IBM's NYSE:IBM Stock Future with AI and Hybrid Cloud

From Financial Revival to Strategic Innovations: How IBM is Shaping the Next Era of Technology | That's TradingNEWS

Analyzing IBM's Renaissance: A Deep Dive into Its Strategic Pivot

Introduction to IBM's Strategic Transformation

International Business Machines Corporation (NYSE:IBM), a titan in the tech industry, has recently demonstrated a remarkable turnaround, signifying a profound strategic pivot from its traditional business models towards embracing cutting-edge technologies like AI and hybrid cloud solutions. This analysis delves into the specifics of IBM's financial health, market positioning, and strategic initiatives that underscore its resurgence and future prospects.

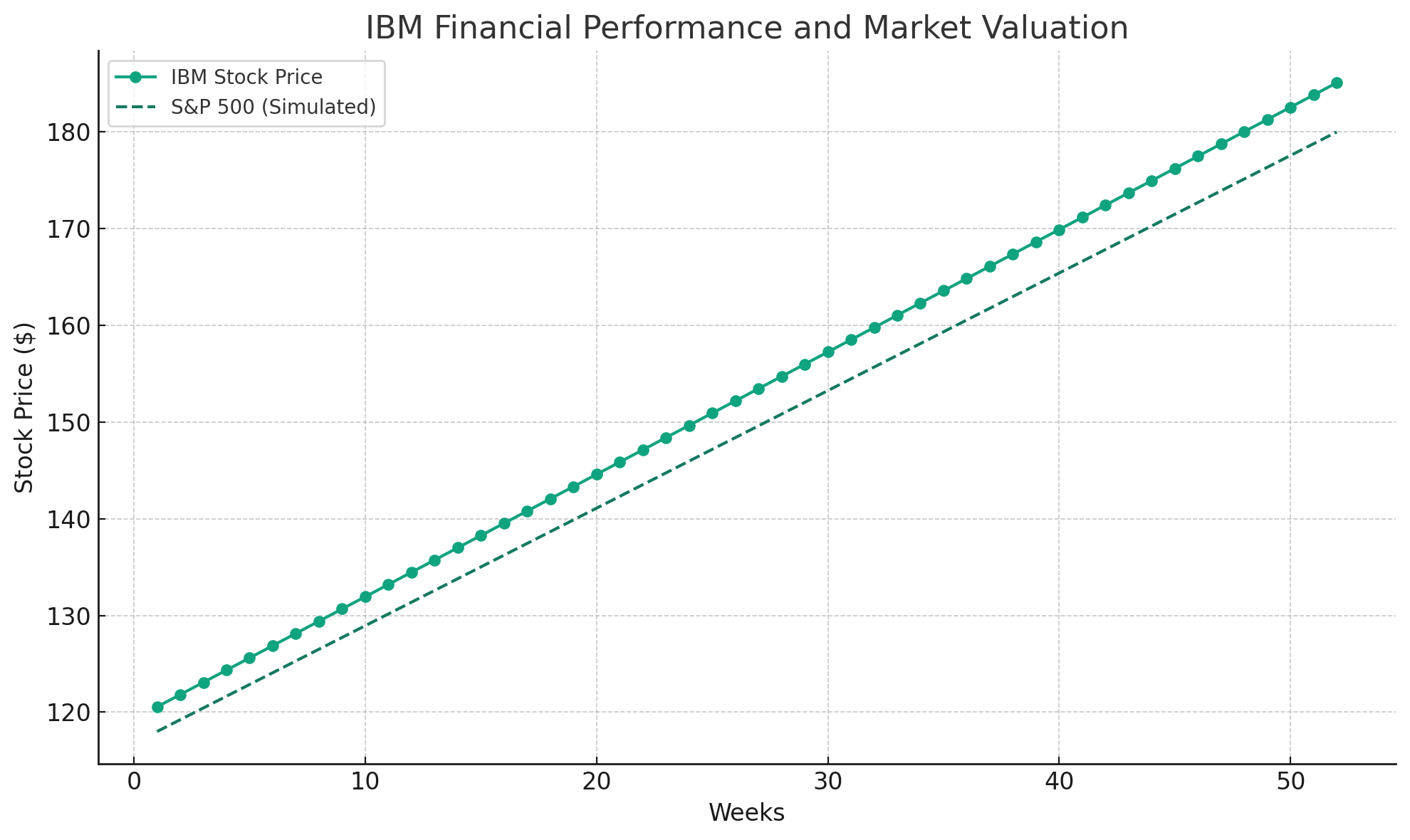

Financial Performance and Market Valuation

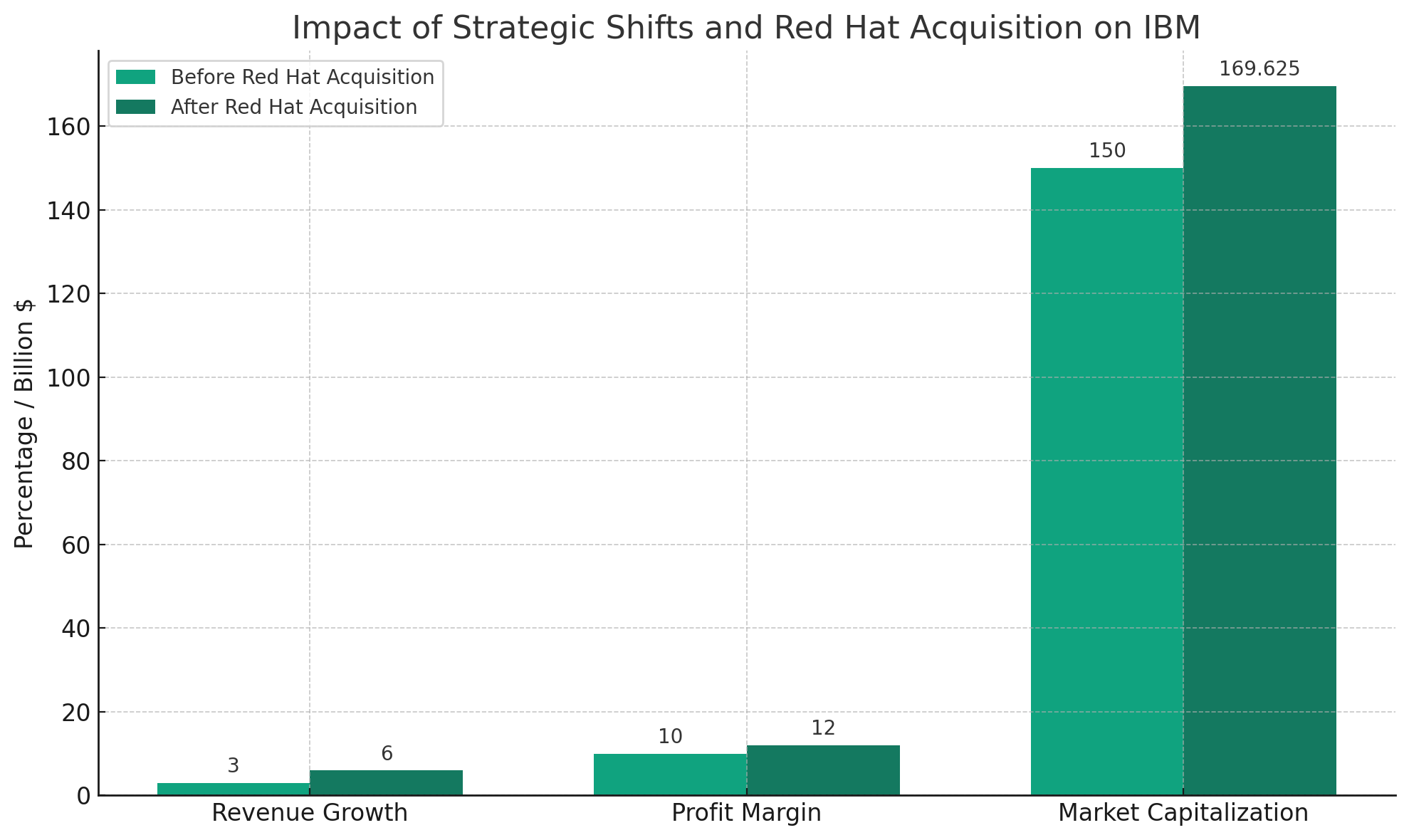

At the heart of IBM's resurgence is its impressive financial metrics. With a closing price of $185.09, a slight dip of 0.12% from its previous close, IBM still showcases robust fundamentals. The company's market capitalization stands at $169.625 billion, underpinned by a PE ratio (TTM) of 22.70, indicating a mature valuation compared to tech startups but promising for a giant recalibrating its focus towards growth sectors.

The stock has experienced a commendable 52-week rally, soaring from a low of $120.55 to a high of $196.90, outstripping the S&P500's performance over the same period. This rally is a testament to investor confidence in IBM's strategic direction and execution.

Strategic Shifts: Embracing AI and Hybrid Cloud

Under the leadership of CEO Arvind Krishna, IBM has taken bold steps to rejuvenate its product portfolio and business model. The acquisition of Red Hat for a staggering $34 billion is a cornerstone of this transformation, enabling IBM to stake its claim in the open-source enterprise cloud domain. This move, coupled with the divestiture of non-core businesses like Kyndryl, has streamlined IBM's focus towards high-growth areas such as AI and hybrid cloud, setting the stage for sustainable growth.

IBM's strategy is not just about acquisitions but also about innovation and partnerships. The collaboration with Meta Platforms, Inc. (META) to integrate the Llama 2 model into the Watsonx AI platform exemplifies IBM's commitment to leading in the AI space, leveraging open-source models to deliver bespoke solutions to enterprise clients.

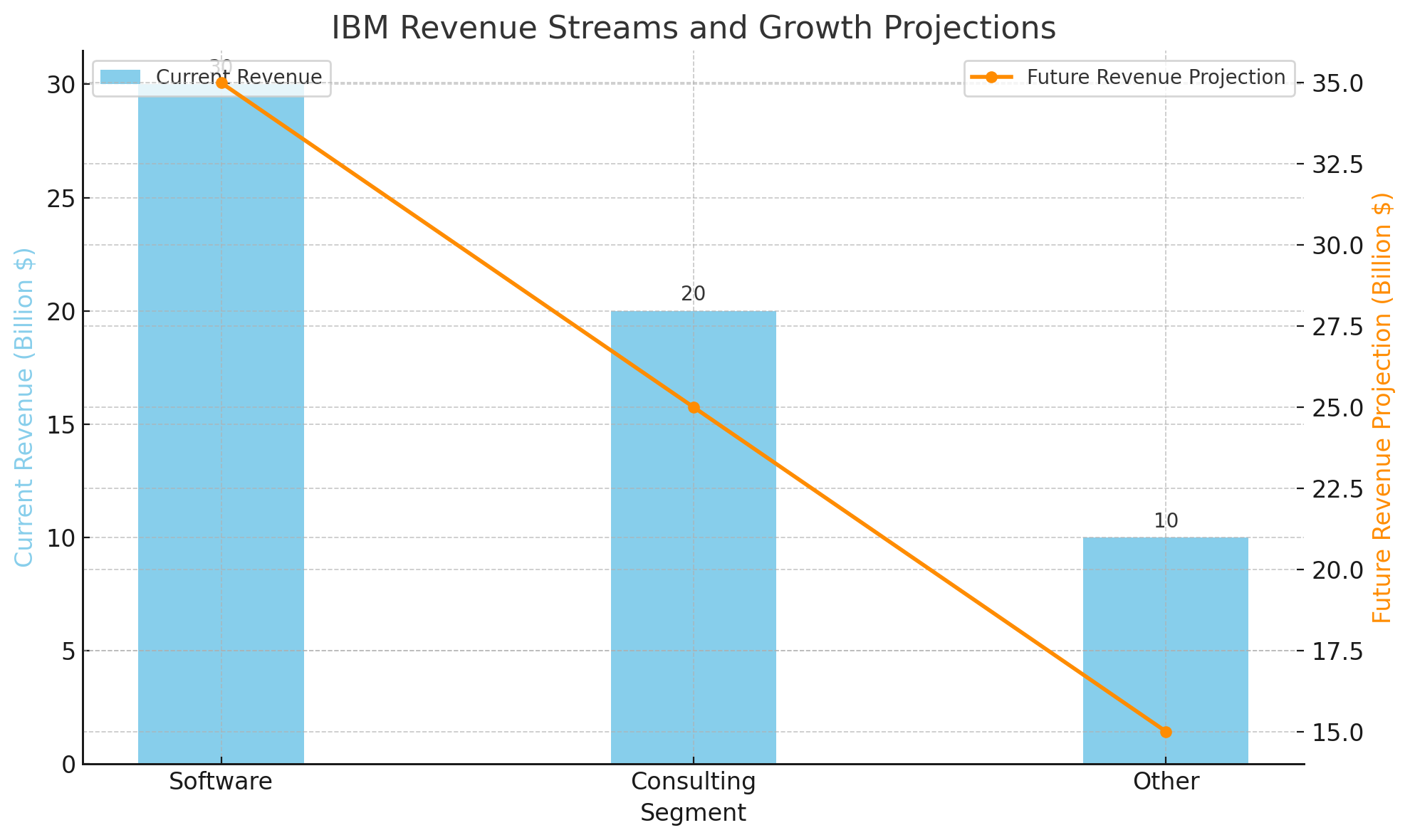

Financial Highlights and Revenue Streams

IBM's latest financials reveal a company on the mend, with a profit margin of 12.13% and an operating margin of 23.17%, highlighting efficient operations and a strong grip on profitability. The company boasts a diverse revenue stream, with significant contributions from its Software and Consulting segments, which are pivotal in IBM's strategic pivot towards emerging technologies.

The focus on AI and hybrid cloud is paying dividends, as reflected in the revenue growth projections. Analysts forecast a bullish outlook for IBM, with earnings estimates suggesting a steady climb in EPS from $1.59 in the current quarter to $10.65 next year. Similarly, revenue estimates indicate a trajectory of growth, from $14.57 billion in the current quarter to $66.66 billion next year, underscoring the efficacy of IBM's strategic realignment.

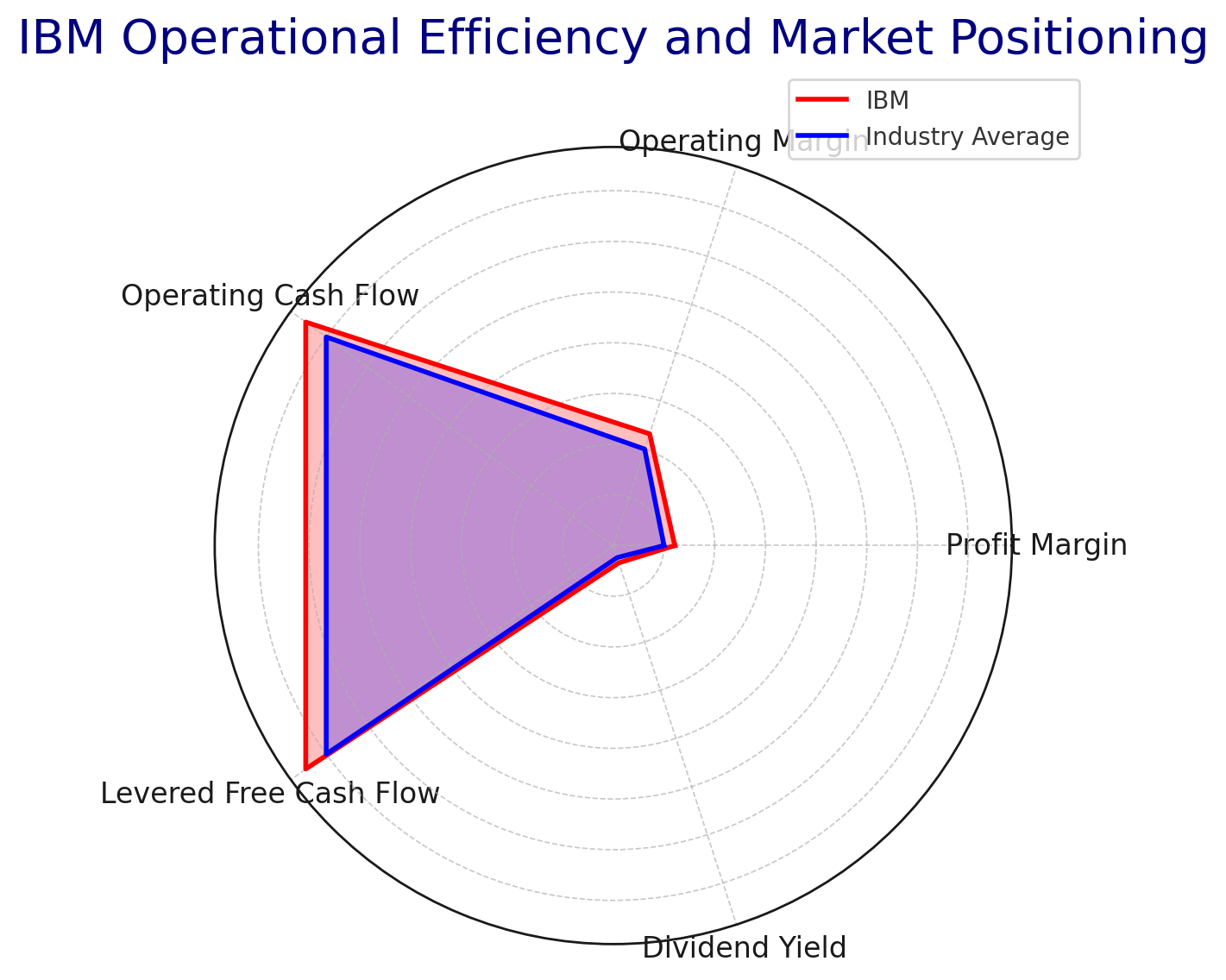

Operational Efficiency and Market Positioning

IBM's operational prowess is evident in its cash flow metrics, with an operating cash flow of $13.93 billion and a levered free cash flow of $10.82 billion. These figures not only demonstrate IBM's operational efficiency but also its capacity to invest in growth initiatives and return value to shareholders through dividends, with a forward annual dividend rate of 6.64, yielding 3.58%.

The strategic divestitures and acquisitions have allowed IBM to become leaner and more focused, enhancing its competitive positioning in the tech landscape. The company's transition towards a platform-centric approach, especially in AI and hybrid cloud, is a strategic maneuver to capitalize on the growing demand for digital transformation and innovation in enterprise solutions.

Looking Ahead: Growth Prospects and Valuation

IBM's forward-looking strategy, centered around AI and hybrid cloud, positions it well to capitalize on the next wave of technological innovation. The company's emphasis on open-source AI models, in collaboration with industry giants like Meta, underscores its commitment to leading the AI revolution in enterprise settings.

The valuation metrics, while reflective of a mature company, suggest room for growth, especially as IBM continues to execute on its strategic vision. The stock's current PE and forward PE ratios, juxtaposed against its growth prospects and strategic initiatives, indicate potential for re-rating, especially as the market begins to fully appreciate IBM's transformation and growth trajectory.

Conclusion: IBM's Strategic Renaissance

In conclusion, IBM's strategic pivot towards AI and hybrid cloud is not just a testament to its adaptability but also a blueprint for other legacy tech firms aiming to remain relevant in a rapidly evolving digital landscape. With a solid financial foundation, a strategic focus on high-growth technologies, and a commitment to innovation and partnerships, IBM is poised for a new era of growth and leadership in the tech industry. As such, IBM represents a compelling investment proposition for those looking to participate in the next wave of technological advancement. For a detailed analysis of IBM's stock, including real-time charts and insider transactions, visit TradingNews.com's IBM Stock Profile and Insider Transactions.

That's TradingNEWS

Read More

-

Microsoft Stock Price Forecast - MSFT at $486: Can the $3.6T AI Giant Still Justify Its Premium?

26.12.2025 · TradingNEWS ArchiveStocks

-

XRP Price Forecast - XRP-USD At $1.87 With Bullish Setup Pointing Toward $2.60 Target

26.12.2025 · TradingNEWS ArchiveCrypto

-

Oil Prices Stabilize: WTI at $58 and Brent at $62 Trapped Between Sanctions Risk and 2026 Oversupply

26.12.2025 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow And S&P 500 Hover Near Records As NVDA, TSLA, PLTR, NKE And CPNG Lead Moves

26.12.2025 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - Pound Holds the 1.35 Zone as Dollar Weakens into 2026

26.12.2025 · TradingNEWS ArchiveForex