Bitcoin Inches Closer to $100K: Will the Bull Run Hold?

Despite a 6% dip, Bitcoin's momentum stays strong with surging institutional interest and ETF inflows. Is the $100K milestone within reach? | That's TradingNEWS

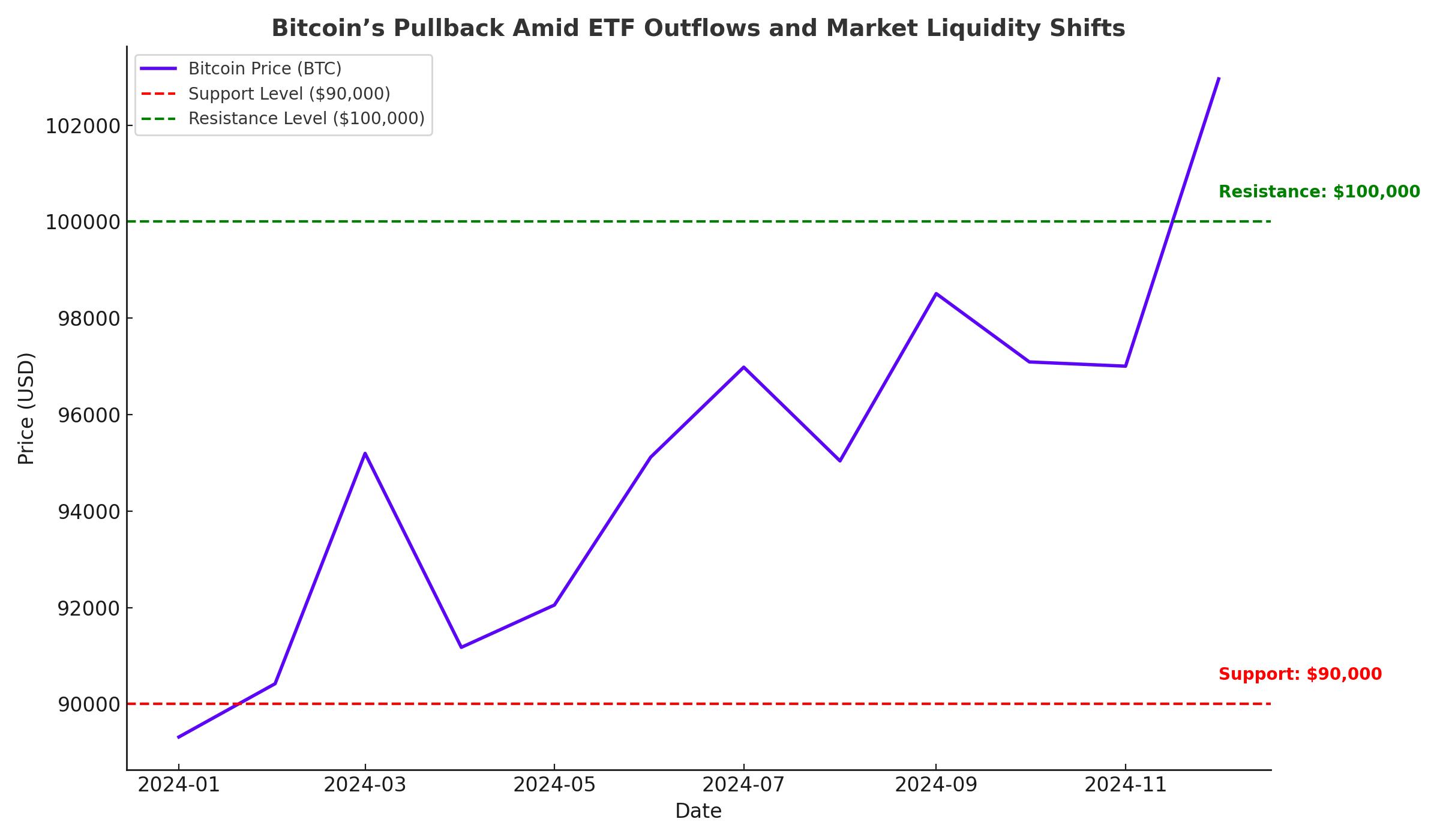

Bitcoin Faces a Critical Pullback Amid ETF Outflows and Market Liquidity Shifts

A Volatile Week for Bitcoin (BTC): Examining the Data Behind the Dip

Bitcoin (BTC) has encountered significant resistance in its attempt to break the psychological $100,000 milestone, retreating to $93,400 as of Wednesday after a sharp 6% decline earlier in the week. Despite optimism following its all-time high of $99,588 on Friday, the crypto market is witnessing heightened volatility, with profit-taking and ETF outflows weighing heavily on BTC's short-term trajectory.

Bitcoin’s Recent Price Action and Market Indicators

Bitcoin’s latest pullback comes on the heels of an impressive rally that saw the cryptocurrency surge by 22.6% earlier in November, driven by institutional inflows and optimism surrounding a more crypto-friendly regulatory environment under the new U.S. administration. However, the retreat from its peak has highlighted key vulnerabilities in the market.

BTC dropped to $91,400 at its lowest point this week, with the Relative Strength Index (RSI) signaling bearish divergence. This technical indicator has shown lower highs despite Bitcoin's price reaching new peaks—a classic warning sign of potential trend reversals. Should Bitcoin fail to maintain its support around $90,000, the next critical level to watch is $85,000.

ETF Outflows and Their Impact

Monday marked the third-largest day of Bitcoin ETF outflows on record, with $435.3 million pulled from these funds. Major ETFs, including BlackRock's iShares Bitcoin Trust (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), and Grayscale’s Bitcoin Trust (GBTC), all experienced notable activity. Despite the broader sell-off, IBIT still recorded $267.8 million in inflows, showcasing a stark division among institutional investors.

These ETF outflows reflect short-term profit-taking among traders, especially those who entered the market during the recent rally above $90,000. However, institutional interest remains robust. BlackRock’s IBIT maintained a commanding $47 billion in assets under management (AUM), demonstrating the fund’s resilience even amid outflows.

Institutional Buying Bolsters Bitcoin Sentiment

Amidst the turbulence, corporations and institutions continue to bet on Bitcoin as a long-term asset. MicroStrategy announced an additional $5.4 billion Bitcoin purchase this week, bringing its total holdings to over 140,000 BTC. Other companies, including Marathon Digital and Semler Scientific, have followed suit, highlighting a growing trend of corporate adoption.

Spot Bitcoin ETFs, such as IBIT and GBTC, remain critical players in the market’s liquidity structure, with daily trading volumes reaching $5 billion on November 26. This demand, coupled with steady corporate acquisitions, has provided a solid floor for Bitcoin prices despite temporary corrections.

Analyzing Bitcoin’s Market Metrics

Long-term holders appear to be reducing their positions at a measured pace. Data reveals that Bitcoin miners have sold approximately 2,500 BTC daily over the past week, equating to $231 million. While this miner activity contributed to the downward pressure, it was offset by institutional buying and increased retail participation.

The options market further supports a neutral to bullish outlook. The put-to-call ratio and 25% delta skew metrics have returned to balanced levels, indicating a stabilization in trader sentiment after last week's aggressive bullish bets. This market equilibrium underscores the resilience of Bitcoin even during corrective phases.

Psychological Resistance at $100,000

Bitcoin’s inability to break through $100,000 underscores the psychological importance of round-number milestones in financial markets. Analysts have pointed out that such levels often act as barriers due to heightened profit-taking and speculative positioning. Columbia Business School professor Omid Malekan noted that this behavior is typical for volatile assets like Bitcoin, especially in bull markets.

Despite the temporary setback, Bitcoin remains up 30% since November 5, benefiting from regulatory optimism and a shift in market sentiment following U.S. election outcomes. The departure of Securities and Exchange Commission Chair Gary Gensler, perceived as a stringent regulator, has further fueled bullish sentiment.

Corporate Adoption and Market Liquidity

Corporate adoption is emerging as a critical driver for Bitcoin’s medium-term outlook. Companies like MicroStrategy, Marathon Digital, and Japan’s MetaPlanet are increasingly viewing Bitcoin as a strategic asset, boosting market liquidity and reducing reliance on speculative retail inflows. The growing presence of Bitcoin ETFs has also enhanced accessibility for institutional investors, creating a more stable demand base.

Moreover, the Bitcoin dominance ratio remains strong at 57%, with a market capitalization of $1.8 trillion. Daily trading volumes have increased by 12% this week to $91 billion, signaling sustained interest despite the price correction.

Outlook: Is Bitcoin a Buy, Hold, or Sell?

While Bitcoin faces immediate resistance near $100,000, the overall market structure remains bullish. Institutional buying and ETF activity provide a strong support base, suggesting that the cryptocurrency could resume its upward trajectory once the current profit-taking phase subsides. Key levels to monitor include the $90,000 support and the critical $85,000 floor, which could serve as entry points for long-term investors.

The path forward depends on broader macroeconomic factors, including regulatory developments and continued corporate interest. For now, Bitcoin remains a compelling asset for those with a long-term perspective, while short-term traders should exercise caution given the heightened volatility.