Bitcoin’s Trajectory: Can BTC-USD Maintain Momentum Above $100,000 Amid Rising Market Volatility?

Will Bitcoin's Psychological $100K Support Hold Firm?

Bitcoin (BTC-USD) has encountered significant resistance and volatility following its recent all-time high of $108,244. The flagship cryptocurrency's price dropped to $98,695 after the U.S. Federal Reserve's hawkish monetary stance signaled slower rate cuts in 2025. Despite this, Bitcoin quickly rebounded above $100,000, currently stabilizing near $101,600. Key technical indicators highlight the critical importance of the $100,000 support level, which could determine BTC's next directional move.

Federal Reserve Impact on Bitcoin's Price Action

The Federal Reserve's decision to cut interest rates by 25 basis points to a range of 4.25%-4.50% has created uncertainty in financial markets. While rate cuts typically benefit risk assets, the Fed's signal of a cautious easing cycle—only two cuts anticipated in 2025—dampened market sentiment. This hawkish pivot led to a broader risk-off environment, reflected in BTC's recent price action. Real yields climbed to 2.14%, reducing Bitcoin's appeal as a non-yielding asset, while the U.S. dollar index surged to 107.69, further pressuring BTC.

Liquidations Highlight Increased Volatility

The cryptocurrency market experienced significant liquidations amid Bitcoin's retracement. Data from Coinglass shows over $661 million in leveraged positions were wiped out in the past 24 hours, with BTC accounting for $110 million. This wave of liquidations underscores heightened volatility, as traders recalibrate their strategies following the Fed's policy announcement.

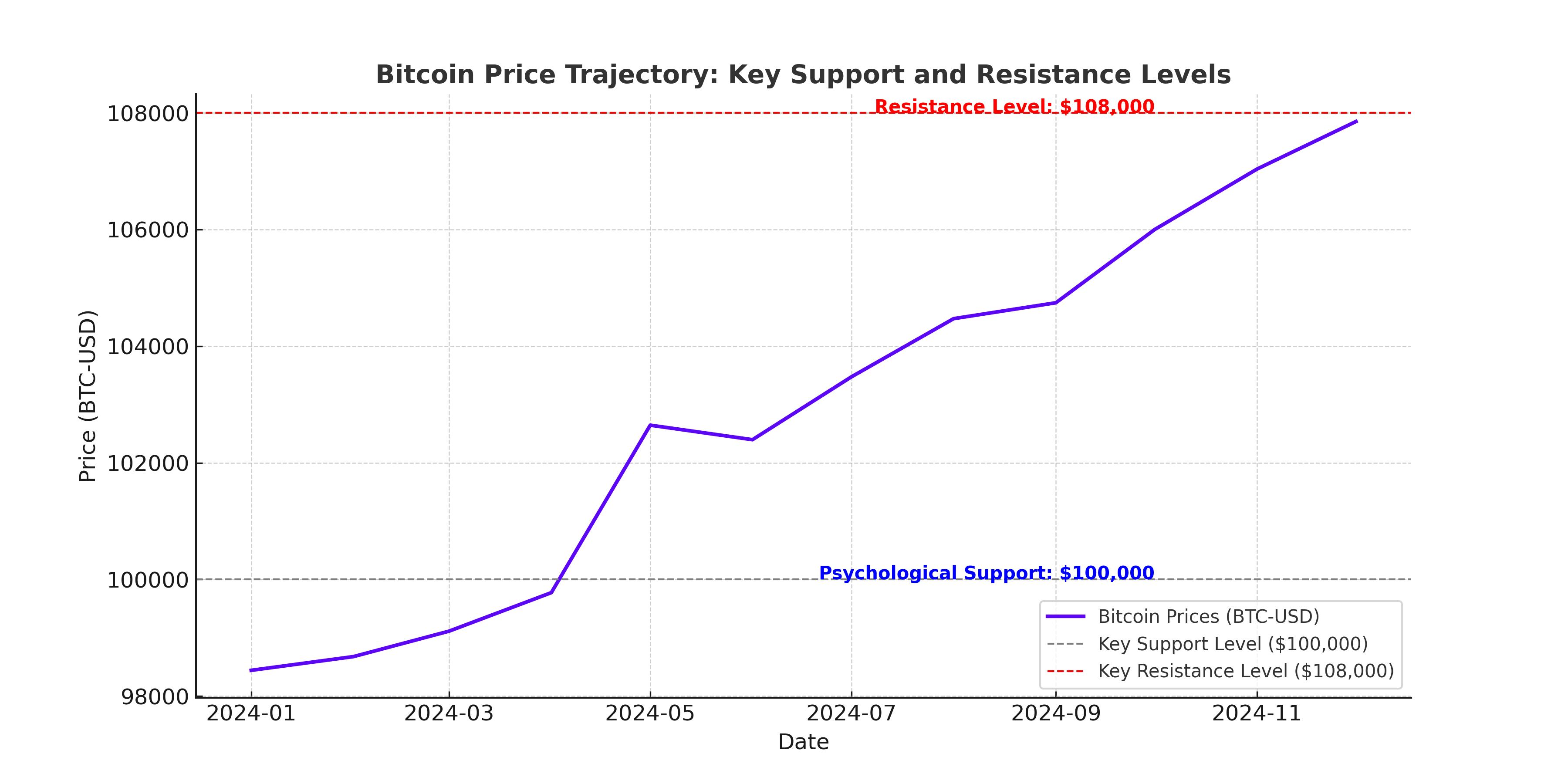

Technical Outlook for BTC-USD: Key Support and Resistance Levels

From a technical perspective, Bitcoin's ability to hold above $100,000 is crucial. The 20-day exponential moving average (EMA) provides additional short-term support, while the 23.6% Fibonacci retracement level at $98,769 serves as a key inflection point. A failure to maintain this support could lead to further downside, targeting $94,300 and the 0.5 Fibonacci retracement at $85,063. Conversely, reclaiming resistance at $108,000 would confirm a bullish reversal, paving the way for a move toward $120,000 or higher.

Institutional Adoption Bolsters BTC's Long-Term Outlook

Institutional interest in Bitcoin has surged, driven by the launch of spot ETFs and corporate accumulation. BlackRock's iShares Bitcoin Trust (IBIT) has amassed nearly $60 billion in assets under management, marking one of the fastest-growing ETFs in history. By year-end, Bitcoin ETFs collectively held over 1 million BTC, or approximately 5% of the circulating supply. Corporate giants like MicroStrategy (MSTR) have also expanded their Bitcoin holdings, signaling confidence in the asset's long-term value.

Impact of Bitcoin's Halving and Inflation Dynamics

The 2024 Bitcoin halving event has further tightened supply dynamics. Block rewards were reduced from 6.25 BTC to 3.125 BTC, lowering annualized supply inflation to 0.85%—below gold's 2.3% inflation rate. This scarcity, coupled with robust institutional demand, has created a bullish backdrop for BTC. Historical data suggests post-halving periods are typically marked by strong price rallies, with the potential for Bitcoin to test new highs by 2025.

Macroeconomic Factors Supporting Bitcoin’s Appeal

The U.S. Federal Reserve's rate cuts, coupled with Donald Trump's pro-crypto policies, have supported Bitcoin's upward trajectory. The president-elect's proposals for a national Bitcoin reserve have bolstered market sentiment, signaling a potential shift in regulatory attitudes. Meanwhile, global economic uncertainties and inflationary pressures continue to drive investors toward Bitcoin as a store of value.

Outlook for Bitcoin in 2025

Looking ahead, analysts remain optimistic about Bitcoin's potential. VanEck forecasts a price peak of $180,000 in Q1 2025, while Standard Chartered projects BTC reaching $200,000. The increasing adoption of Bitcoin ETFs and the potential establishment of national strategic reserves could propel prices even higher, with some experts predicting levels above $350,000 by the end of 2025.

Conclusion Pending Further Developments

As Bitcoin consolidates around the $100,000 level, its ability to maintain this psychological support will shape its near-term trajectory. While macroeconomic factors and institutional demand provide a solid foundation, technical indicators suggest caution in the short term. Investors should closely monitor support levels and market developments to navigate the evolving landscape of Bitcoin's price action.