Meta Platforms (NASDAQ:META): The Bold Blueprint Redefining Tech Leadership

From ad revenue mastery to pioneering AI and AR/VR, Meta is transforming tech and delivering market-shaping innovation | That's TradingNEWS

Meta Platforms Inc. (NASDAQ:META): A Transformative Tech Powerhouse

Meta Platforms Inc. (NASDAQ:META) continues to redefine the landscape of technology with its multi-pronged growth strategies that combine an unshakable advertising foundation, cutting-edge AI investments, and bold innovations in virtual reality. The company’s ability to dominate the social media ecosystem while driving strategic growth through advanced AI, Reality Labs, and operational excellence makes it a formidable force in the market. Investors are now presented with a compelling case for considering META as a buy, given its financial performance, technological foresight, and innovative vision.

Meta's Core Strength: A Dominant Advertising Ecosystem

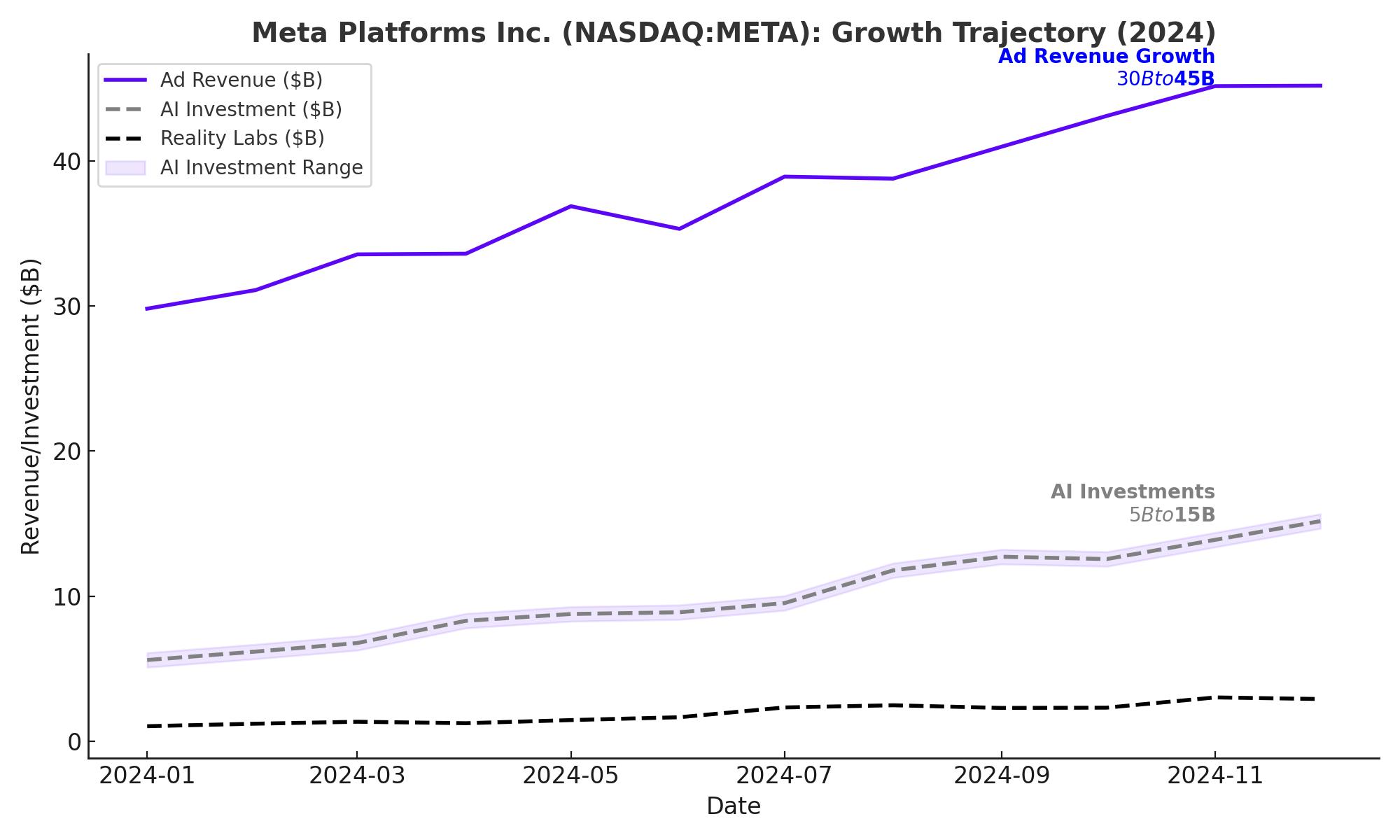

Meta's advertising business remains its lifeblood, accounting for an astounding 96% of its total revenue. This dominance is reflected in its Q3 2024 results, where advertising revenue surged 19% year-over-year to $39.9 billion, driven by improved ad targeting and greater user engagement. Meta's Average Revenue Per Person (ARPP) also saw an impressive 12% increase, reaching $12.29 in Q3. This growth, fueled by AI-enhanced ad targeting, underscores Meta's capability to extract more value from its user base.

Meta’s advertising prowess hinges on its "Family of Apps," which boasts 3.29 billion daily active users (DAPs)—a 5% year-over-year increase. Platforms like Facebook, Instagram, WhatsApp, and Messenger continue to be indispensable to billions worldwide. Additionally, features such as Reels and Stories have increased user engagement, contributing to an 8% rise in time spent on Facebook and a 6% rise on Instagram this year. These metrics illustrate Meta's ability to keep its platforms indispensable to users and advertisers alike.

However, Meta faces growing competition from platforms like TikTok, YouTube Shorts, and Snapchat, all of which are aggressively courting advertisers. While emerging players such as Reddit increase pressure on Meta, the company has effectively mitigated these threats by integrating generative AI tools, which have enabled advertisers to create over 15 million ads in just one month, boosting conversion rates by 7%. This technological edge positions Meta to maintain its leadership in the digital advertising market.

Strategic AI Integration: A Game-Changer for Meta

Meta's commitment to artificial intelligence goes beyond enhancing advertising. Its open-source Llama model marks a bold departure from competitors like Microsoft and Google. By making Llama freely available to developers, Meta is fostering innovation, collaboration, and faster adoption. This open-source approach aims to establish Llama as a foundational AI model, creating network effects that reinforce Meta’s leadership.

AI is already yielding results across Meta’s ecosystem. Meta AI now has over 500 million monthly active users, while its AI-driven recommendation engines have significantly improved user engagement and ad performance. For example, the company’s AI-based unified video player led to a 10% increase in time spent on Facebook’s video platform.

Meta’s strategic investments in AI are supported by a robust data center infrastructure, which serves as the backbone for training and deploying advanced models. These investments not only bolster AI capabilities but also ensure Meta remains a step ahead in leveraging AI to drive revenue growth and operational efficiencies.

Reality Labs: High Potential, High Risk

Meta's foray into virtual and augmented reality through Reality Labs showcases the company’s willingness to invest in long-term growth areas. In Q3 2024, Reality Labs reported $270 million in revenue, a 29% year-over-year increase. However, the segment remains deeply unprofitable, posting $4.4 billion in operating losses, up 19% from the previous year.

Reality Labs' losses underscore the challenges of building an entirely new computing platform. Despite these setbacks, CEO Mark Zuckerberg remains bullish on its potential, emphasizing the integration of AI and wearables as a critical next step. Products like Ray-Ban Meta smart glasses and the Orion holographic AR glasses represent early attempts to redefine personal computing. While the commercial success of these initiatives remains uncertain, they highlight Meta's commitment to innovation and its vision for the future.

However, the metaverse vision faces skepticism. Critics argue that Meta's capital-intensive approach may take years to bear fruit, if at all. For Reality Labs to succeed, Meta must balance its ambitious innovation with financial sustainability.

Financial Resilience and Operational Discipline

Meta’s financial performance underscores its operational strength and efficiency. In Q3 2024, the company reported $40.3 billion in total revenue, up 19% year-over-year, with $21.8 billion in operating income and a remarkable 54% operating margin. This level of profitability reflects Meta's ability to scale while managing costs effectively.

Meta has demonstrated exceptional cost discipline, reducing general and administrative expenses from 6% of revenue to 5%. Meanwhile, it has increased research and development spending to 28% of revenue, underscoring its commitment to innovation. These efforts have allowed Meta to maintain a robust free cash flow, even as it invests heavily in AI and Reality Labs.

The company’s capital expenditures (CAPEX) reached a record $22.6 billion in 2024, driven by its investments in AI and data center infrastructure. Despite these significant outlays, Meta’s expenses-to-revenue ratio remains favorable, highlighting its ability to grow sustainably while pursuing ambitious projects.

Valuation: An Undervalued Opportunity in Big Tech

Meta's valuation metrics suggest the stock remains attractively priced relative to its peers. With a forward price-to-earnings (P/E) ratio of 25x, Meta is cheaper than Apple (31x) and Microsoft (32x), and significantly more affordable than Nvidia (51x) and Tesla (138x). Its price-to-book ratio of 8.68x and forward price-to-sales ratio of 8.77x further underscore its undervaluation.

Analysts estimate Meta’s intrinsic value at $987 per share, representing a 78% premium over its current price. This valuation reflects the company’s strong growth prospects, driven by its advertising dominance, AI advancements, and innovative ventures like Reality Labs.

Risks: Challenges to Consider

Meta faces several risks that could impact its growth trajectory. Rising competition in social media and advertising poses a significant threat. Platforms like TikTok and YouTube continue to innovate, challenging Meta’s ability to retain user engagement. Additionally, regulatory scrutiny and legal challenges could disrupt Meta's operations, particularly concerning its handling of user data and market dominance.

Another risk lies in the execution of its Reality Labs strategy. The metaverse vision, while ambitious, remains speculative. Failure to commercialize these efforts could lead to prolonged financial losses and shareholder dissatisfaction. Furthermore, the success of Meta’s open-source AI strategy depends on widespread adoption and effective monetization, both of which are far from guaranteed.

A Comprehensive Verdict

Meta Platforms Inc. (NASDAQ:META) stands out as a transformative force in technology, combining the strength of its advertising business with innovative AI integration and bold ventures into AR/VR. While challenges exist, the company’s financial resilience, operational efficiency, and visionary leadership position it well for sustained growth.

With strong fundamentals, a compelling valuation, and promising growth drivers, Meta represents an attractive opportunity for long-term investors. Based on its current trajectory, Meta is a strong buy, offering significant upside potential in the rapidly evolving tech landscape.

That's TradingNEWS