Gold Prices Crash Below $2,630 as Geopolitical Risks Ease

Easing Tensions and U.S. Treasury Optimism Erode Safe-Haven Demand for Gold | That's TradingNEWS

Gold Prices Face Heavy Pressure Amid Geopolitical Easing and Economic Stability

Gold Prices Plummet Amid Ceasefire Reports and U.S. Policy Stability

Gold prices (XAU/USD) experienced a sharp decline of over 3% on Monday, tumbling to $2,627.01 per ounce after reports surfaced of potential de-escalation in the Israel-Hezbollah conflict. The steep drop erased the gains from last week’s rally, marking its worst single-day performance in over five months. Gold futures followed suit, closing at $2,634.40 per ounce in New York.

The safe-haven appeal of gold has diminished in light of easing geopolitical tensions, particularly with reports that Israel and Lebanon may announce a ceasefire agreement within hours. These developments have shifted investor sentiment, driving a sell-off in gold and sparking renewed interest in risk assets.

Scott Bessent's Nomination Shifts Market Dynamics

The nomination of Scott Bessent as U.S. Treasury Secretary by President-elect Donald Trump further weighed on gold prices. Known for his market-friendly approach, Bessent's nomination has bolstered optimism around U.S. economic stability and the stock market. This optimism contributed to a rally in the Dow Jones Industrial Average, diverting investor interest away from gold.

Bessent’s potential to stabilize the financial landscape, coupled with his phased approach to tariffs, has softened inflationary concerns. This, in turn, has prompted market participants to reassess their positions in safe-haven assets like gold.

Federal Reserve Policy Outlook Dampens Gold’s Appeal

The Federal Reserve’s evolving monetary policy also played a significant role in gold’s decline. Recent comments from Fed officials, including Chicago Fed President Austan Goolsbee and Minneapolis Fed President Neel Kashkari, suggest a cautious stance toward future rate cuts. Markets now estimate only a 59.6% probability of a 25-basis-point rate cut in December, according to CME’s FedWatch Tool.

Higher Treasury yields have compounded the pressure on gold. The yield on the 10-year U.S. Treasury bond saw its most significant drop since August but remains elevated, limiting the appeal of non-yielding assets like gold.

Geopolitical Tensions and Safe-Haven Flows: A Balancing Act

Despite the bearish momentum, gold prices found some support from lingering uncertainties. Trump’s tariff threats, particularly a proposed 25% levy on imports from Mexico and Canada and an additional 10% on Chinese goods, have heightened market concerns about global economic stability.

Meanwhile, escalating military actions in Gaza and Lebanon have kept geopolitical risks alive. Israeli airstrikes and ground operations in northern Gaza, coupled with tensions in Lebanon, continue to underpin gold’s safe-haven demand.

Central Bank Buying and Long-Term Gold Demand

Gold’s 30% gain this year has been largely supported by central bank purchases. Countries like China and Turkey have ramped up their gold reserves as part of broader diversification strategies. Central bank buying has provided a strong floor for gold prices, even amid periods of high volatility.

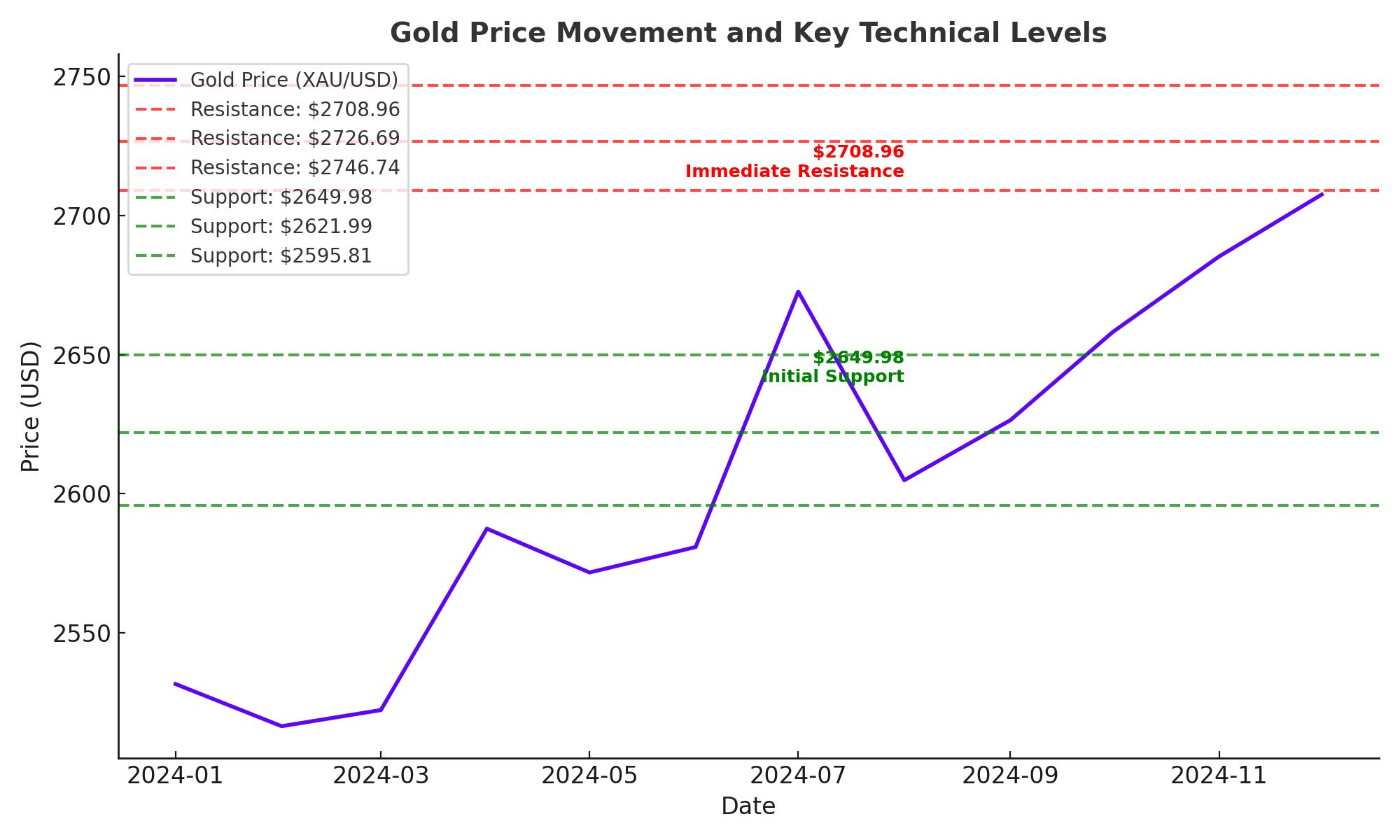

Technical Analysis: Key Levels to Watch for Gold

Gold prices face significant resistance near the $2,650 level, which coincides with the 100-period Simple Moving Average (SMA) on the 4-hour chart. A break above this level could trigger a recovery toward $2,700 and potentially the $2,722 zone. On the downside, immediate support rests at $2,600, a critical psychological level. A sustained break below this could expose the $2,565 mark, with further declines targeting $2,537.

Indicators such as the Relative Strength Index (RSI) suggest neutral momentum, but the broader trend remains bearish unless gold decisively breaks above the $2,651 resistance.

Short-Term Forecast: Bearish Bias with Volatility Ahead

Gold remains vulnerable to further downside amid easing geopolitical tensions and a hawkish Federal Reserve outlook. However, upcoming economic data, including the U.S. Q3 GDP revision and Personal Consumption Expenditure (PCE) Price Index, could shift sentiment. Traders will also scrutinize the Federal Open Market Committee (FOMC) meeting minutes for insights into the Fed’s next moves.

In the short term, gold is likely to hover near the $2,620 mark, with bearish momentum targeting $2,589. A recovery above $2,651 could signal a bullish reversal, but the broader outlook remains cautious.

Key Takeaways for Investors

- Bullish Drivers: Central bank buying, geopolitical risks, and tariff uncertainties.

- Bearish Drivers: Fed rate policy, rising Treasury yields, and easing Middle East tensions.

- Outlook: Gold remains under pressure but retains its appeal as a hedge against long-term economic uncertainties.

Gold investors should closely monitor geopolitical developments and economic data releases. While the immediate trajectory appears bearish, any escalation in global tensions or dovish pivot by the Fed could reignite gold’s safe-haven demand.