Gold Soars Toward New Highs: Opportunity as Markets Turn Bullish

With gold prices rising on strong momentum, driven by imminent Fed rate cuts and global uncertainties, now is the time to consider adding gold to your investment portfolio | That's TradingNEWS

U.S. Gold Prices Hover Near Record Highs Amid Economic Uncertainty and Geopolitical Tensions

Durable Goods Orders Signal Mixed Economic Outlook

Gold prices have recently surged to levels not seen in years, reflecting a growing concern among investors about the U.S. economy's future and ongoing global tensions. The latest data from the U.S. Commerce Department highlights a complex economic landscape. While headline durable goods orders jumped by 9.9% in the past month, far exceeding the expected 4.0%, a closer look reveals underlying weaknesses. Core durable goods orders, which exclude the often-volatile transportation sector, dipped by 0.2%, signaling potential cracks in the economic foundation.

Additionally, non-defense capital goods orders excluding aircraft—a key indicator of business investment—fell by 0.1%. This weaker-than-expected data has failed to shake the bullish momentum in the gold market, where December futures last traded at $2,559.10 per ounce, marking a 0.50% increase for the day.

Federal Reserve's Rate Cut Speculation: A Catalyst for Gold?

The gold market is increasingly influenced by the anticipated monetary policy shifts from the Federal Reserve. After recent comments by Fed Chair Jerome Powell, suggesting that interest rate cuts could be on the horizon, gold has rallied as investors seek safe havens in a low-rate environment. As of 9 a.m. Eastern Time, gold was trading at $2,522.54 per ounce, up 0.4% from the previous day and a staggering 23.88% over the past year.

Expectations of a rate cut as early as September have fueled this rally. Historically, gold benefits from lower interest rates, which reduce the opportunity cost of holding non-yielding assets. This speculation is bolstered by dovish comments from key Fed officials, including Philadelphia Fed President Patrick Harker and Chicago Fed President Austan Goolsbee, both advocating for multiple rate cuts in the coming months.

Gold vs. Inflation: A Historical Perspective

Gold has long been regarded as a hedge against inflation, which erodes the purchasing power of fiat currencies like the U.S. dollar. With inflationary pressures remaining a key concern for global economies, gold has become increasingly attractive. Over the past year, the price of gold has risen sharply, from $1,920.06 to $2,522.54 per ounce, reflecting a 23.88% increase as investors seek to protect their wealth.

This trend is not new. Historically, gold has served as a store of value during periods of economic uncertainty. From 1971 to 2024, gold delivered an average annual return of 7.9%, compared to the stock market's 10.7% over the same period. While not outperforming stocks over the long term, gold's stability and intrinsic value make it a critical component of a diversified investment portfolio.

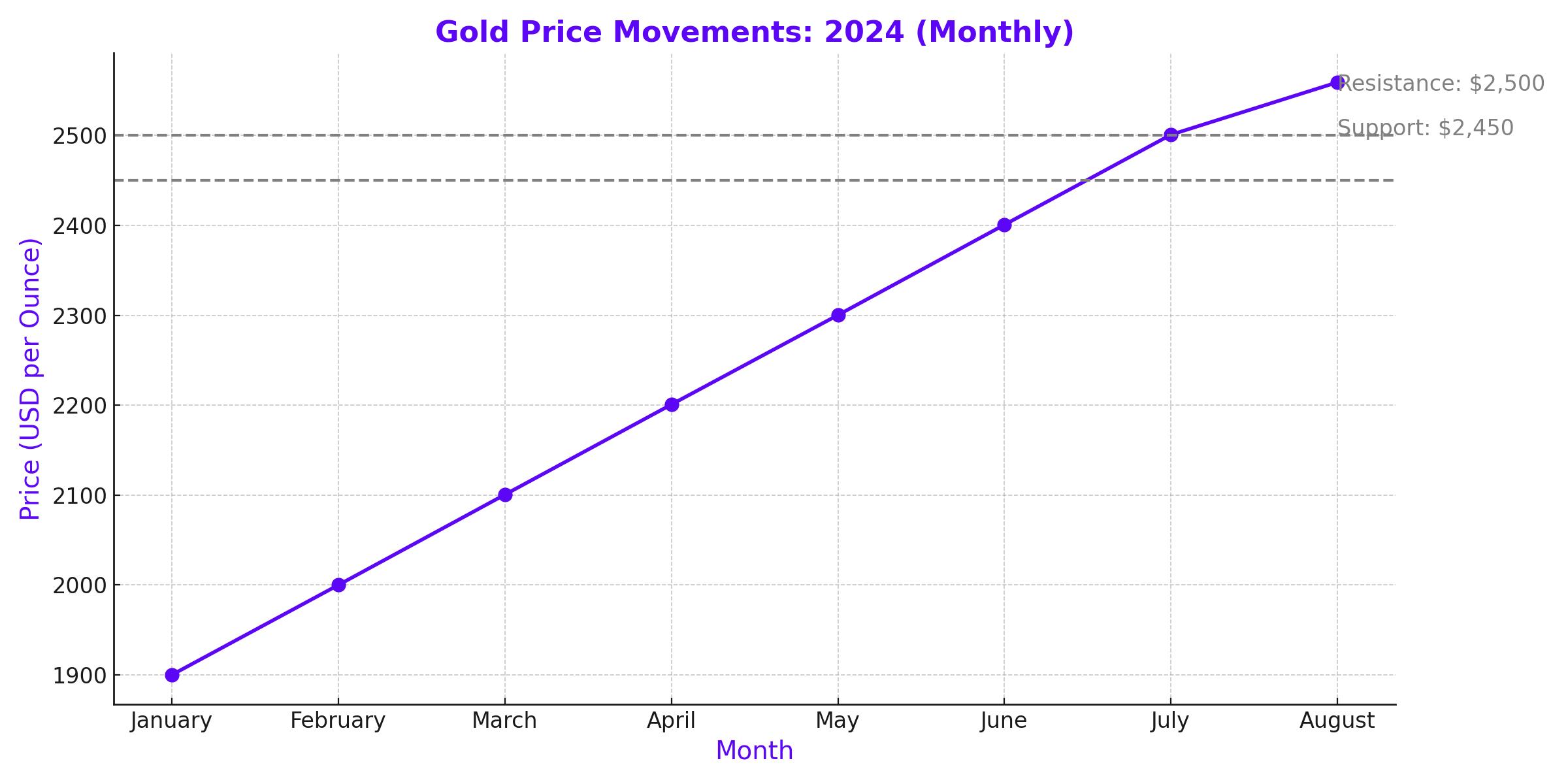

Gold Market Technical Analysis: Eyeing the $2,650 Level

Technically, gold markets have shown considerable strength, with prices recently breaking above the significant $2,500 level. This psychological barrier has attracted substantial interest, pushing gold toward a potential move to $2,650, according to technical indicators. The $2,450 level has provided robust support, and the market's bullish trend suggests that gold could continue to climb, driven by geopolitical concerns and central bank purchases.

Central banks worldwide have been increasing their gold reserves, further boosting prices. With ongoing conflicts in Ukraine and the Middle East, gold is seen as a safe haven, likely to attract more investors if global tensions escalate.

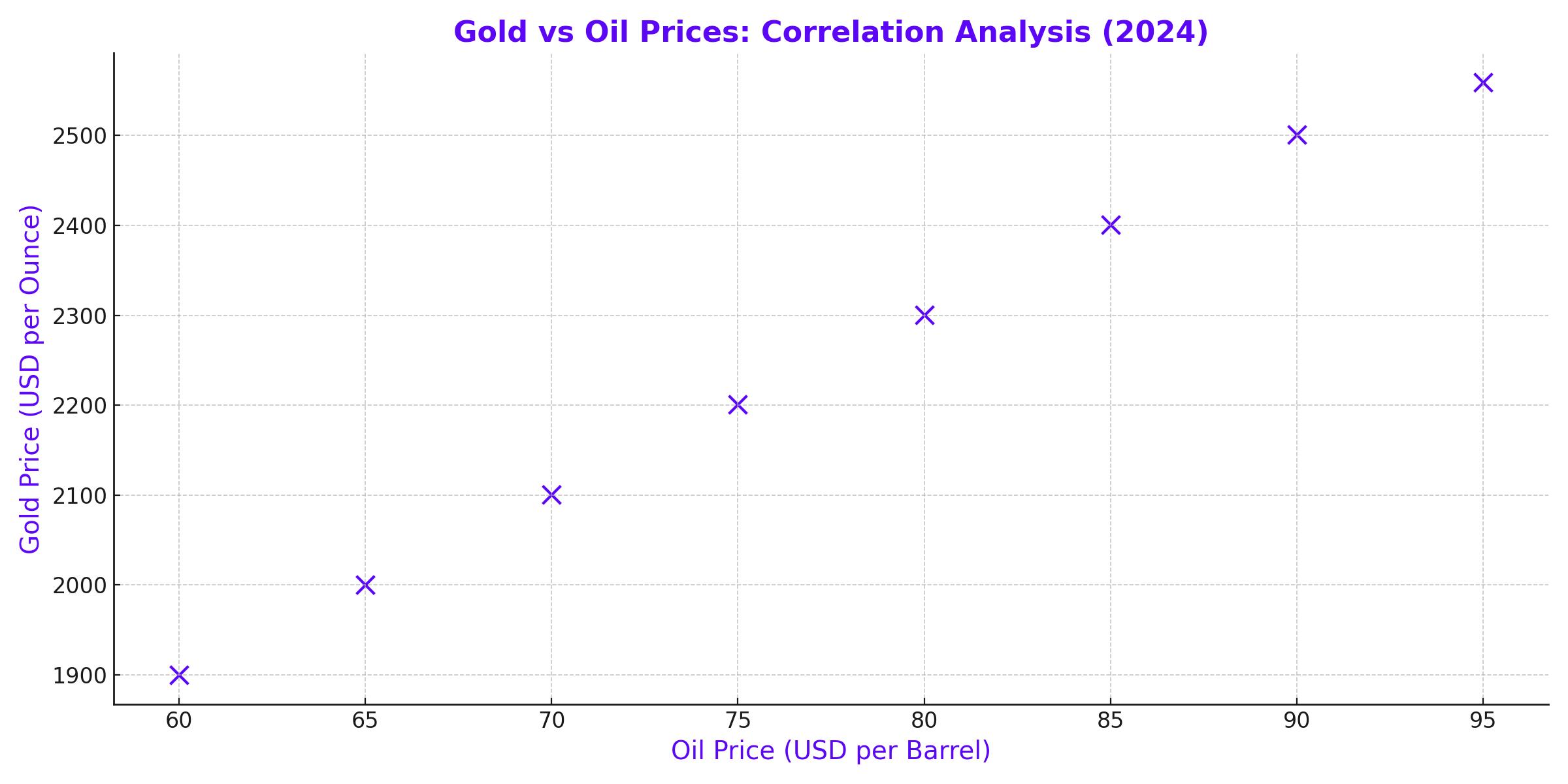

Gold and Oil: Analyzing the Historical Correlation

The relationship between gold and oil prices has been a focal point for economists and investors alike. Historically, the oil-to-gold ratio, which measures how many barrels of oil one ounce of gold can purchase, has averaged around 19 barrels per ounce. As of August 2024, this ratio stands at approximately 31 barrels per ounce, with gold prices near $2,500 per ounce and Brent crude oil just below $80 per barrel.

This anomalous ratio suggests that oil is historically cheap relative to gold, even though global economic conditions do not seem to justify such a disparity. Analysts at Bernstein have proposed several scenarios to bring the ratio closer to its historical average, including a significant increase in oil prices or a decrease in gold prices. However, the path to such a reversion remains uncertain, making this an area of keen interest for investors.

Market Sentiment and Geopolitical Risks: The Tug-of-War

Gold prices are also being shaped by broader market sentiments and geopolitical risks. Tensions in the Middle East, particularly between Hezbollah and Israel, have traditionally driven safe-haven demand for gold. However, recent market behavior suggests that economic factors, such as expectations of U.S. interest rate cuts, are currently exerting a stronger influence on gold prices.

Despite the pressure from risk-on sentiment, which typically weighs on gold, upcoming economic data and further geopolitical developments could shift market dynamics. The Relative Strength Index (RSI) for gold is currently at 56, indicating a balanced market. However, if gold fails to break through the resistance level at $2,515.43, upward momentum could stall, potentially leading to a sell-off if it falls below $2,494.37.

Investment Strategies: Navigating the Gold Market

For investors, the current landscape offers both opportunities and risks. The potential for further rate cuts by the Federal Reserve, combined with ongoing geopolitical tensions, could continue to support gold prices. However, the market's recent performance also suggests the need for caution, particularly if economic conditions change unexpectedly.

Given the cautious sentiment prevailing in the market, a strategy of selling below $2,515, targeting $2,490, with a stop-loss at $2,531, could be considered to manage risk effectively. As always, diversification remains key, and investors might also consider exposure to related assets such as major mining companies like Barrick Gold (NYSE:GOLD), which has been rated as Outperform by analysts.

That's TradingNEWS

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex