NASDAQ:VCIG: A Closer Look at a Burgeoning Opportunity in AI and Data Centers

VCI Global Limited (NASDAQ:VCIG), a diversified holding company with operations spanning fintech, AI, real estate, and cybersecurity, has recently emerged as a high-profile player in the rapidly growing data center and AI markets. At the center of this momentum is a conditional Letter of Award valued at approximately $24 million for a major data center project in Malaysia’s Enstek City. This strategic win showcases VCI Global's potential to capitalize on the booming AI and digital infrastructure sectors across Southeast Asia and beyond.

Major Contract with Hexatoff Group Positions VCI Global as a Leader in AI Integration

VCI Global's subsidiary, V-Gallant, has been chosen to deliver state-of-the-art AI hardware and software solutions, including 640 NVIDIA H200 Tensor Core GPUs. This deployment will form the backbone of Hexatoff Group’s advanced data center. The contract not only emphasizes VCI Global’s technical capabilities but also aligns with Malaysia’s strategic vision of becoming an AI and digital hub in the ASEAN region.

Hexatoff Group, a high-grade turnkey infrastructure provider, plays a pivotal role in this development. Its collaboration with VCI Global further underscores Malaysia’s status as a premier destination for data center investments, which have attracted global giants such as Microsoft, Google, and NVIDIA.

Explosive Growth in the Data Center Sector

Malaysia’s data center sector is booming, with $21 billion in investments approved between 2021 and mid-2024, according to the Malaysian Investment Development Authority (MIDA). Of these, six projects worth $16 billion are already operational, reinforcing Malaysia’s position as a key regional hub. VCI Global’s involvement in this transformative landscape highlights its strategic alignment with high-growth markets.

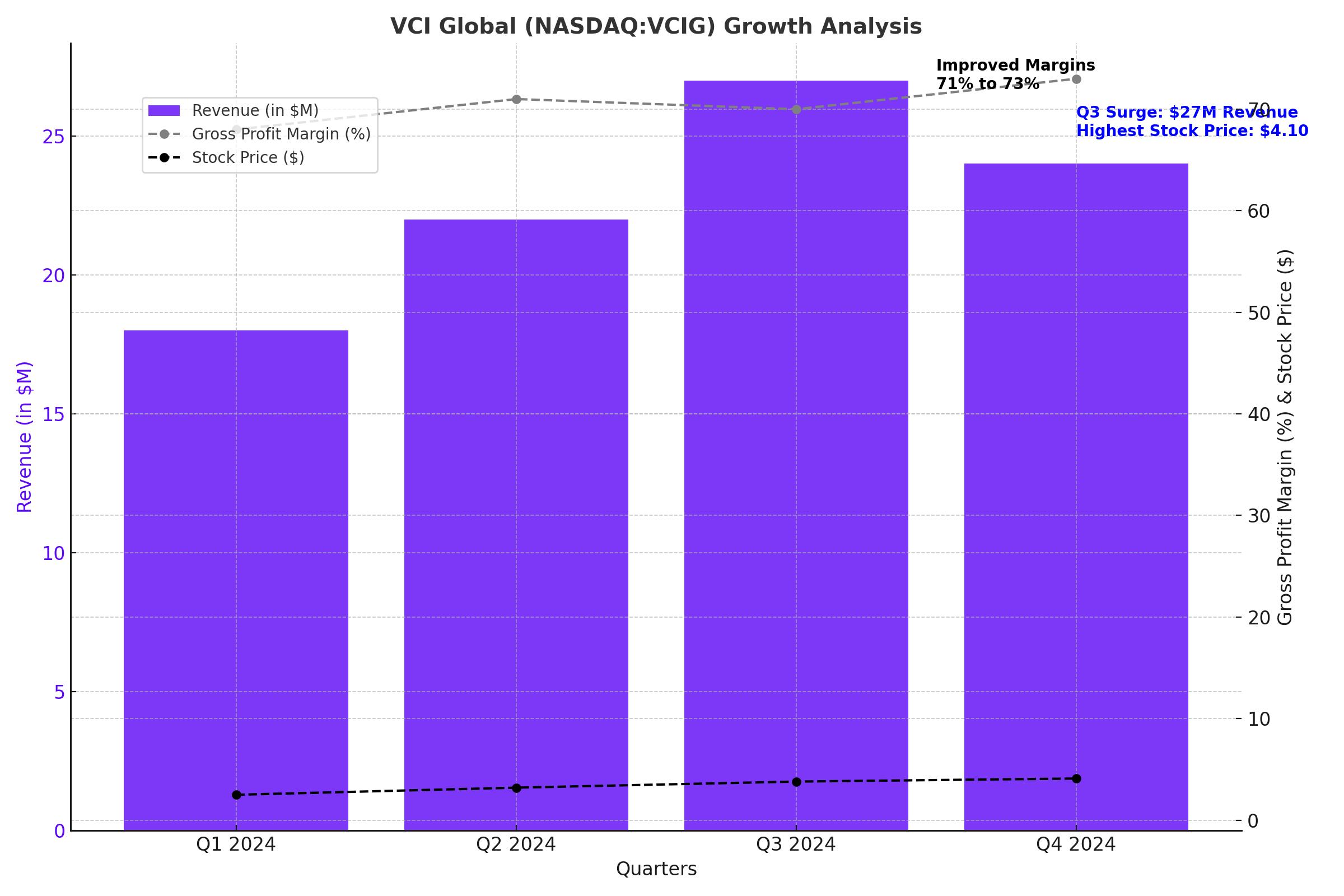

Stock Performance: Volatility Meets Opportunity

NASDAQ:VCIG stock has exhibited remarkable volatility, skyrocketing over 125% in recent trading sessions to close at $4.10, with intraday highs reaching $7.74. This dramatic surge was fueled by excitement surrounding the $24 million data center project. Despite this, the stock remains priced at a low Price-to-Book (P/B) ratio of 0.1, suggesting that its market valuation may still not fully reflect the underlying assets and future potential.

VCI Global’s Diversified Portfolio Fuels Expansion

Beyond its recent contract wins, VCI Global has consistently expanded its portfolio. The company secured a $16 million contract to develop an AI-powered live streaming platform for an e-commerce client in Malaysia. The integration of NVIDIA H200 Tensor Core GPUs into this project further cements VCI Global’s reputation as a leader in AI innovation.

Additionally, VCI Global has successfully concluded a $10 million share buyback program and raised $1.77 million through an At-The-Market equity offering. These strategic moves enhance its financial flexibility to pursue growth opportunities.

VCIG’s Strategic Push into Nasdaq Listings

In another bold move, VCI Global recently inked an $18 million deal to list four Malaysian companies on the Nasdaq exchange. This initiative, spearheaded through its collaboration with Legacy Corporate Advisory, highlights the company’s expertise in capital markets consultancy and positions it as a key facilitator for Southeast Asian firms seeking global exposure.

Financial Health: A Strong Foundation for Growth

VCI Global’s robust financials support its aggressive expansion strategy. The company’s gross profit margin of 70.86% and liquidity position, with more cash than debt, underline its operational efficiency and financial prudence. These metrics provide confidence in the company’s ability to sustain its growth trajectory while navigating market challenges.

A Bullish Outlook or Strategic Caution?

The stock’s meteoric rise and underlying fundamentals suggest strong growth potential. However, investors should consider the inherent risks of market volatility and the conditional nature of the $24 million contract. With a diversified portfolio, robust financials, and a focus on high-growth sectors like AI and digital infrastructure, VCI Global offers a compelling opportunity for investors seeking exposure to transformative markets.

Is NASDAQ:VCIG a Buy, Sell, or Hold?

Given the promising developments, undervalued metrics, and strong positioning in booming sectors, NASDAQ:VCIG appears to be a Buy for long-term investors willing to navigate its volatility. At its current price of $4.10, the stock represents a rare opportunity to capitalize on the AI and data center revolutions. Monitor live performance and updates at VCIG Real-Time Chart.