Bitcoin (BTC-USD) Analysis: Can Bulls Defend $94K or Is a Drop to $90K Next?

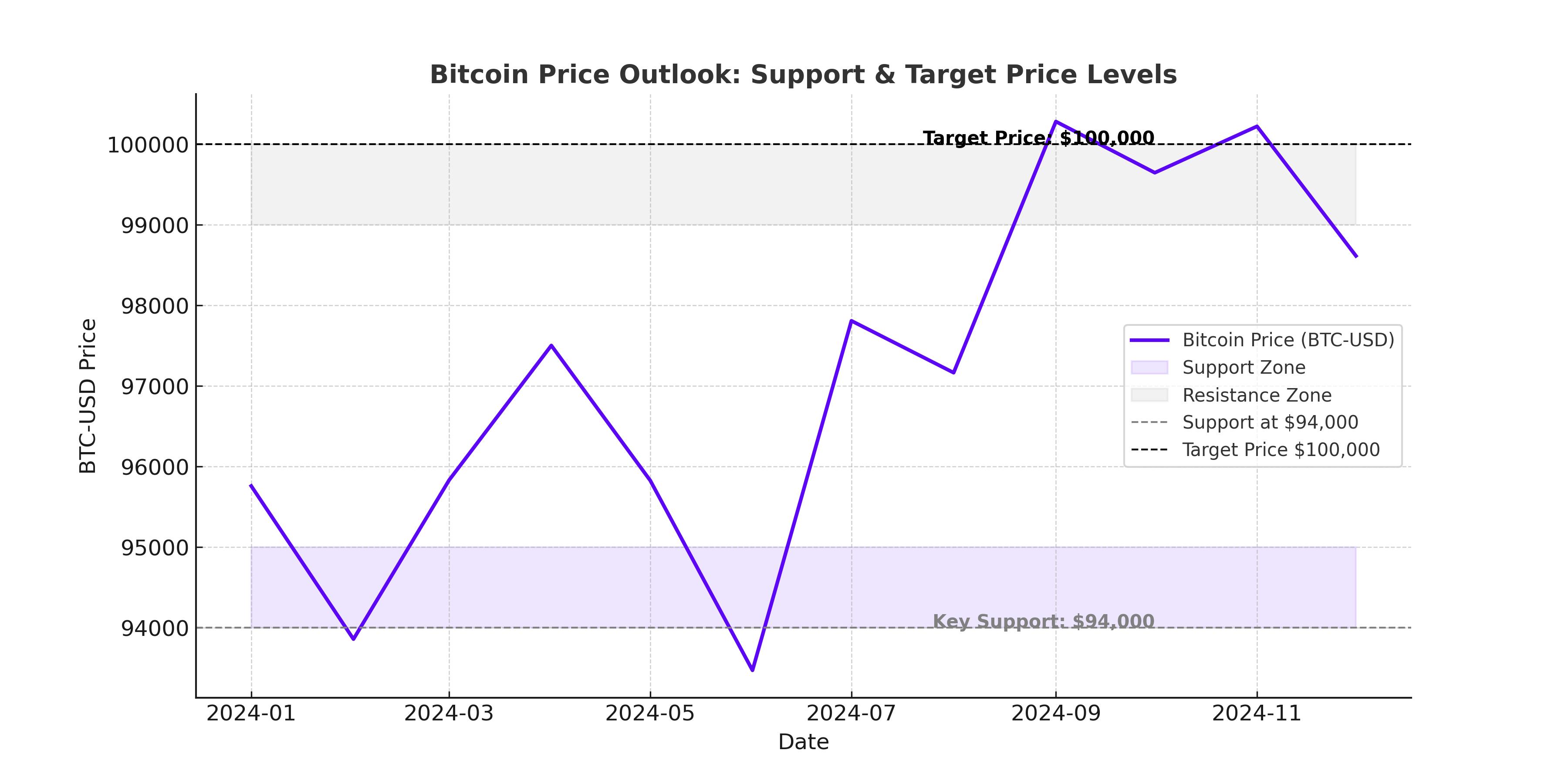

Bitcoin is teetering at a critical support level, with BTC-USD trading at $96,100, caught in a tight consolidation range between $94,000 and $100,000. The market is flashing mixed signals, with institutional outflows raising concerns while on-chain data suggests accumulation. The question remains: will Bitcoin break higher or succumb to selling pressure?

Institutional Demand Weakens as ETF Outflows Mount

One of the biggest concerns for Bitcoin’s short-term trajectory is the sharp outflows from spot Bitcoin ETFs, which recorded a $580.2 million net outflow last week, signaling declining institutional interest. This comes after an unprecedented six-week $5 billion inflow streak, highlighting a shift in sentiment.

Despite BlackRock's iShares Bitcoin Trust (IBIT) purchasing $662M in BTC, the overall trend in ETF flows has turned negative. Grayscale's Bitcoin Trust (GBTC) continues to bleed funds, with $46.95 million in exits last week, bringing total outflows to $22 billion since its ETF conversion.

This weakening institutional appetite suggests that Bitcoin may struggle to reclaim the $100,000 level in the near term, especially as macroeconomic pressures mount.

Technical Breakdown: Key Levels to Watch

Bitcoin’s technical indicators reflect a fragile structure, with the Relative Strength Index (RSI) at 43, signaling bearish momentum. The MACD has confirmed a bearish crossover, while the 50-day EMA is acting as overhead resistance around $98,000.

BTC has formed a descending wedge pattern, often a bullish reversal setup, but only if support holds. The $94,000 level has been tested multiple times, making it the key line in the sand. If BTC breaks below this zone, it could quickly tumble to $90,000, where a stronger demand zone sits.

On the upside, Bitcoin must reclaim $100,000 to regain bullish momentum, with $106,000 as the next major resistance. A breakout above this level would validate the long-term uptrend and open the door to retesting $110,000 and beyond.

On-Chain Metrics: Whales Accumulate as Exchange Balances Decline

Despite the price consolidation, on-chain data suggests that long-term holders are using the dip to accumulate. CryptoQuant's 30DMA exchange inflow/outflow ratio has dropped to 0.98, meaning that BTC outflows from exchanges are exceeding inflows—typically a bullish sign as supply tightens.

Additionally, Bitcoin’s total exchange balance has fallen by over 20,000 BTC in the past month, showing that investors are moving coins into cold storage rather than selling. Historically, such supply contractions have preceded major price rallies.

However, realized volume has dropped significantly, indicating a lack of aggressive buying pressure. Without a surge in trading volume, BTC’s upside may remain capped in the short term.

Macroeconomic Pressures: Fed Policy & Inflation Data Weigh on Bitcoin

The broader macro backdrop presents another hurdle for Bitcoin. Federal Reserve Chair Jerome Powell recently reaffirmed a hawkish stance, signaling that interest rate cuts may be delayed due to higher-than-expected inflation data.

U.S. CPI rose to 3.0% in January, while the labor market remains strong, with unemployment dropping to 4.1%. This combination reduces the urgency for the Fed to ease policy, which is typically bearish for Bitcoin and other risk assets.

Historically, Bitcoin thrives in a low-rate environment, as reduced borrowing costs fuel speculative investment. But with rates expected to remain elevated, BTC’s upside may be limited unless the Fed pivots sooner than expected.

Political & Regulatory Landscape: Trump’s Pro-Crypto Stance Adds a Wild Card

While macroeconomic conditions remain uncertain, Bitcoin’s long-term outlook could be bolstered by pro-crypto regulatory shifts under the Trump administration.

The SEC has already rescinded Staff Accounting Bulletin No. 121, a restrictive rule that prevented banks from holding Bitcoin directly. This opens the door for greater institutional adoption.

Additionally, Trump’s selection of pro-crypto figures like Paul Atkins to head the SEC and Brian Quintenz to lead the CFTC could create a much more favorable regulatory environment. If major financial institutions get the green light to integrate Bitcoin more deeply into their operations, demand could surge in the coming months.

Bitcoin Price Forecast: Will Bulls Reclaim $100K or Break Below $94K?

Bitcoin’s price action remains at a pivotal juncture. If BTC can hold above $94K and reclaim $100K, a retest of $106K is likely, with potential upside toward $110K-$115K if momentum strengthens.

However, a breakdown below $94K could trigger a sell-off toward $90K, with $88K as a deeper support zone. The next few weeks will be critical in determining whether Bitcoin resumes its uptrend or faces a more extended consolidation period.

For now, Bitcoin is at a crossroads, with technicals favoring a cautious stance while accumulation metrics suggest long-term strength. Will BTC hold the line, or is a deeper correction on the horizon?