EUR/USD Momentum Boosted by Eurozone Data and Policy Anticipation

The EUR/USD pair has gained attention in recent sessions as better-than-expected economic data from France and Germany temporarily strengthened the euro. France’s Manufacturing PMI rose to 45.3, exceeding forecasts of 42.4, while Germany’s PMI hit 44.1, above its predicted 43. Services sectors also showed resilience, with German Services PMI reaching 52.5, reinforcing optimism. The currency pair is currently trading near $1.0480, reflecting a cautious upward movement supported by these developments.

The market focus is now on the European Central Bank's (ECB) monetary policy stance, with traders closely monitoring ECB President Christine Lagarde’s speeches and Germany’s Ifo Business Climate data. The Ifo Index rose to 85.1 in January, surpassing expectations of 84.6 and reflecting cautious optimism in German business sentiment. Nevertheless, concerns surrounding U.S. President Trump’s shifting tariff policies and their impact on Eurozone economic stability weigh heavily on the pair’s outlook. ECB decisions later this week could introduce further volatility, as policymakers consider a potential 25-basis-point rate cut in response to lingering inflationary pressures and sluggish growth.

EUR/USD Technical Outlook Shows Mixed Momentum

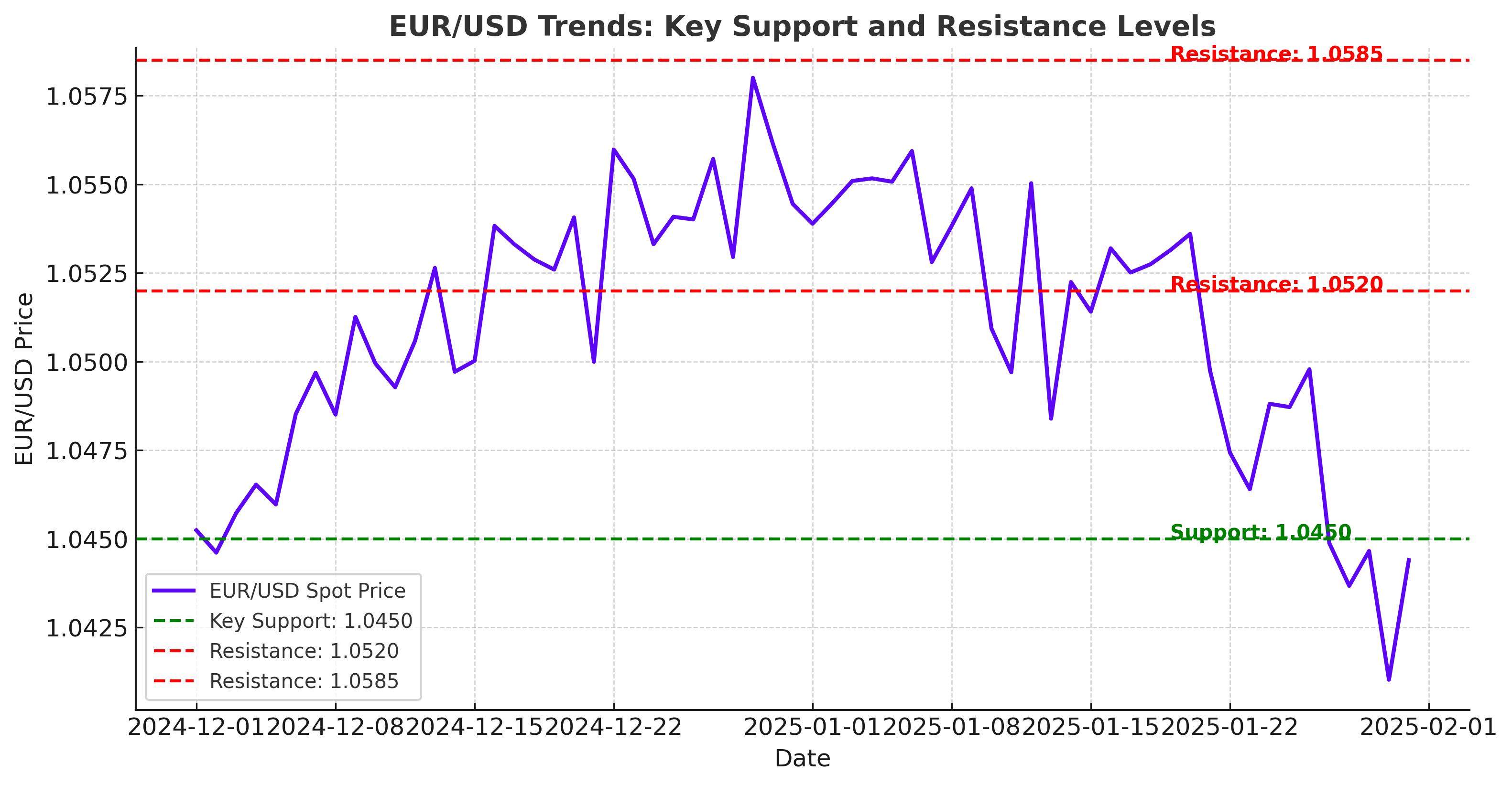

The EUR/USD pair is navigating a challenging technical landscape, currently trading near $1.0480 after retreating from last week’s six-week high of $1.0520. Key support is found at $1.0450, aligned with the 50-day Exponential Moving Average (EMA), which has provided stability for the pair. Short-term resistance levels include $1.0520 and a more robust barrier at $1.0585, with any sustained movement above these thresholds signaling renewed bullish momentum.

Conversely, a decline below $1.0450 could expose the pair to further downside pressure, targeting the January 20 low of $1.0266. The Relative Strength Index (RSI) indicates modest bullish divergence, supporting the possibility of a near-term recovery, yet traders remain cautious ahead of this week’s pivotal ECB and Federal Reserve meetings.

U.S. Dollar Strengthens Amid Renewed Risk Aversion

The U.S. Dollar Index (DXY), which measures the greenback’s value against a basket of major currencies, has rebounded from its recent lows and is trading near 107.60. Renewed risk aversion following President Trump’s unexpected tariff announcements has bolstered the dollar, as investors seek safety amid global uncertainties. Trump’s proposed 25% tariffs on Colombia initially rattled markets, although subsequent agreements between the U.S. and Colombia to ease tensions have provided limited relief.

The Federal Reserve is expected to keep interest rates unchanged at 4.25%-4.50% in its upcoming policy meeting. Chair Jerome Powell’s remarks during the post-meeting press conference will be closely scrutinized for indications of future rate adjustments. Market participants are also awaiting key U.S. economic indicators, including Durable Goods Orders and Q4 GDP data, which could further influence the EUR/USD trajectory.

Eurozone Economic Outlook: Growth Concerns Persist

Eurozone economic data points to mixed signals as inflationary pressures ease, but growth remains tepid. Preliminary Q4 GDP figures, expected later this week, are projected to show a modest annual growth rate of 1%, compared to 0.9% in the previous quarter. This sluggish pace underscores the challenges faced by the Eurozone as it contends with global headwinds, including weaker consumer demand and ongoing geopolitical uncertainties.

The ECB is widely expected to reduce its Deposit Facility rate by 25 basis points to 2.75%, marking its fourth consecutive rate cut. Christine Lagarde’s guidance during the post-meeting press conference will be critical in shaping market sentiment. Investors anticipate further rate reductions in subsequent meetings, reflecting the ECB’s cautious approach to fostering economic stability.

Technical Analysis: EUR/USD Trends Hinge on Central Bank Decisions

The EUR/USD pair remains highly sensitive to policy developments, with near-term price action reflecting an ongoing tug-of-war between bullish and bearish pressures. Key levels to watch include the 50-day EMA at $1.0460, which serves as an important support zone. A breach below this level could intensify selling pressure, pushing the pair toward the January lows near $1.0266. On the upside, sustained movement above $1.0520 could pave the way for a test of the December high at $1.0630, representing a significant hurdle for euro bulls.

Market sentiment is further complicated by divergent central bank policies. While the Fed maintains a relatively stable outlook, the ECB’s dovish stance raises questions about the euro’s ability to sustain its recent gains. The euro’s resilience will largely depend on the ECB’s ability to reassure markets about its commitment to balancing growth and inflationary risks.

Market Sentiment and Broader Implications

Investors remain cautious as geopolitical tensions and economic policy uncertainties continue to dominate headlines. The EUR/USD pair’s performance will hinge on key macroeconomic events this week, including preliminary Eurozone GDP data and U.S. Durable Goods Orders. Additionally, shifts in global risk sentiment, driven by Trump’s unpredictable tariff policies, could introduce further volatility.

While the euro has shown resilience in recent sessions, supported by improved PMI data and a temporary reprieve in U.S.-Eurozone trade tensions, the longer-term outlook remains uncertain. Policymakers on both sides of the Atlantic face significant challenges in navigating a complex economic landscape, with growth prospects clouded by a confluence of domestic and international factors. For traders, the EUR/USD remains a closely watched barometer of global financial stability and central bank policy effectiveness.