Bitcoin Price Reclaims $101,300: The Path to $200K

As Bitcoin steadies above $100K, strong institutional backing and reduced sell-side pressure fuel predictions of a $200K milestone this year. Will BTC break through? | That's TradingNEWS

Current Price Levels and Market Movements

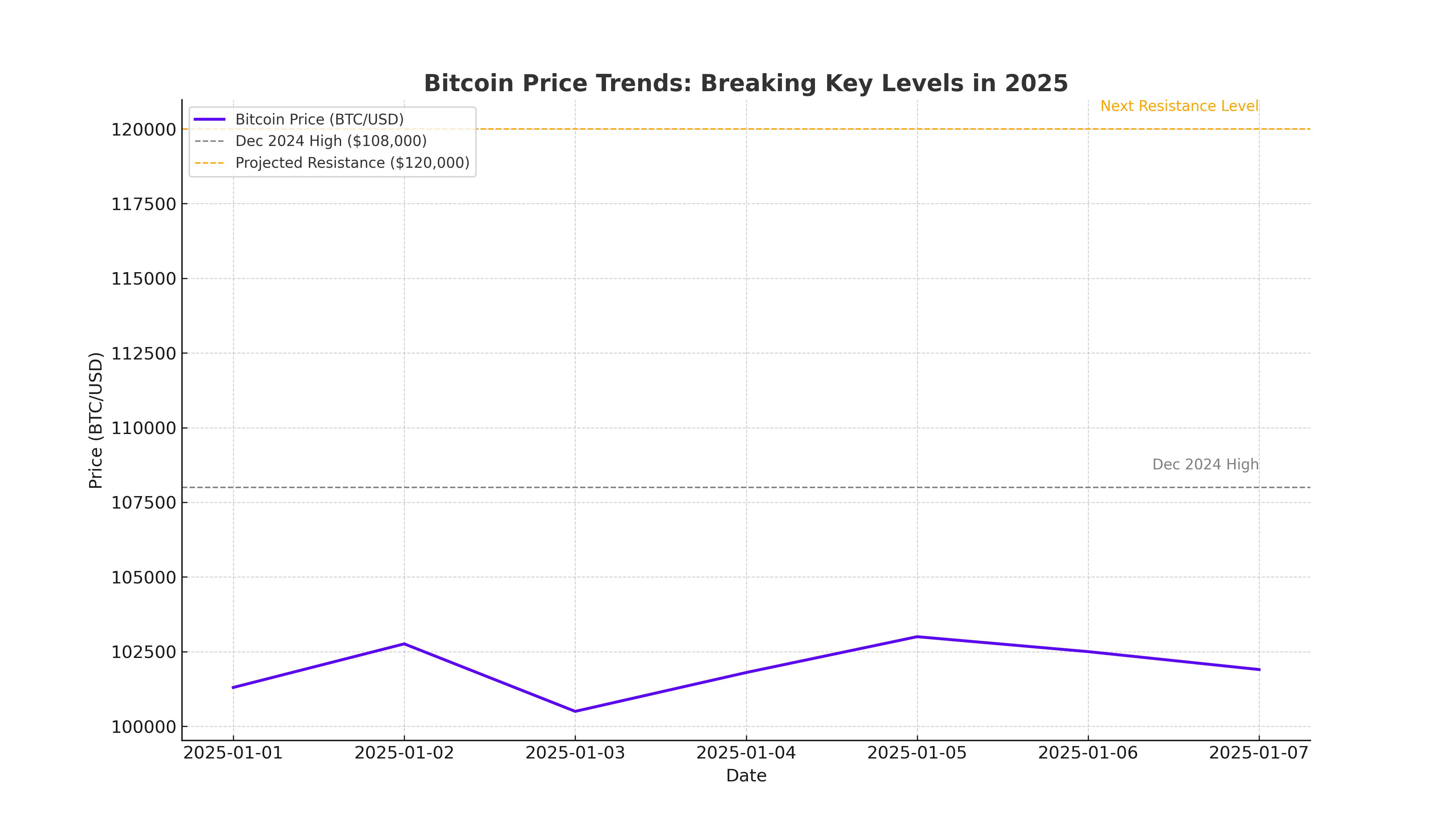

Bitcoin (BTC-USD) has reclaimed the critical $100,000 mark, currently trading at approximately $101,300. This resurgence follows a December slump that saw Bitcoin fluctuating between $90,000 and $99,000. The cryptocurrency hit a three-week high of $102,760 earlier this week, showcasing a sharp recovery and renewed investor confidence. Notably, this rally comes amid major market developments, including institutional purchases and regulatory shifts.

MicroStrategy, one of Bitcoin’s largest institutional holders, added $101 million worth of BTC to its reserves, bringing its holdings to 447,470 BTC. This significant acquisition has contributed to the market's bullish momentum. Similarly, Bitcoin ETFs reported $900 million in inflows on January 3, highlighting growing institutional interest.

Regulatory Shifts and Market Impact

The resignation of Michael S. Barr as the Federal Reserve's Vice Chair for Supervision has further influenced Bitcoin’s upward trajectory. Known for his stringent crypto-regulatory stance, Barr’s departure alleviates fears of aggressive regulatory actions under the Biden administration. Bitcoin surged above $102,000 after the announcement and remains steady, with analysts predicting continued bullish momentum.

Technical Indicators and Chart Patterns

Bitcoin's daily Relative Strength Index (RSI) stands at 59, signaling bullish sentiment. Additionally, the Moving Average Convergence Divergence (MACD) indicator flipped to a bullish crossover, reinforcing the positive outlook. If BTC maintains its support above $100,000, analysts project a potential retest of its December high of $108,353. However, failure to hold this level could see Bitcoin testing the $92,493 support, representing a 38.2% Fibonacci retracement level.

Liquidity Dynamics and Miner Activity

Data from Bitfinex highlights a tightening of Bitcoin’s sell-side liquidity, with the Liquidity Inventory Ratio dropping sharply from 41 months in October to just 6.6 months in January. This tightening aligns with reduced miner activity post the April 2024 halving event. Miners are currently in profit and are holding onto their Bitcoin, reducing sell-side pressure. Such trends have bolstered Bitcoin's price stability, with reduced selling contributing to the bullish outlook.

Seasonal Trends and Historical Patterns

Historical patterns suggest Bitcoin may mirror last year’s trajectory. In 2024, Bitcoin peaked at $73,000 in March before a sideways summer led to a December high of $108,000. BitMEX founder Arthur Hayes predicts a similar cycle, anticipating a local top in the first quarter, followed by a correction tied to U.S. Treasury liquidity shifts post-Tax Day. Hayes highlights that Bitcoin thrives during periods of increased dollar liquidity, often tied to U.S. government borrowing.

Institutional Influence and Long-Term Projections

Institutional activity remains a cornerstone of Bitcoin’s price action. Analysts from Tyr Capital and WealthSquad Chris foresee Bitcoin reaching between $120,000 and $200,000 in 2025. WealthSquad Chris highlights Bitcoin breaking out of consolidation and targeting $120,000 as the next resistance. Meanwhile, MartyParty’s Fibonacci analysis places potential targets at $175,000 to $450,000, depending on market conditions and liquidity influx.

Market Volatility and Liquidation Events

Despite the bullish outlook, Bitcoin’s volatility remains a significant factor. Recent price drops to $97,160 after peaking at $102,760 illustrate the market's unpredictability. This volatility has led to over $390 million in liquidations, with the largest single liquidation worth $12 million occurring on Binance. While traders face challenges, long-term holders view these dips as buying opportunities.

Bullish and Bearish Scenarios

Bitcoin’s future hinges on its ability to sustain support above $100,000. A bullish scenario could see Bitcoin retesting and breaking its December 2024 high of $108,000, potentially moving toward $120,000. In contrast, a bearish breakdown below $100,000 could see Bitcoin revisiting $92,000, where strong support is expected. Key resistance levels include $107,500, aligned with the 1.0 Fibonacci extension, and $175,700, representing a bull flag target.

Broader Market Trends and Altcoin Performance

Bitcoin’s dominance continues to overshadow altcoins, which have faced sharper corrections. Ethereum has dropped below $3,500, while XRP and SOL hover around $2.3 and $210, respectively. This divergence underscores Bitcoin's resilience as the leading cryptocurrency, benefiting from its established network and institutional adoption.

Final Considerations

Bitcoin’s journey above $100,000 has reignited optimism in the crypto market. Institutional support, reduced sell-side pressure, and favorable technical indicators suggest a bullish trajectory. However, market volatility and macroeconomic factors, such as U.S. fiscal policies, remain critical variables. With projections ranging from $120,000 to $450,000, Bitcoin presents a compelling case for both short-term trading and long-term investment. Investors should closely monitor liquidity trends, regulatory shifts, and market sentiment as Bitcoin navigates its path in 2025.

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex