Bitcoin’s Path to $100K: Sharp Dip to $92K Sparks Profit-Taking & New Opportunities

Why BTC’s Correction Isn’t the End: Institutional Demand, On-Chain Metrics, and $100K Prospects | That's TradingNEWS

Bitcoin’s Volatility Explained: Unpacking the $92,000 Price Retreat and Future Trajectories

The Current State of Bitcoin (BTC): Below $93,000 Amid Profit-Taking

Bitcoin's price has seen a sharp decline, falling over 5.6% to $92,774 as of Nov. 26, retreating further from the psychologically critical $100,000 milestone. This correction comes after Bitcoin recorded an all-time high of $99,000 on Nov. 22, following a 46% rally since early November driven by President-elect Donald Trump's pro-crypto policies.

Profit-taking from long-term holders has been identified as a primary driver of this pullback. According to on-chain data, long-term holders sold 128,000 BTC, a move that coincided with spot Bitcoin ETFs absorbing 90% of the sell pressure. This highlights the tug-of-war between profit-booking and strong institutional demand.

Key Drivers of the Bitcoin Decline

Long-Term Holder Activity Dominates Market Dynamics

Recent data indicates that long-term Bitcoin holders, defined as entities holding BTC for 155 days or more, have been liquidating their positions. This sell-off amounted to 128,000 BTC offloaded, overshadowing institutional inflows. Analysts suggest this trend reflects profit realization as Bitcoin approached the $100,000 mark, a milestone seen as both a technical and psychological resistance level.

ETFs Play a Stabilizing Role

U.S.-based spot Bitcoin ETFs absorbed 90% of the selling pressure, reflecting sustained institutional interest despite the pullback. However, $435 million in ETF outflows on Monday marked the first net outflow in six days, signaling a temporary pause in bullish momentum.

Overheating Leverage Conditions

Data from CryptoQuant reveals that leverage ratios across exchanges hit an annual high, amplifying market fragility. The estimated leverage ratio currently stands at 0.24, reminiscent of levels last seen in August 2023. This over-leveraged environment exacerbates Bitcoin's susceptibility to sharp corrections, with recent liquidations totaling $150 million in BTC and $520 million across all cryptocurrencies.

On-Chain Metrics Highlight Bullish Potential Despite Setbacks

Market Value to Realized Value (MVRV) Signals Continued Bull Cycle

Despite the pullback, Bitcoin's MVRV ratio, a key metric for assessing overvaluation, suggests the cryptocurrency remains in a bullish phase. Historical patterns indicate that corrections of 10-20% are common during uptrends and do not negate long-term bullish trajectories.

Net Unrealized Profit/Loss (NUPL) Supports Positive Outlook

The NUPL metric, which measures unrealized profits and losses across the network, continues to indicate optimistic sentiment. Current levels align with previous bull markets, suggesting room for further upside.

Impact of Trump's Pro-Crypto Policies on Bitcoin's Trajectory

President-elect Donald Trump's proposed economic policies, including making America a "crypto capital," have fueled optimism in the digital asset market. His administration's perceived favorability towards cryptocurrency regulation has drawn comparisons to the early days of institutional Bitcoin adoption.

Market Reactions to Trump's Appointments

The nomination of Scott Bessent as Treasury Secretary has introduced mixed sentiment. While Bessent's market-friendly policies are expected to stabilize financial markets, they have also led to a reallocation from safe-haven assets like Bitcoin to traditional risk assets. Trump's broader tariff threats have yet to significantly impact Bitcoin markets but could act as a wildcard in shaping near-term price movements.

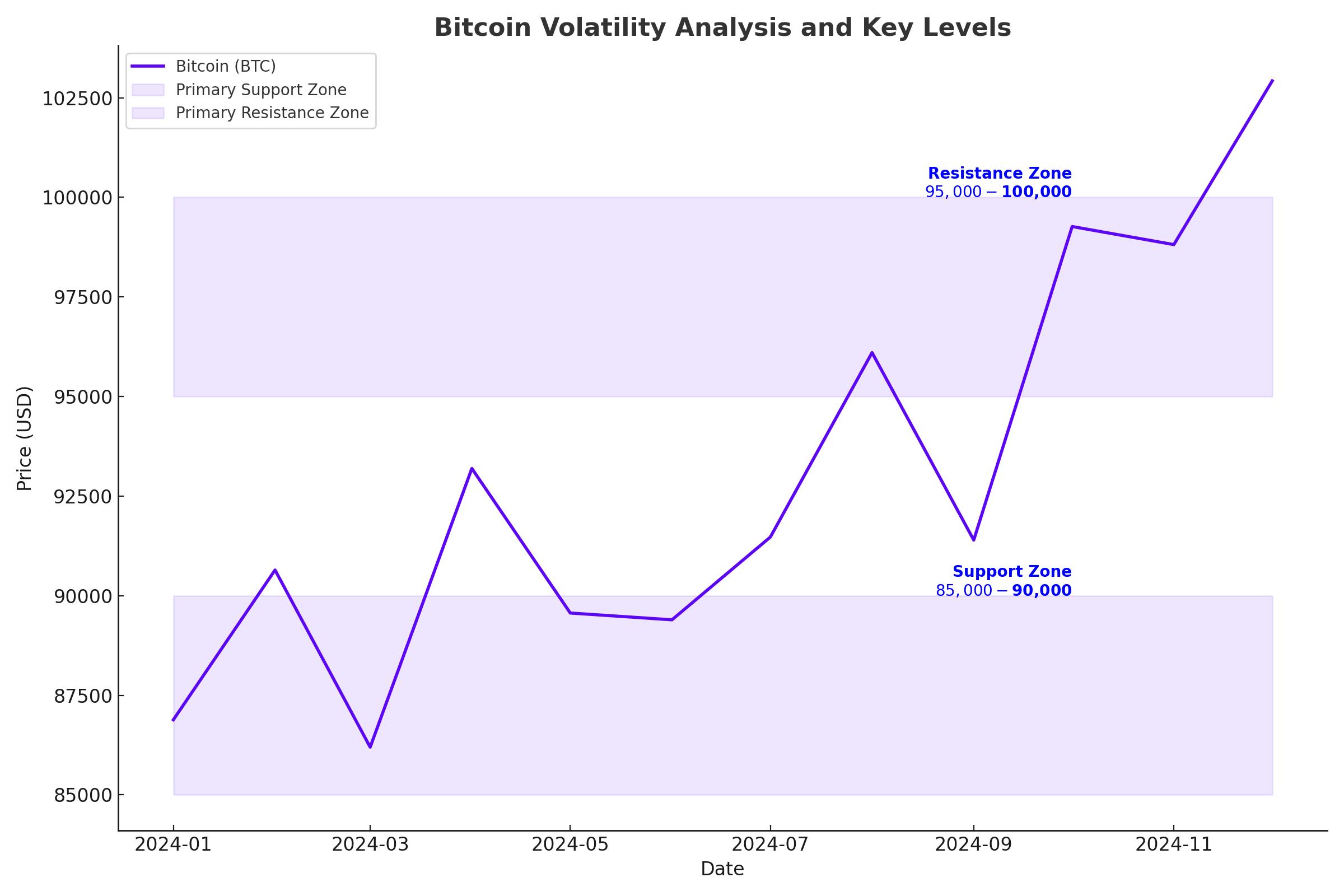

Technical Analysis: Key Levels to Watch for BTC/USD

Resistance Levels

Bitcoin faces immediate resistance at the $93,000 mark, followed by stronger barriers at $95,000 and the critical $100,000 milestone. A breach above $100,000 could signal renewed bullish momentum, with potential targets at $110,000 and $120,000 in the coming weeks.

Support Levels

On the downside, Bitcoin finds initial support at $90,000, a key psychological level. A sustained break below could see the cryptocurrency retest $87,000 and possibly $80,000, the latter being a crucial level identified by prominent analysts like Michael Novogratz.

Bearish Divergence in RSI

The Relative Strength Index (RSI) shows bearish divergence, with lower RSI readings contradicting higher price highs. This indicates weakening bullish momentum and suggests that Bitcoin's short-term correction may persist.

Profit-Taking and Liquidation Trends

Profit-Taking by Short-Term Holders

The Short-Term Spent Output Profit Ratio (SOPR) reached 1.01, indicating increased profit realization by short-term holders. Historical trends suggest that profit-taking at this level often precedes pullbacks, as observed during Bitcoin's recent dip.

Liquidation Cascades

The correction triggered cascading liquidations, with $150 million liquidated in Bitcoin alone. This trend underscores the role of leveraged positions in amplifying price volatility.

Future Outlook: Buy, Sell, or Hold?

Bullish Case

Bitcoin's long-term fundamentals remain strong, with institutional adoption continuing to grow. Metrics like MVRV and NUPL, combined with sustained ETF inflows, point to a broader bull market. Analysts project a possible rally to $120,000-$150,000 in 2024, supported by the upcoming Bitcoin halving and favorable macroeconomic conditions.

Bearish Case

The over-leveraged market and ongoing profit-taking could see Bitcoin test $80,000 before resuming its upward trajectory. A break below $80,000 would raise concerns about deeper corrections.

Final Take

Bitcoin's recent pullback reflects healthy market consolidation rather than a reversal of its bullish trend. For long-term investors, this correction may present an attractive entry point, while short-term traders should exercise caution amid heightened volatility.

Conclusion

Bitcoin's journey to $100,000 remains firmly within reach despite the current pullback. With strong institutional demand, favorable on-chain metrics, and supportive macroeconomic factors, BTC continues to showcase its resilience. However, navigating the immediate volatility requires careful analysis of both technical and fundamental drivers.