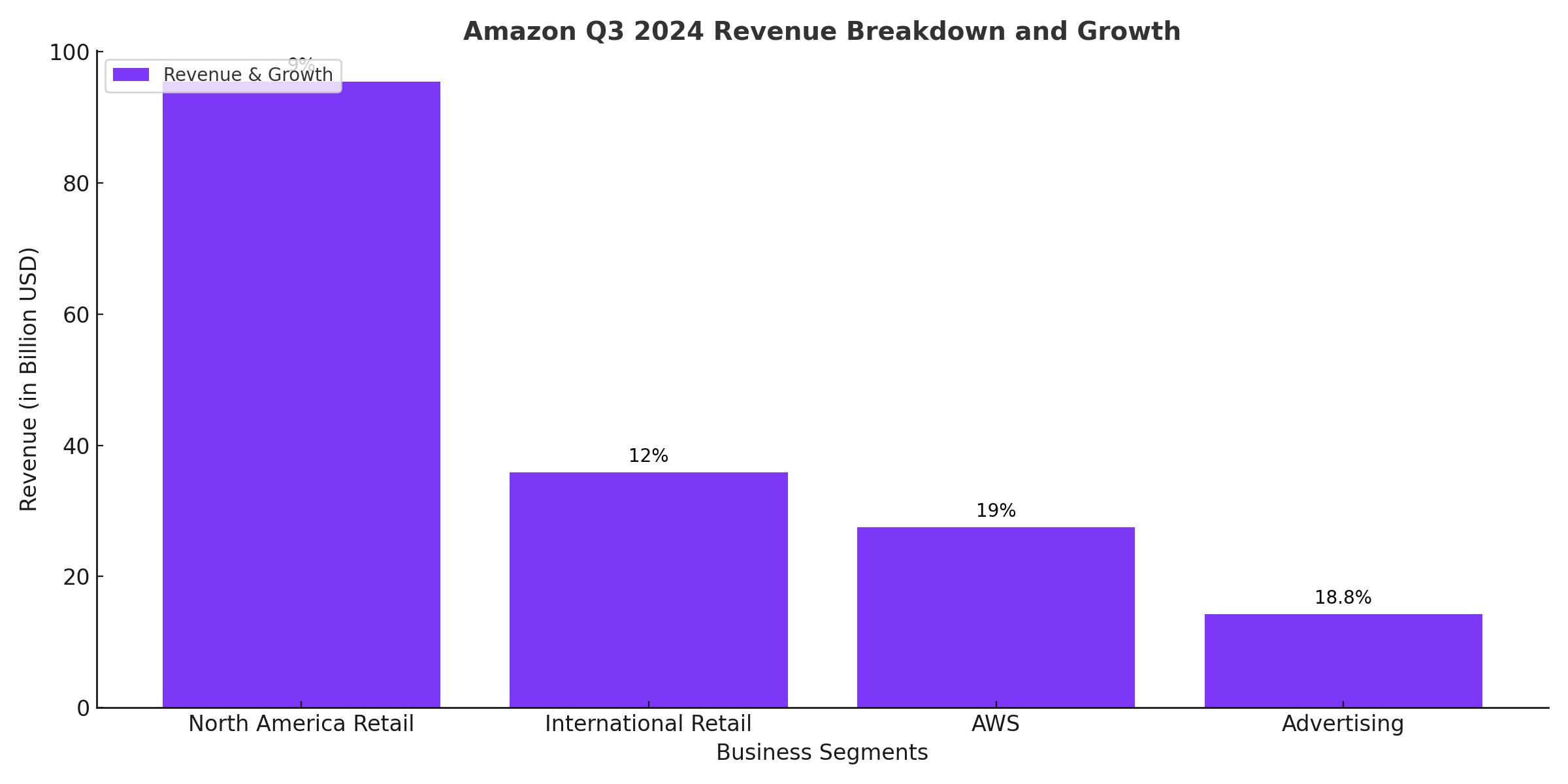

Revenue Breakdown and Key Growth Drivers

Amazon reported an impressive $158.9 billion in Q3 2024 revenue, up 11% year-over-year, driven by strong performance in North America, international retail markets, Amazon Web Services (AWS), and advertising. North America retail sales reached $95.5 billion, a 9% YoY increase, while international sales grew even faster at 12% YoY, contributing $35.9 billion to the top line. AWS recorded $27.5 billion in revenue, marking a 19% YoY growth, while advertising posted a standout performance with $14.3 billion, growing 18.8% from the same period last year.

The revenue growth was underpinned by a strategic focus on optimizing delivery times and enhancing customer experience. Amazon's investments in regional fulfillment centers, robotics, and same-day delivery capabilities contributed to a 25% increase in inventory placement efficiency. These operational upgrades have enabled the company to achieve faster delivery speeds while reducing costs, ultimately improving customer retention and loyalty.

AWS: Powering Profitability and Cloud Dominance

AWS remains a significant growth driver for Amazon, contributing $10.4 billion in operating income for the quarter, representing a staggering 50% YoY increase. With an annualized revenue run rate exceeding $110 billion, AWS has solidified its leadership position in the cloud computing market, boasting a 38.1% operating margin. For comparison, Google Cloud's margin stands at 17%, and Microsoft Azure's growth, while robust, has not matched AWS’s efficiency.

The demand for generative AI and cloud solutions has been a game-changer for AWS, especially with its partnerships with industry giants like Nvidia. AWS is strategically leveraging AI-powered solutions to offer advanced infrastructure and tools to businesses, further enhancing its competitive edge. The cloud computing market, expected to grow at a 19.5% compound annual growth rate (CAGR) until 2028, provides AWS with ample runway for future expansion.

Advertising: A Silent Growth Engine

Amazon's advertising business generated $14.3 billion in Q3 2024 revenue, marking an 18.8% YoY increase and demonstrating the company’s ability to monetize its ecosystem. By offering targeted advertising solutions across its e-commerce platform, Prime Video, and other digital properties, Amazon has become the third-largest player in the global digital advertising market, behind only Google and Meta. With tools like AI-powered video generation for sellers, Amazon is enhancing both advertiser and consumer experiences.

The introduction of ad-supported tiers on Prime Video is another strategic move that adds high-margin revenue streams to Amazon's portfolio. Early estimates suggest that Prime Video ads could generate over $3 billion in global revenue by the end of 2024, with EBITDA margins projected to exceed 60%. This aligns with Amazon’s broader strategy of integrating AI across its advertising platforms to drive efficiency and ROI for advertisers.

Financial Strength and Operating Efficiency

Amazon’s Q3 operating income reached $17.4 billion, a 56% YoY increase, reflecting strong expense management and economies of scale. The EBIT margin hit a record high, surpassing levels seen in previous quarters, showcasing Amazon’s ability to convert revenue growth into profitability. The company also reported $8.4 billion in free cash flow for the quarter, marking the sixth consecutive quarter of positive FCF.

Amazon's balance sheet remains robust, with $88.1 billion in cash and marketable securities and a reduced debt load of $54.9 billion. These financial metrics highlight Amazon's emphasis on maintaining financial flexibility, enabling it to fund large-scale investments in AI, cloud infrastructure, and fulfillment networks without jeopardizing its liquidity position.

Prime Video and the Streaming Wars

Amazon's Prime Video continues to gain traction, with over 80 million North American subscribers, edging out Netflix in viewing hour market share. While its annual revenue of $5 billion is currently dwarfed by Netflix's $31.6 billion, Prime Video’s integration into the broader Amazon ecosystem offers a unique value proposition. By introducing ad-supported tiers and leveraging generative AI tools to optimize content delivery and advertising, Prime Video is poised for significant revenue growth in the coming years.

Recent surveys indicate that Prime Video is now the second-favorite streaming service in the U.S., with 21% viewing hour market share compared to Netflix's 20%. The ability to bundle Prime Video with a Prime membership further strengthens its value proposition, enhancing customer retention across Amazon's ecosystem.

Valuation and Growth Outlook

Despite its $2 trillion market capitalization, NASDAQ:AMZN remains attractively valued when considering its growth potential. The stock trades at 36x earnings, one of its lowest P/E multiples in the past three years, compared to its historical average of 60x. A discounted cash flow (DCF) analysis suggests that Amazon is undervalued by approximately 21.7%, even with conservative assumptions regarding revenue growth and operating margins.

Management’s Q4 2024 guidance projects revenue between $181.5 billion and $188.5 billion, representing 7–11% YoY growth. Operating income is expected to range between $16 billion and $20 billion, significantly higher than the $13.2 billion reported in Q4 2023. The holiday season, coupled with strong consumer demand and continued operational efficiencies, is likely to drive both revenue and profitability.

Risks and Challenges

While the growth narrative is compelling, potential risks include geopolitical uncertainties, particularly with the U.S.-China trade relationship, which could impact Amazon’s global supply chain. Additionally, the competitive landscape in cloud computing and digital advertising remains fierce, with Microsoft, Google, and Meta posing significant threats. Execution risks associated with large-scale AI investments also warrant caution, as delayed ROI could weigh on profitability.

Investment Recommendation

Based on Amazon’s Q3 2024 performance, strategic positioning in high-growth markets, and attractive valuation metrics, NASDAQ:AMZN is a strong buy. The company’s diversified revenue streams, operational efficiencies, and forward-looking investments in AI and cloud infrastructure provide a robust foundation for sustained growth. Investors should capitalize on the current price levels to secure exposure to one of the most dynamic and resilient companies in the market.

Track real-time price movements for NASDAQ:AMZN here.