Bitcoin (BTC) Hits 6-Week High Amid Trump's Pro-Crypto Stance

Detailed Analysis of Bitcoin’s Recent Price Movements, Political Influences, and Market Indicators | That's TradingNEWS

Bitcoin (BTC): Bullish Momentum Amid Political Support and Market Dynamics

Recent Price Surge and Influences

Bitcoin (BTC) has surged to its highest level in over six weeks, peaking at around $69,745 on Monday, driven by statements from former President Donald Trump. At the Bitcoin 2024 convention in Nashville, Trump pledged to end what he termed the "persecution" of the crypto industry if elected. This pro-Bitcoin stance contributed to the cryptocurrency's price rally, marking a significant rise from its previous levels.

Political Support and Market Sentiment

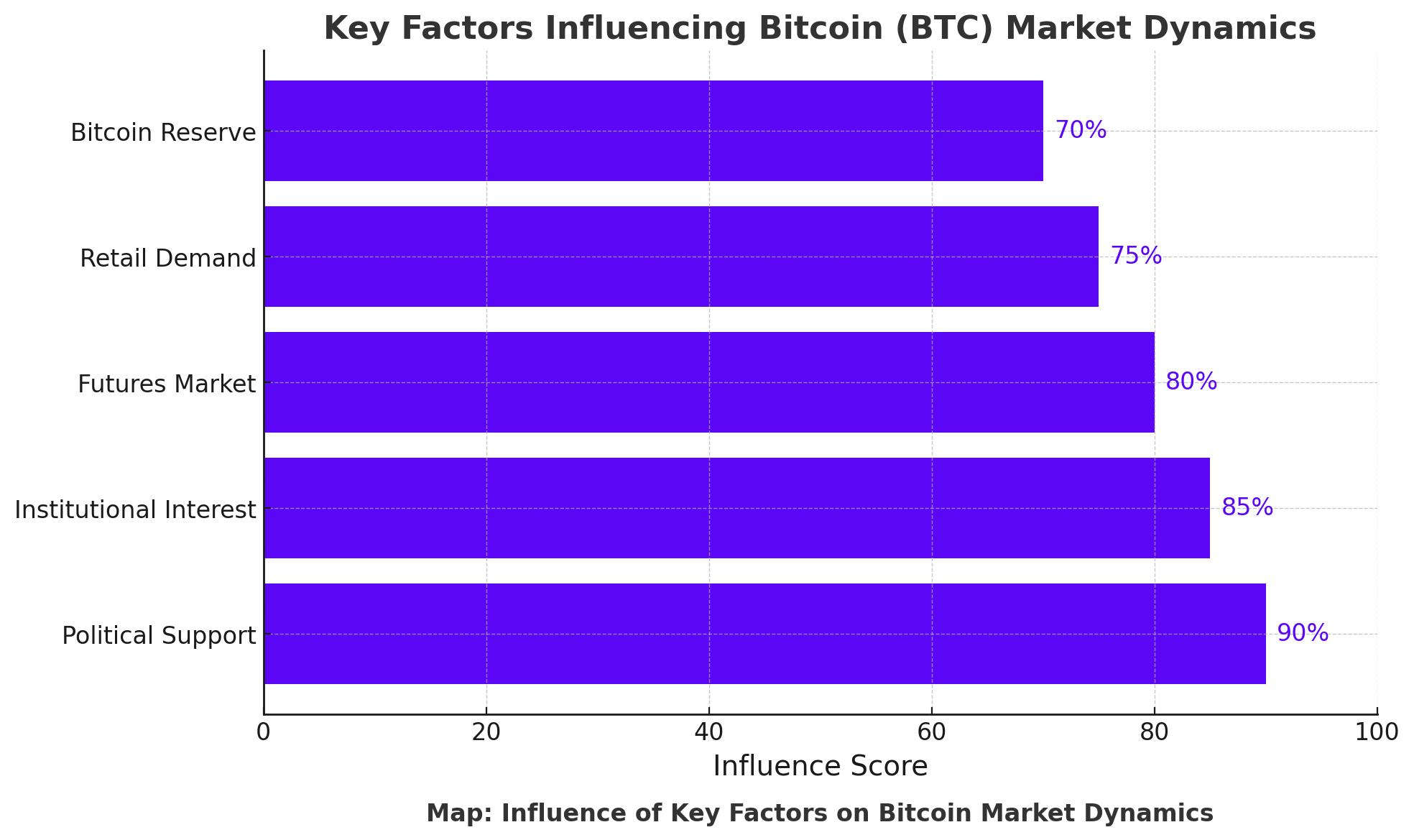

Trump's remarks have added a layer of political support to Bitcoin's recent gains. He committed to making the US a global leader in cryptocurrency, contrasting his stance with that of his rival, Kamala Harris. He also announced plans to fire Gary Gensler, the current chair of the US Securities and Exchange Commission (SEC), who has been a known skeptic of cryptocurrencies. These statements have fueled optimism among Bitcoin investors, anticipating a more favorable regulatory environment under a Trump administration.

Technical Analysis and Key Levels

From a technical perspective, Bitcoin's recent rally has brought it close to key resistance levels. Trading at around $69,745, the next significant target for Bitcoin is the $71,500 mark. Breaking through this level could pave the way for Bitcoin to reach new all-time highs. The increase in Bitcoin futures’ open interest to an all-time high of $39.46 billion indicates growing investor interest, which could support further price increases.

Market Dynamics and Institutional Interest

Bitcoin (BTC) has experienced significant price movements driven by a combination of market dynamics and increased institutional interest. As of the latest data, Bitcoin's price has surged to around $69,745, influenced by multiple factors.

Institutional Engagement and Futures Market

A critical indicator of institutional interest is the recent all-time high in Bitcoin futures’ open interest, which has reached $39.46 billion across all exchanges. This surpasses the previous record of $39.03 billion set on March 29, 2024. The surge in open interest indicates that institutional investors are actively trading and investing in Bitcoin, reflecting a robust demand for the cryptocurrency.

Short-Term Holder Profits and Retail Demand

Moreover, approximately 75% of Bitcoin’s short-term holders are currently in profit, as of July 24. This profitability among short-term holders often signals strong retail demand, as these investors are more likely to hold onto their assets or buy more, anticipating further price increases. This trend can contribute to upward momentum in Bitcoin’s price.

Strategic Bitcoin Reserve and Government Policies

Trump's proposal to establish a strategic national Bitcoin reserve and maintain the US government's seized Bitcoin has significant implications. By emphasizing the importance of digital assets, he aims to prevent other countries, particularly China, from dominating the crypto market. His pledge to "never sell" the US government’s Bitcoin holdings aligns with his vision of positioning the US as a leader in cryptocurrency.

Long-Term Price Projections

Prominent figures in the crypto community, such as Michael Saylor, co-founder and chairman of MicroStrategy, have made bold predictions for Bitcoin's long-term value. Saylor's forecast suggests a base case scenario where Bitcoin could reach $13 million per coin by 2045, with a market capitalization ranging from $68 trillion in a bear case to $1,030 trillion in a bull case. This long-term bullish outlook reflects the potential for Bitcoin to achieve significant growth as adoption increases.

Bitcoin Dominance and Market Position

Bitcoin's growing dominance in the cryptocurrency market is another positive indicator. According to Benjamin Cowen, CEO and Founder of Into The CryptoVerse, Bitcoin is expected to capture an increasing share of the total crypto market capitalization. This growing dominance suggests that Bitcoin will continue to be a leading asset in the digital currency space.

Short-Term Sentiment and Market Behavior

In the short term, Bitcoin’s recent price rebound has shifted trader sentiment to its most bullish levels in 16 months. Despite this optimism, market participants remain cautious, aware of the potential for volatility. According to data from Santiment, Bitcoin’s 20% price rally over three weeks has contributed to this positive sentiment, but traders are advised to remain vigilant.

Implications of Bitcoin ETFs and Institutional Flows

The recent inflows into US-based spot Bitcoin exchange-traded funds (ETFs) have also played a role in Bitcoin's price dynamics. With $795 million worth of net inflows in the previous week, the continuous positive inflows highlight growing institutional interest. This trend is likely to influence Bitcoin's price action moving forward, especially as ETFs provide a regulated avenue for institutional investment in Bitcoin.

Conclusion

Bitcoin's recent rally to nearly $70,000 reflects a confluence of factors, including political support, institutional interest, and favorable market dynamics. Trump's pro-Bitcoin stance and his proposed policies have bolstered investor confidence, contributing to the upward momentum. With significant resistance levels approaching and long-term bullish projections, Bitcoin remains a strong contender in the cryptocurrency market. Investors should closely monitor political developments, institutional flows, and technical indicators to navigate Bitcoin's evolving landscape.

That's TradingNEWS

Read More

-

Ferrari Stock Price Forecast - RACE at $377 Stock Turns Sentiment Slump Into A High-Margin Buying Window

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Holds the $2 Line as Clarity Act Vote and Powell Drama Put Crypto on Edge

12.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast Oil Slip as Iran “Control” Claim and Fast-Tracked Venezuela Deal Test the $60 Floor

12.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow, S&P 500, Nasdaq Drop As Gold Rips Higher And WMT, TEM, SNCY Rally

12.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Spikes Back Toward 1.35 as Fed Turmoil Cracks the Dollar

12.01.2026 · TradingNEWS ArchiveForex