Why Is Amazon Stock (NASDAQ:AMZN) a Buy at $132?

How Does Amazon (NASDAQ:AMZN) Sustain Growth Against Rivals While Trading at $132? | That's TradingNEWS

1/14/2025 10:18:21 PM

NASDAQ:AMZN – Expanding E-Commerce Dominance with Unprecedented Margins

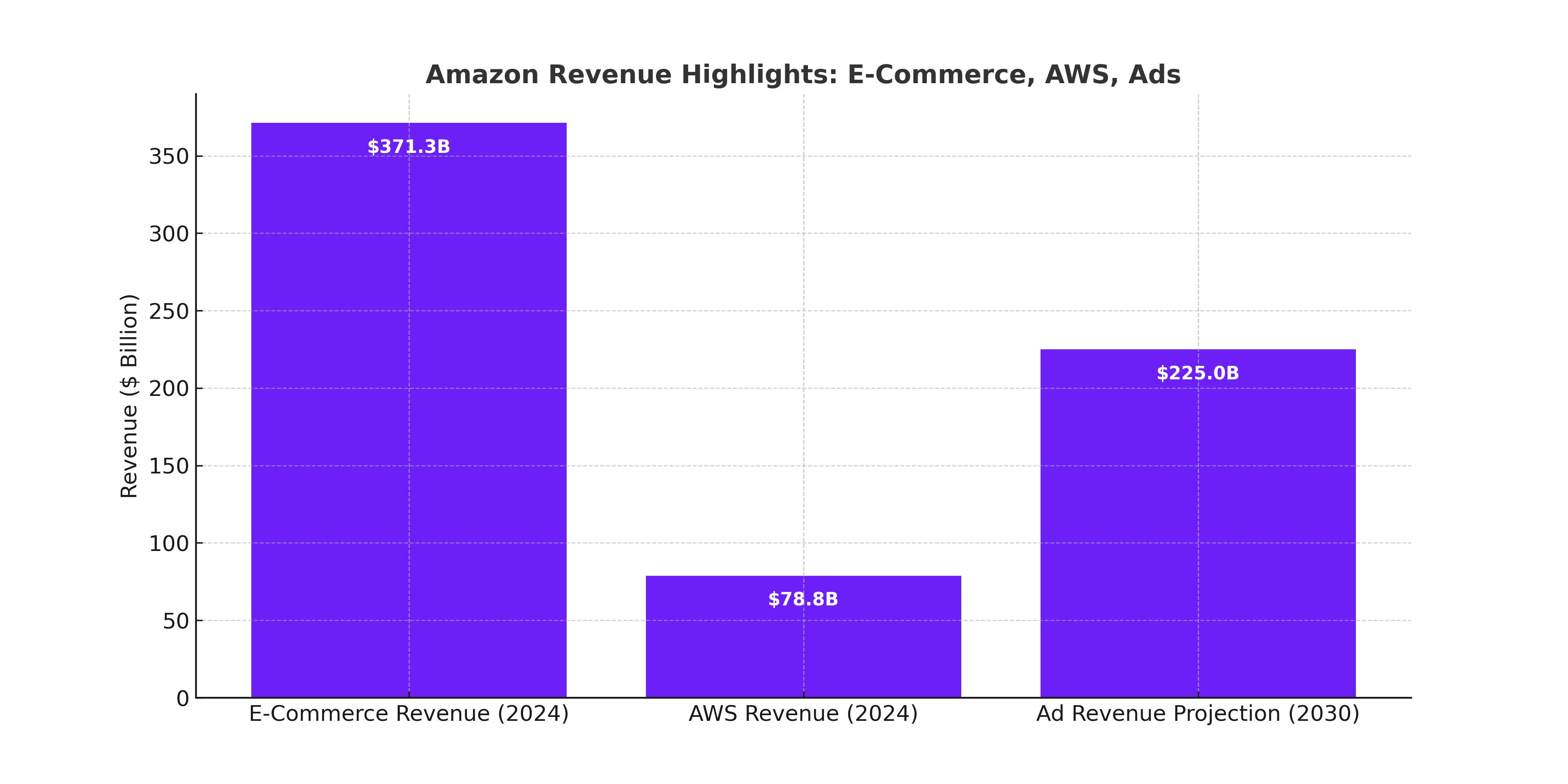

Amazon’s e-commerce business continues to define the global retail market, achieving $271.9 billion in revenue from North America and $99.4 billion internationally in 2024. Holding a 12% global market share in e-commerce, Amazon stands poised to capture substantial growth. McKinsey projects the global e-commerce market will reach $17 trillion by 2040, translating to a $2 trillion opportunity for Amazon if it maintains its current market share. Efficiency gains through robotics and logistics optimization further strengthen its profitability. Deploying over 750,000 robots, Amazon leads global automation efforts, cutting costs and improving delivery speed. Notably, the North American segment hit a record 5.8% operating income margin in 2024—its highest in six years—while the international segment achieved a 2.5% margin.

Read More

-

UNG ETF At $12.25: Can Natural Gas, LNG Expansion And AI Power Demand Ignite A Rebound In 2026?

31.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI at $10.52 and XRPR at $14.90 End 2025 Red as Inflows Hit $1.15B

31.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Slides Toward $3.70 as Warm Forecasts Dominate but LNG Exports Support NG=F

31.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds Near 156.60 as Fed Easing and BoJ Tightening Collide at Year-End

31.12.2025 · TradingNEWS ArchiveForex