Gold Soars to $2,659: A Safe-Haven Favorite in a Volatile Market

Escalating Geopolitical Tensions and Dollar Weakness Propel Gold Toward New Highs | That's TradignNEWS

Gold Prices Rebound Amid Geopolitical Risks and Fed Speculations

Geopolitical Tensions Elevate Gold’s Safe-Haven Demand

Gold (XAU/USD) continues to attract investors, trading above $2,650 per ounce as geopolitical tensions intensify. The precious metal has rebounded strongly after a brief dip earlier in the week, fueled by escalating tensions in the Middle East and Ukraine. Israel’s airstrikes on Hezbollah facilities in southern Lebanon and Russia's nuclear-capable missile threats against Ukraine have heightened uncertainty, driving safe-haven flows into gold. Such events reinforce the metal’s role as a reliable hedge during geopolitical crises.

The failure of a ceasefire agreement between Israel and Hezbollah has been a critical factor in the recent surge. Additionally, Russian strikes on Ukraine’s energy infrastructure have left over a million people without electricity, further amplifying geopolitical risks. These developments underscore gold's enduring appeal in volatile global scenarios.

The Role of the US Dollar and Treasury Yields in Supporting Gold Prices

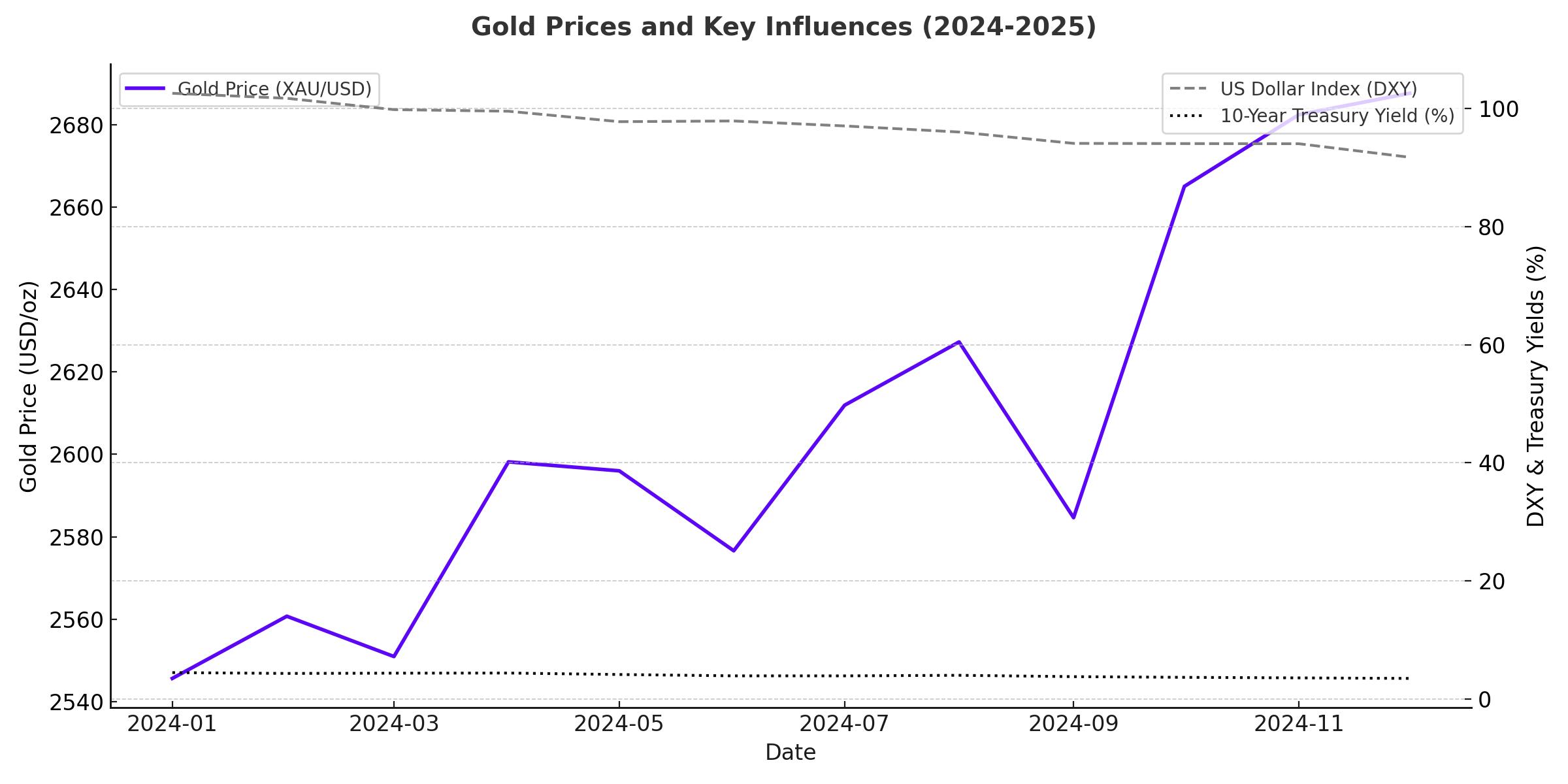

A weakening US Dollar has significantly contributed to gold's upward momentum. The Dollar Index (DXY), which measures the greenback's strength against a basket of major currencies, has dipped to its lowest level since mid-November. This decline makes gold more affordable for investors holding other currencies, boosting demand.

US Treasury yields also play a pivotal role in gold's performance. The benchmark 10-year Treasury yield recently hit a two-week low, reflecting investor expectations of potential Federal Reserve rate cuts in December. Lower yields reduce the opportunity cost of holding non-yielding assets like gold, enhancing its attractiveness.

Federal Reserve Policies and Inflationary Pressures Impact Gold Dynamics

The Federal Reserve's cautious approach to monetary policy has been another factor supporting gold prices. Market participants currently assign a 66.5% probability to a 25-basis-point rate cut at the Fed's next meeting. This sentiment follows stagnation in US inflation, as reflected in October's PCE data, which has raised concerns about the Fed's ability to maintain its hawkish stance.

President-elect Donald Trump's policy proposals, including potential trade tariffs and expansionary fiscal measures, are expected to stoke inflationary pressures. These factors add to the uncertainty surrounding the Fed's rate trajectory, further underpinning gold's appeal.

Technical Levels Define Gold’s Short-Term Trajectory

From a technical perspective, gold has rebounded from key support levels near $2,600 and breached the $2,650 resistance area, supported by the 100-hour Simple Moving Average (SMA). The next significant resistance lies at $2,663-$2,664, aligned with the 50% Fibonacci retracement level. A breakout above this zone could propel gold toward $2,677, with the $2,700 psychological mark serving as a subsequent target.

Conversely, failure to sustain above $2,650 could trigger a retracement toward $2,633, with stronger support near $2,620 and $2,600. A break below these levels would expose gold to deeper corrections, potentially targeting the $2,573 and $2,536 zones.

Gold’s Performance in 2024: Year-to-Date Overview

Gold has witnessed an impressive rally in 2024, rising approximately 30% year-to-date. The surge has been driven by central bank purchases, geopolitical uncertainties, and the Federal Reserve's pivot toward rate cuts. However, November has presented challenges, with gold registering a 3% decline for the month, its worst performance since September 2023. Profit-taking following Donald Trump's election victory and a rally in the US Dollar have weighed on the metal.

Spot gold currently trades at $2,659.49 per ounce, reflecting a weekly decline of 2% amid significant volatility. US gold futures have also mirrored this trend, indicating cautious sentiment as markets await further clarity on economic data and Fed policy decisions.

Broader Market Implications and Investor Outlook

Gold's performance has broader implications for global markets, serving as a barometer of economic and political uncertainty. Heightened tensions in the Middle East and Eastern Europe continue to support demand for safe-haven assets. Central bank activity has also played a critical role, with robust gold purchases reinforcing its strategic importance as a reserve asset.

Investors are closely monitoring upcoming US economic releases, including the ADP employment report, job openings data, and non-farm payroll figures, for insights into the Federal Reserve's monetary policy trajectory. Any signs of economic weakness or dovish policy adjustments could further bolster gold prices.

Conclusion: Strategic Outlook for Gold

Gold remains at the center of global financial markets, reflecting its multifaceted role as a hedge against inflation, geopolitical risks, and currency volatility. With key resistance levels in sight, its trajectory will likely depend on developments in US monetary policy, geopolitical dynamics, and investor sentiment toward risk assets. Whether gold will sustain its upward momentum or face renewed pressure hinges on these critical factors, making it a focal point for market participants heading into 2025.

That's TradingNEWS

Gold Prices Eye Upside as Fed Cuts and Global Tensions Stoke Demand

Crude Oil Markets Eye Explosive Upside: WTI & Brent Ready for Next Big Move