Trump’s Crypto Push Powers Bitcoin Past $97K Toward $100K

With Trump’s Pro-Crypto Policies, Bitcoin’s Meteoric Rise Signals a New Era for Digital Gold | That's TradingNEWS

Bitcoin Soars Towards $100,000 Amid Optimism

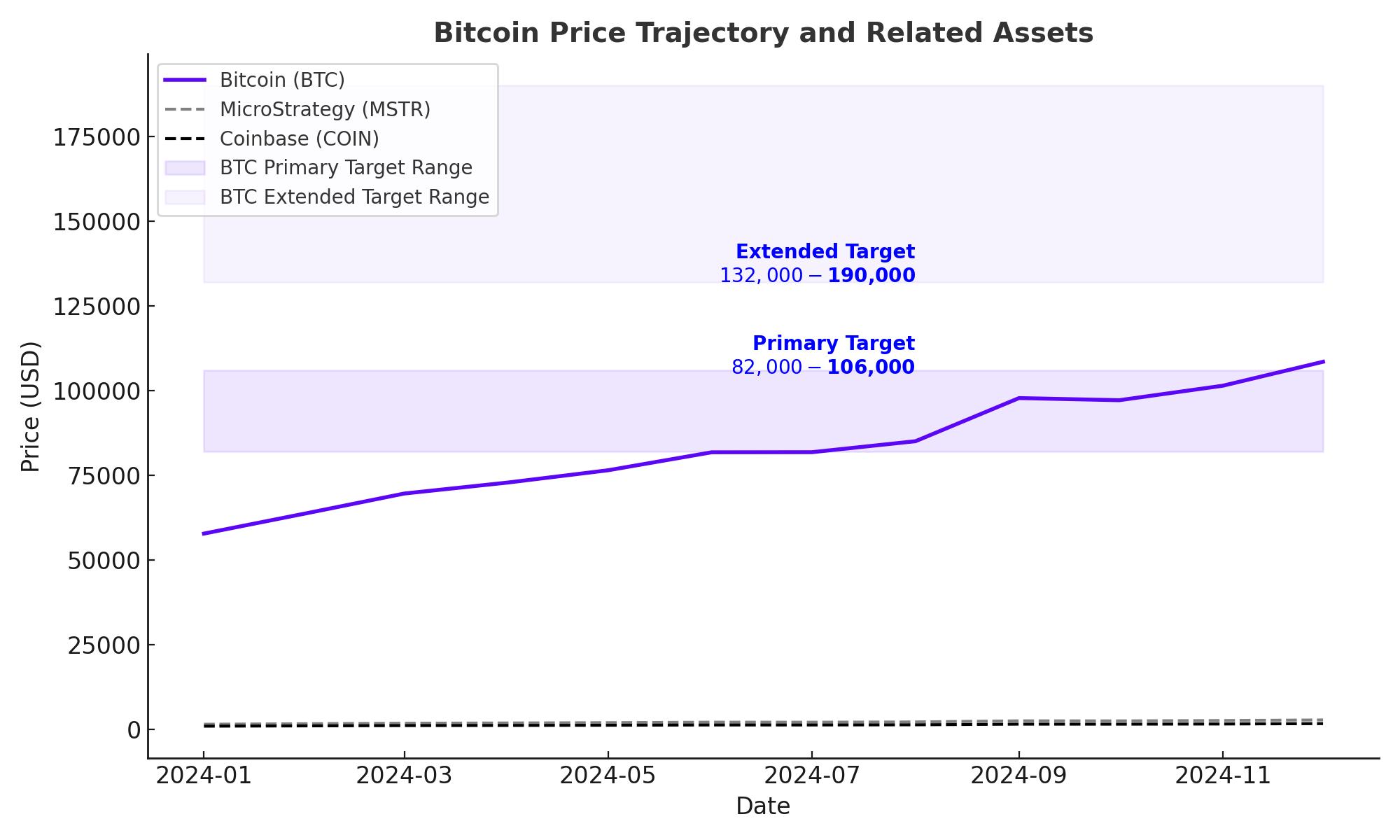

The current trajectory of Bitcoin is a testament to its resilience and growing acceptance. BTC recently surpassed the $97,000 mark, approaching the symbolic $100,000 milestone with year-to-date gains of over 120%. The cryptocurrency’s remarkable rally has been bolstered by a confluence of factors, including the approval of U.S.-listed Bitcoin exchange-traded funds (ETFs) and the election of a pro-crypto administration in the U.S. These developments have significantly enhanced Bitcoin’s reputation as a legitimate asset class, attracting a surge of institutional and retail interest.

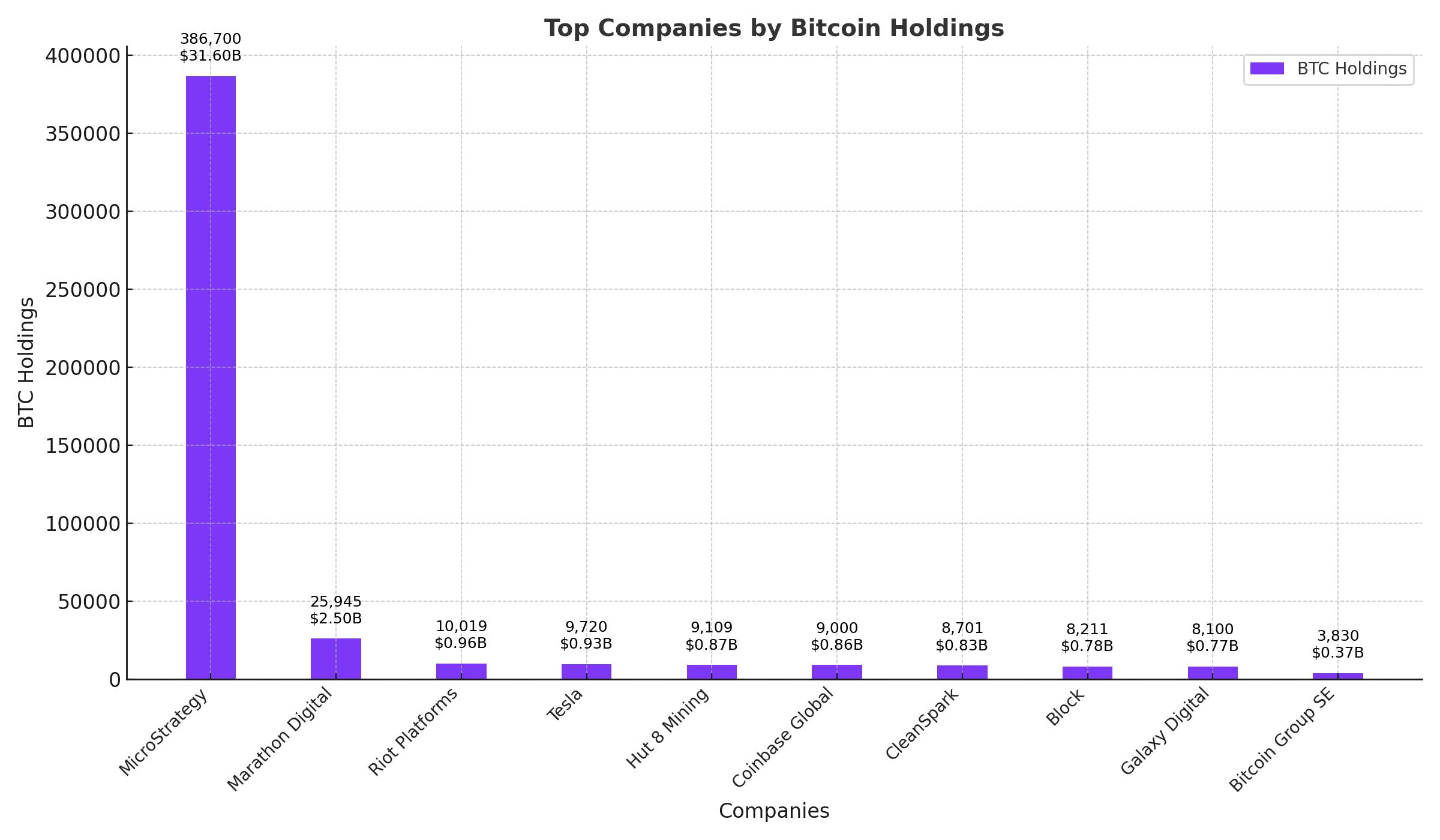

Institutional inflows into Bitcoin ETFs have played a pivotal role in propelling its price. Funds like Fidelity’s FBTC have witnessed substantial inflows, reversing previous outflows and signaling growing confidence among large-scale investors. Additionally, miners have demonstrated bullish sentiment by holding their BTC reserves instead of liquidating them, reflecting optimism for sustained price appreciation.

Geopolitical Turbulence Adds to Bitcoin’s Appeal

The global geopolitical landscape has further underscored Bitcoin’s status as a hedge against uncertainty. Rising tensions in regions like Eastern Europe and the Middle East have heightened investor demand for decentralized assets. The ongoing conflict between Russia and Ukraine, coupled with escalating hostilities in the Middle East, has fueled concerns over traditional asset stability, driving capital into Bitcoin. Historical data reveals that while BTC often experiences short-term volatility during crises, it tends to recover and thrive in the long run, proving its resilience as a safe-haven asset.

Technical Indicators Highlight BTC’s Bullish Momentum

From a technical perspective, Bitcoin’s price action remains robust. The daily Relative Strength Index (RSI) currently reads 67, indicating bullish momentum without entering overbought territory. Meanwhile, the Moving Average Convergence Divergence (MACD) suggests caution, as a recent bearish crossover hints at potential near-term corrections. However, the overall trend remains decisively upward, with BTC likely to retest its all-time high of $99,588 before making a definitive move towards $100,000.

Support levels around $90,000 have provided a solid foundation for Bitcoin’s price, while resistance near $100,000 remains a psychological barrier. If BTC sustains its recovery, a breakout could push it to new heights, potentially reaching $150,000 in 2025, as predicted by several market analysts.

Bitcoin’s Historical Performance and Market Position

BTC’s historical performance underscores its ability to defy skepticism and deliver exceptional returns. Since its inception in 2009, Bitcoin has grown exponentially, driven by increasing adoption and technological advancements. The introduction of upgrades like Taproot has enhanced Bitcoin’s scalability and privacy, reinforcing its utility and value proposition. These developments, coupled with its fixed supply of 21 million coins, have solidified Bitcoin’s narrative as digital gold.

With a current market capitalization nearing $2 trillion, Bitcoin dominates the cryptocurrency landscape, accounting for over 45% of the total market value. Its liquidity and widespread adoption make it a benchmark asset, influencing the broader crypto market’s movements.

Institutional Adoption and Regulatory Developments

The rise of institutional interest has been a game-changer for Bitcoin. Major corporations and hedge funds have integrated BTC into their portfolios, recognizing its potential as a hedge against inflation and currency devaluation. The approval of Bitcoin ETFs has further facilitated institutional participation, providing a regulated avenue for exposure to the cryptocurrency.

Regulatory clarity has also played a crucial role in fostering Bitcoin’s growth. The U.S. Securities and Exchange Commission’s (SEC) acknowledgment of Bitcoin as a non-security has alleviated concerns over potential legal hurdles. Additionally, the election of a pro-crypto administration has set the stage for favorable policy developments, including the potential establishment of a Bitcoin strategic reserve.

Challenges and Opportunities Ahead

Despite its remarkable achievements, Bitcoin faces challenges that could impact its trajectory. Regulatory scrutiny, market volatility, and environmental concerns associated with mining remain key issues. However, innovations like the adoption of renewable energy for mining and layer-2 scaling solutions provide promising solutions to these challenges.

Bitcoin’s future prospects remain intrinsically tied to global economic conditions. As central banks grapple with inflation and monetary policy shifts, Bitcoin’s role as a non-correlated asset is likely to gain prominence. Analysts predict that sustained institutional adoption, coupled with macroeconomic instability, could propel BTC to new heights, with some forecasting a price of $250,000 by the end of the decade.

Conclusion on Bitcoin’s Position in the Financial Ecosystem

As BTC approaches the $100,000 milestone, its journey reflects the transformative potential of blockchain technology and decentralized finance. Bitcoin’s ability to navigate market volatility, geopolitical tensions, and regulatory developments underscores its status as a cornerstone of the modern financial landscape. Whether as a store of value, a medium of exchange, or a speculative asset, Bitcoin continues to captivate the world, offering a glimpse into the future of money.