Bitcoin Market Analysis: Trends, Predictions and Strategic Investment

Unpacking Bitcoin's Recent Price Fluctuations and Future Outlook Amidst Global Economic Shifts and Anticipated U.S. Monetary Policies | That's TradingNEWS

Bitcoin's Market Dynamics and Future Outlook

Current Market Overview

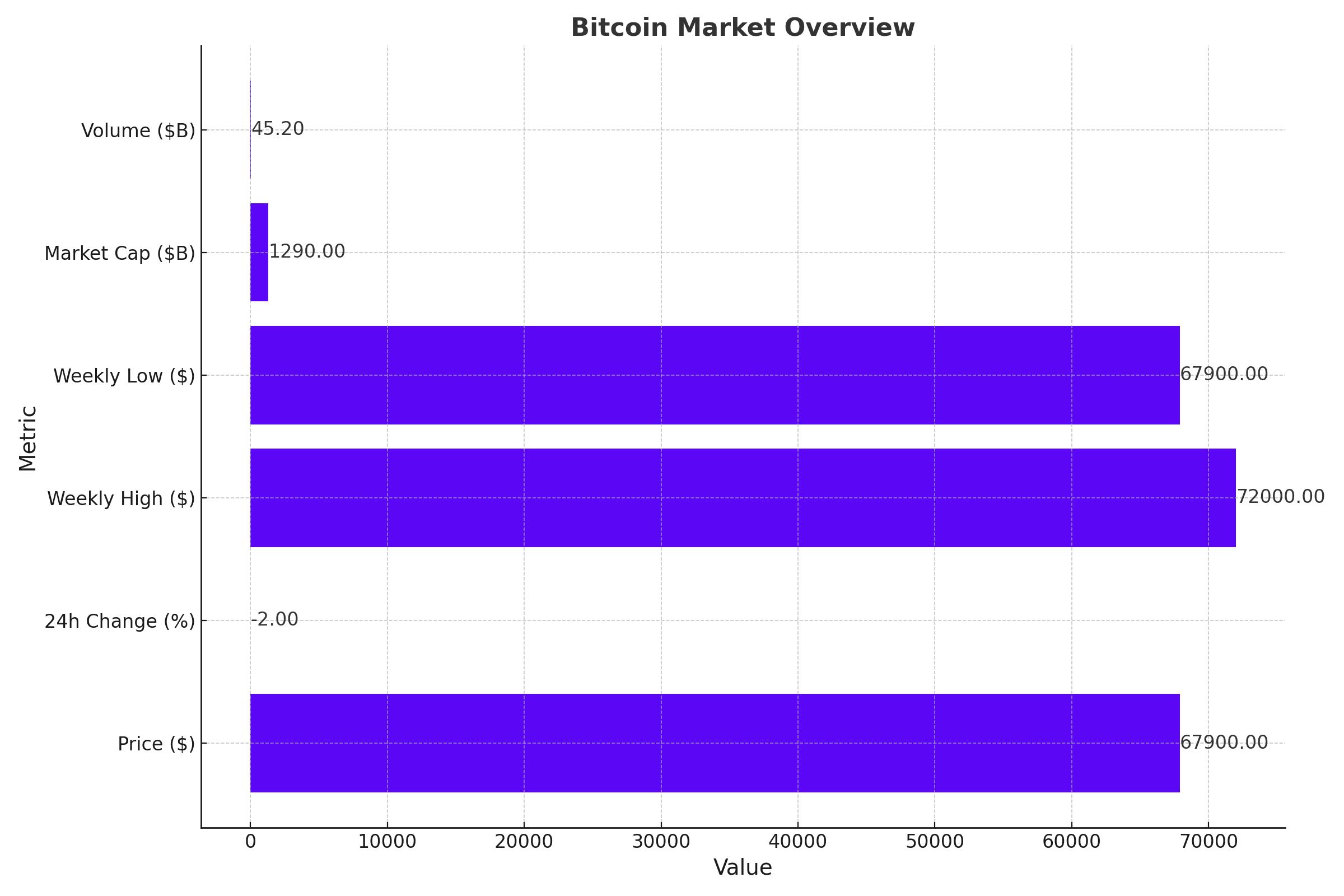

Bitcoin recently experienced a notable decline, falling over 2% to $67,900, retreating from its recent highs near $72,000. This dip is part of a broader downturn in the cryptocurrency market, with Ether and other altcoins also witnessing significant drops. For instance, Ethereum dipped below $3,550, and the broader CoinDesk 20 Index fell by 1% to 2,370 points. This market correction coincides with a $64.9 million outflow from U.S.-listed spot Bitcoin ETFs, signaling a cautious shift by investors.

Influencing Factors and Market Sentiment

Several factors are contributing to the current volatility in the crypto market:

- Global Economic Indicators: Traditional markets are also experiencing shifts, with Chinese stocks dropping and the U.S. dollar index seeing consolidation. Such movements often have parallel impacts on crypto markets due to investor sentiment and the interconnected nature of global finance.

- Political and Economic Uncertainties: Recent gains by right-wing parties in Europe and potential adjustments in Japanese economic policies are creating uncertainty, affecting investment strategies across markets, including cryptocurrencies.

- Upcoming U.S. Financial Decisions: The anticipation around the U.S. CPI release and the Federal Reserve's rate decision are making investors wary, contributing to conservative or protective trading behaviors in crypto.

Technical Analysis and Market Movements

Bitcoin's attempt to breach the $70,000 mark was met with strong resistance, leading to a rapid price drop. This correction has pushed Bitcoin's price to its lowest since early June, with significant sell-offs noted across the market. The total crypto market cap has seen an $80 billion reduction, and liquidations have been extensive, affecting over 75,000 traders in recent times.

Risk Assessment and Future Projections

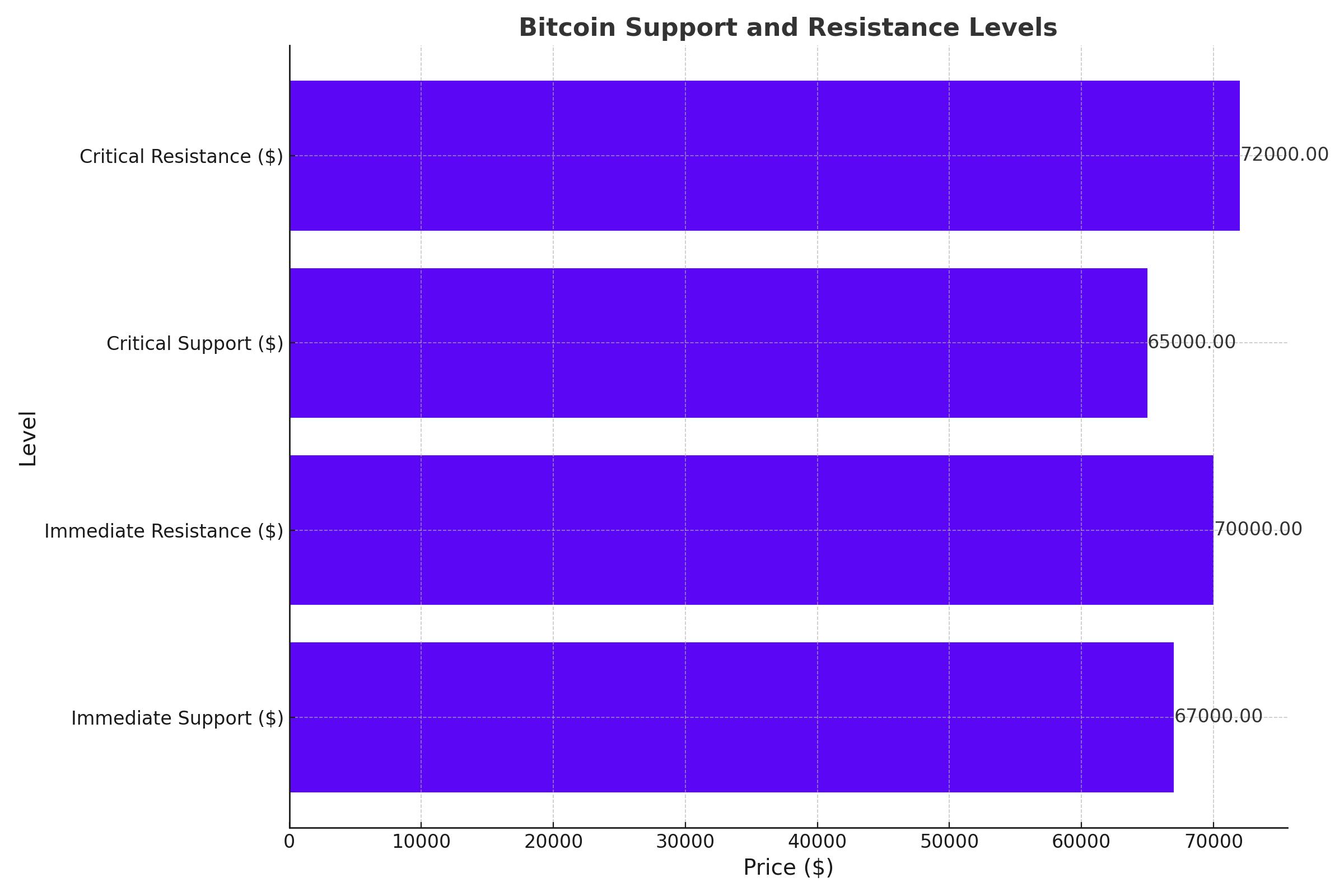

- Support Levels: Traders and analysts are eyeing critical support levels around $67,000, with potential further drops anticipated if these levels fail to hold. The immediate psychological barrier remains at $70,000, which, if overcome, could signal a bullish reversal.

- Open Interest and Market Liquidity: High open interest in Bitcoin futures suggests a cautious market, with potential for high volatility. Investors and traders need to monitor these levels closely as they can indicate significant market movements.

Market Strategy and Investment Analysis

Current Market Overview

Amidst volatile market conditions and impending economic reports, investors are advised to navigate with heightened vigilance. Bitcoin's price, after attempting to surpass the $70,000 threshold, retracted sharply to approximately $67,900, underlining the market's instability and the influence of external economic events.

Investment Strategies for Different Investor Profiles

-

For Short-term Traders:

- Opportunity Amid Volatility: With Bitcoin's price demonstrating significant fluctuations, from a high near $72,000 down to recent levels around $67,900, traders should monitor key price levels. Immediate support is found at $67,000, with resistance near $70,000. Successful breaches or defenses of these levels could indicate short-term trading opportunities.

- Tactical Trades: Engage in tactical trades around these pivot points, utilizing tight stop-losses to manage risks associated with sudden price movements, potentially driven by upcoming U.S. CPI data and Federal Reserve announcements.

-

For Long-term Investors:

- Market Trend Analysis: Considering the broader market trends, where Bitcoin has shown resilience by bouncing back from its low of $67,500 to current levels, long-term investors should evaluate the sustainability of these recoveries amidst global economic shifts.

- Economic Indicators: With significant attention on the forthcoming U.S. financial decisions, investors should align their portfolio strategies with the potential macroeconomic changes. A keen eye on inflation rates and Federal Reserve policies will be crucial in forecasting market directions.

That's TradingNEWS

Read More

-

Ferrari Stock Price Forecast - RACE at $377 Stock Turns Sentiment Slump Into A High-Margin Buying Window

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Holds the $2 Line as Clarity Act Vote and Powell Drama Put Crypto on Edge

12.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast Oil Slip as Iran “Control” Claim and Fast-Tracked Venezuela Deal Test the $60 Floor

12.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow, S&P 500, Nasdaq Drop As Gold Rips Higher And WMT, TEM, SNCY Rally

12.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Spikes Back Toward 1.35 as Fed Turmoil Cracks the Dollar

12.01.2026 · TradingNEWS ArchiveForex