Bitcoin Bullish Surge: Eyes Set on $73K

Positive Market Sentiment and Institutional Investments Propel Bitcoin's Bullish Run |That's TradingNEWS

Bitcoin Price Rally: Key Drivers and Market Impact

Strong Institutional Interest

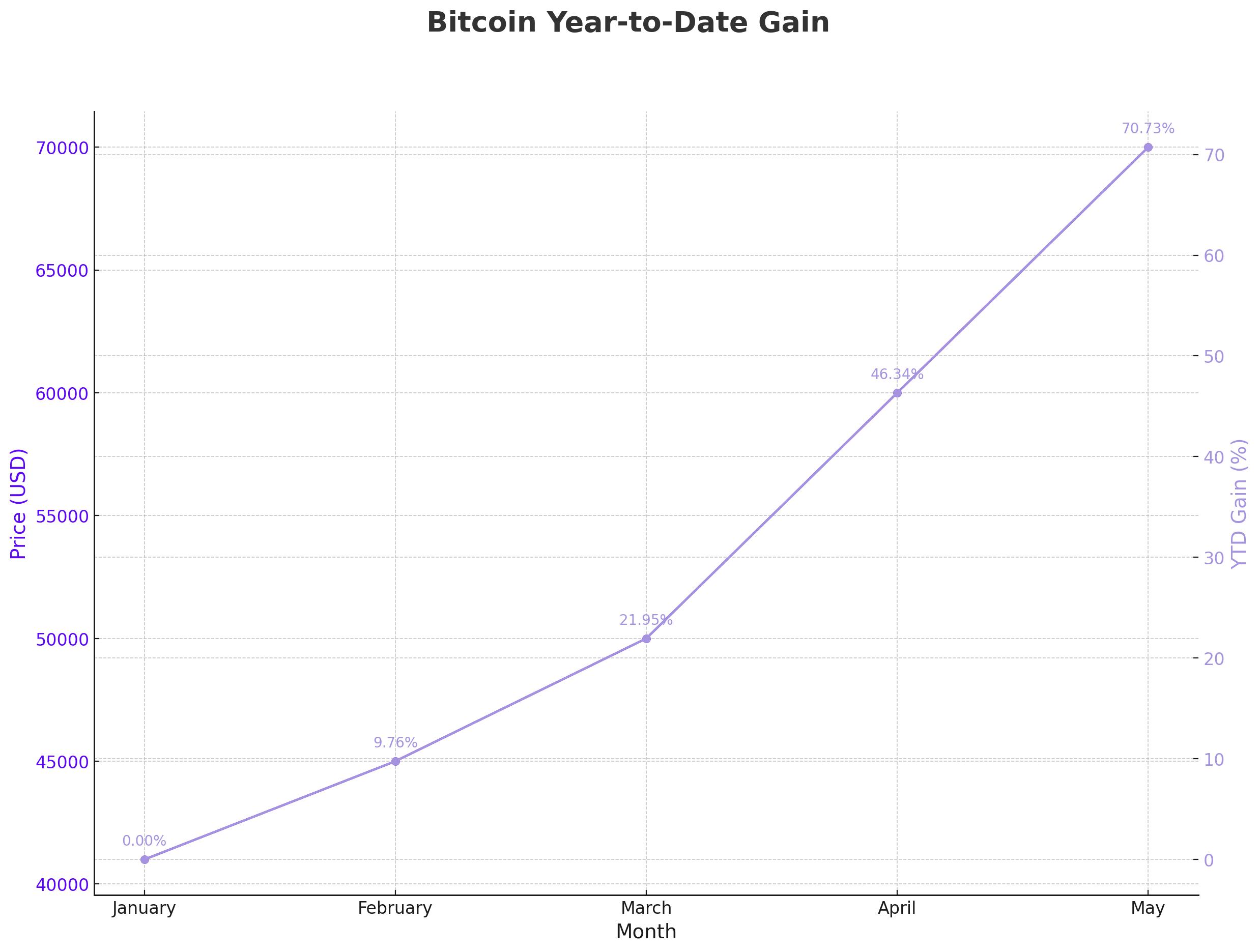

Bitcoin (BTC) saw a sharp rise, reaching $70,000, as institutional investors continued to pour capital into newly approved spot Bitcoin exchange-traded funds (ETFs). This surge marks the first time BTC has hit this level since April, showcasing robust market confidence.

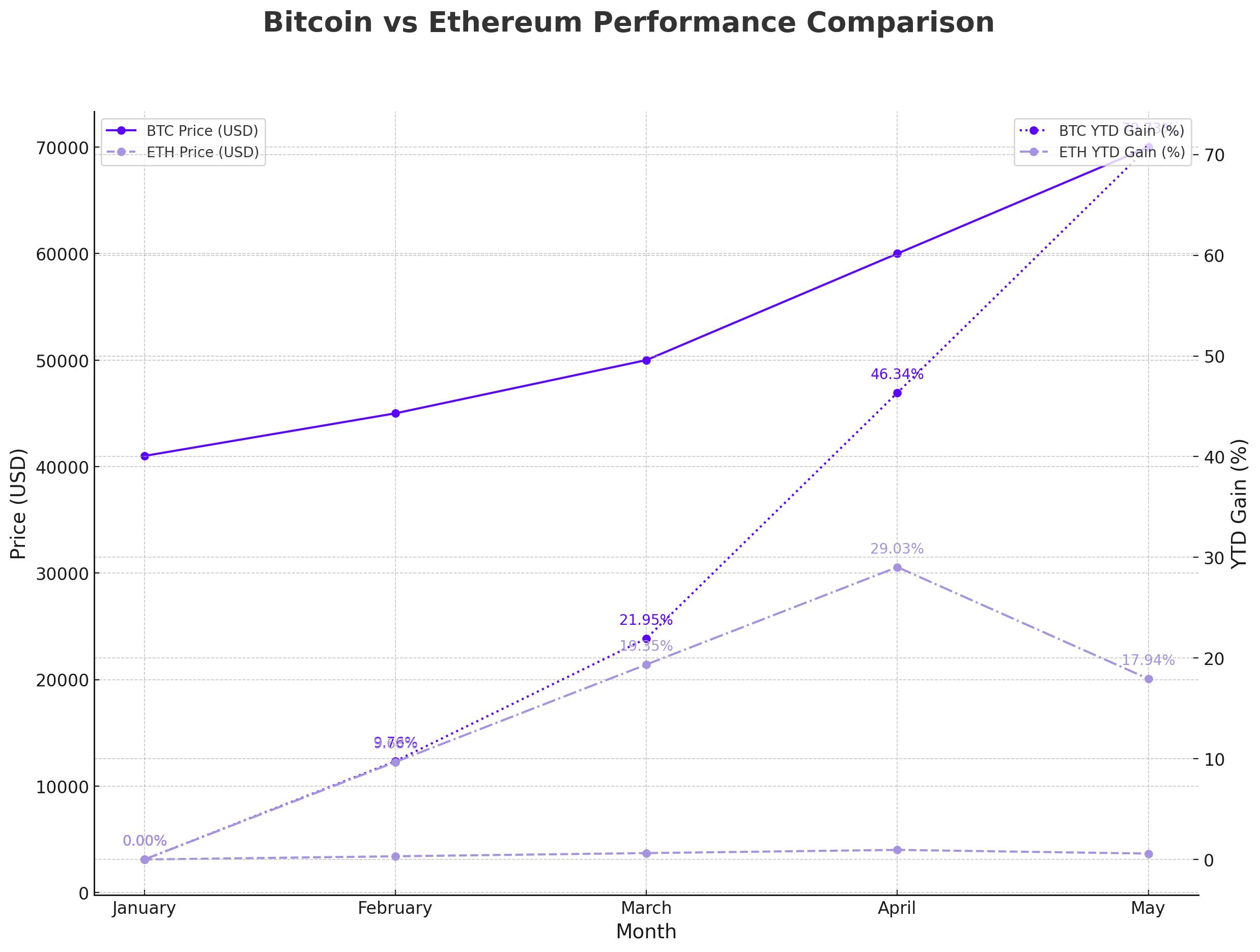

Ether's Influence and SEC Developments

Ether (ETH) also experienced a significant surge, rising 17% to $3,656.01. This boost followed reports that the U.S. Securities and Exchange Commission (SEC) had asked applicants for spot Ether ETFs to update key filings. Bloomberg analysts increased the probability of ETF approval to 75%, suggesting a potential market shift.

Market Sentiment and Federal Reserve Speculation

Data from CoinShares indicated that crypto investment products saw $932 million in inflows last week, driven by expectations of U.S. interest rate cuts. Bitcoin dominated these inflows, reflecting its growing appeal as a hedge against inflation. The Federal Reserve's potential rate cuts could further enhance BTC's attractiveness.

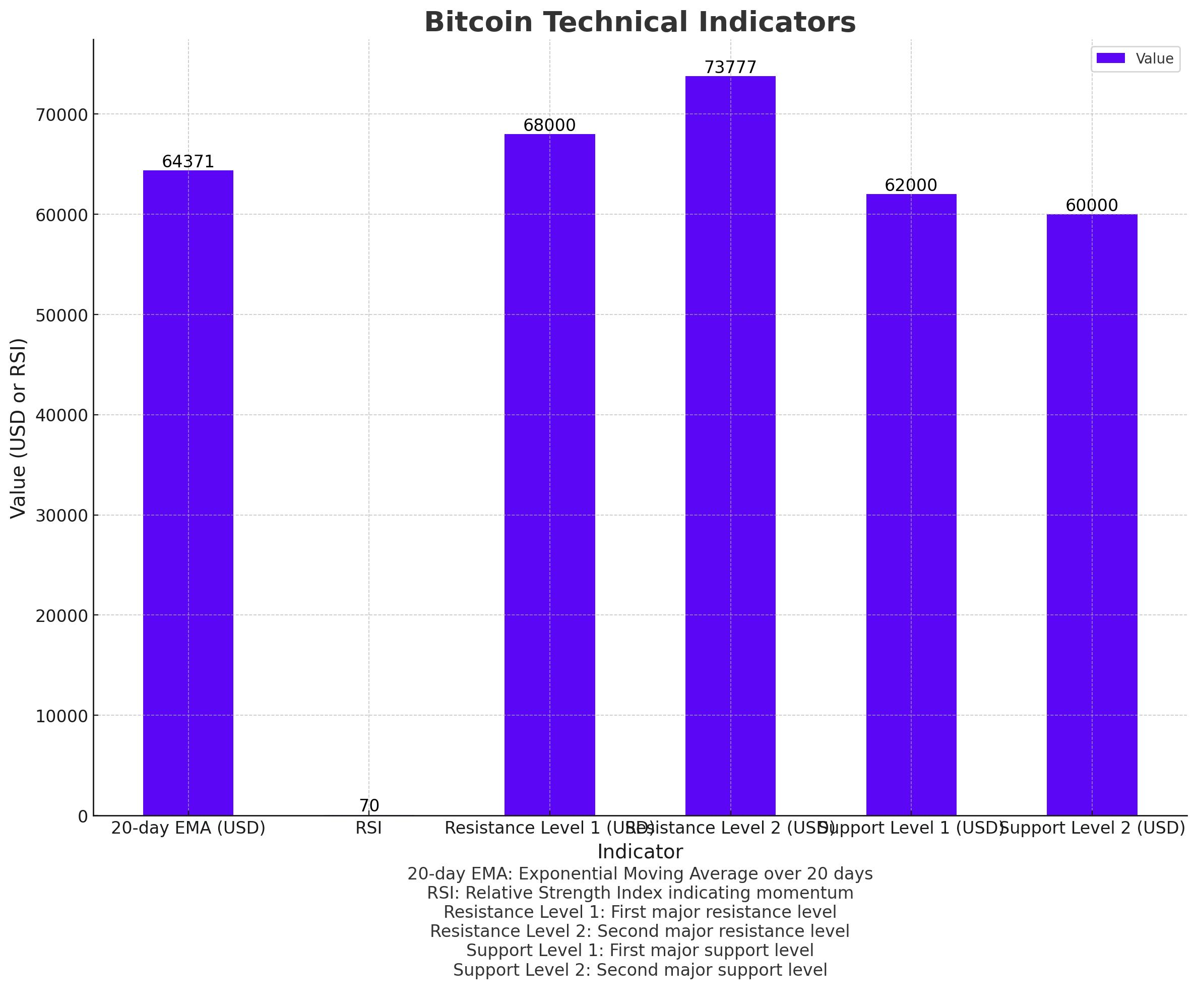

Bitcoin Technical Indicators

Bitcoin's price is showing strong bullish signals. The 20-day Exponential Moving Average (EMA) stands at $64,371, and the Relative Strength Index (RSI) indicates positive momentum. Overcoming the resistance at $68,000 suggests that BTC could reach $73,777, approaching its all-time high.

Exchange BTC Reserves at Seven-Year Low

Exchange BTC reserves have dropped to a seven-year low, with only 1,918,417 BTC available on major trading platforms. This scarcity, combined with the recent halving event, makes Bitcoin's bullish outlook more compelling.

Impact of U.S. Monetary Policy

Bitcoin's 51% year-to-date gain mirrors investors' expectations of U.S. monetary expansion. The Federal Reserve's liquidity injections to support the banking sector and broader economy have driven investors toward scarce assets like Bitcoin. With the M2 monetary base exceeding $21.0 trillion in April 2024, inflationary pressures are rising, making Bitcoin an attractive hedge.

Bitcoin's Role as an Inflation Hedge

The U.S. monetary base expansion hints at rising inflation, which typically boosts the appeal of scarce assets like Bitcoin. As traditional investment options face challenges, Bitcoin's unique position as a digital store of value becomes increasingly compelling, driving its price higher and attracting more investors.

Bullish Price Predictions Today

With Bitcoin trading just below $70,000, analysts suggest that surpassing the $68,000 resistance could push BTC towards $73,777. The strong market fundamentals and institutional backing support a bullish outlook for Bitcoin, making it a compelling buy for investors.

Why Buy Bitcoin Now?

The recent surge in Bitcoin’s price to $70,000, driven by institutional interest and positive market sentiment, signals a robust bullish trend. The potential approval of spot Ether ETFs and anticipated Federal Reserve rate cuts further strengthen BTC's outlook. With exchange reserves at a seven-year low and strong technical indicators, Bitcoin is poised for significant gains, making it an attractive investment opportunity. Investors should consider buying Bitcoin now to capitalize on these favorable conditions and potential for new all-time highs.

That's TradingNEWS

Read More

-

Ferrari Stock Price Forecast - RACE at $377 Stock Turns Sentiment Slump Into A High-Margin Buying Window

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Holds the $2 Line as Clarity Act Vote and Powell Drama Put Crypto on Edge

12.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast Oil Slip as Iran “Control” Claim and Fast-Tracked Venezuela Deal Test the $60 Floor

12.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow, S&P 500, Nasdaq Drop As Gold Rips Higher And WMT, TEM, SNCY Rally

12.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Spikes Back Toward 1.35 as Fed Turmoil Cracks the Dollar

12.01.2026 · TradingNEWS ArchiveForex