Bitcoin's Potential Surge: Analyzing Future Prospects

From holder activity and new crypto listings to strategic ETF expansions in Asia, delve into the factors that could drive Bitcoin's price beyond current levels and shape its long-term viability in the financial market | That's TradingNEWS

Bitcoin's Potential Surge: Evaluating the Cryptocurrency's Prospects

Current Market Dynamics and Holder Activity

Despite a tepid market response from new traders, Bitcoin continues to see significant purchasing from existing holders, particularly those with wallets ranging from 100 to 1,000 BTC. This segment of the market seems undeterred by the recent downtrend and is using the opportunity to average down their holdings, potentially setting the stage for a future rebound.

Influence of New Listings and Technological Upgrades

Recent listings such as Arbitrum's ARB and Optimism's OP have sparked interest and potentially increased adoption, contributing positively to Bitcoin's ecosystem by enhancing overall market liquidity. Additionally, technological advancements like network upgrades and halvings are expected to fundamentally bolster Bitcoin's value proposition over time.

Bitcoin Technical Analysis: A Closer Look at Price Movements

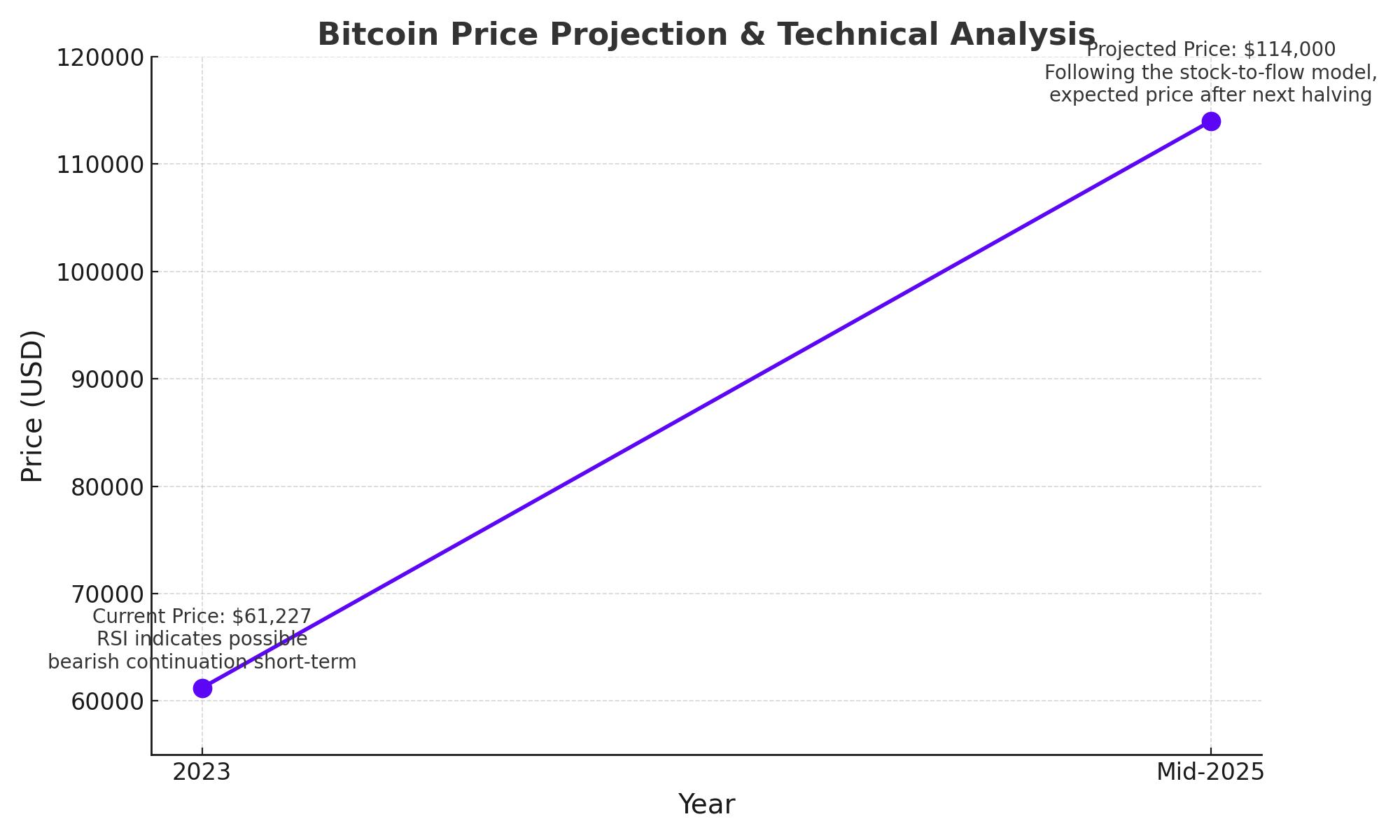

Bitcoin is currently consolidating within a falling wedge pattern on the trading charts, a formation that traditionally signals a bullish reversal. The current price of Bitcoin hovers around $61,227, with this technical pattern suggesting a potential rise by as much as 20%, which could see prices escalate to approximately $73,472. However, a cautious note is sounded by indicators such as the Relative Strength Index (RSI) and Awesome Oscillator (AO), both of which point to a potential extension of the recent bearish trend before any breakout occurs.

Expanding ETF Frontiers: Strategic Developments in Asia

Wintermute's recent initiative to establish a significant presence in Asia through collaborations with OSL and HashKey for the launch of new Bitcoin and Ether ETFs marks a strategic enhancement in cryptocurrency accessibility and market liquidity. These efforts are aimed at drawing institutional and retail investment, bolstering market stability and the health of digital asset exchanges.

Impact of Regulatory Movements on Cryptocurrency

The market is currently poised on the brink of potential regulatory developments, with the U.S. Securities and Exchange Commission (SEC) contemplating the approval of Ether ETFs following their sanction of Bitcoin ETFs. Such regulatory advancements could potentially catalyze further acceptance and integration of cryptocurrencies into mainstream financial frameworks, fostering growth despite recent price declines in Bitcoin.

Pantera Capital’s Market Outlook: A Bullish Projection

Leveraging the stock-to-flow model, Pantera Capital forecasts Bitcoin's price could soar to $114,000 by mid-2025. This model, highlighting the scarcity of Bitcoin against its mining rate, underscores the significant bullish runs historically observed following halving events—a reduction by half in the Bitcoin rewards for miners, which constrains supply and boosts price.

Market Sentiment and Volatility: Navigating Through Turbulence

Bitcoin’s market has experienced heightened volatility, with price movements ranging dramatically over short periods. Despite these fluctuations, the market sentiment leans towards cautious optimism. This sentiment is supported by steady trading volumes and activities around ETFs, suggesting the market may be entering a phase of stabilization that could attract new investments.

That's TradingNEWS

Read More

-

Ferrari Stock Price Forecast - RACE at $377 Stock Turns Sentiment Slump Into A High-Margin Buying Window

12.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD Holds the $2 Line as Clarity Act Vote and Powell Drama Put Crypto on Edge

12.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast Oil Slip as Iran “Control” Claim and Fast-Tracked Venezuela Deal Test the $60 Floor

12.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow, S&P 500, Nasdaq Drop As Gold Rips Higher And WMT, TEM, SNCY Rally

12.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Spikes Back Toward 1.35 as Fed Turmoil Cracks the Dollar

12.01.2026 · TradingNEWS ArchiveForex