Bitcoin Surges Above $67,000 on Fed Rate Cut Hopes

Geopolitical Tensions and Market Dynamics Drive Bitcoin's Bullish Momentum | That's TradingNEWS

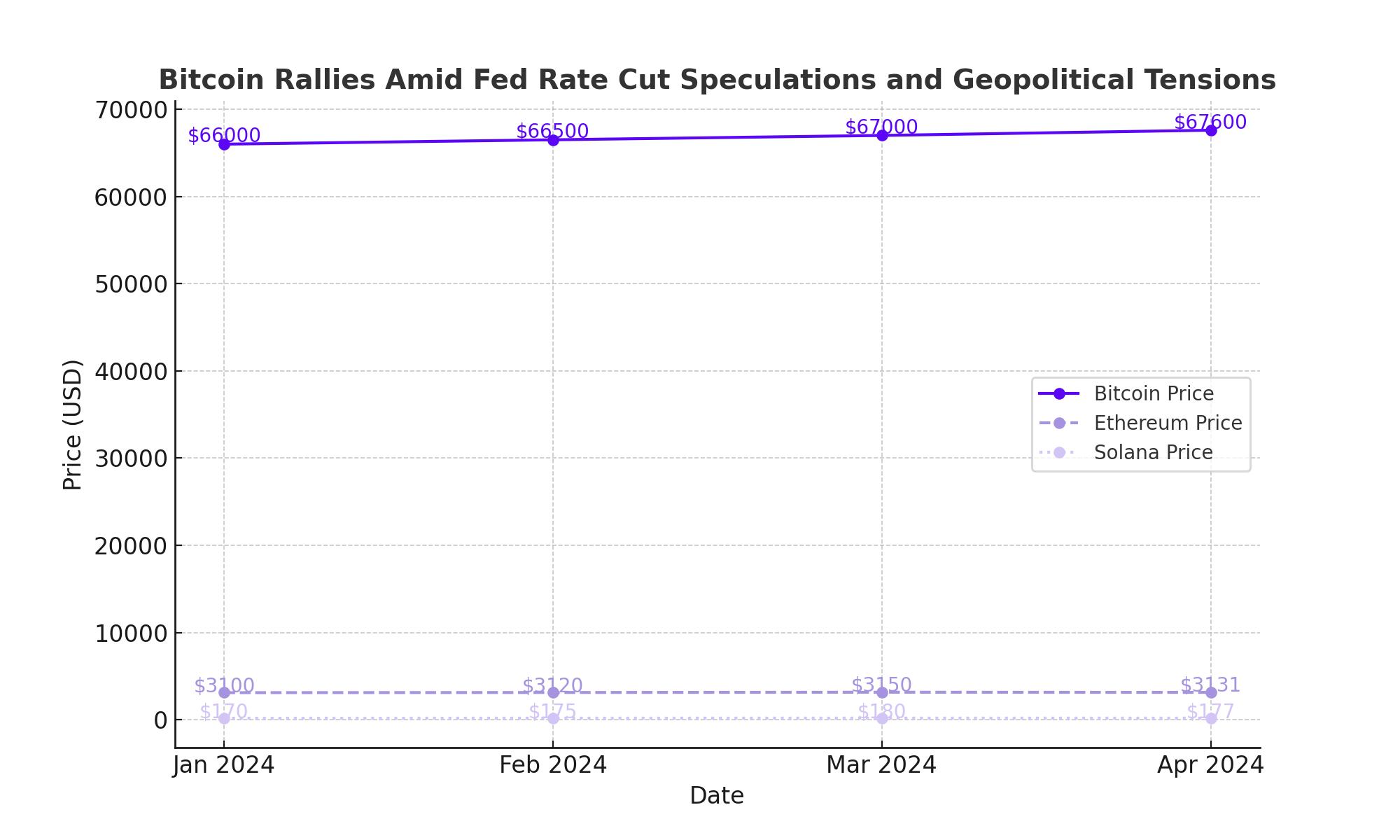

Bitcoin Rallies Amid Fed Rate Cut Speculations and Geopolitical Tensions

Bitcoin Rebounds to $67,600, Eyes Further Gains

Bitcoin (BTC) halted its decline and regained traction, climbing above $67,000 and reaching an intraday high of $67,600. This recovery followed a dip below $66,000, driven by expectations of Federal Reserve rate cuts and escalating tensions in the Middle East after a helicopter crash involving Iran's President. These developments have positioned Bitcoin as a hedge against economic and geopolitical uncertainty.

Bitcoin as Digital Gold

Renowned investor Mike Novogratz highlighted that Bitcoin could be viewed as digital gold, benefiting from similar forces that drive up gold's value, such as inflation and economic instability. Novogratz emphasized the potential impact of US federal government spending and growing national debt on Bitcoin's value, suggesting that Bitcoin could outperform gold due to its newer technology and faster adoption cycle.

Fed Rate Cut Expectations

The broad-based US dollar edged lower as investors anticipated potential Fed rate cuts. Richmond Fed President Thomas Barkin noted that while inflation is easing, reaching the 2% target will take more time. Cleveland Fed President Loretta Mester stated that the current monetary policy is appropriate as they continue to assess economic data. The CME FedWatch tool indicates a 10% chance of a rate cut in June and nearly 80% in September.

Bitcoin Price Prediction

The BTC/USD is currently trading at $66,927, up 1.01%, with a bullish outlook. The 4-hour chart shows the pivot point at $65,984, a crucial level for near-term price action. Immediate resistance is at $67,443, followed by $69,156 and $71,194. On the downside, immediate support lies at $64,617, with further support at $63,040 and $61,328. The Relative Strength Index (RSI) is at 59, indicating moderate momentum. An ascending triangle pattern is forming, typically signaling a potential breakout to the upside. The 50-day Exponential Moving Average (EMA) at $64,562 supports the bullish outlook.

Geopolitical Unrest Boosts Bitcoin as a Safe Haven Asset

Bitcoin often gains value as a safe haven asset during periods of geopolitical turmoil or economic uncertainty. Recently, Iran’s President Ebrahim Raisi and Foreign Minister Hossein Amirabdollahian tragically died in a helicopter crash in East Azerbaijan province. Rescuers found the crash site after searching in challenging weather conditions. The perception of Bitcoin as a safe haven asset can lead to increased demand and a higher BTC price amid such crises.

Major Cryptocurrencies See Mixed Sentiment

The top crypto prices today witnessed mixed sentiment. The Bitcoin (BTC) price sustained above the $67,000 mark, up 0.06% to $67,169.93. Ethereum (ETH) gained 0.37% to $3,131.46, while Solana (SOL) surged 1.51% to $177.63. Conversely, XRP dropped 0.94% to $0.5173, and Cardano (ADA) slipped 0.78% to $0.477. The overall market sentiment remains cautious amid regulatory concerns and ongoing geopolitical tensions.

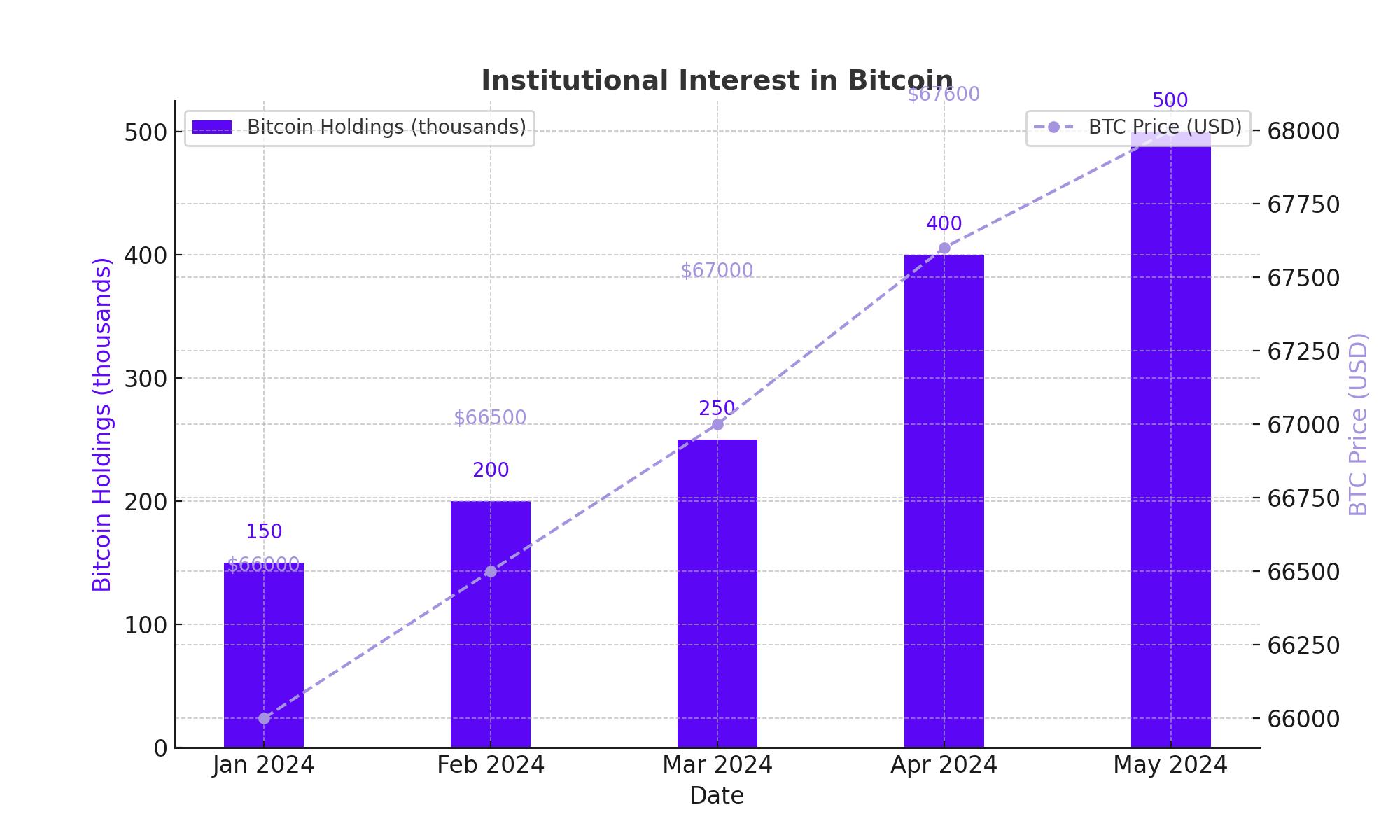

Institutional Interest in Bitcoin

According to crypto analytics firm IntoTheBlock, Bitcoin holdings by addresses with over 1,000 BTC have surged by 250,000 BTC since the launch of Bitcoin ETFs. This increase highlights the growing institutional interest and support for Bitcoin, potentially stabilizing and elevating its market position. With overhead supply at $67,500 intact, the BTC price showcases its sustainability above $65,000. If the level holds, buyers could lead a rally to $74,000.

Technical Analysis

Technical analysis continues to point towards an upward price movement for Bitcoin. The Bollinger Bands and Moving Averages indicate strong buying pressure, while the RSI suggests that the price is currently overbought. However, based on previous patterns, Bitcoin could potentially increase another 2-3% before losing momentum.

Market Volatility and Liquidations

The crypto market remains volatile, with significant liquidations occurring frequently. In the past 24 hours alone, over $120 million were liquidated, affecting 59,032 traders. Most of these losses came from traders who had taken long positions on BTC and ETH. Despite this volatility, Bitcoin's resilience and institutional support suggest a stable long-term outlook.

Conclusion

Bitcoin's recent price surge above $67,000 is driven by expectations of Fed rate cuts and heightened geopolitical tensions. As investors seek safe haven assets, Bitcoin's role as digital gold becomes more prominent. With increasing institutional interest and favorable technical indicators, Bitcoin's bullish trend is likely to continue, potentially reaching new highs in the near future.

That's TradingNEWS

Read More

-

Ferrari Stock Price Forecast - RACE at $377 Stock Turns Sentiment Slump Into A High-Margin Buying Window

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Holds the $2 Line as Clarity Act Vote and Powell Drama Put Crypto on Edge

12.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast Oil Slip as Iran “Control” Claim and Fast-Tracked Venezuela Deal Test the $60 Floor

12.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow, S&P 500, Nasdaq Drop As Gold Rips Higher And WMT, TEM, SNCY Rally

12.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Spikes Back Toward 1.35 as Fed Turmoil Cracks the Dollar

12.01.2026 · TradingNEWS ArchiveForex