Ripple (XRP-USD) Faces Heavy Selling Pressure – Is a Breakdown Below $2 Inevitable?

Ripple’s price has been hammered by a massive sell-off, dropping over 20% in the last 24 hours and sinking below the critical $2.30 level. The broader crypto market is reeling from macroeconomic shocks, including Donald Trump’s aggressive tariffs on Canada, Mexico, and China, which have driven risk-off sentiment across global financial markets. Meanwhile, whales dumped 130 million XRP—worth over $310 million—raising concerns that the worst may not be over yet. With billions in liquidations and major technical levels breaking down, XRP holders are now wondering: is this a temporary crash, or is a deeper collapse to $1.90 and beyond on the horizon?

XRP’s Crash Fueled by Whales and Market Uncertainty

One of the biggest warning signs for XRP investors is the heavy whale activity over the past week. Large holders have aggressively sold their positions, unloading 130 million XRP into the market. Historically, when whales offload such massive amounts in a short timeframe, it signals increasing downward pressure, making it harder for bulls to regain control.

Adding to the bearish sentiment, Ripple unlocked 1 billion XRP from its escrow in accordance with its usual monthly release policy. While the company typically re-locks a portion of these tokens, the market has responded negatively, fearing an oversupply problem that could further depress prices. This panic selling has contributed to XRP’s rapid fall from $3.07 to $2.23 in just a week.

Trump’s Tariffs Send Shockwaves Through Crypto Markets

The broader macroeconomic environment is also working against XRP. The U.S. government's new 25% tariffs on Canada and Mexico, alongside a 10% tariff on Chinese goods, have triggered a wave of uncertainty across global financial markets. Investors have been pulling capital from risk assets—including cryptocurrencies—while moving toward safer holdings like the U.S. dollar and U.S. Treasuries.

XRP has been among the worst-hit assets, reflecting the overall shift away from speculative investments. The crypto market has seen over $2.5 billion in total liquidations over the past 24 hours, with $117 million in XRP alone. This aggressive de-risking has put XRP in a dangerous position, as it now sits just above a major technical support level at $2.25.

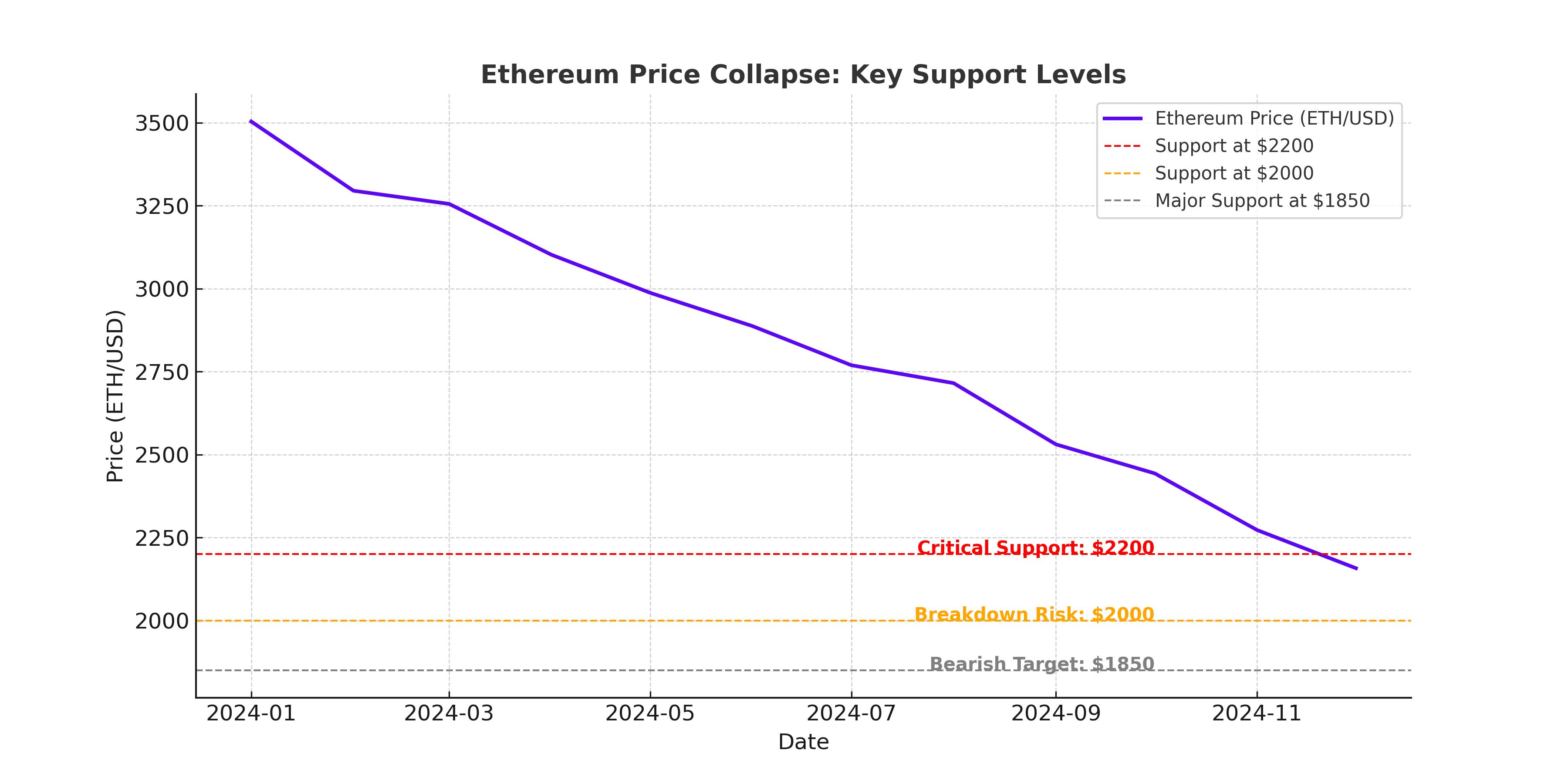

Key Technical Levels: Where Does XRP Go Next?

From a technical standpoint, XRP is in a fragile state after breaking key support levels. The current trading zone around $2.25-$2.30 is critical—if it fails to hold, XRP could face another wave of selling that pushes it toward $1.90, a level that hasn’t been seen in months.

Here are the key levels traders are watching:

- Immediate Support: $2.25 (Current zone where XRP is attempting to stabilize)

- Next Major Support: $1.90 (A breakdown here would confirm a deeper correction)

- Major Resistance: $2.50 (Needs to reclaim this for any chance of bullish momentum)

- Upside Target: $3.00 (If XRP can reverse and break resistance, this would be a key psychological level)

One concerning technical signal is the 50-day Exponential Moving Average (EMA), which XRP closed below at $2.61. This suggests the momentum has firmly shifted in favor of sellers, making it increasingly difficult for buyers to regain control in the near term.

Another red flag is the Relative Strength Index (RSI), which sits around 30—dangerously close to oversold territory. While this could indicate a potential short-term bounce, history shows that oversold conditions can persist in major downtrends, meaning XRP isn’t necessarily in a “buy-the-dip” zone just yet.

Buy, Sell, or Hold?

The biggest risk for XRP is continued whale selling and broader market weakness. If institutional traders and large holders keep offloading XRP, it could trigger a cascade effect, pushing prices below the key $2.25 support and toward $1.90 or even $1.60 in a worst-case scenario.

On the flip side, long-term investors might see this as a buying opportunity. Historically, XRP has bounced strongly from deep sell-offs, and with Ripple’s ETF approval potentially on the horizon, sentiment could shift rapidly. However, for now, the price action remains bearish, and caution is advised.

Bottom Line: XRP must hold $2.25 in the coming days. A breakdown below this level would confirm that the sell-off isn’t over, while a strong bounce above $2.50 would indicate buyers are stepping back in. Until then, traders should expect continued volatility, with XRP at risk of testing new lows before any meaningful recovery.