Gold (XAU/USD): Bullish Trends Amid Geopolitical and Economic Dynamics

Analyzing Recent Gold Price Movements, Key Technical Levels, and Market Influences | That's TradingNEWS

Gold (XAU/USD): Bullish Outlook Amid Market Dynamics

Recent Price Movements and Influences

Gold prices have been on an upward trajectory, trading around $2,400 per troy ounce during the European session on Monday. This positive momentum has been supported by several factors, including a depressed US Dollar (USD) amid expectations of a Federal Reserve (Fed) rate cut in September, and heightened geopolitical risks in the Middle East. The US Personal Consumption Expenditures (PCE) Price Index data released recently indicated modest inflation, reinforcing the likelihood of an imminent start to the Fed's rate-cutting cycle. This scenario has led to a decline in US Treasury bond yields, which further supports the non-yielding yellow metal.

Geopolitical Risks and Market Sentiment

The geopolitical landscape has added a layer of support to gold prices. The recent Golan Heights attack, which escalated tensions between Israeli forces and Hezbollah in Lebanon, has prompted investors to seek the safe-haven asset. Despite these supportive factors, the upside for gold remains capped due to the upbeat mood in global equity markets, which tends to reduce demand for traditional safe-haven assets like gold. Market participants are also awaiting the outcome of the Federal Open Market Committee (FOMC) meeting and key US macroeconomic data, including the Nonfarm Payrolls (NFP) report, which will provide fresh impetus to the commodity.

Technical Analysis and Key Levels

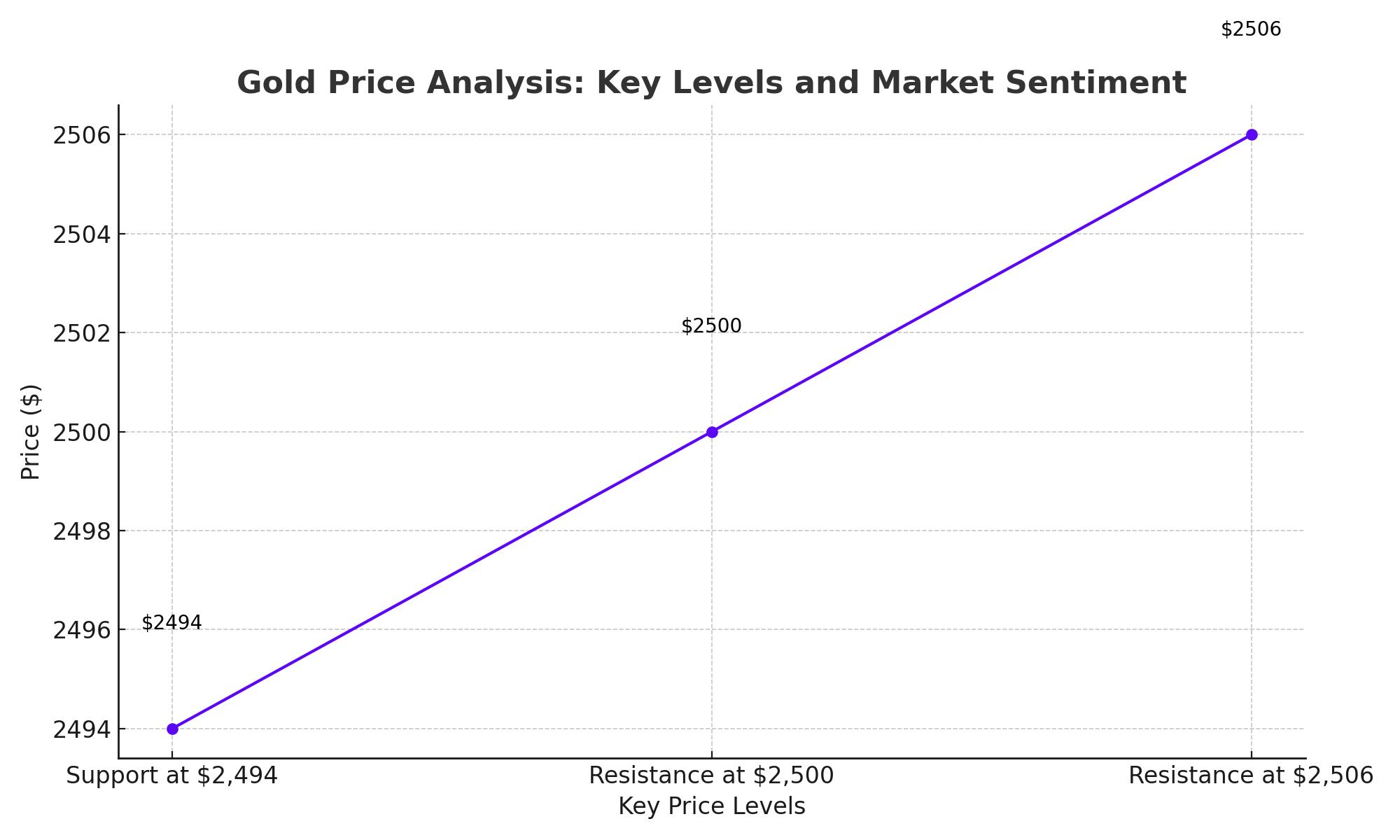

From a technical perspective, gold has seen repeated failures to secure a position below the 50-day Simple Moving Average (SMA), suggesting caution among bearish traders. The $2,400 mark has been a significant level of resistance, with further hurdles expected around $2,412 and last week's swing high near $2,432. A sustained move beyond these levels could signal that the recent corrective decline has ended, setting the stage for additional gains toward the $2,470 resistance zone and potentially challenging the record highs around $2,484.

Conversely, any weakness below the $2,380 level is likely to find buyers near the 50-day SMA at $2,360. A breakdown below this support could drag prices towards the next significant support near the $2,325 area, with a further decline possibly testing the $2,300 mark.

Long-Term Bullish Factors

Long-term charts for gold remain bullish, indicating that short-term consolidations or sell-offs are mere noise. Historical data, including the 50-year and 10-year gold price charts, show a persistent uptrend. This broader perspective supports the view that gold remains in a bullish phase, with lower timeframes creating opportunities rather than indicating a peak.

Correlation with Other Markets

Gold's performance is closely linked with movements in the Euro (EUR), given its inverse correlation with the USD. A recent breakout attempt in the EUR/USD pair, marked by a rise above critical Fibonacci levels, suggests a potential boost for gold prices if the trend continues. This correlation highlights the importance of monitoring currency markets to gauge gold's trajectory.

Speculative Interest and Market Positioning

One concern for the gold market is the high level of speculative interest, with many traders holding long positions. The managed money index indicates a bullish stance among speculators, which could lead to a price correction if these positions are unwound. For gold to maintain its bullish trend, a reduction in speculative interest followed by a strong uptrend in the EUR/USD would be ideal.

Market Dynamics and Future Outlook

Gold's recent price action has been influenced by multiple factors, including dovish Fed expectations, geopolitical tensions, and fluctuating equity market sentiment. The precious metal has managed to defend key support levels and shows potential for further gains, particularly if it can break through the $2,400 resistance and sustain momentum. Investors should keep an eye on central bank meetings, macroeconomic data releases, and geopolitical developments, all of which will play crucial roles in shaping gold's future.

That's TradingNEWS

Read More

-

SPYI ETF at $52.59: 11.7% Yield, 94% ROC and Near S&P 500 Returns

04.01.2026 · TradingNEWS ArchiveStocks

-

XRPI and XRPR Rally as XRP-USD Defends $2.00 on $1.2B XRP ETF Inflows

04.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Eyes $4.30 if Storage Draws Tighten

04.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X at 156.91: 157.75 Breakout Sets 160 Target as Fed Jobs Week Tests The Dollar

04.01.2026 · TradingNEWS ArchiveForex