XRP-USD Price Prediction: Can Ripple Break $3 or Is a Bigger Drop Ahead?

After a 44% Plunge, XRP-USD Soars 37%—Is a Massive Rally Coming? | That's TradingNEWS

Ripple (XRP-USD) Battles Market Volatility – Is a Breakout or Breakdown Ahead?

XRP-USD Under Heavy Pressure as Global Trade Tensions Roil Markets

Ripple (XRP-USD) has struggled to maintain stability amid heightened global trade tensions, particularly as the United States, China, Mexico, and Canada navigate a volatile economic landscape. The market-wide downturn sent XRP plunging by 44% in just four days, hitting a critical low of $1.80. However, the dramatic sell-off was met with an aggressive wave of buying, catapulting XRP back up by 37% within hours. Trading volumes soared by an unprecedented 441%, reaching $34.42 billion, signaling a surge in investor activity as traders sought to capitalize on the extreme volatility.

Despite the rebound, XRP remains at a critical juncture. Market participants are debating whether the recovery signals the start of a new uptrend or if it’s merely a relief bounce before another downturn. The broader crypto market has been rattled by uncertainty following President Donald Trump’s newly imposed tariffs, which triggered widespread sell-offs across digital assets. Bitcoin (BTC-USD) and Ethereum (ETH-USD) were also hit hard, with Bitcoin dropping nearly 7% and Ethereum losing over 20% of its value at one point. The sharp declines across major cryptocurrencies have left traders on edge, unsure whether the worst is over or if further downside risk remains.

XRP’s Technical Battle: Can It Reclaim the $3.00 Mark?

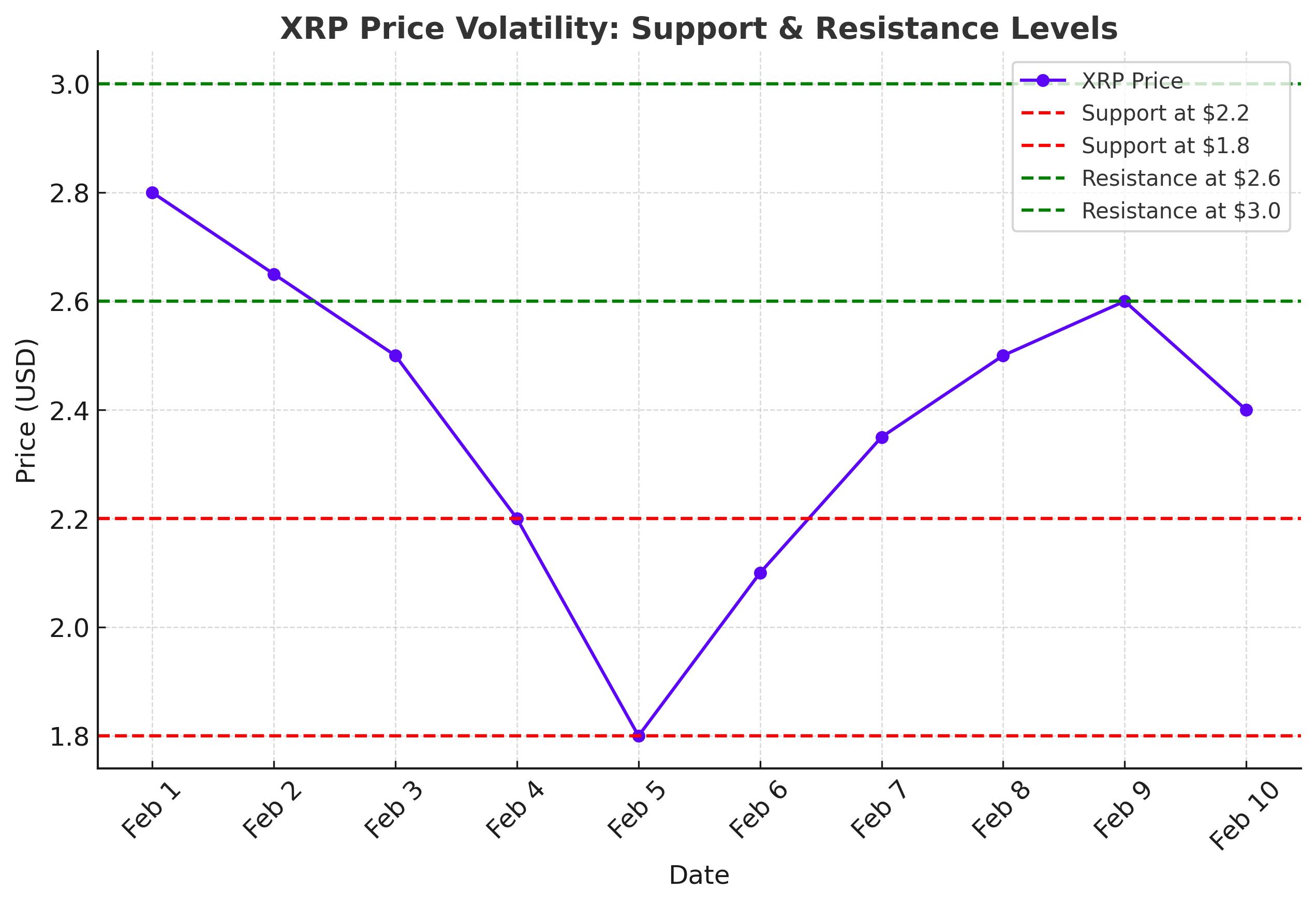

XRP’s price action has been defined by extreme swings, and all eyes are now on key resistance and support levels that will dictate its next major move. The recent rally pushed XRP back toward $2.40, but it is struggling to reclaim the psychologically significant $3.00 level. This resistance level has historically acted as both support and resistance, and it remains a major obstacle for the bulls.

Technical analysis suggests that if XRP can successfully hold above the $2.60 support level, it could create a launching point for another attempt at $3.20. Beyond that, a breakout past $3.50 could send XRP on a much larger rally, potentially retesting the $4.00 region in the weeks ahead. However, failure to hold the $2.60 level could trigger another sell-off, with support levels at $2.20 and $1.80 being closely watched. A drop below $1.80 would likely signal a deeper bearish move, potentially dragging XRP down toward the $1.50 zone.

Adding to the uncertainty, XRP has broken below the lower boundary of its ascending wedge pattern, a bearish technical signal that suggests the possibility of extended downside. However, the sharp bounce off the lows indicates that bulls are still active, preventing a complete collapse in price. The next few trading sessions will be crucial in determining whether XRP can regain its bullish momentum or if sellers will regain control and push the price lower.

Institutional Investors and Whales Fuel XRP’s Rebound

One of the key drivers behind XRP’s swift recovery has been the growing presence of institutional investors accumulating the asset at lower price levels. Blockchain analytics firm LookOnChain reported that several large whale addresses have significantly increased their XRP holdings in recent days, taking advantage of the market dip.

World Liberty Financial, a major institutional investor, executed a $5 million XRP purchase shortly after Eric Trump’s public endorsement of Ripple on social media. This purchase added 1,826 XRP to the firm’s growing portfolio, bringing its total holdings to 61,114 tokens. Despite suffering temporary unrealized losses, the firm appears confident in XRP’s long-term potential and is strategically accumulating during price dips.

On-chain data further supports the institutional interest, showing that XRP’s trading volume has surged dramatically in the wake of the recent correction. With a 441% increase in volume, the spike in trading activity suggests that both retail and institutional investors are actively engaging with XRP, potentially setting the stage for further price appreciation.

Trump’s Sovereign Wealth Fund Sparks Speculation on XRP Inclusion

A major development that could have long-term implications for Ripple is President Donald Trump’s recent announcement of a U.S. sovereign wealth fund. While details on the fund’s specific allocations remain unclear, speculation is growing that it could include Bitcoin and possibly even XRP as part of its investment strategy.

The involvement of pro-crypto officials such as Howard Lutnick and Scott Bessent has fueled optimism that digital assets may receive a larger role in government-backed financial initiatives. Should XRP gain traction within the fund, it could provide a major source of institutional demand, potentially driving long-term price appreciation.

XRP Faces Uncertainty Amidst Broader Crypto Market Trends

Despite the sharp recovery, XRP still faces significant macroeconomic and regulatory challenges. The Securities and Exchange Commission’s (SEC) ongoing legal battles with Ripple remain a looming factor, and any negative regulatory decisions could weigh on the asset’s price. While recent court rulings have been favorable for Ripple, uncertainty still lingers, and investors remain cautious about the long-term impact of potential regulatory actions.

Adding to the complexity, XRP’s market dominance has been declining, with its share of the total crypto market shrinking in recent months. While XRP continues to be a dominant player in cross-border payments, competition from alternative blockchain solutions is intensifying. The growing adoption of stablecoins and emerging Layer-2 networks presents challenges for XRP’s long-term growth trajectory.

From a technical perspective, XRP’s recent rally has provided some relief, but the asset remains in a vulnerable position. The 14-day Relative Strength Index (RSI) has recovered from oversold levels, currently sitting near 45, suggesting that there is room for further upside. However, a failure to break past resistance at $3.00 would likely lead to another wave of selling pressure.

Is XRP a Buy, Sell, or Hold Right Now?

The recent price action in XRP presents both opportunities and risks for investors. Traders looking for short-term gains may find opportunities in the current volatility, particularly if XRP manages to reclaim the $3.00 level. A breakout above this resistance could trigger a sharp rally toward $3.50 or higher, making XRP an attractive play for momentum traders.

For long-term investors, the outlook remains mixed. While XRP has strong institutional backing and an established use case in cross-border payments, ongoing regulatory uncertainty and broader market risks could weigh on its price performance. Those with a long-term perspective may find current levels attractive for accumulation, particularly if XRP holds above $2.60. However, caution is warranted, as another breakdown below key support levels could lead to a deeper retracement.

Ultimately, XRP’s next major move will be dictated by broader market trends, institutional demand, and regulatory developments. If positive catalysts emerge—such as inclusion in the U.S. sovereign wealth fund or favorable legal outcomes—XRP could see a significant upside. Conversely, continued macroeconomic instability and regulatory uncertainty could limit its growth potential. Investors should closely monitor key technical levels and market trends before making any major trading decisions.

That's TradingNEWS

Read More

-

QQQ ETF At $626: AI-Heavy Nasdaq-100 Faces CPI And Yield Shock Test

11.01.2026 · TradingNEWS ArchiveStocks

-

Bitcoin ETF Flows Flip Red: $681M Weekly Outflows as BTC-USD Stalls Near $90K

11.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Near $3.33: NG=F Sinks as Supply Surges and China Cools LNG Demand

11.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar Breaks Toward ¥158 as Yen Outflows and US Data Fuel Dollar Charge

11.01.2026 · TradingNEWS ArchiveForex