Bitcoin Hits $100,000: Is This the Start of a New Crypto Revolution?

With regulatory optimism and institutional adoption driving momentum, Bitcoin could soar to $200,000 or beyond | That's TradingNEWS

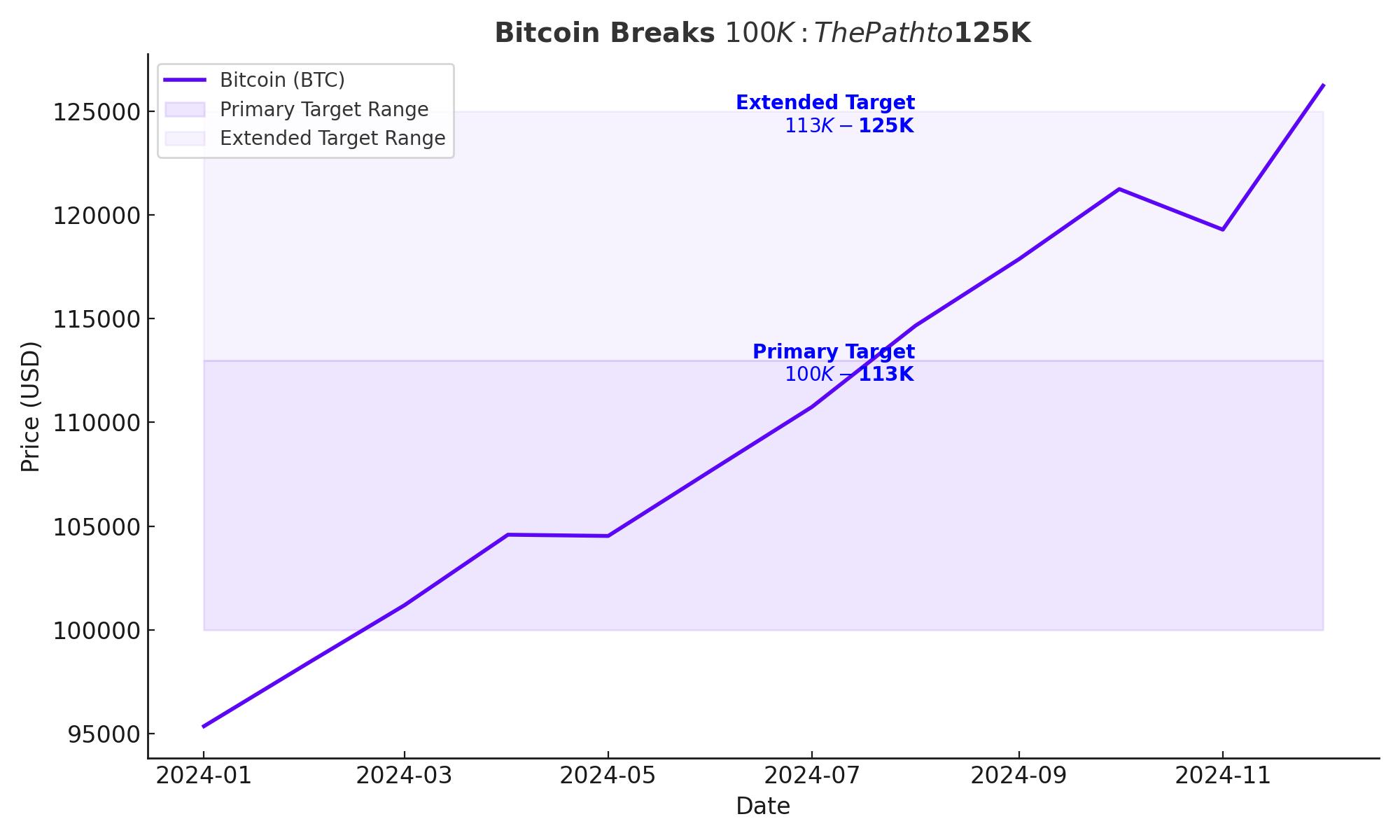

Bitcoin Breaks the $100,000 Barrier: The Dawn of a New Financial Era

Bitcoin (BTC) has finally shattered the long-anticipated $100,000 milestone, signaling a historic moment for the cryptocurrency market and redefining its position in global finance. This rally, fueled by a mix of political, economic, and market-driven forces, has propelled Bitcoin’s market capitalization beyond $2 trillion for the first time. With renewed optimism, institutional adoption, and potential regulatory easing on the horizon, Bitcoin is now entering uncharted territory.

The Political Boost: Trump’s Pro-Crypto Stance Drives Optimism

The catalyst for Bitcoin's latest surge was the election of Donald Trump, whose administration is widely perceived as pro-crypto. His announcement of Paul Atkins, a known cryptocurrency advocate, as the incoming chairman of the Securities and Exchange Commission (SEC), has instilled confidence in the crypto community. Atkins’ appointment marks a departure from Gary Gensler’s enforcement-heavy approach, signaling the possibility of lighter regulations and clearer guidelines for digital assets.

Under Trump’s leadership, speculation has emerged about a national Bitcoin reserve and a strategic push toward embracing cryptocurrency within the broader financial system. These developments have emboldened institutional investors, pushing Bitcoin to break past its $99,588 all-time high and settle above $103,000.

Institutional Adoption and Corporate Momentum

Bitcoin’s meteoric rise in 2024 was bolstered by substantial institutional adoption. U.S.-approved spot Bitcoin ETFs brought in over $31 billion in net inflows, tightening the supply of BTC in circulation. This came on the heels of Bitcoin’s fourth halving in April, reducing miner rewards and further constraining supply.

MicroStrategy (NASDAQ: MSTR), a major corporate Bitcoin holder, has played a pivotal role in fueling this rally. The company now owns over 402,100 BTC, valued at more than $40 billion, representing a year-to-date stock price surge of over 540%. Such corporate enthusiasm underscores Bitcoin’s growing recognition as a store of value and inflation hedge.

Technical Drivers: The Role of Halving and Supply Constraints

The halving event in April 2024 significantly influenced Bitcoin’s price dynamics. By halving the block rewards from 6.25 BTC to 3.125 BTC, the supply of newly minted Bitcoin was effectively cut, tightening the overall market supply. This scarcity, paired with increasing institutional demand, created a perfect storm for upward price pressure.

Bitcoin’s price is currently in discovery mode, with analysts targeting $113,000 as the next key level, followed by a psychological milestone of $125,000. The Relative Strength Index (RSI) remains in overbought territory, indicating potential caution for short-term traders. However, long-term investors remain unfazed, citing Bitcoin’s deflationary nature and its role in portfolio diversification.

The $1 Million Dream: Bold Predictions Amid Market Volatility

Market leaders have not hesitated to issue bold forecasts for Bitcoin’s future. Standard Chartered analysts have pegged a $125,000 price target by year-end, while Bernstein predicts $200,000 by 2025. Some, like Arthur Hayes, co-founder of BitMEX, envision Bitcoin reaching $1 million, fueled by deficit spending and global economic shifts.

Despite these bullish projections, Bitcoin remains a volatile asset. Analysts warn of potential corrections, with prices possibly retesting the $90,000 support level. Gracy Chen, CEO of Bitget, notes that profit-taking and overleveraged positions could trigger short-term declines. Yet, even with these fluctuations, Bitcoin’s long-term trajectory appears firmly upward.

Altcoin Momentum: Ripple Effects Across the Crypto Market

Bitcoin’s rally has ignited optimism across the broader cryptocurrency market. Ethereum’s Ether (ETH) has surged past $3,800, while Solana (SOL) reached a new all-time high of $263, driven by its growing ecosystem of decentralized applications and memecoins. Ripple’s XRP has also seen explosive growth, up over 360% in the past month, signaling renewed interest in altcoins as Bitcoin leads the charge.

Is Bitcoin Undervalued at $100,000?

Despite crossing the six-figure mark, Bitcoin’s potential remains vast. With a current market capitalization of $2 trillion, Bitcoin still lags behind gold, which boasts a $12 trillion market cap. As Bitcoin solidifies its role as “digital gold,” analysts argue that its price could rival or even surpass that of physical gold in the coming decade.

The upcoming years could see Bitcoin becoming a mainstream asset class, supported by regulatory clarity, institutional adoption, and technological advancements. As traditional finance increasingly embraces blockchain, Bitcoin’s intrinsic value as a decentralized and finite asset becomes more apparent.

Investor Takeaway: Buy, Hold, or Wait?

Bitcoin’s recent breakthrough offers a compelling buy opportunity for long-term investors. The current rally reflects not just speculative enthusiasm but also a structural shift in how Bitcoin is perceived as an asset. With forecasts ranging from $125,000 to $200,000 in the near term and even $1 million in the long run, Bitcoin appears undervalued despite its record highs.

Short-term traders should remain cautious of volatility and leverage risks. However, for those seeking exposure to the burgeoning cryptocurrency space, Bitcoin remains the gold standard. Its ability to withstand market downturns and emerge stronger underscores its resilience and appeal.

In conclusion, Bitcoin’s journey to $100,000 is more than just a price milestone—it’s a validation of its transformative potential. As the world’s largest cryptocurrency enters its next phase of growth, it offers unparalleled opportunities for those willing to embrace its volatility and invest in its vision of a decentralized future.

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex