Ethereum (ETH-USD) Inches Closer to $3,000 – Is This the Breakout That Ignites an Altcoin Rally?

Will Ethereum Finally Smash Through $3,000 or Face Another Harsh Rejection? | That's TradingNEWS

Ethereum Price (ETH-USD) Targets $3,000 as Bulls Push for Breakout – Will the Surge Hold?

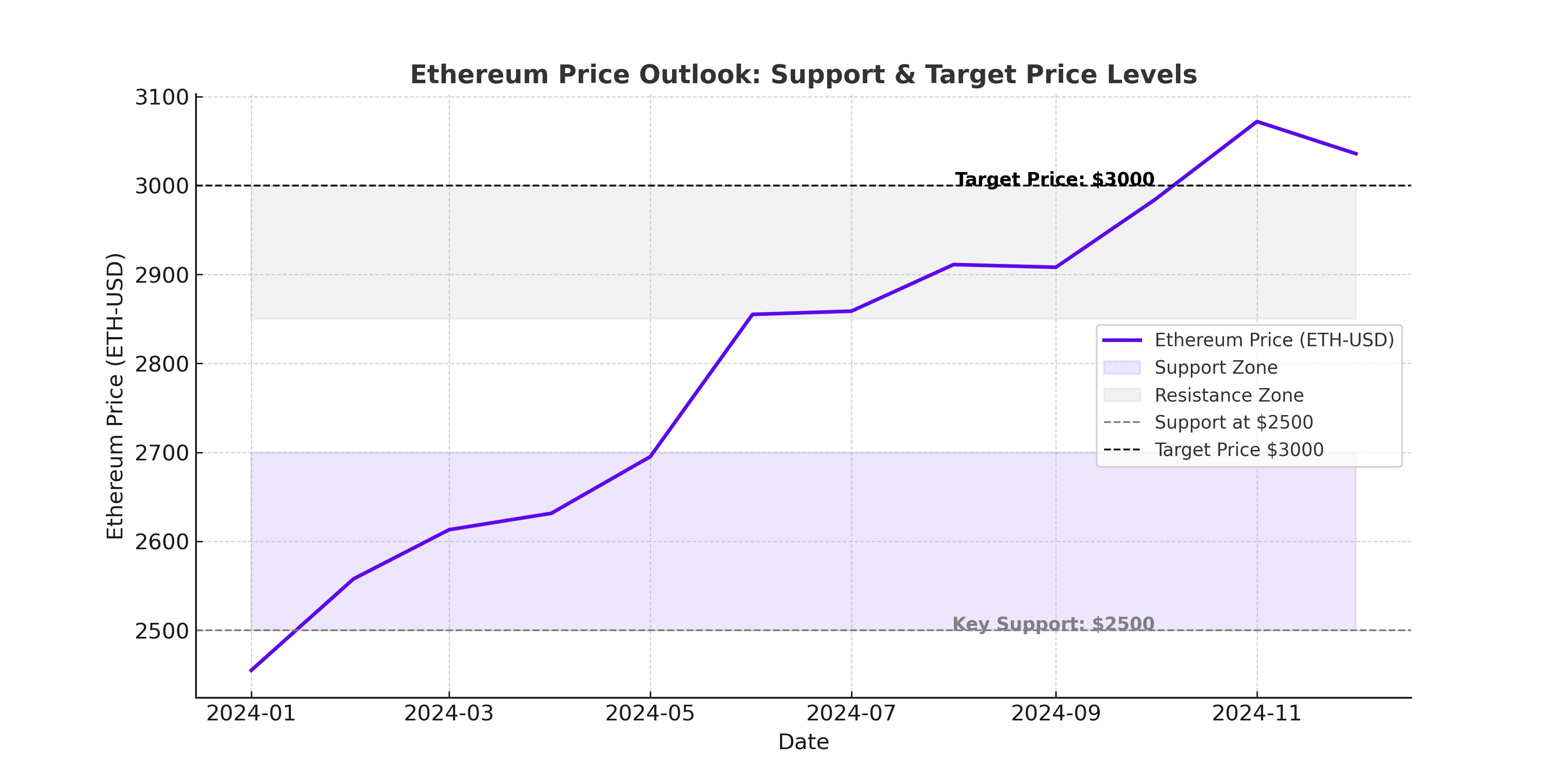

Ethereum (ETH-USD) has been on a volatile trajectory, with price movements testing critical resistance and support levels in the past weeks. Currently trading at $2,690, Ethereum has seen a 1.38% daily decline but remains up 2.57% for the week despite a 19% loss on the monthly chart. While the broader crypto market remains uncertain, Ethereum's fundamental catalysts, technical indicators, and growing institutional interest could be setting the stage for a major rally toward $3,000 and beyond.

Ethereum’s Pectra Upgrade and Institutional Adoption Driving Market Excitement

The upcoming Pectra upgrade is one of the most anticipated Ethereum developments, with testnet launches expected in late February and early March before full activation on April 8. This upgrade is set to enhance Ethereum’s scalability and efficiency, making it a more attractive investment for institutional players. Historically, major Ethereum network upgrades have coincided with price surges as investor confidence grows. Could the Pectra upgrade be the catalyst that finally pushes ETH past the $3,000 mark?

Ethereum’s transaction fees have also plunged 70%, dropping from $23 million to just $7.5 million per day due to increased gas limits. Lower fees historically boost network activity, as seen in previous fee reductions in 2021 and mid-2023, which led to higher transaction volumes and increased adoption. If history repeats itself, Ethereum could see another influx of users, strengthening demand and price momentum.

Adding to the bullish sentiment, Ethereum ETFs have experienced massive inflows, with 145,000 ETH entering ETFs in February alone, a 700% increase compared to January. Meanwhile, Bitcoin ETFs have struggled with 2,214 BTC in net outflows. Institutional capital is flowing into Ethereum at a significant pace, signaling confidence in its long-term potential.

Ethereum (ETH-USD) Breaks Key Technical Levels – Can Bulls Maintain Control?

Ethereum’s price action has been highly reactive to key technical barriers. It retested the $2,800 to $2,900 resistance level six times in the past two weeks, but each attempt faced rejection. A clean breakout above $2,817 could see Ethereum surge toward $3,000, a crucial psychological and technical level. Beyond that, the next major resistance stands at $4,100, a level that has historically triggered strong selling pressure.

The Relative Strength Index (RSI) sits near neutral levels, suggesting Ethereum has room to move higher. Meanwhile, the Moving Average Convergence Divergence (MACD) has turned bullish, with histograms flipping into positive territory. If ETH can sustain momentum, technical indicators suggest a potential move toward $3,400–$3,600 in the coming months.

However, failure to hold above $2,680 could result in a pullback toward $2,560, with a deeper decline to $2,359 if selling pressure intensifies. Ethereum’s 200-day EMA remains a strong resistance level, reinforcing the need for a decisive breakout before confirming an extended rally.

Ethereum’s Growing Market Dominance and Stablecoin Inflows Signal Strength

Ethereum has significantly outperformed Solana (SOL), Avalanche (AVAX), and other major Layer 1 blockchains in terms of weekly stablecoin inflows. While competing networks saw $772 million in outflows, Ethereum posted $1.1 billion in inflows, suggesting capital rotation into ETH. This capital migration often precedes price rallies, as investors position themselves for upside moves.

Additionally, Ethereum’s dominance in DeFi remains unchallenged, with Total Value Locked (TVL) in Ethereum-based DeFi protocols increasing by 8% to $100 billion. The rise in TVL reflects increasing capital inflow, reinforcing Ethereum’s strength in the crypto ecosystem.

On-Chain Data Confirms Accumulation – Will Ethereum Surpass $3,000?

On-chain data shows that 5.87 million ETH were accumulated by investors between $2,380 and $2,460, indicating strong support. This level has historically acted as a launchpad for Ethereum rallies, reinforcing the bullish case.

Meanwhile, exchange reserves have dropped nearly 1 million ETH in the past 10 days, signaling that investors are moving Ethereum off exchanges, a move that typically precedes supply shocks and price appreciation.

Ethereum’s whale activity has also increased, with large investors acquiring 280,000 ETH, valued at approximately $760 million. This institutional accumulation further supports Ethereum’s price outlook, as whales typically accumulate ahead of major price movements.

Ethereum vs. Bitcoin: ETH Strengthens While BTC Consolidates

Ethereum has outperformed Bitcoin (BTC-USD) in the past week, with ETH gaining 3% while BTC declined 2%. The ETH/BTC trading pair on Binance recorded a 10% volume increase, highlighting Ethereum’s growing dominance.

ETH’s improving performance against BTC aligns with historical altcoin season patterns, where Ethereum tends to gain momentum as Bitcoin consolidates. The ETH/BTC pair recently tested the 0.071 BTC level, a key resistance that, if broken, could lead to further outperformance.

Ethereum Price Prediction: Bullish or Bearish?

Ethereum remains at a critical inflection point, with strong technical support and growing institutional demand providing bullish momentum. If ETH clears $2,817 and establishes it as support, the $3,000 mark could be next, with a potential breakout toward $3,400 and beyond. However, if ETH fails to hold $2,680, it could retest $2,500, with a deeper decline to $2,359 if selling pressure increases.

For traders, Ethereum remains a buy-on-breakout candidate, with $3,000 as a key trigger point. The coming weeks will be decisive, with Ethereum’s price movement likely dictated by the Pectra upgrade, ETF inflows, and stablecoin migration trends. Will Ethereum finally break out and reclaim its 2021 highs, or is another rejection at $3,000 on the horizon?

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex