Microsoft Corporation (NASDAQ:MSFT): Revolutionizing Cloud and AI Integration Amid Valuation Opportunities

Microsoft's Strategic Dominance in AI and Cloud Services

Microsoft Corporation (NASDAQ:MSFT) continues to solidify its position as a leader in technology, leveraging AI advancements and a diversified portfolio to drive consistent growth. With Azure's 33% year-over-year growth and its groundbreaking partnership with OpenAI, Microsoft is seamlessly integrating AI into its offerings, reshaping enterprise solutions and cloud computing. The company’s AI and cloud infrastructure investments exceeded $20 billion in Q1 FY25, underscoring its commitment to dominating the future of AI-powered services.

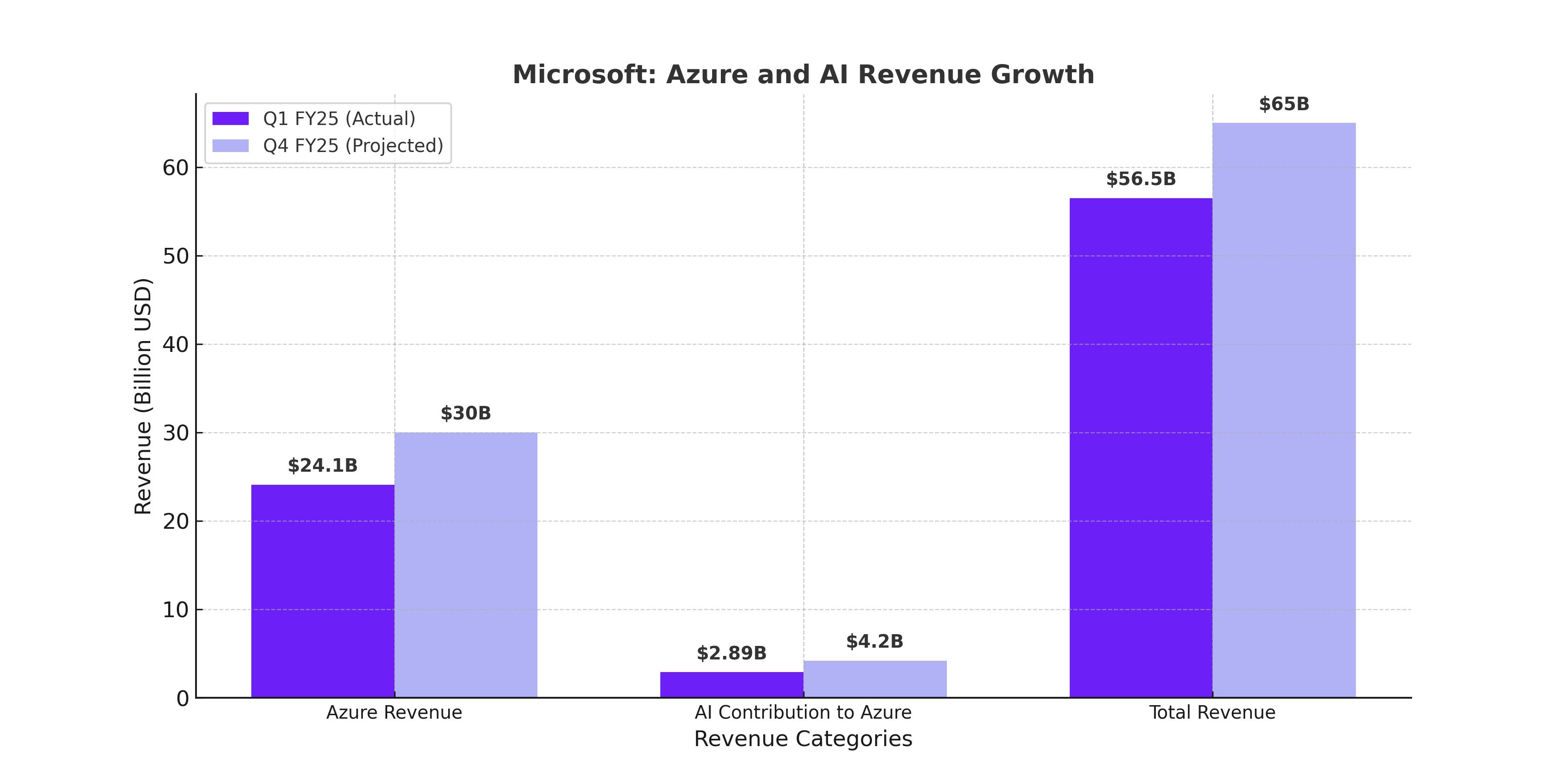

Azure and AI: A Winning Formula for Sustained Growth

Azure's stellar performance, contributing $24.1 billion in Q1 FY25, highlights its pivotal role in Microsoft’s growth trajectory. AI services accounted for approximately 12% of this expansion, demonstrating robust demand for its cutting-edge solutions. As OpenAI's "o" series reasoning models set new benchmarks in AI capabilities, Microsoft’s privileged access to these advancements offers unparalleled differentiation in the hyperscale cloud market, propelling customer acquisition and retention.

Microsoft 365: Redefining Enterprise Productivity

The integration of AI into Microsoft 365 Copilot and GitHub Copilot exemplifies the company’s innovative approach to enhancing enterprise productivity. These tools are designed to provide actionable insights, streamline workflows, and boost efficiency, making them indispensable in corporate environments. With over $103 billion in remaining performance obligations, Microsoft is poised to maintain its double-digit growth, supported by enterprise-level adoption of its comprehensive AI-powered ecosystem.

Impact of the Activision Blizzard Acquisition

Despite short-term dilution of $0.44 billion in operating income from the Activision Blizzard acquisition, Microsoft’s strategic investments are expected to yield long-term benefits. Synergies across gaming and entertainment platforms will further strengthen its ecosystem, driving revenue and profitability in adjacent markets. The company’s disciplined cost management and ability to extract value from acquisitions reinforce its operational resilience.

Financial Fortitude and Shareholder Value Creation

Microsoft boasts a robust balance sheet, with $116 billion in cash against $45 billion in debt. This financial strength enables continued investment in innovation while returning value to shareholders. The company repurchased $9 billion worth of shares and distributed dividends, aligning with its strategy to deliver consistent shareholder returns. Trading at a forward P/E of 33x, Microsoft’s valuation reflects its industry leadership and long-term growth prospects.

Navigating Competitive Pressures and Regulatory Challenges

While Amazon (AWS) and Google Cloud remain formidable competitors, Microsoft's integration of OpenAI’s technologies provides a decisive edge. However, regulatory scrutiny and antitrust challenges pose potential risks. The European Commission’s recent charges highlight the need for careful navigation of legal landscapes as Microsoft continues its expansion into high-growth markets.

Valuation and Growth Potential

With an intrinsic value estimate of $526 per share, representing a 21% upside, Microsoft offers a compelling investment opportunity. Analysts project consistent double-digit revenue growth, supported by Azure’s momentum, AI integration, and strong customer lock-in. As the market transitions toward AI-centric solutions, Microsoft’s strategic positioning ensures its ability to capture and sustain market leadership.

Conclusion

Microsoft Corporation (NASDAQ:MSFT) stands as a dominant force in the AI and cloud revolution, leveraging its innovative capabilities, financial strength, and strategic foresight to reshape the technology landscape. With Azure delivering 33% year-over-year growth and AI integration accelerating adoption across its enterprise solutions, Microsoft continues to define industry standards. The company’s focus on cutting-edge advancements, such as its collaboration with OpenAI, positions it as a leader in transformative technologies that drive efficiency and productivity. Trading at approximately $333 per share as of recent market close, Microsoft offers investors a blend of growth and resilience, backed by its diversified portfolio and robust cash generation. With intrinsic value estimates suggesting a 21% upside to $526 per share, Microsoft represents a compelling opportunity for long-term investors seeking exposure to the future of AI, cloud computing, and enterprise innovation. Stay updated with real-time stock prices and insider transactions for Microsoft Corporation here.