SoundHound AI (NASDAQ:SOUN): Transforming Conversational AI with Bold Growth Strategies

Revolutionizing AI: The Rise of NASDAQ:SOUN

SoundHound AI (NASDAQ:SOUN) has emerged as a formidable player in the rapidly evolving artificial intelligence landscape. With its innovative voice recognition technology and aggressive market expansion, SoundHound is capitalizing on the surging demand for conversational AI solutions. Investors have been captivated by the company’s potential to disrupt traditional industries with its voice AI offerings, propelling the stock to outperform market benchmarks.

Revenue Growth Signals a Breakout for NASDAQ:SOUN

In Q3 2024, SoundHound reported a record-breaking revenue of $25.1 million, an 89% increase year-over-year, driven by its successful diversification across industries. Traditionally reliant on automotive clients, which accounted for 90% of revenue in 2023, the company has now reduced this segment to just 25%. Key contributors include new markets like healthcare, financial services, insurance, and restaurants, all of which have embraced its conversational AI solutions.

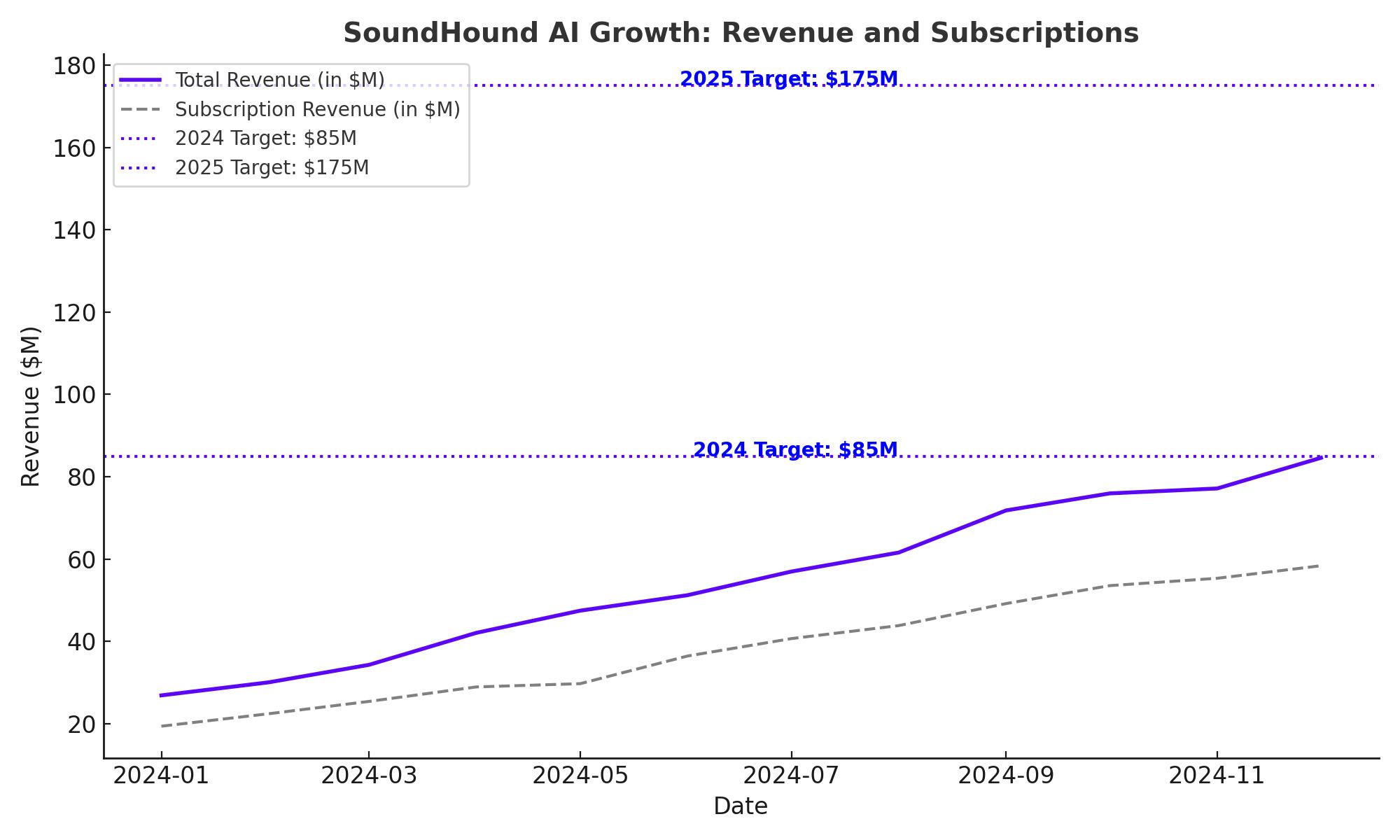

SoundHound’s forward-looking guidance reflects even greater confidence in its growth trajectory:

- 2024 revenue projection: $82–$85 million, representing over 75% growth from 2023.

- 2025 revenue forecast: $155–$175 million, driven by acquisitions and robust subscription growth.

This shift demonstrates SoundHound’s agility in diversifying revenue streams while maintaining aggressive growth.

Explore Live Stock Data for NASDAQ:SOUN

Subscriptions Powering NASDAQ:SOUN’s Future Growth

SoundHound’s strategic pivot toward subscription services is paying off. By acquiring startups like Amelia, Allset, and SYNQ3, the company has unlocked new growth avenues in service-based subscriptions, contributing $18.5 million in Q3 alone. This surge has positioned subscriptions as a primary revenue driver, overtaking traditional product royalties.

- Automotive partnerships: Integration with Stellantis vehicles in Europe and Japan, showcasing SoundHound’s advanced generative AI chatbots.

- Restaurant industry gains: SoundHound’s voice-enabled systems are now embedded in seven of the top 20 quick-service restaurants, enhancing customer service efficiency.

- Healthcare and finance breakthroughs: Entry into these high-demand verticals demonstrates SoundHound’s versatility in addressing complex conversational AI needs.

This robust ecosystem of products and services has solidified SoundHound’s position as a leader in conversational AI, likened to being “as necessary as Wi-Fi and electricity” in the modern business environment.

Navigating Challenges: Margins and Profitability Targets

While SoundHound’s growth story is compelling, challenges remain. Gross margins dropped to 48.6% in Q3 2024, down from 72.9% a year ago, largely due to the integration of acquired businesses. However, management has implemented a detailed roadmap to address these issues, focusing on:

- Backend integrations: Migrating acquired assets to unified cloud infrastructure to achieve cost synergies.

- Cost rationalization: Standardizing technology stacks across acquisitions to optimize operational efficiency.

Despite these pressures, management has reaffirmed its commitment to achieving adjusted EBITDA profitability by the end of 2025, balancing high growth with financial discipline.

Insider Transactions Provide Strategic Insights

Recent insider activities reflect confidence in SoundHound’s long-term prospects. Key transactions include:

- CEO Keyvan Mohajer sold 90,641 shares for $442,328, yet still holds 2.36 million shares, signaling strong commitment to the company’s future.

- Insider James Ming Hom reduced holdings by 21,024 shares, worth $102,597, maintaining significant ownership stakes.

These transactions represent minor adjustments rather than signals of waning confidence. View All Insider Transactions

Momentum and Market Sentiment for NASDAQ:SOUN

SoundHound has outpaced many tech sector peers in 2024, evidenced by its 27% price surge since the last quarter, compared to the S&P 500’s modest 5% gain. The stock has maintained a strong “A” momentum rating, further validating its growth narrative. With a 50-week moving average indicating a steady uptrend, SOUN’s price action suggests continued bullish sentiment.

However, challenges such as high short interest (22% of float) could introduce volatility, making it essential for investors to monitor market conditions closely.

Strategic Acquisitions Amplify NASDAQ:SOUN’s Competitive Edge

SoundHound’s Polaris foundation model has been pivotal in delivering high-accuracy conversational AI solutions. This proprietary technology positions the company favorably against competitors like Salesforce (CRM) and Microsoft (MSFT), which are also vying for dominance in AI-enabled services.

Key partnerships include:

- Automotive industry: Continued collaboration with major automakers for next-generation voice assistants.

- Enterprise AI integration: Expansion into finance, healthcare, and insurance sectors, demonstrating the versatility of SoundHound’s AI capabilities.

These partnerships not only validate SoundHound’s market leadership but also highlight its ability to scale across diverse industries.

Valuation and Growth Potential for NASDAQ:SOUN

Despite a high price-to-sales (P/S) ratio of 29x, SoundHound’s valuation remains competitive within the AI sector. For example, Palantir trades at over 55x sales, yet lags behind SoundHound’s revenue growth pace.

- 2025 outlook: Revenue of $160 million positions SoundHound at a much more appealing 16x P/S multiple.

Management’s ability to revise revenue guidance upward, coupled with adjusted EBITDA profitability targets, adds further credibility to the investment thesis.

Investment Outlook: Is NASDAQ:SOUN a Buy?

SoundHound AI’s remarkable growth, innovative product offerings, and expansion into high-value verticals make it a compelling choice for investors seeking exposure to AI-driven opportunities. While near-term risks like margin compression and high short interest require caution, the long-term growth potential far outweighs these concerns.

Verdict: NASDAQ:SOUN is a strong Buy for investors with a high-risk tolerance, poised to benefit from the ongoing AI revolution.

Explore Full Stock Insights for NASDAQ:SOUN