Seizing Opportunities in a Tense Geopolitical Landscape

From oil price dynamics to diversification strategies: how astute investors can capitalize on global challenges and uncertainties | That's TradingNEWS

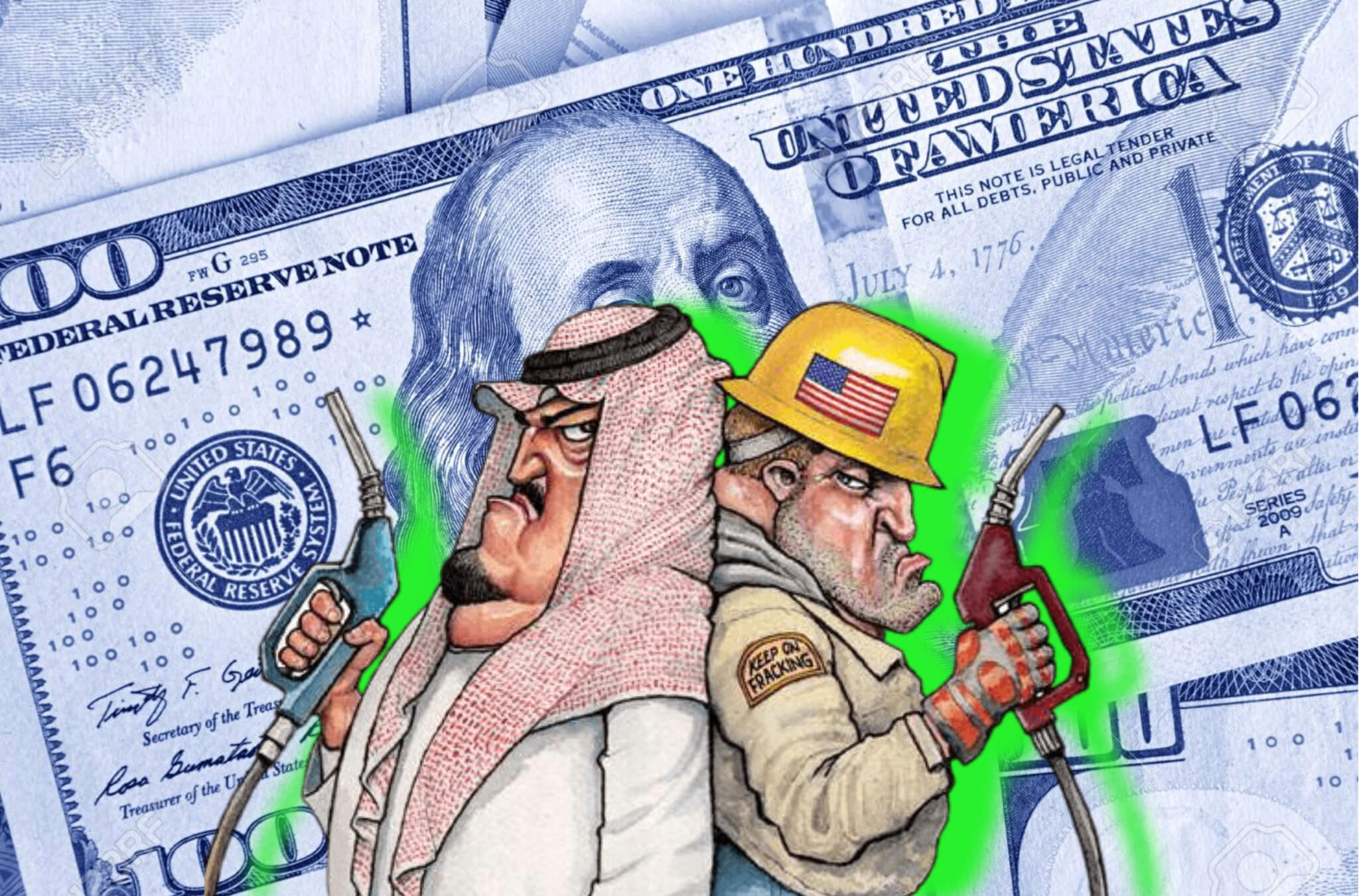

Investment Opportunities Amid Global Tensions

The Current Landscape

Amid the recent conflict between Israel and Hamas, the World Bank has expressed concerns about oil prices venturing into uncharted territories. Notably, the current situation could drive oil prices higher, leading to profound implications for global food prices. The complexity of this geopolitical tension is only intensified by the already present strain from Russia's invasion of Ukraine.

Oil Price Dynamics: A Closer Look

The World Bank's projections on oil prices offer a panoramic view of the possible future scenarios:

- A localized conflict might pull down the oil prices from their current stance at $90 a barrel to an average of $81.

- A medium-scale disruption, similar to the aftermath of the Iraq war, would likely lead to a price surge of up to 35%, propelled by a drop in global oil supply by 3 million to 5 million barrels daily.

- In the event of a large-scale disruption, mirroring the Arab oil embargo of 1973, the prices could rocket between $140 to $157 a barrel, driven by a colossal drop of 6 million to 8 million barrels per day.

Economic Implications

It's imperative to underscore the ripple effects of these potential oil price shifts. As highlighted by prominent figures such as Indermit Gill and Ayhan Kose from the World Bank, the global economy could experience a dual energy shock. The pre-existing food inflation, particularly in developing nations due to the Ukraine situation, might be compounded further, posing a grave threat to global food security.

Diversifying Commodities

Since the beginning of the Israel-Hamas conflict, oil prices have risen by 6%. On the other hand, gold, which is known to be sensitive to geopolitical upheavals, has seen an 8% surge. While this might appear as an alarming trend for some, discerning investors might view it as a diversification opportunity.

The Analyst Perspective

At a recent event hosted by Bloomberg, Treasury Secretary Janet Yellen underscored the global implications of an expanding Israel-Hamas conflict. Furthermore, Fatih Birol, the head of the International Energy Agency, emphasized the risks associated with over-reliance on oil and gas, especially considering the prevailing geopolitical scenarios.

Historical Lessons

Drawing insights from history can be instructive. The World Bank's comparisons with events such as the 1973 Arab oil embargo, which led to a quadrupling of oil prices, are worth noting. Such dramatic shifts have traditionally heralded economic turmoil, but they have also presented investment avenues for those with a keen foresight.

The Commodities Angle

Beyond oil, the stability observed in other commodities such as agricultural products and industrial metals may not last if hostilities gain momentum. Any intensification might offer varied investment options across these commodities.

Market Behavior

The volatile nature of current market activities, epitomized by the sharp oscillations in oil prices and other commodities, reflects the influence of geopolitical dynamics. For instance, the Brent futures settled at $90.48 a barrel, marking a 2.9% increase. Meanwhile, the U.S. WTI crude settled at $85.54 after a 2.8% rise. However, these numbers also exhibited weekly declines, indicating the unpredictable market trajectory.

Conclusion: The Investment Path Ahead

Given the multifaceted data at hand, the global landscape seems to be at an inflection point. The escalating tensions in the Middle East, coupled with already existing geopolitical uncertainties, offer both challenges and opportunities for investors.

For those poised to capitalize, the upward trajectory of gold prices and potential oil price spikes could offer lucrative returns. A diversified approach, encompassing varied commodities beyond just oil, might be the key to hedging against potential risks. As always, monitoring the evolving geopolitical scenarios remains crucial.

Given the potential for unprecedented oil prices, possibly even surpassing $150 a barrel, there seems to be a substantial upside for investors who navigate these turbulent waters astutely. The future, while uncertain, holds significant promise for those with a keen market acumen and an eye on the broader global landscape.

Read More

-

GPIX ETF 8% Monthly Yield and S&P 500 Upside at $53

13.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI, XRPR and Bitwise XRP Pull In $1.5B as XRP-USD Stalls Around $2.13

13.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Climbs Off $3.00 Floor as Cold Snap and LNG Flows Lift UNG

13.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Charges Toward ¥159 as Japan Election Fears Hit the Yen

13.01.2026 · TradingNEWS ArchiveForex