EUR/USD Price Analysis: Navigating Volatility Amid Central Bank Policies and Market Sentiment

EUR/USD Pressures Continue as Prices Slip Below $1.0455

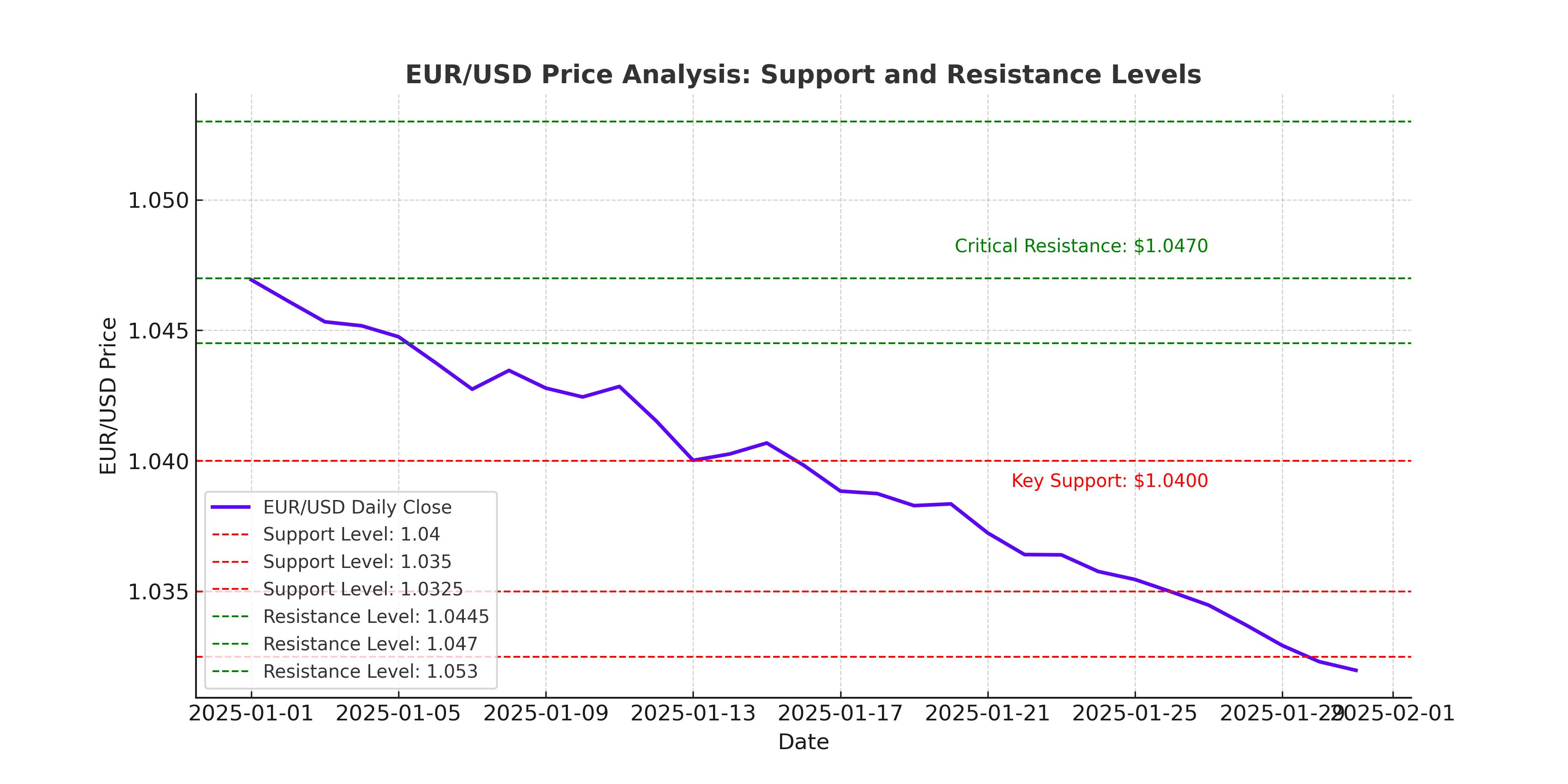

The EUR/USD pair remains under selling pressure, recently dropping below the critical resistance level of $1.0455 and testing a new low at $1.0430. Current market sentiment leans bearish as traders prepare for pivotal decisions from the European Central Bank (ECB) and the Federal Reserve (Fed) this week. EUR/USD's failure to break through the $1.0470 resistance highlights weakening bullish momentum, with immediate support emerging near $1.0400. This comes amidst growing demand for the US dollar, supported by higher Treasury yields and geopolitical uncertainty.

Central Bank Divergence: Fed Holds Steady, ECB Moves Toward Rate Cuts

The Federal Reserve is expected to maintain its current interest rate range of 4.25%-4.50%, signaling a pause in monetary tightening. However, the European Central Bank is widely anticipated to cut its Deposit Facility rate by 25 basis points to 2.75%, citing sluggish economic growth across the Eurozone and easing inflationary pressures. ECB President Christine Lagarde's recent comments at the World Economic Forum emphasized the challenges posed by external trade factors and hinted at additional accommodative measures. The market has priced in these moves, but the tone of the accompanying statements from both central banks could dictate EUR/USD's next move.

Geopolitical and Trade Factors Drive USD Demand

The US dollar has benefited from its safe-haven status, with the Dollar Index (DXY) climbing to 108.00. This strength is partly fueled by uncertainty around US trade tariffs proposed by Treasury Secretary Scott Bessent, including a universal tariff plan starting at 2.5%, with incremental hikes monthly. Such policies add to the US dollar's appeal as global investors brace for potential disruptions in trade and economic growth.

At the same time, rising geopolitical tensions and a flight from risk assets, including a sell-off in technology stocks, have further supported the dollar. These factors have pressured the EUR/USD pair, which remains vulnerable to external shocks and investor sentiment.

Technical Analysis: Key Levels for EUR/USD

EUR/USD's downward trend has brought the pair dangerously close to breaching critical support at $1.0400. A sustained drop below this level could push the pair toward the next support zone near $1.0350 and $1.0325, aligning with bearish forecasts. On the upside, any recovery attempt would need to decisively break the resistance at $1.0470 to regain bullish momentum, with additional targets near $1.0530.

Momentum indicators such as the Relative Strength Index (RSI) have slipped into bearish territory, currently hovering around 45, while the Moving Average Convergence Divergence (MACD) histogram reflects slowing buying pressure. The 50-day EMA at $1.0445 acts as immediate resistance, with the 20-day EMA at $1.0390 providing a short-term support floor.

Macroeconomic Events to Watch: Durable Goods and Consumer Confidence

The upcoming US economic docket could further influence EUR/USD price movements. Key releases include Durable Goods Orders, which declined by 2.2% in December, missing expectations of 0.8% growth, and the Consumer Confidence Index, forecasted at 105.7. A strong consumer confidence reading could boost the dollar, while disappointing data may provide some respite for the euro. The Richmond Manufacturing Index, expected at -13, could also sway sentiment around the US economy.

In contrast, Eurozone economic data remains mixed. Germany’s Ifo Business Climate Index showed slight improvement at 85.1, but other indicators, such as Belgium’s NBB Business Climate, point to ongoing challenges with a reading of -13.6. Traders will closely monitor ECB President Lagarde’s press conference for insights into how the central bank plans to counter economic stagnation.

Outlook and Decision: Bearish Bias Prevails

Given the current environment of USD strength and ECB dovishness, the EUR/USD outlook remains tilted to the downside. The pair’s ability to sustain above $1.0400 will be crucial in the short term. However, a combination of technical weakness and fundamental headwinds suggests further declines are likely, with the next major target set at $1.0325.