Bitcoin’s Bullish Momentum: Analyzing the Path to New Highs

Bitcoin (BTC) Breaks Through Key Resistance Levels

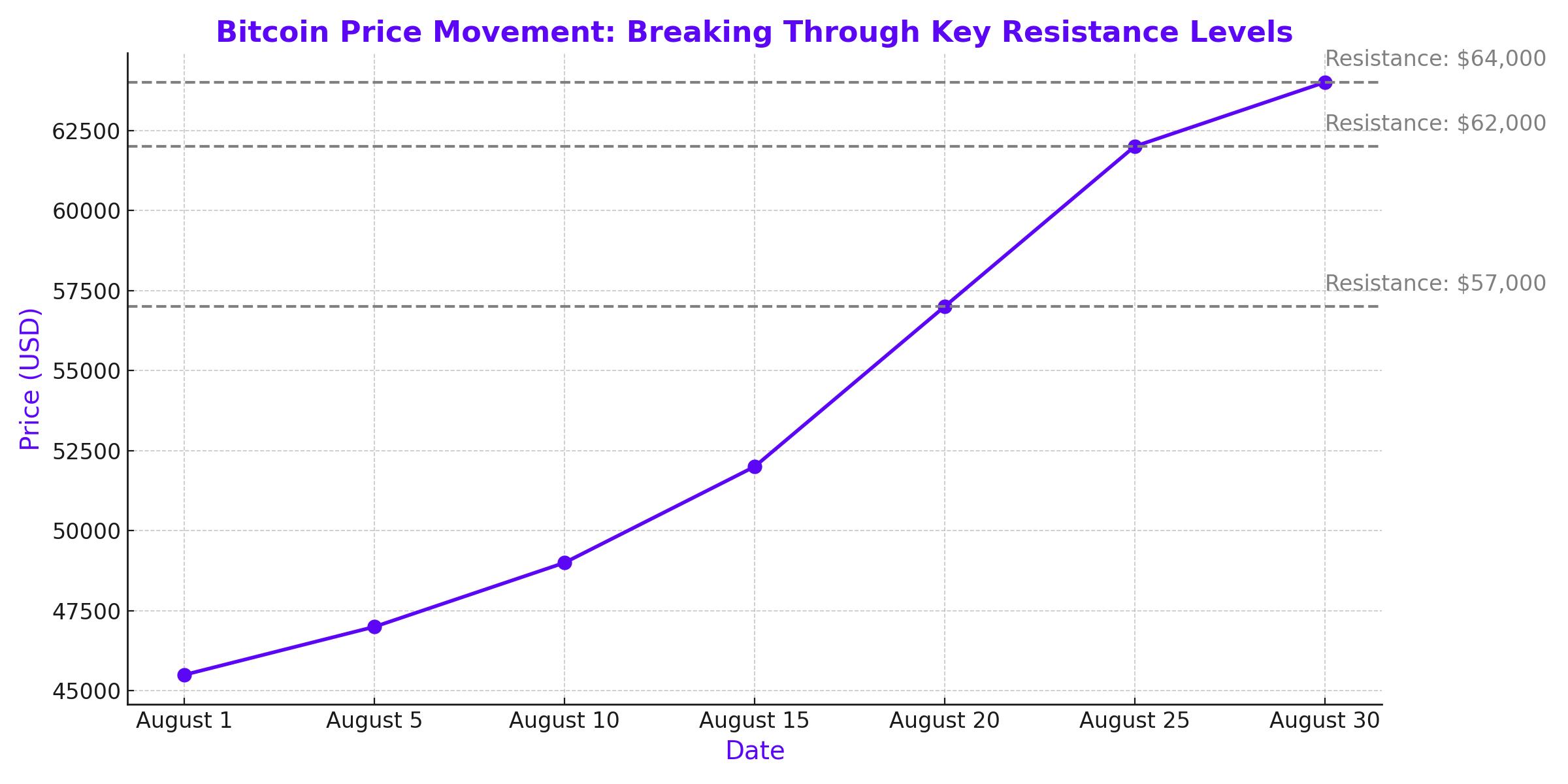

Bitcoin’s recent price action has captured the attention of investors and analysts alike, as the leading cryptocurrency surged past significant resistance levels. After weeks of consolidation within the $57,000 to $62,000 range, Bitcoin broke above $64,000, signaling a potential rally ahead. This move was bolstered by positive market sentiment following U.S. Federal Reserve Chair Jerome Powell’s indication of a likely interest rate cut in September. This news catalyzed a wave of optimism across the cryptocurrency markets, driving substantial inflows into Bitcoin-focused ETFs and setting the stage for what could be a historic price surge.

Spot Bitcoin ETFs See Massive Inflows

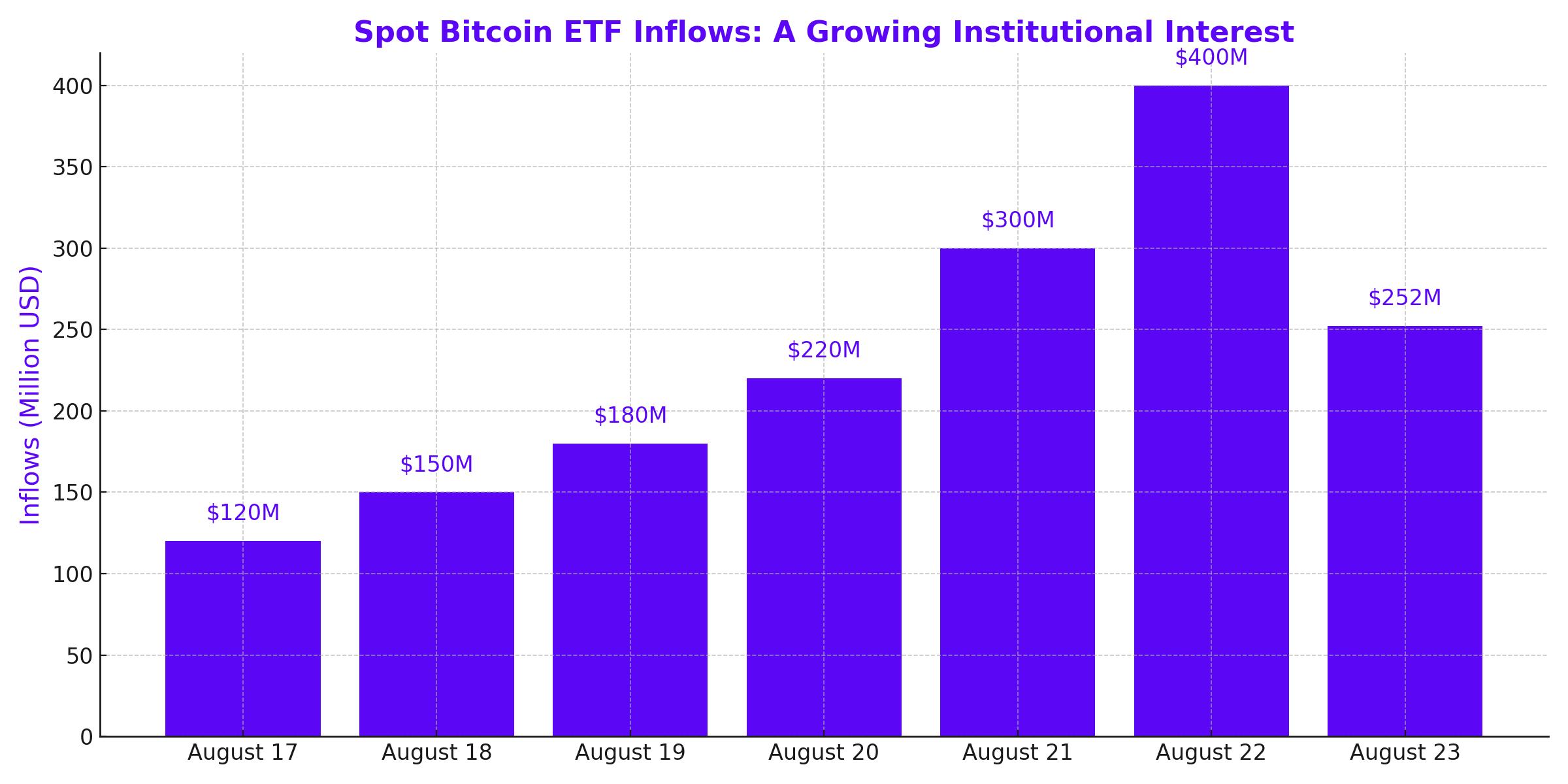

One of the key indicators of growing institutional interest in Bitcoin has been the significant inflows into U.S. spot Bitcoin ETFs. Last week alone, these ETFs recorded net inflows of $506.40 million, marking the highest weekly influx since mid-July. On Friday, August 23, alone, spot Bitcoin ETFs saw a single-day inflow of $252 million. The combined Bitcoin reserves held by the 11 U.S. spot Bitcoin ETFs now stand at an impressive $44.60 billion. This surge in institutional participation underscores the growing recognition of Bitcoin as a legitimate asset class and a viable hedge against traditional financial market volatility.

Miners Position Index Indicates Reduced Selling Pressure

On-chain data continues to support a bullish outlook for Bitcoin. The Miners Position Index (MPI), a key metric that tracks the ratio of miners' outflows in USD to the 365-day moving average, has shown a significant decrease. The MPI dropped from -0.63 to -1.46 between Friday and Monday, indicating that miners are less inclined to sell their Bitcoin holdings. This reduction in selling pressure from miners typically suggests a positive price outlook, as it implies that miners are holding onto their Bitcoin in anticipation of higher prices.

Positive Funding Rates Signal Bullish Sentiment in the Futures Market

Further bolstering Bitcoin’s bullish case, the funding rates in the futures market have turned positive. Currently, Bitcoin’s funding rate stands at 0.008, indicating a dominance of long-position traders. Positive funding rates suggest that traders are willing to pay a premium to hold long positions, reflecting strong bullish sentiment. This dynamic in the perpetual swaps market often precedes continued price appreciation, as it signals confidence among traders in the sustainability of the current rally.

Technical Analysis: Bitcoin Breaks Above Key Moving Averages

From a technical perspective, Bitcoin’s price movement has been particularly noteworthy. On Friday, Bitcoin decisively broke above its 200-day Exponential Moving Average (EMA) at $62,280, as well as its 61.8% Fibonacci retracement level, drawn from the high on July 29 to the low on August 5, which stood at $62,042. At the time of writing, Bitcoin is trading slightly lower at $64,021, but it remains well above these critical levels, reinforcing the bullish momentum.

The break above the 200-day EMA is a significant technical milestone, as this level often serves as a long-term indicator of market trends. A sustained move above this level could pave the way for Bitcoin to challenge its previous all-time highs, especially as the broader market sentiment remains positive.

Market Sentiment and Macroeconomic Factors

As Bitcoin approaches its monthly close, the market is closely watching for signs of continued bullish momentum. The cryptocurrency has bounced back impressively from its August lows, rising over 40% from its $45,500 bottom earlier in the month. Traders and investors are now anticipating whether Bitcoin can maintain this momentum and push towards the $70,000 mark.

Macroeconomic factors are also expected to play a crucial role in Bitcoin’s near-term price action. The upcoming release of the Personal Consumption Expenditures (PCE) index, a key inflation metric favored by the Federal Reserve, could influence market expectations regarding the timing and extent of future interest rate cuts. Additionally, the U.S. second-quarter GDP data and earnings reports from major companies, including Nvidia, are likely to impact market sentiment and, by extension, Bitcoin’s price trajectory.

Mining Difficulty and Hashrate Point to Network Strength

Bitcoin’s network fundamentals also remain strong, with mining difficulty expected to resume its uptrend after a recent decline. The latest estimates suggest that mining difficulty will increase by approximately 2.8% this week, bringing it close to a new all-time high. This resilience in mining difficulty reflects the ongoing commitment of miners to the Bitcoin network, despite recent fluctuations in profitability.

In tandem with rising difficulty, Bitcoin’s hashrate—a measure of the processing power dedicated to mining—continues to trend upwards. On August 23, Bitcoin’s hashrate reached a new peak of 774 exahashes per second, signaling robust network security and stability. This uptrend in hashrate is a positive indicator for Bitcoin’s long-term outlook, as it demonstrates the growing confidence of miners in the cryptocurrency’s future value.

Short-Term Holder Activity and Market Distribution

The behavior of short-term holders (STHs) has also been a focal point of analysis. Over the past week, STHs have distributed approximately $10 billion worth of Bitcoin into the market, according to data from CryptoQuant. This increase in selling by STHs is a common occurrence during periods of price recovery, as these investors often seek to capitalize on short-term gains. However, the aggregate cost basis for STHs, currently around $63,600, may serve as a potential support level if Bitcoin experiences another price dip.

Despite this distribution, the broader market sentiment has shifted from extreme fear to neutral territory, as reflected in the Crypto Fear & Greed Index. This rapid change in sentiment suggests that investors are regaining confidence in Bitcoin, with many now positioning themselves for further upside.

Implications of the Fed’s Rate Cut and Economic Data

Looking ahead, the anticipated interest rate cut by the Federal Reserve in September could act as a significant catalyst for Bitcoin. Markets have already priced in a rate cut, with current odds at 61.5% for a 25-basis-point reduction and 38.5% for a 50-basis-point cut. A rate cut, particularly one that exceeds expectations, could further boost Bitcoin’s appeal as a hedge against inflation and traditional financial market risks.

Additionally, the upcoming U.S. economic data, including the PCE index and second-quarter GDP figures, will be closely watched by investors. Positive data could reinforce the case for a sustained Bitcoin rally, while any signs of economic weakness may lead to increased volatility in the cryptocurrency markets.

Conclusion: Bitcoin’s Path Forward

Bitcoin’s recent price action, coupled with strong on-chain metrics and favorable macroeconomic conditions, suggests that the cryptocurrency is well-positioned for further gains. However, as Bitcoin approaches critical resistance levels, it will be crucial for bulls to maintain momentum and break above the $64,000 to $65,000 range. A successful breach of this zone could pave the way for Bitcoin to challenge its previous all-time highs and potentially set new records.

Investors should remain vigilant, as the market is likely to experience heightened volatility in the coming weeks. Nonetheless, the overall outlook for Bitcoin remains positive, with the cryptocurrency continuing to attract significant institutional interest and demonstrating resilience in the face of economic uncertainties.