Gold Market TradingNEWS - Trends and Projections

Unpacking the Impact of Federal Reserve Decisions and Global Tensions on Gold Investments | That's TradingNEWS

Current State of the Gold Market

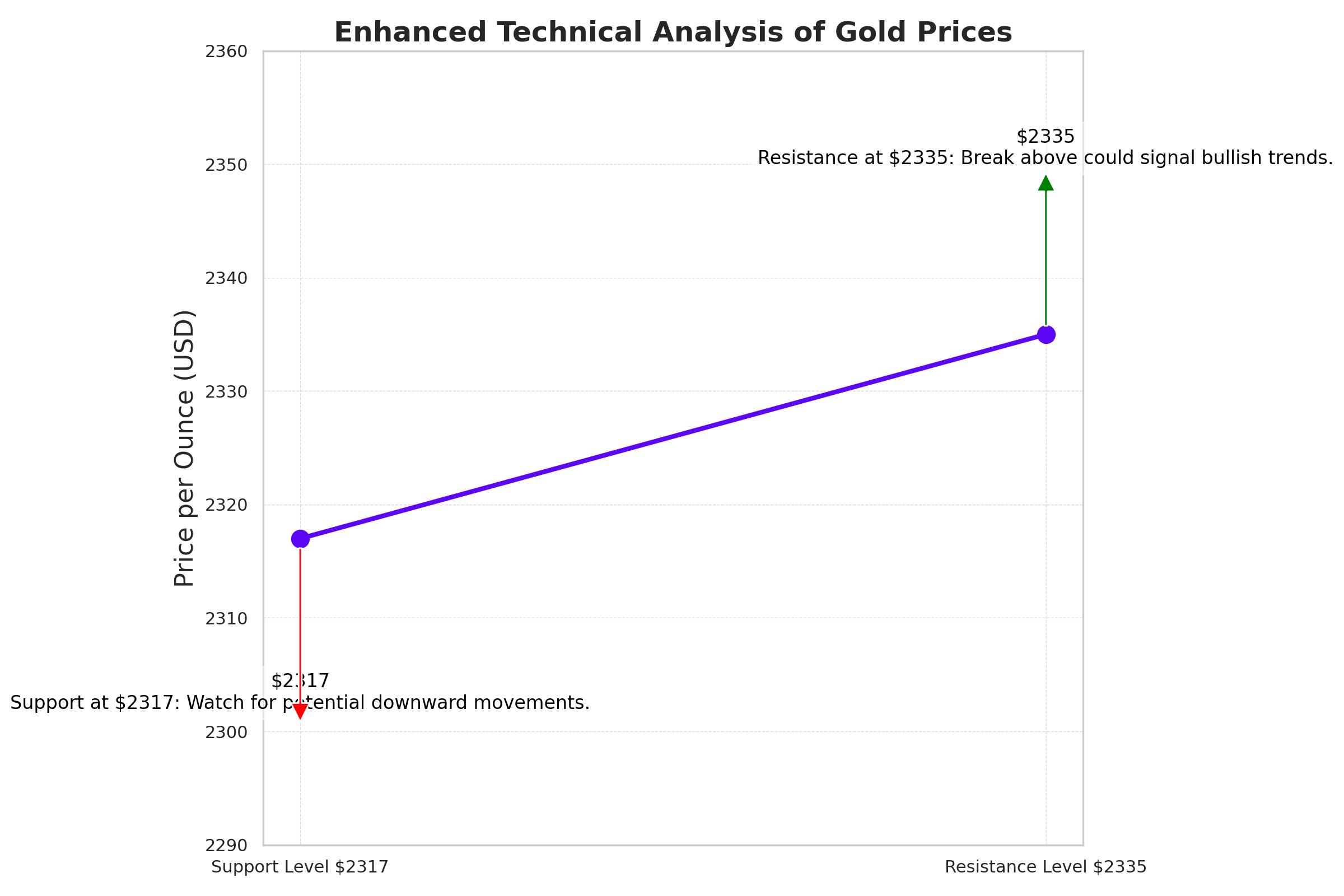

As of the latest trading session in Asia, gold prices saw a marginal increase, with spot gold reaching $2,317 per ounce. This modest uptick reflects a cautious optimism among traders, yet prices remain notably below the highs of late April, signaling persistent market hesitancy.

Here's a comprehensive analysis of the current dynamics affecting gold prices, incorporating a range of economic indicators, technical signals, and geopolitical factors:

Federal Reserve's Influence on Gold Prices

Recent comments from Federal Reserve officials, including Minneapolis Fed President Neel Kashkari, have introduced a degree of uncertainty regarding future interest rate cuts. Kashkari's cautious tone suggests a reluctance to adjust rates downward in 2024, potentially increasing the opportunity cost of holding non-yielding assets like gold. This scenario tends to dampen the appeal of gold as an investment.

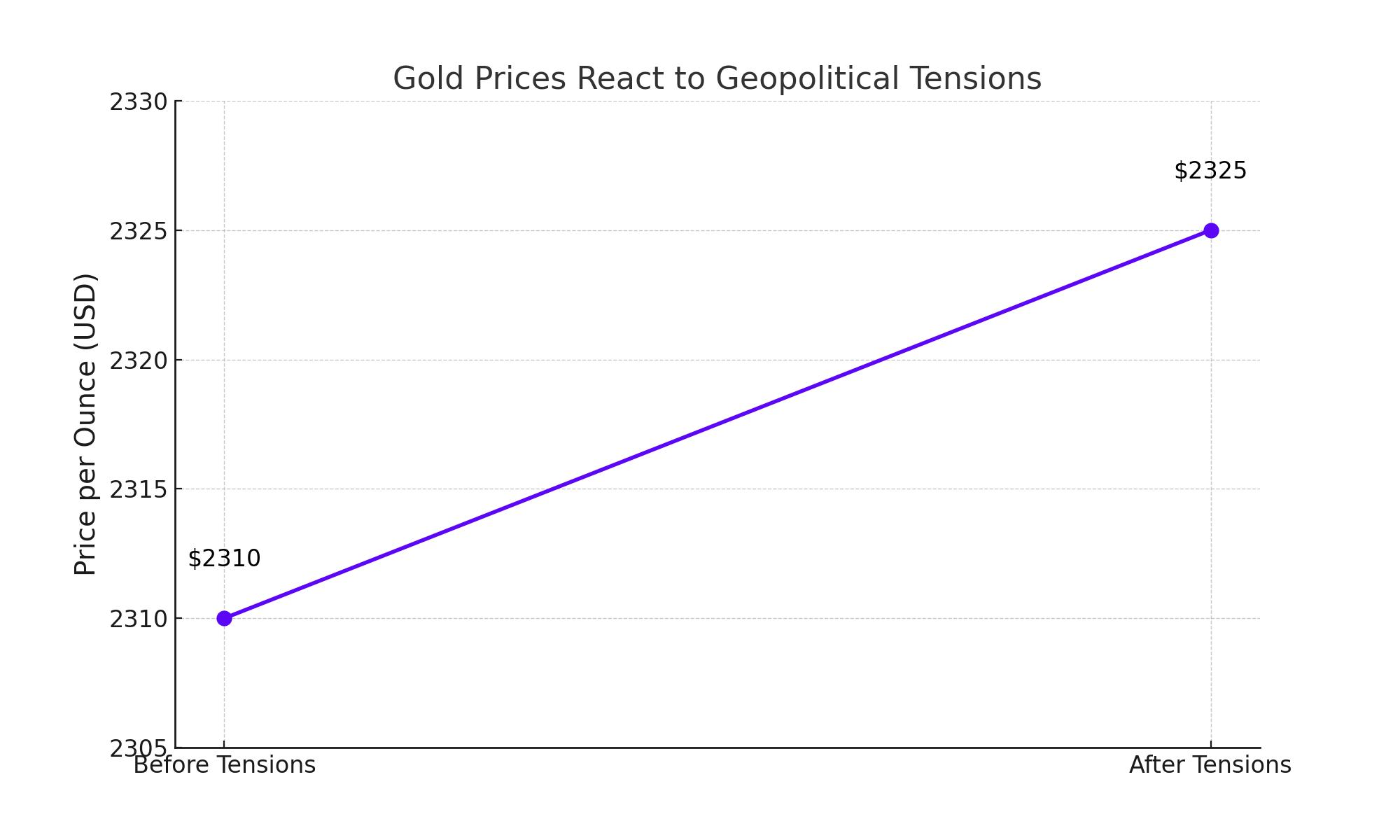

Geopolitical Tensions and Market Sentiment

The ongoing conflict between Israel and Hamas has prompted some investors to turn to gold as a safe-haven asset, though this has not been sufficient to drive a significant price rally. The complex geopolitical landscape, when combined with the Fed's hawkish stance, presents a challenging environment for gold traders.

Technical Analysis and Market Forecasts

Technical indicators highlight a nuanced picture:

- The main trend on the daily swing chart for August WTI Crude Oil is downward, with a recent minor uptrend suggesting an increase in momentum.

- Key resistance is found between $66.34 and $66.85, with a breakout above this range potentially leading to a rally towards $68.43 to $69.43.

- Support levels are critical near $65.10 and $64.67, with a breakdown below these points possibly accelerating the downtrend.

Bullish Prospects for Gold Amid Economic Indicators and Federal Reserve Developments

As global financial markets await further speeches from Federal Reserve officials and upcoming economic data, including the consumer sentiment index, the gold market is poised for potential bullish movements. These economic indicators serve as key drivers in forecasting gold’s price trajectory, currently trading around $2,317 per ounce. Positive or dovish remarks from the Fed could diminish expectations for high interest rates, typically bolstering the attractiveness of gold as a non-yielding asset.

Strategic Investment Approaches in a Volatile Market

In the face of ongoing economic uncertainties and a complex technical landscape, savvy investors might see an advantageous environment to enhance their portfolios. The current market setup, with gold prices showing resilience despite various pressures, suggests a strategic opportunity to leverage gold as a hedge against volatility. Investors are advised to adopt a dynamic investment strategy, attuned to swift shifts in monetary policy and international geopolitical developments, to capitalize on potential upswings in gold prices.

Optimistic Outlook for Gold Investors

For those engaged in the gold market, staying informed and reactive to the blend of macroeconomic signals and policy changes is crucial. The interplay of these factors with the inherent uncertainties of global geopolitical scenarios provides a fertile ground for potential gains. Gold’s traditional role as a safe-haven asset, combined with a cautious but potentially dovish stance from the Federal Reserve, may offer bullish opportunities for investors.

That's TradingNEWS

Read More

-

NLR ETF at $145.21: Uranium, Nuclear Power and the AI Baseline Energy Trade

14.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Demand Lifts XRPI, XRPR and Bitwise XRP as XRP-USD Defends $2.10 Support

14.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Slides Toward $3 as Warm Winter Clashes With LNG Demand

14.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Climbs Toward 160 as Japan’s Debt Fears Clash With BoJ Hike Hopes

14.01.2026 · TradingNEWS ArchiveForex