EUR/USD COLLAPSES BELOW 1.0200 – WILL THE EURO CRACK FURTHER?

EUR/USD BEARS TAKE CONTROL AMID TRUMP TARIFFS AND EUROZONE WEAKNESS

The EUR/USD pair is in freefall, breaking down below 1.0200 as selling pressure accelerates. A 0.90% drop in a single session highlights the euro’s vulnerability, with risk-off sentiment dominating markets. The downward spiral follows Trump’s tariff escalation on Canada, Mexico, and China, with the former U.S. President now warning that Europe will be next. The market reaction has been brutal, as traders rush into U.S. dollars as a safe-haven play, leaving the euro exposed to further downside risk. The RSI has dropped to 42, indicating growing bearish momentum, while the MACD histogram prints rising red bars, reinforcing the negative outlook.

TECHNICAL ANALYSIS – EUR/USD BREAKS BELOW KEY SUPPORT LEVELS

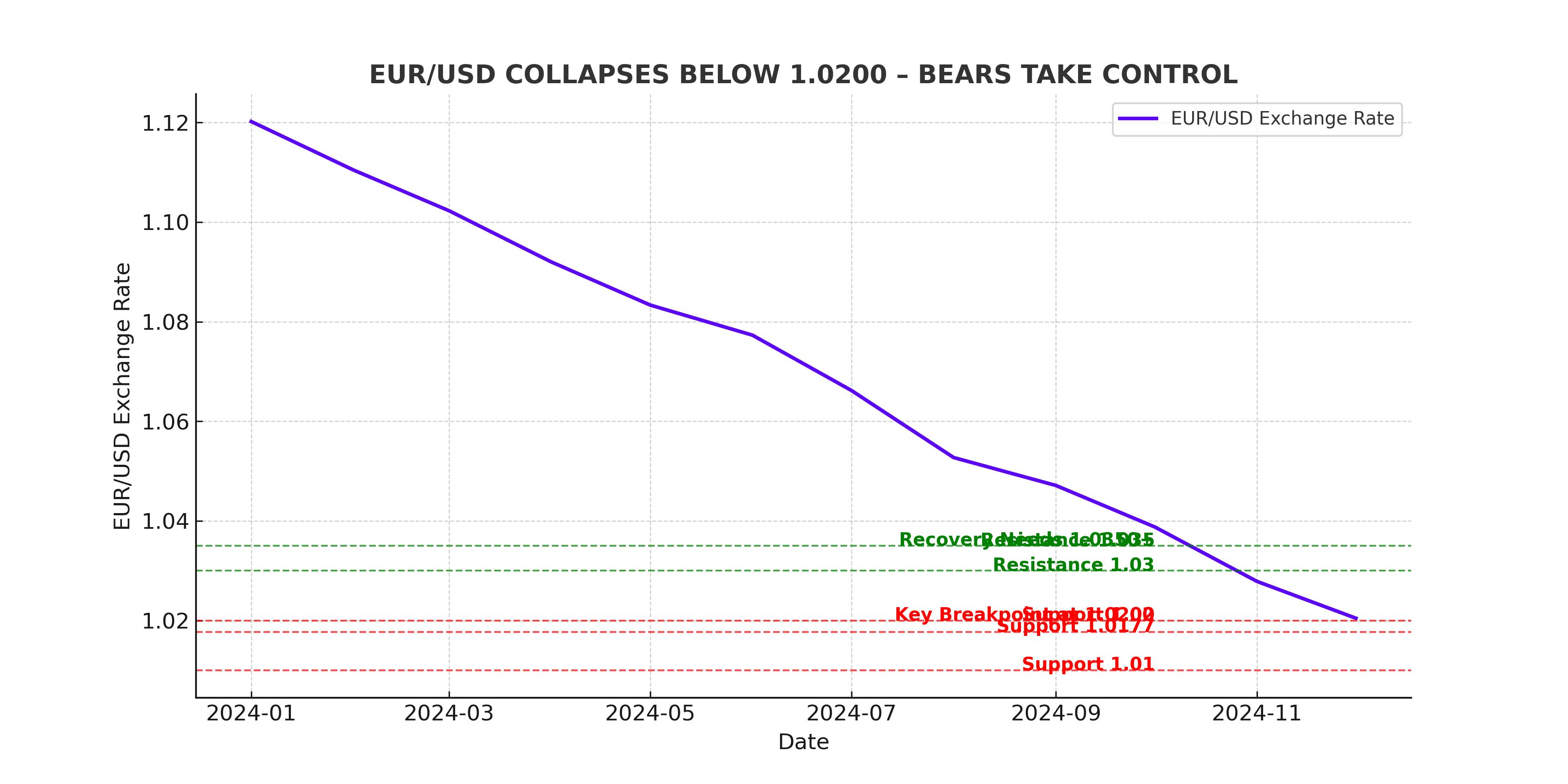

The technical picture remains firmly bearish, with EUR/USD trading below both the 20-day and 50-day EMAs, reflecting sustained downside pressure. The 1.0220 support level, which held for most of last week, has now collapsed, leaving the door open for a test of 1.0177, the lowest level in 27 months. If this fails to hold, a move toward the psychological 1.0100 level becomes the next downside target, with parity firmly back on the radar.

Resistance now shifts to 1.0300, where sellers remain dominant. A move above 1.0350 (the 20-day EMA) would be required to slow the bleeding, but at this stage, the upside remains limited unless there is a fundamental shift in sentiment. The descending channel pattern that has confined EUR/USD for weeks suggests that lower levels are likely, with 1.0050 coming into focus if the selling pressure does not ease.

TRUMP TRADE WAR REIGNITES – HOW MUCH DAMAGE WILL IT DO TO EUR/USD?

The return of Trump’s aggressive trade rhetoric is shaking global markets, and EUR/USD is taking the hit. The former President announced fresh 25% tariffs on Canada and Mexico, along with 10% tariffs on China, but the real concern is his next target: the European Union. Trump claims that "Europe has taken advantage of the U.S. for too long", and that tariffs on EU goods are coming "pretty soon." This uncertainty is fueling heavy selling in the euro, as traders fear that an all-out trade war with the U.S. would severely weaken the Eurozone’s already fragile economy.

EUROZONE GROWTH STALLS – CAN THE ECB STOP THE BLEEDING?

Economic data from the Eurozone continues to disappoint, adding to EUR/USD’s downward momentum. The latest GDP figures confirmed that the region’s economy was flat in Q4 2024, barely avoiding contraction after a 0.4% growth in Q3. Germany, the largest economy in the bloc, shrank by 0.2% YoY, reinforcing concerns that a recession could be imminent.

The ECB’s recent rate cut to 2.75% has only added to the euro’s weakness, as markets fully price in at least three more rate cuts in 2025. The central bank has signaled that it is prepared to ease further, but with inflation still hovering at 2.7%, policymakers may be forced to delay additional cuts, leaving the euro vulnerable to further downside.

US DOLLAR STRENGTHENS – CAN THE FED HOLD THE LINE?

The U.S. dollar is surging, fueled by solid economic data and the safe-haven rush triggered by Trump’s tariff announcements. The latest Core PCE inflation report showed a 0.2% increase, in line with expectations, while personal spending jumped 0.7%, exceeding forecasts of 0.5%. This resilience in consumer demand is keeping the Federal Reserve’s rate outlook uncertain, with traders now reassessing whether rate cuts will happen as soon as expected.

The Dollar Index (DXY) has surged past 109.50, breaking above key resistance levels and reinforcing the bearish case for EUR/USD. With the U.S. NFP data, ISM Manufacturing PMI, and JOLTS job openings all due this week, the next major catalyst for EUR/USD will come from U.S. economic reports. Stronger-than-expected data could further accelerate the dollar’s rally, pushing EUR/USD toward 1.0100 or lower in the coming sessions.

WILL EUR/USD CRASH BELOW 1.0000?

With EUR/USD now in freefall, the question is whether the pair will break below parity for the first time since 2022. The combination of Trump’s tariff threats, weak Eurozone growth, and rising U.S. dollar demand makes the bearish case overwhelming. The next major supports at 1.0177 and 1.0100 are critical—if they fail, the path toward 0.9730 becomes a real possibility. The only hope for a recovery lies in a shift in U.S. monetary policy or a de-escalation in Trump’s trade war rhetoric, but neither seems likely in the short term. Bears remain firmly in control.