Bitcoin Price Analysis: BTC-USD Eyes Support and Resistance Amid Trump Momentum

Bitcoin (BTC-USD) surged to an all-time high of $109,114 ahead of Donald Trump’s inauguration, fueled by optimism surrounding his potential pro-crypto policies. However, BTC faced sharp selling pressure post-event, declining to $102,000 as the president refrained from addressing cryptocurrencies directly. The rally highlighted growing anticipation of reduced regulatory hurdles, but market dynamics quickly shifted amid profit-taking and uncertainty.

Technical Patterns Signal Short-Term Risks

Bitcoin's price chart formed a shooting star candlestick pattern after reaching its peak, signaling potential reversal. A preceding bearish engulfing pattern also emerged over the weekend, adding to concerns about waning momentum. The RSI divergence, where price hit new highs while the RSI failed to follow, further underlined weakening bullish momentum.

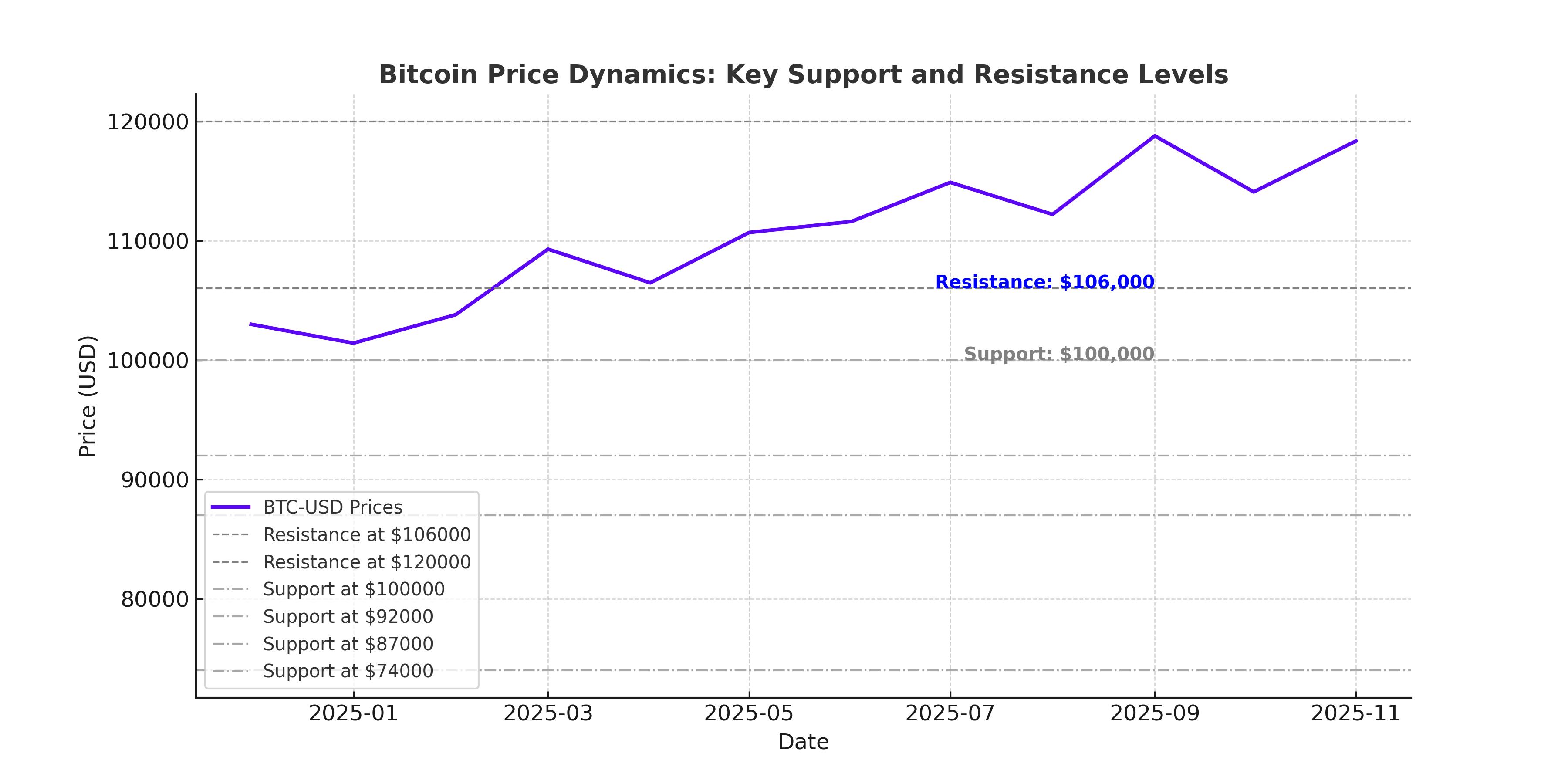

Critical support levels now lie at $92,000, $87,000, and $74,000, with $92,000 acting as the most immediate defense zone aligned with November's highs. A breach of $92,000 could invite significant downside pressure toward $87,000. Resistance remains at $106,000, a crucial threshold that has capped Bitcoin’s upward moves since mid-December. Breaking this level could position BTC for a test of $120,000, calculated from a measured move of recent consolidation.

Trump’s Crypto Influence: Mixed Signals

Initial optimism around Trump’s potential pro-crypto agenda bolstered BTC sentiment, yet his silence on Bitcoin during his inaugural speech dampened the rally. Reports of the Trump administration exploring crypto adoption remain speculative, adding to market uncertainty. The launch of $TRUMP and $MELANIA memecoins further exacerbated volatility, diverting liquidity from BTC. These tokens reached a combined market cap of over $20 billion before collapsing, reflecting speculative excesses in the market.

Institutional Activity Remains a Bullish Pillar

MicroStrategy’s addition of 11,000 BTC at an average price of $101,191 demonstrated continued institutional confidence. With total holdings exceeding 461,000 BTC, MicroStrategy remains a bellwether for corporate adoption. Spot buying pressure, particularly from U.S.-based exchanges, underscores strong demand even as retail sentiment wavers.

On-Chain Data Highlights Accumulation Trends

Net exchange flows for Bitcoin continue to show negative values, indicating sustained accumulation by large holders. This trend reduces supply, supporting a bullish outlook. Additionally, the Spot Cumulative Volume Delta (CVD) has trended upward, reflecting increased market participation and strong bid activity.

Short-Term Outlook and Key Levels

Bitcoin’s immediate test lies at maintaining the $100,000 psychological support. A break below could prompt further downside, targeting $92,000 and $87,000. Conversely, reclaiming $106,000 could reignite bullish momentum, setting the stage for a push toward $120,000 and higher. Indicators like RSI and MACD suggest mixed sentiment, with potential for short-term consolidation before a decisive breakout.

Bitcoin's medium-term trajectory remains positive, with institutional demand and limited supply providing a strong foundation. However, traders must monitor key levels and evolving sentiment for clearer signals amid ongoing volatility.