Gold Price Soars Beyond $2,870 – Can XAU/USD Reach $3,000?

Gold’s Record-Breaking Rally: What’s Fueling the Surge?

Gold prices are smashing through new all-time highs, with XAU/USD climbing past $2,873.69 per ounce in New York trading. This move follows an explosive rally driven by central bank purchases, inflation fears, and escalating trade war tensions. The question now is: Is gold headed for $3,000, or is a pullback inevitable?

Several catalysts are behind gold’s recent breakout. Central banks have ramped up their gold reserves, purchasing over 1,000 tons for the third consecutive year. The US-China trade war is flaring up again, with Trump imposing 10% tariffs on Chinese imports and Beijing responding with countermeasures. The Federal Reserve’s rate-cut trajectory is also keeping the US dollar under pressure, making gold even more attractive as an inflation hedge.

Gold Demand Explodes: Central Banks and Investors Drive Market Strength

The World Gold Council reports that total gold demand in 2024 hit a record 4,974 tons, with Q4 demand alone reaching $111 billion in value. Central banks have been the dominant force, accelerating purchases to 333 tons in Q4 amid concerns over financial instability. Investment demand surged 25% year-over-year to 1,180 tons, with ETFs reversing three years of net outflows.

Gold’s safe-haven appeal has never been stronger. The US dollar is weakening, Treasury yields are falling, and geopolitical tensions are rising. The ongoing Ukraine conflict and growing concerns over fiscal sustainability in the US and Europe are pushing both governments and institutions to hedge against economic turmoil.

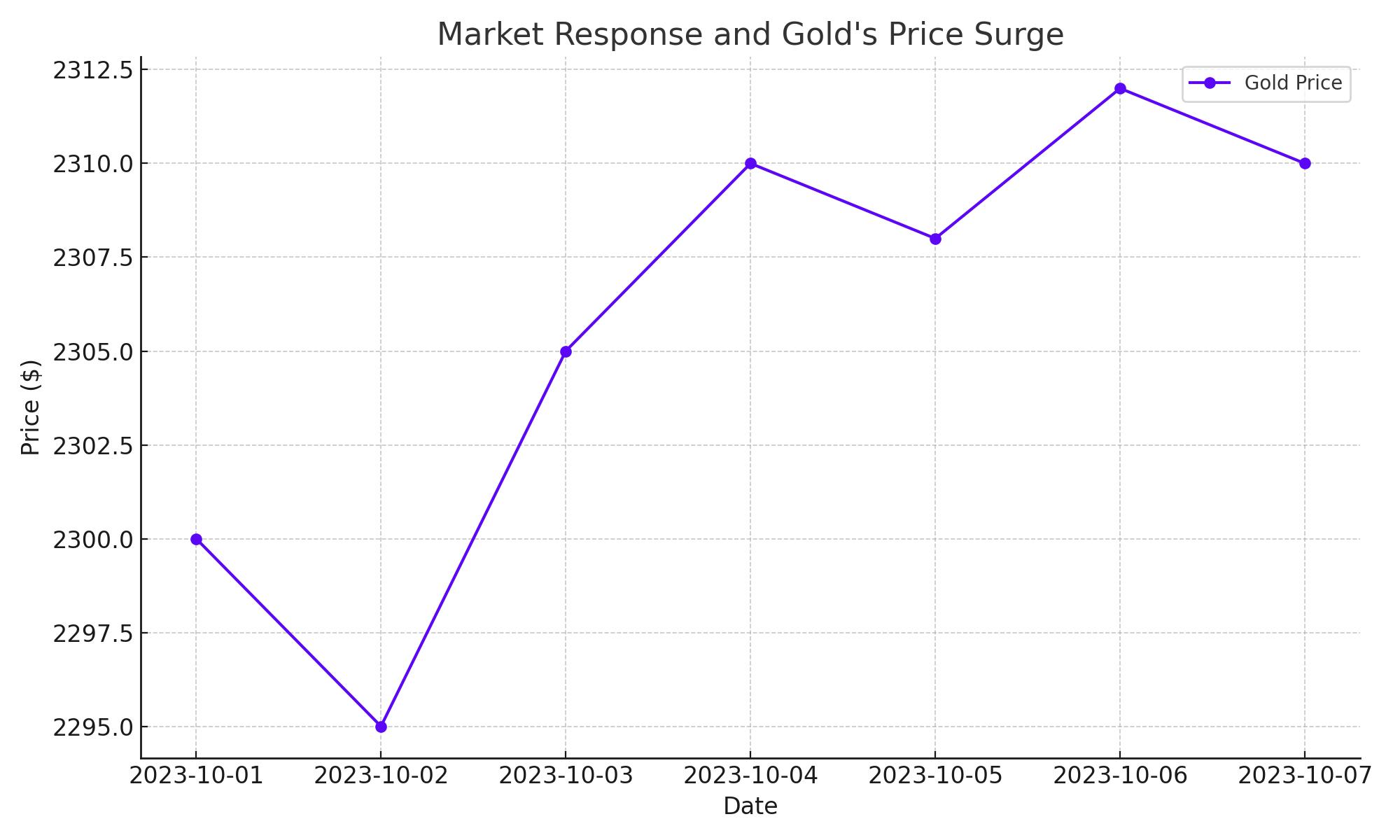

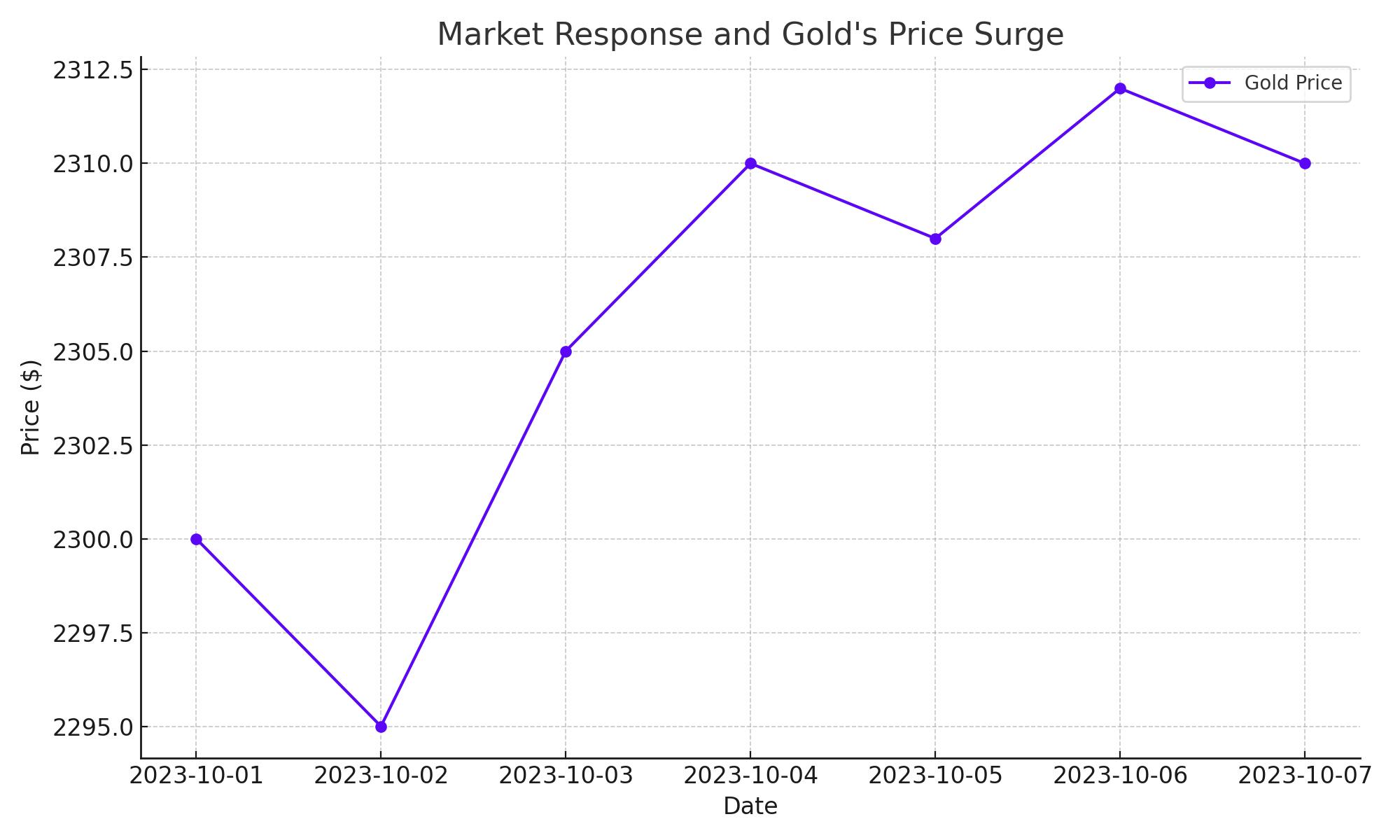

Technical Outlook: Where is XAU/USD Headed Next?

From a technical perspective, gold remains in a powerful uptrend, but overbought conditions are flashing warning signs. The Relative Strength Index (RSI) on both daily and hourly charts suggests that XAU/USD is approaching exhaustion levels. That said, the breakout above $2,800 and now $2,870 is a significant bullish signal, keeping the path open toward $3,000.

Key support levels to watch:

- $2,830 – First immediate support level

- $2,800 – Major psychological support

- $2,775 – Key technical support

On the upside, $2,900 is the next short-term target, with $3,000 as the key milestone if momentum continues. A break below $2,775, however, could signal a corrective pullback.

Trade War Impact: How Will Tariffs Influence Gold Prices?

Trump’s new 10% tariffs on Chinese goods are already disrupting global markets. The gold market is seeing increased demand as a direct result of these trade tensions, with investors rushing to secure physical gold before additional duties kick in. There are even reports of long queues at the Bank of England for central banks withdrawing bullion and shifting it into private vaults.

Meanwhile, lease rates for gold in London have surged to 4.7%, signaling an extreme tightness in the market. This means physical gold is in high demand, and institutions are willing to pay a premium to get their hands on it.

Will Gold Continue to Outperform Other Assets?

Compared to other major asset classes, gold is dominating 2025 performance so far. Bitcoin, which was expected to be a strong alternative hedge, has pulled back to $97,600, while stock markets remain volatile amid Fed policy uncertainty.

- Gold year-to-date gain: +10%

- S&P 500 YTD: +4.2%

- Bitcoin YTD: -7.3%

With inflation concerns still elevated and rate cuts on the horizon, gold could continue outperforming in the near term. However, if the Fed takes a more hawkish stance, or if the US dollar finds strength, we could see gold face short-term selling pressure.

Is Gold a Buy, Sell, or Hold at These Levels?

Gold’s rally looks unstoppable in the short term, but buying at current levels could be risky due to stretched technical indicators. A more strategic approach would be waiting for a pullback toward $2,800 before re-entering long positions.

For now, XAU/USD remains in a strong bullish trend, with $3,000 as the next major resistance level. If central bank demand continues and trade tensions escalate further, this target could be hit sooner rather than later. However, any sharp rally should be met with caution, as profit-taking could trigger temporary price corrections.

Verdict: Bullish with caution. Hold existing positions, buy on dips near $2,800, and watch for key resistance near $2,900-$3,000.

That's TradingNEWS