Gold Price Surges: Is XAU/USD Heading for a Record-Breaking Rally or a Brutal Correction?

With gold hitting a new high of $2,942, traders ask: Will XAU/USD hold above $2,900, or is a pullback toward $2,800 imminent? | That's TradingNEWS

Gold Price Analysis: Will XAU/USD Hold Above $2,900 or Is a Sharp Reversal Coming?

Gold Surges Past $2,900 Amid Trade War Fears and Safe-Haven Demand

Gold prices have reached an all-time high, surpassing $2,942 before pulling back slightly. The primary driver behind this surge has been the escalating trade war tensions triggered by U.S. President Donald Trump’s aggressive tariff policies. The newly imposed 25% tariffs on steel and aluminum imports, with no exemptions, have raised fears of a multi-front global trade war, increasing gold's appeal as a safe-haven asset. Investors are now questioning whether this rally has the strength to push past $3,000 or if profit-taking and technical overbought conditions will trigger a near-term correction.

The Federal Reserve’s monetary policy remains another critical factor influencing XAU/USD. Fed Chair Jerome Powell’s congressional testimony this week will be closely watched for any indication of interest rate cuts or a continuation of the current hawkish stance. If Powell hints at prolonged higher rates to curb inflation, gold could see a temporary dip as higher rates typically reduce the appeal of non-yielding assets like gold. However, with rising inflation risks fueled by increased import costs, traders are still betting on gold's long-term bullish outlook.

Technical Indicators Flash Overbought Warnings: Is a Pullback Inevitable?

Gold’s recent parabolic rise has placed it in heavily overbought territory, with the Relative Strength Index (RSI) hovering above 75, signaling potential exhaustion in the rally. Historically, gold struggles to sustain such extreme overbought levels without a period of consolidation or correction.

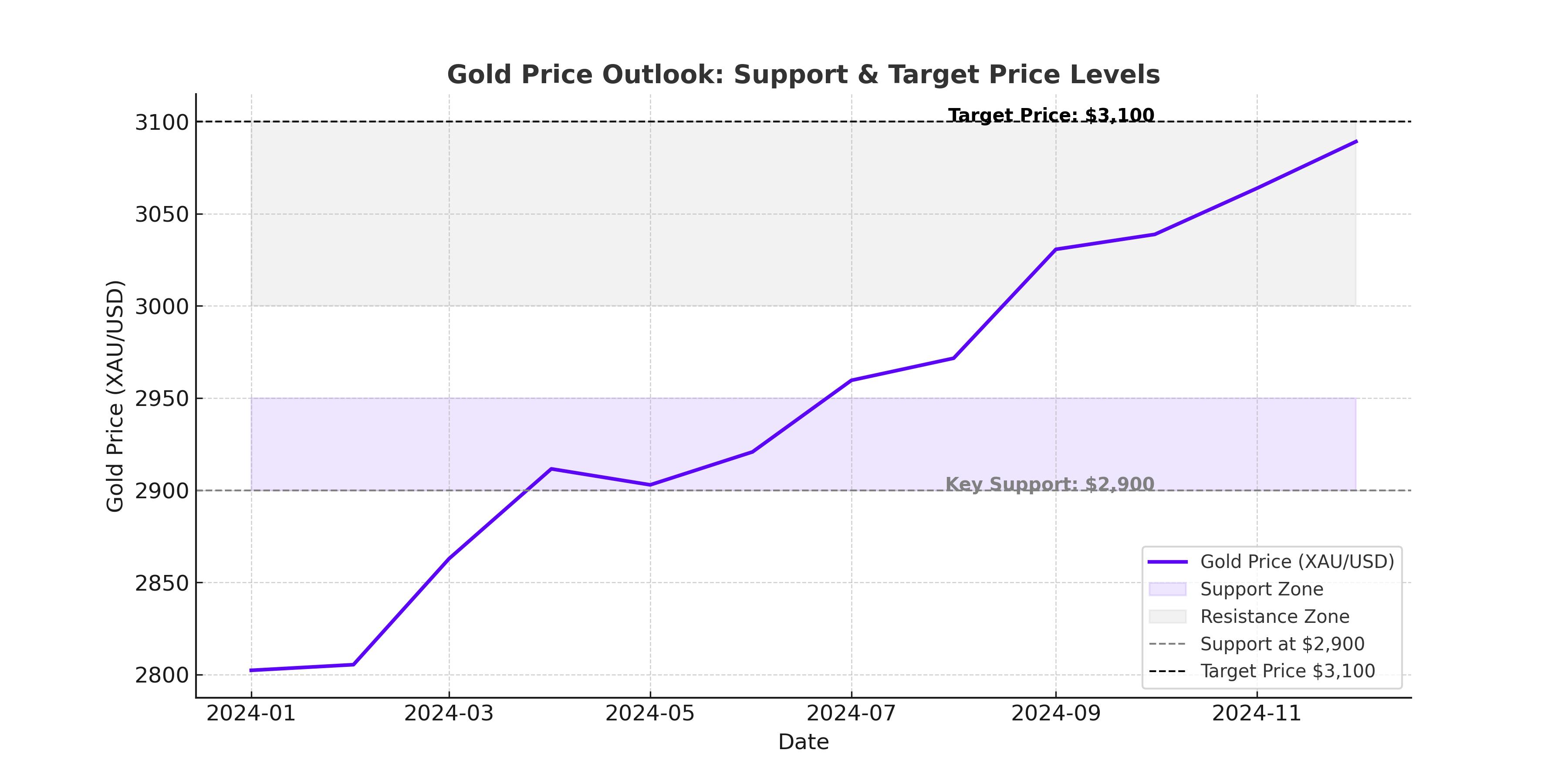

The wide gap between the current price and the 50-day moving average at $2,702 also raises concerns about a sharp reversal. A strong daily close below $2,900 could open the door for further downside, with key support levels at $2,888, $2,855, and $2,834. A deeper correction could see gold testing the crucial psychological level of $2,800, a level that bulls would aggressively defend.

On the upside, gold needs a sustained break above $2,942 to resume its bullish momentum. If buyers push through this resistance, XAU/USD could easily target $3,000, a level that would bring fresh momentum traders into the market.

Trump’s Tariffs and Global Risks Keep Gold’s Bullish Case Intact

While gold may see short-term profit-taking, the fundamental backdrop remains bullish. Trump's tariffs are likely to stoke inflation, increasing gold’s attractiveness as a hedge. Furthermore, geopolitical tensions in the Middle East continue to provide a safety bid for gold, with investors closely monitoring developments surrounding Israel, Hamas, and the U.S.

Additionally, market participants are preparing for further economic uncertainty as the U.S. heads into a heated election cycle. Historically, election-year volatility tends to drive demand for gold as a safe-haven asset, especially if concerns about trade policies and economic growth intensify.

Buy, Sell, or Hold? The Best Strategy for Gold Investors Right Now

For short-term traders, caution is warranted as gold's overextended rally increases the risk of a pullback. A dip below $2,900 could trigger further declines toward $2,855, providing a potential buying opportunity for those looking to enter at lower levels. However, if gold decisively breaks above $2,942, momentum could take it to $3,000 in the near term.

Long-term investors should remain bullish, as inflationary risks and geopolitical uncertainties continue to favor gold. Even if XAU/USD sees a temporary correction, it is unlikely to fall below $2,800 without a major shift in market sentiment. The next few trading sessions will be crucial in determining whether gold can maintain its record-breaking rally or if a much-needed correction is on the horizon.

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex